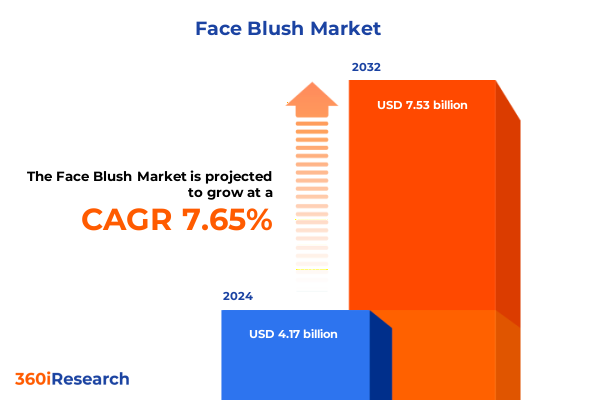

The Face Blush Market size was estimated at USD 4.34 billion in 2025 and expected to reach USD 4.67 billion in 2026, at a CAGR of 7.64% to reach USD 7.28 billion by 2032.

Unveiling the Dynamic Trajectory of the Face Blush Market Through Emerging Innovations and Consumer Behavior Shifts Shaping Formulations and Distribution Strategies

The face blush category has emerged as a focal point of innovation and consumer engagement within the broader beauty industry, reflecting a nuanced interplay of formulation technology, branding, and experiential retail. Driven by heightened demand for products that deliver both aesthetic and functional benefits, the market is witnessing an expansion in texture variants and finish options, catering to everything from a subtle flush to a bold statement look. Beyond aesthetics, the contemporary consumer prioritizes clean formulations, ethical sourcing, and multi-functional attributes, reshaping how brands conceive, develop, and communicate their offerings.

Moreover, advances in formulation science have enabled breakthrough textures-ranging from lightweight gels and buildable mousses to velvety creams and finely milled powders-each engineered to address specific performance criteria, such as blendability, longevity, and skin-feel. Digital transformation, including virtual try-ons and social media-driven trends, has further accelerated experimentation and awareness, allowing brands to engage with target audiences in immersive, interactive ways. As influencers and micro-communities champion niche shades and application techniques, consumer expectations have reached new heights, compelling stakeholders to prioritize agility and responsiveness in product development and marketing strategies.

Consequently, the face blush sector has transcended its role as a mere color enhancer to become a vehicle for personal expression, wellness, and inclusivity. By marrying consumer insights with innovation roadmaps, industry participants can navigate this dynamic environment, seize emerging opportunities, and foster brand loyalty through differentiated, value-driven propositions that resonate across diverse demographics and markets.

How Digital Augmentation Sustainability Imperatives and Customization Trends Are Redefining the Competitive Landscape of Face Blush

In recent years, the face blush marketplace has undergone transformative shifts, propelled by the convergence of digital engagement, sustainability imperatives, and personalized beauty experiences. Brands are increasingly leveraging AI-driven product recommendations and augmented-reality applications, enabling consumers to visualize shades in real-time before committing to a purchase. Such initiatives have not only reduced return rates but also fostered deeper brand interactions and data-driven consumer profiling.

Simultaneously, the sustainability movement has redirected focus toward responsibly sourced pigments, recyclable packaging, and low-waste manufacturing processes. This paradigm shift is reshaping supply chains, as companies collaborate with ingredient suppliers to validate traceability and minimize environmental footprints. The rise of refillable compacts and compostable tubes exemplifies how packaging innovations can serve both ecological goals and premium positioning, reinforcing brand authenticity.

Furthermore, customization has become a cornerstone of competitive differentiation, with bespoke shade-matching services and modular palettes allowing consumers to curate their blush selection according to individual preferences and seasonal trends. By integrating social listening insights with agile product roadmaps, leading players are delivering limited-edition collections and collaborative capsule releases that resonate with niche communities, thereby driving repeat purchases and sustained engagement.

Assessing the Multifaceted Ramifications of 2025 United States Tariff Adjustments on Face Blush Manufacturing Procurement and Supply Chain Resilience

The imposition of revised tariffs by the United States in early 2025 has exerted multifaceted pressures on the face blush sector, particularly affecting raw material imports, packaging components, and cross-border distribution models. As duty rates escalated for certain pigment classifications and chemical intermediates, manufacturers experienced notable increases in input costs, prompting a reevaluation of sourcing strategies and supplier diversification. In response, several industry players have accelerated efforts to develop domestic supply chains for key ingredients and collaborated with regional packaging converters to mitigate exposure to imported tariffs.

These cost headwinds have been accompanied by logistical challenges, including extended lead times at ports of entry and heightened customs inspections. Brands with offshore production facilities have faced the dual burden of compliance complexities and elevated freight charges, leading to a renewed emphasis on near-shore manufacturing and inventory onshoring. By strategically relocating assembly operations closer to end markets, companies have succeeded in stabilizing delivery schedules and preserving margin integrity, albeit at the expense of initial capital expenditures for facility upgrades.

Despite short-term disruptions, the tariff environment has catalyzed innovation in cost management and supply chain resilience. Forward-looking stakeholders are redefining supplier contracts with flexible volume commitments and index-linked pricing, while simultaneously exploring alternative raw material sources in emerging markets. These adaptive measures underscore the importance of proactive scenario planning and cross-functional collaboration in navigating the evolving regulatory landscape of the face blush market.

Harnessing Segmentation Intelligence to Decode Texture Preferences Formulation Demands and Distribution Behaviors Across the Face Blush Consumer Spectrum

In-depth analysis by product type reveals that gel blush and liquid blush offerings are gaining traction among consumers seeking hydrating textures and dewy finishes, while mousse blush continues to appeal to those prioritizing buildability and lightweight wear. Cream blush products maintain their appeal for makeup enthusiasts valuing smooth blendability, and powder blush remains a steadfast choice for consumers desiring oil-absorbing properties during warmer seasons.

When examining formulation types, matte blush formulations have solidified their position as go-to options for oil-prone and normal skin types seeking a velvety, shine-controlled aesthetic. Satin blush serves as a bridge between matte and shimmer, offering a subtle luminosity suited to combination and dry skin users. Shimmer and glitter blush variants cater to younger demographics and trend-driven consumers who embrace bolder, high-impact looks for special occasions.

Consideration of skin types underscores how product developers are fine-tuning ingredient selections-such as hydrating emollients for dry skin and lightweight powders with mattifying agents for oily skin-to meet diverse consumer needs. Packaging innovation, segmented into compacts, jars, sticks, and tubes, highlights a spectrum of user preferences: compacts for on-the-go touch-ups, jars and tubes for multi-purpose routines, and stick formats for precision application. Application methods further diversify market offerings, with brush applicators delivering refined finishes, finger application enabling seamless blending, sponge applicators popular for stippling techniques, and airbrush systems redefining at-home professional results.

Age group segmentation illuminates evolving demand patterns: teenagers are drawn to playful, budget-friendly formats, young adults to mid-tier brands emphasizing clean credentials, and middle-aged consumers to premium lines with anti-aging or skin-care-infused properties. Distribution channels bifurcate into offline retail-spanning specialty beauty stores and supermarkets that offer tactile experiences-and online retail via brand websites and e-commerce platforms that provide convenience, broader shade selections, and subscription models.

This comprehensive research report categorizes the Face Blush market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Format

- Finish Type

- Skin Type

- Packaging Type

- Application Method

- Distribution Channel

Unlocking Regional Variations and Growth Opportunities in the Americas EMEA and Asia Pacific Face Blush Markets Through Consumer Behavior and Market Dynamics Analysis

Within the Americas, established markets such as the United States and Canada exhibit a mature face blush ecosystem characterized by robust omnichannel strategies and strong uptake of influencer-driven limited-edition launches. Latin American markets, buoyed by rising disposable incomes and growing interest in beauty tutorials, are rapidly embracing mid-tier and premium blush formats, with local brands also making inroads through culturally resonant shade expansions.

In the Europe, Middle East & Africa region, diversity in consumer preferences is driving a broad spectrum of product offerings. Western European consumers favor innovative textures and clean-label formulations, while in Eastern Europe and the Middle East, there is a pronounced demand for long-wear and climate-adapted formulations that perform under high humidity or extreme temperature conditions. African markets are witnessing an uptick in products designed for deeper skin tones, as international and domestic players alike expand pigment ranges and specialized lines to address historically underserved demographics.

Asia-Pacific stands out as the fastest-evolving region, with markets such as China, Japan, and South Korea leading in beauty tech adoption and K-beauty-inspired innovations. Here, multi-functional blush products that combine skincare benefits with color payoff-such as serum-infused tints and cushion formats-are capturing market imagination. Southeast Asian markets demonstrate strong growth in both premium and affordable segments, driven by social media tutorials and cross-border e-commerce accessibility.

This comprehensive research report examines key regions that drive the evolution of the Face Blush market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Evaluating How Global Heritage Brands Natively Digital Labels and Indie Innovators Are Shaping the Competitive Face Blush Landscape Through Innovation Partnerships and Localized Strategies

Leading stakeholders within the face blush segment are driving competitive differentiation through a combination of product innovation, strategic partnerships, and brand storytelling. Global heritage brands have leveraged R&D prowess to introduce advanced formulations-such as ultra-fine pigment encapsulations and micro-encapsulated hydrating complexes-that enhance color longevity and skin compatibility. Simultaneously, digitally native brands emphasize direct-to-consumer models, harnessing social media engagement and limited-edition capsule releases to cultivate brand communities and foster repeat purchase cycles.

Collaborations between established manufacturers and niche influencers or artists have become instrumental in raising brand visibility and generating hype. These partnerships often yield co-created color collections that resonate with specific cultural moments or seasonal trends, amplifying earned media reach while reinforcing brand ethos. Furthermore, packaging alliances with sustainable material innovators are enabling companies to reduce environmental impact without compromising on aesthetic appeal, catering to eco-conscious consumer segments.

Amid these dynamics, regional champions and emerging indie labels are carving out niche positions by tailoring product assortments to local skin tones, cultural beauty norms, and distribution preferences. Strategic investments in localized marketing and targeted retail activations-ranging from pop-up experiences to beauty masterclasses-are strengthening brand equity and building deeper consumer loyalty in competitive markets worldwide.

This comprehensive research report delivers an in-depth overview of the principal market players in the Face Blush market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amway Corp

- Anastasia Beverly Hills, LLC

- Burberry Limited

- BUXOM Cosmetics

- Chanel inc.

- Coty Inc.

- Glossier, Inc.

- Hourglass Cosmetics by Unilever

- HUDA beauty

- L'Oréal S.A.

- Laura Mercier US Buyer LLC

- LVMH Moët Hennessy Louis Vuitton S.E.

- MILAN COSMETICS PRIVATE LIMITED.

- Mrucha Beauty

- Natasha Denona Makeup LLC

- Oriflame Cosmetics AG.

- Pixi Beauty Inc.

- Rare Beauty, LLC

- RENÉE Cosmetics Private Limited

- Revlon, Inc.

- Shiseido Cosmetics

- SUGAR Cosmetics by Vellvette Lifestyle Pvt. Ltd.

- SWISS BEAUTY Cosmetics

- Tarte Inc.

- The Estée Lauder Companies Inc.

Driving Growth Through Consumer Centric Innovation Sustainability Emphasis and Seamless Personalization to Elevate Face Blush Brand Competitiveness

Industry leaders should prioritize the integration of consumer-centric innovation frameworks that harness data from social listening, e-commerce behaviors, and in-store interactions to inform agile product development cycles. By aligning cross-functional teams around real-time trend insights, companies can accelerate go-to-market timelines for on-trend textures and shade expansions, thereby enhancing relevance and market responsiveness.

In parallel, investing in scalable sustainability initiatives across ingredient sourcing, formulation processes, and packaging materials will not only meet regulatory expectations but also resonate with increasingly eco-aware consumers. Establishing transparent supply chain traceability and amplifying these credentials through storytelling can serve as a powerful differentiator in crowded landscapes.

Furthermore, expanding personalization capabilities-such as AI-enabled shade matching, modular palette systems, and subscription-based reordering solutions-can deepen consumer engagement and drive lifetime value. Coupled with omnichannel optimization strategies that seamlessly integrate offline experiential touchpoints with robust digital platforms, these measures will fortify customer loyalty and operational resilience.

Finally, forging strategic partnerships with technology providers, ingredient innovators, and cultural influencers can unlock new growth vectors and co-creation opportunities. By fostering collaborative ecosystems, industry players can tap into fresh perspectives, de-risk R&D investments, and amplify brand narratives in an increasingly fragmented market environment.

Applying a Rigorous Hybrid Research Framework Combining Comprehensive Secondary Analysis and Targeted Primary Interviews to Ensure Data Integrity and In depth Insights

This research study employs a hybrid methodology, beginning with an exhaustive secondary research phase that assimilated insights from industry publications, regulatory databases, and company literature. This foundational work established a comprehensive understanding of market drivers, regulatory frameworks, and competitive landscapes, setting the stage for targeted primary research engagement.

During the primary research phase, in-depth interviews and structured questionnaires were conducted with key stakeholders, including product development executives, brand managers, distributors, and supply chain specialists. These interactions provided qualitative perspectives on strategic priorities, operational challenges, and innovation roadmaps, offering nuanced context to complement secondary findings. The respondent universe was carefully selected to ensure representation across brand tiers, geographic regions, and functional roles.

Data triangulation techniques were applied throughout to validate insights, cross-referencing qualitative inputs with publicly available financial disclosures, import/export statistics, and patent filings. This multi-layered approach facilitated robust scenario analysis and trend validation, enhancing the credibility and reliability of conclusions. Throughout the research process, stringent data integrity protocols and confidentiality agreements were maintained to uphold methodological rigor and safeguard proprietary information.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Face Blush market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Face Blush Market, by Product Format

- Face Blush Market, by Finish Type

- Face Blush Market, by Skin Type

- Face Blush Market, by Packaging Type

- Face Blush Market, by Application Method

- Face Blush Market, by Distribution Channel

- Face Blush Market, by Region

- Face Blush Market, by Group

- Face Blush Market, by Country

- United States Face Blush Market

- China Face Blush Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2385 ]

Summarizing the Convergence of Consumer Preferences Regulatory Forces and Technological Advancements Shaping the Future of the Face Blush Industry Through an Integrated Lens

The face blush market stands at a pivotal juncture, shaped by dynamic consumer expectations, evolving regulatory landscapes, and accelerating technological advancements. Across product types and formulations, the emphasis on clean-label ingredients, sustainable packaging, and personalized experiences is redefining how brands differentiate and deliver value. Meanwhile, geopolitical developments such as tariff revisions underscore the need for resilient supply chains and proactive scenario planning.

Segmentation analysis highlights distinct preferences across textures, skin types, and age cohorts, underscoring the imperative for tailored product portfolios and marketing narratives. Regional insights reveal diverse growth trajectories, with Asia-Pacific emerging as a hotbed of innovation, the Americas displaying mature omnichannel integration, and EMEA navigating complex cultural and climatic considerations. Leading companies are capitalizing on these trends through strategic collaborations, targeted product launches, and brand storytelling that resonates with localized consumer bases.

As the market evolves, the capacity to synthesize real-time data, leverage sustainable practices, and foster engaged communities will determine competitive positioning. By embracing an agile, insights-driven approach and forging cross-industry partnerships, stakeholders can unlock sustained growth and solidify their standing in the vibrant and ever-expanding face blush landscape.

Unlock Tailored Market Intelligence Through a Direct Conversation With Ketan Rohom to Propel Your Face Blush Strategy

For organizations seeking to deepen their understanding of evolving consumer behaviors, supply chain dynamics, and segmentation intricacies within the face blush category, our comprehensive market research report offers unparalleled insight. Engaging directly with Ketan Rohom, Associate Director of Sales & Marketing, will provide you with tailored guidance on how this research can address your strategic objectives, whether you're aiming to refine product portfolios, optimize go-to-market approaches, or identify emerging opportunities in key regions and segments. Connect with Ketan today to arrange a personalized demonstration of report highlights, discuss bulk licensing options, or explore enterprise-wide access, ensuring your team is armed with the intelligence needed to outpace competitors and capture growth in the dynamic face blush landscape.

- How big is the Face Blush Market?

- What is the Face Blush Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?