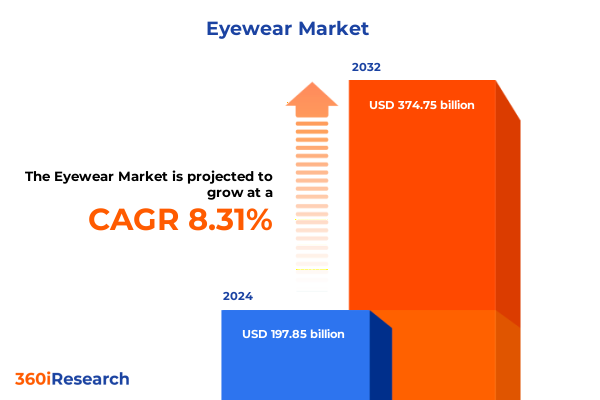

The Eyewear Market size was estimated at USD 213.58 billion in 2025 and expected to reach USD 230.71 billion in 2026, at a CAGR of 8.36% to reach USD 374.75 billion by 2032.

Navigating the Evolving Global Eyewear Market with Insightful Executive Overview Emphasizing Growth Drivers, Innovation Trends, and Stakeholder Implications

The global eyewear industry is experiencing an unprecedented period of transformation driven by rapid technological innovation, evolving consumer expectations, and shifting macroeconomic forces. In response to the convergence of smart eyewear, sustainable materials, and omnichannel retailing, market participants ranging from legacy manufacturers to digital-first disruptors are racing to redefine value propositions. As consumers demand seamless integration of fashion, function, and digital convenience, stakeholders must stay ahead of design trends, regulatory complexities, and emerging business models to maintain relevance and profitability.

This executive summary distills critical developments shaping the eyewear ecosystem, offering a concise yet comprehensive lens on transformative market dynamics. From the ripple effects of new tariff measures in the United States to granular segmentation and regional nuances, this overview highlights opportunities and risks that merit strategic consideration. By examining competitive landscapes, evaluating granular customer segments, and outlining actionable recommendations, readers will gain the clarity needed to make informed, future-focused decisions in a highly competitive industry environment.

Examining Pivotal Evolutionary Forces Redefining the Eyewear Landscape Through Technological Innovation, Sustainability Trends, and Shifting Consumer Behavior

The eyewear landscape has been profoundly reshaped by a series of evolutionary forces that are redefining product development, distribution strategies, and consumer engagement. Advances in lens technology, such as high-index plastics and smart displays, have opened new frontiers for value-added offerings. At the same time, commitments to eco-friendly manufacturing and circular economy principles are inspiring brands to incorporate bio-based materials and take-back programs, heightening consumer loyalty and environmental stewardship.

Concurrently, the proliferation of digital sales channels and augmented reality fitting tools have revolutionized the path to purchase, enabling customers to explore extensive virtual catalogs and receive personalized recommendations without visiting a physical store. This shift is complemented by data-driven marketing initiatives that harness behavioral analytics to optimize promotions and inventory management. As traditional optical chains adapt to compete with agile online retailers, the interplay between omnichannel retailing and supply chain resilience has become a defining battleground for market leadership.

Assessing the Impact of United States Tariff Measures in 2025 on Supply Chains, Pricing Structures, and Competitive Dynamics within the Eyewear Sector

In 2025, the imposition of revised tariff schedules on a wide range of imported eyewear components has introduced significant cost pressures throughout the supply chain. Manufacturers reliant on offshore production are experiencing elevated input costs, prompting strategic reviews of sourcing strategies and supplier relationships. These changes have led many to explore nearshoring and onshore assembly options to maintain margins and mitigate exchange rate volatility.

Retailers have responded to higher landed costs by adjusting price points, renegotiating vendor agreements, and optimizing inventory turnover to reduce warehousing expenses. Some brands have accelerated product launches that leverage domestically available materials to circumvent tariff-related price hikes. In this environment, companies that can demonstrate supply chain agility and transparent communication regarding cost structures are gaining favor with both distributors and end consumers. The cumulative impact of these measures is a more localized manufacturing footprint and a renewed focus on efficiency across every stage of the value chain.

Utilizing Segmentation Frameworks to Uncover Consumer Preferences, Distribution Channel Influences, Product Type Variations, and Material Selection in Eyewear

The eyewear market demonstrates nuanced behaviors when examined through multiple segmentation lenses that reveal varied growth trajectories and competitive landscapes. For example, contact lenses-divided into rigid gas permeable and soft types, with the soft category further differentiated by daily and monthly disposables-continue to benefit from innovations in comfort and wearability, catering to prescription and cosmetic needs alike. Protective eyewear, with applications spanning industrial, medical, and sports contexts, underscores the importance of specialized designs and safety certifications to meet stringent regulatory standards.

In the realm of spectacles, frame styles segmented into full rim, rimless, and semi rimless designs reflect consumer preferences for durability, aesthetics, and weight reduction. Sunglasses maintain a bifurcation between polarized and non-polarized lenses, each appealing to distinct use cases from fashion-oriented sun protection to high-glare outdoor activities. Distribution channels are equally diverse; brick-and-mortar outlets such as department stores, optical boutiques, and specialty retailers coexist with direct-to-consumer digital platforms powered by proprietary websites and third-party marketplaces. End users, including children, men, and women, exhibit specific style, comfort, and price sensitivities, while lens technologies-spanning single vision, bifocal, and progressive options-address a wide spectrum of corrective needs. Material choices between metal and plastic components further inform product positioning and cost structures, ensuring that manufacturers can tailor offerings to the unique requirements of each customer cohort.

This comprehensive research report categorizes the Eyewear market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Lens Type

- Material

- Distribution Channel

- End User

- Gender

Mapping Strategic Regional Variations Across the Americas Europe Middle East and Africa and Asia Pacific to Illuminate Market Drivers and Key Opportunities

The Americas region remains a cornerstone of innovation and premium demand, driven by high consumer spending power and a robust retail infrastructure that melds traditional optical chains with digitally native brands. Market leaders frequently pilot new product lines and sustainability initiatives in North America, using insights from these experiments to refine global rollouts. In Latin America, growing middle-class segments and rising health awareness have catalyzed increased demand for both corrective lenses and fashionable eyewear, albeit tempered by economic variability and distribution challenges.

Europe, the Middle East, and Africa present a mosaic of mature luxury markets and emerging economies. Western European countries leverage strong regulatory frameworks and health insurance systems to support widespread adoption of advanced corrective solutions. In contrast, the Middle East and Africa exhibit rapid uptake of branded sunglasses and protective eyewear, often influenced by regional climatic conditions and occupational safety imperatives.

Asia Pacific continues to be the fastest-growing region, spurred by large populations in China, India, and Southeast Asia investing in vision care and fashion accessories. E-commerce penetration and mobile-first buying behaviors are particularly pronounced here, prompting global and local players to customize digital outreach and logistics networks to capture diverse consumer cohorts across urban and rural areas.

This comprehensive research report examines key regions that drive the evolution of the Eyewear market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting the Strategic Moves, Innovation and Competitive Positioning of Leading Eyewear Manufacturers and Emerging Disruptors Driving Market Evolution

Leading industry incumbents are expanding their portfolios through targeted acquisitions, strategic partnerships, and vertical integration. Major conglomerates have integrated in-house lens manufacturing capabilities with branded retail formats to deliver end-to-end quality control and margin security. At the same time, specialist firms renowned for precision optics are forging alliances with technology providers to accelerate the launch of smart eyewear, positioning themselves at the intersection of vision correction and digital facilitation.

Emerging disruptors have captured consumer attention by offering direct engagement models, leveraging social media influencers and advanced virtual try-on experiences to build brand equity quickly. These challengers often focus on sustainable materials, limited-edition collections, and subscription services, forcing legacy players to reassess traditional business architectures. Companies that effectively balance heritage craftsmanship with digital-first, consumer-centric offerings are establishing formidable defenses against low-cost competition.

This comprehensive research report delivers an in-depth overview of the principal market players in the Eyewear market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alcon Vision LLC

- Bausch + Lomb Corporation

- Blanchard Laboratories, LLC

- Carl Zeiss AG

- Contamac Ltd.

- CooperVision, Inc.

- De Rigo Vision S.p.A.

- EssilorLuxottica SA

- Fielmann Group AG

- Hoya Corporation

- Johnson & Johnson Vision Care, Inc.

- Kering SA

- LVMH Group

- Marchon Eyewear, Inc. by VSP Vision Care Company

- Marcolin S.p.A.

- Menicon Co., Ltd.

- MOSCOT

- Prada S.p.A.

- Precilens SAS

- Precision Technology Services, LLC

- Safilo Group S.p.A.

- SEED Co., Ltd.

- Silhouette Group

- UltraVision CLPL Ltd.

- X-Cel Specialty Contacts, Inc.

Proposing Tactical Strategies for Eyewear Industry Leaders to Capitalize on Emerging Trends, Strengthen Supply Chains, and Drive Sustainable Growth Beyond 2025

Industry leaders must adopt a dual focus on supply chain resilience and digital transformation to secure competitive advantage. Prioritizing flexible sourcing strategies that blend domestic and offshore partners will mitigate tariff-related disruptions and inflationary pressures. Simultaneously, investing in advanced planning systems and predictive analytics will enhance inventory accuracy, reduce stockouts, and optimize stock levels across channels.

On the consumer front, enhancing omnichannel experiences is paramount. Brands should integrate online fitting tools with in-store expertise, ensuring that customers receive seamless support regardless of purchase journey. Collaborations with health care providers and vision specialists can reinforce credibility and drive prescription lens adoption, while loyalty programs powered by personalized offers and sustainability pledges will cultivate long-term relationships. Finally, pursuing continuous innovation in smart features-such as integrated heads-up displays, biometric sensing, and adaptive lens technologies-will differentiate premium offerings and capture the next wave of tech-savvy consumers.

Detailing Multimethod Research Approaches Integrating Quantitative Analysis, Expert Interviews, and Data Triangulation to Ensure Robust Eyewear Market Insights

This analysis synthesizes insights gleaned from a rigorous multimethod research framework. Primary data was collected through in-depth interviews with industry executives, optical retailers, and consumer groups, ensuring direct perspectives on innovation priorities, channel evolution, and competitive pressures. Quantitative analysis leveraged proprietary databases tracking product introductions, patent filings, and digital engagement metrics, providing an empirical foundation for observed trends.

Secondary research incorporated a comprehensive review of industry publications, regulatory filings, and logistics reports to validate tariff impacts and regional variations. Data triangulation techniques harmonized findings across qualitative and quantitative sources, enhancing the reliability of segmentation insights and strategic implications. This holistic approach ensures that the final recommendations and conclusions are grounded in robust evidence and reflect the current state of the global eyewear ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Eyewear market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Eyewear Market, by Product Type

- Eyewear Market, by Lens Type

- Eyewear Market, by Material

- Eyewear Market, by Distribution Channel

- Eyewear Market, by End User

- Eyewear Market, by Gender

- Eyewear Market, by Region

- Eyewear Market, by Group

- Eyewear Market, by Country

- United States Eyewear Market

- China Eyewear Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1749 ]

Synthesizing Core Findings from Industry Dynamics, Segment Nuances, Tariff Ramifications, and Regional Variations to Provide Clear Vision for Eyewear Stakeholders

The aggregated findings highlight a market at the crossroads of technological disruption, sustainability imperatives, and evolving consumer preferences. Tariff-driven cost pressures are accelerating the shift toward localized production and supply chain transparency, while segmentation analytics reveal differentiated growth pockets across product types, channels, and end-user demographics. Regions exhibit distinct adoption curves, with mature markets refining premium and health-oriented offerings, and emerging economies embracing digital retail and cost-effective alternatives.

Competitive dynamics underscore the importance of agility, as both established players and insurgent brands race to introduce next-generation products and personalized experiences. To thrive in this environment, stakeholders must balance short-term operational efficiencies with long-term innovation roadmaps. By aligning strategic priorities with customer-centric insights and macroeconomic realities, organizations can unlock new avenues for growth and resilience.

Engage with Ketan Rohom to Secure Your Eyewear Market Research Report Offering Actionable Insights and Strategic Intelligence to Outpace Competitors

Engage with Ketan Rohom, Associate Director of Sales & Marketing, to acquire a definitive market research report that equips your team with data-driven insights and competitive intelligence designed to fuel growth and innovation in today’s dynamic eyewear marketplace

- How big is the Eyewear Market?

- What is the Eyewear Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?