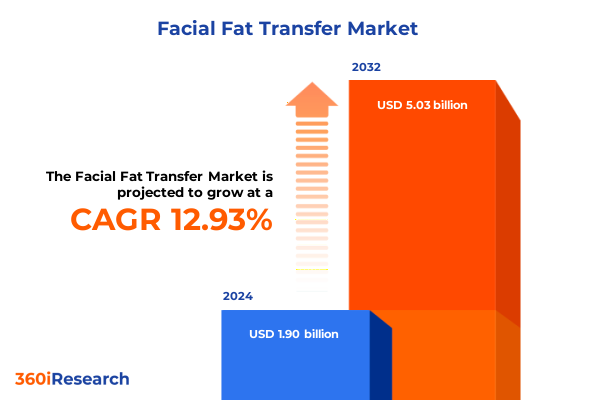

The Facial Fat Transfer Market size was estimated at USD 2.12 billion in 2025 and expected to reach USD 2.38 billion in 2026, at a CAGR of 13.09% to reach USD 5.03 billion by 2032.

A clear understanding of facial fat transfer fundamentals sets the stage for grasping its transformative potential and evolving clinical adoption trends

Facial fat transfer has emerged as a cornerstone of aesthetic and reconstructive interventions, combining autologous tissue’s natural compatibility with versatile procedural applications. By harvesting adipose tissue through minimally invasive methods and processing it for reinjection, practitioners can address volume deficits, contour irregularities, and signs of aging with enduring outcomes. This approach leverages the patient’s own tissue to reduce the risk of rejection, inflammation, and foreign body reactions, positioning it as a preferred choice among both clinicians and patients seeking natural enhancement.

As interest in personalized medicine grows, the intersection of patient-specific considerations and advanced processing techniques continues to expand the relevance of facial fat transfer. Technological refinements in fat harvesting, purification, and delivery have simplified workflows and heightened procedural safety. Consequently, the technique has transitioned from a niche reconstructive procedure to a mainstream offering in cosmetic surgery suites and outpatient centers, underlining its transformative role in delivering tailored, long-lasting results.

An overview of technological advances and evolving patient demands reshaping facial fat transfer practices across cosmetic enhancement and reconstructive care

Over the past decade, technological innovations have driven a paradigm shift in facial fat transfer, with refinements in tissue processing and delivery enhancing both safety and efficacy. Automated centrifugation systems now standardize separation protocols, ensuring consistent graft viability and minimizing cell trauma. Parallel advances in microcannula design have further refined fat placement, reducing trauma to recipient sites and improving precision in contouring delicate facial zones.

Moreover, patient expectations have evolved in tandem with these procedural developments. A growing emphasis on natural-looking results and reduced downtime has fueled demand for techniques that integrate seamlessly with patients’ lifestyles. Minimally invasive approaches, combined with real-time imaging guidance, enable clinicians to optimize graft retention and symmetry while addressing patient concerns about bruising and recovery. As a result, facial fat transfer has solidified its position as a versatile treatment that bridges cosmetic refinement with reconstructive versatility.

An analysis of the broad economic and clinical ripple effects stemming from recent tariff adjustments on facial fat transfer imports within the United States

Changes in United States tariff structures introduced in early 2025 have injected new complexity into the cost dynamics of facial fat transfer procedures. Enhanced duties on imported instrumentation and processing devices have placed upward pressure on equipment pricing for ambulatory settings and surgical suites. These cost increases have prompted some providers to reassess procurement strategies, turning attention toward domestically manufactured systems or exploring bundled purchasing agreements with device suppliers.

Consequently, clinics and hospitals have begun to adapt their service models, balancing the need to maintain competitive pricing with margin preservation. Some practices have responded by integrating procedural enhancements that emphasize efficiency, reducing per-case operating time to offset higher equipment expenses. Others are negotiating with distributors for volume-based discounts or exploring leasing arrangements for high-speed centrifugation units. In this evolving tariff environment, agile operational strategies are proving essential to sustaining procedural accessibility and ensuring patient demand remains robust.

Deep insights into facial fat transfer market segments covering application types, product variants, user settings, technique approaches, and age group dynamics

Facial fat transfer applications encompass a diverse range of indications, from elective cosmetic enhancements to critical reconstructive interventions. Cosmetic utilization prioritizes facial contouring to refine cheek volume and jawline definition, lip augmentation to restore fullness, and wrinkle correction that addresses dynamic and static rhytides. In contrast, reconstructive applications focus on congenital defect correction, such as hemifacial microsomia, and trauma repair involving post-injury volume restoration. Each of these distinct use cases drives demand for tailored procedural protocols and influences practitioner training requirements.

Product types within this market fall into two primary categories: autologous fat transfer and composite grafting. The former has evolved into sub-variants including microfat transfer, which emphasizes fine particulate sizes for superficial wrinkles; nanofat transfer, designed to harness stromal vascular fractions for skin rejuvenation; and standard transfer, which targets deeper volume restoration. Composite grafting, though less prevalent, combines adipose tissue with adjunctive materials-such as platelet-rich plasma-to enhance graft viability and accelerate recovery timelines.

End users of facial fat transfer services vary significantly in their operational environments. Aesthetic clinics-which include dedicated cosmetic surgery centers and medical spas-prioritize high patient throughput and minimal recovery periods. Ambulatory surgical centers offer a balance of surgical complexity and cost efficiency, catering to patients who require moderate sedation and more invasive volumetric corrections. Hospitals, both private and public, handle complex reconstructive cases and provide multidisciplinary care, integrating facial fat transfer into broader treatment plans for oncologic defects or congenital abnormalities.

Technique selection plays a critical role in graft success and operational workflow. Centrifugation remains the most widely adopted processing method, with high-speed protocols facilitating rapid separation of adipose and fluid components, while low-speed centrifugation emphasizes cell viability preservation. Filtration techniques-microfiltration to remove debris and nanofiltration to isolate regenerative cell fractions-offer alternative processing streams that can reduce inflammatory by-products. Sedimentation, though simpler and cost-effective, requires longer processing times and may yield lower cell purity.

Demographic analysis indicates differentiated adoption patterns across age cohorts. Patients aged 18 to 40 often seek facial fat transfer for aesthetic refinements that align with contemporary beauty trends, leveraging minimally invasive protocols. The 40 to 60 cohort balances cosmetic and early reconstructive needs, such as volume restoration and wrinkle mitigation, driving demand for techniques that promise enduring outcomes. Finally, individuals aged 60 and above typically pursue reconstructive objectives, including facial symmetry correction and age-related volume loss remediation, underscoring the procedure’s therapeutic versatility.

This comprehensive research report categorizes the Facial Fat Transfer market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technique

- Age Group

- Application

- End User

Comprehensive regional analysis highlighting key clinical adoption patterns and growth drivers across the Americas, Middle East and Africa, and Asia Pacific

Geographically, the Americas have emerged as a leading region for facial fat transfer procedures, driven by high disposable incomes, widespread access to outpatient facilities, and a strong aesthetic surgery culture. The United States, in particular, supports a dense network of aesthetic clinics and ambulatory centers offering advanced fat processing equipment, which has accelerated adoption rates and fueled innovation in minimally invasive facial volumization.

Europe, Middle East and Africa present a heterogeneous landscape in procedural uptake. Western Europe demonstrates mature market characteristics, with established reimbursement frameworks and rigorous regulatory standards that emphasize safety and practitioner certification. Conversely, certain Middle Eastern markets have experienced rapid growth in demand for cosmetic procedures, supported by medical tourism inflows. Across Africa, clinical applications remain nascent but are gaining traction in major private hospital networks where reconstructive needs arise from trauma and congenital cases.

In the Asia Pacific region, a growing emphasis on youthful appearance and a burgeoning middle class have catalyzed strong demand for aesthetic enhancements. Countries such as South Korea and Japan-well-known for their advanced cosmetic surgery ecosystems-are at the forefront of technique refinement and equipment innovation. Southeast Asian markets, leveraging medical tourism, are increasingly integrating facial fat transfer into broader wellness offerings, while China’s expanding private hospital sector continues to invest in regenerative aesthetic technologies.

This comprehensive research report examines key regions that drive the evolution of the Facial Fat Transfer market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Exploration of leading industry players shaping innovation, forging strategic collaborations, and defining competitive positioning in facial fat transfer

Leading industry participants are spearheading innovation through investments in advanced processing systems and proprietary delivery devices. Cytori Therapeutics has focused on automation platforms that streamline adipose tissue purification, positioning its technology as a solution for high-volume clinics seeking consistency and efficiency. Lipogems has differentiated itself by developing microfiltration systems that enhance graft purity, enabling practitioners to deliver refined fat suspensions suitable for both superficial and deep tissue augmentation.

Strategic collaborations between device manufacturers and academic research centers have further bolstered the evidence base for facial fat transfer. Partnerships facilitate longitudinal studies that assess graft retention rates and patient-reported outcomes, ultimately informing best practices and device optimization. Moreover, alliances with regenerative medicine startups are exploring the integration of growth factors and stem cell enrichment, signaling a shift toward next-generation composite treatments that promise accelerated healing and enhanced volumetric stability.

Emerging players are leveraging digital platforms and artificial intelligence to refine injection mapping and procedural planning. By harnessing machine learning algorithms trained on three-dimensional imaging datasets, some companies enable highly personalized treatment blueprints that optimize volumetric distribution according to patient-specific anatomy. These technological synergies underscore the competitive landscape’s evolution, as incumbents and disruptors alike vie to define the future of facial fat transfer.

This comprehensive research report delivers an in-depth overview of the principal market players in the Facial Fat Transfer market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Apyx Medical Corporation

- Arthrex, Inc.

- Cytori Therapeutics, Inc.

- Genesis Biosystems, Inc.

- Harvest Technologies, Inc.

- Human Med AG

- Integra LifeSciences Corporation

- Kurin Systems, Inc.

- Lipogems International S.p.A.

- Medikan International Inc.

- MicroAire Surgical Instruments, Inc.

- MÖLLER Medical GmbH

- Plus Therapeutics, Inc.

- Ranfac Corporation

- RegenLab SA

- Tissue Genesis, LLC

- Tulip Medical Products, Inc.

Actionable strategies to accelerate clinical adoption, optimize procedural workflow, and enhance patient satisfaction in facial fat transfer

To capitalize on emerging opportunities, providers should prioritize investment in training programs that standardize technique execution and reinforce safety protocols. Cultivating expertise in both high-speed and low-speed centrifugation methods, as well as filtration alternatives, will enable practices to tailor offerings to patient needs while maintaining procedural consistency. In addition, forging long-term relationships with device suppliers to secure preferential pricing or service agreements can mitigate the impact of tariff-related cost pressures.

Clinical adoption may also be accelerated through the integration of digital planning tools and patient engagement platforms. By leveraging three-dimensional imaging for preoperative simulations, practitioners can set realistic expectations and enhance patient confidence. Furthermore, partnerships with regenerative medicine firms can unlock access to adjunctive biologics, offering differentiated value propositions that resonate with patients seeking faster recovery and prolonged aesthetic benefits. Collectively, these strategies will strengthen competitive positioning and ensure sustained growth in a dynamic market landscape.

Overview of research methodology combining extensive data capture, expert consultations, and analytical frameworks to deliver facial fat transfer insights

Overview of research methodology combining extensive data capture, expert consultations, and analytical frameworks to deliver facial fat transfer insights

This study employs a multi-faceted approach to ensure depth and reliability. Primary research involved structured interviews with leading plastic surgeons, dermatologists, and ambulatory center directors to capture experiential insights on procedural protocols, market dynamics, and patient preferences. Quantitative data were sourced from public health registries, device shipment records, and clinical trial registries, enabling cross-validation of adoption trends and equipment utilization patterns.

Analytical frameworks integrated both descriptive and comparative techniques. Thematic analysis of interview transcripts highlighted emerging best practices, while statistical evaluation of procedure volumes and tariff impacts illuminated economic drivers. Regional decomposition was conducted to contrast maturity levels across the Americas, Europe Middle East and Africa, and Asia Pacific. Finally, triangulation with secondary literature and proprietary databases ensured that findings reflect both the breadth and nuance of the facial fat transfer ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Facial Fat Transfer market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Facial Fat Transfer Market, by Product Type

- Facial Fat Transfer Market, by Technique

- Facial Fat Transfer Market, by Age Group

- Facial Fat Transfer Market, by Application

- Facial Fat Transfer Market, by End User

- Facial Fat Transfer Market, by Region

- Facial Fat Transfer Market, by Group

- Facial Fat Transfer Market, by Country

- United States Facial Fat Transfer Market

- China Facial Fat Transfer Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2067 ]

A forward-looking summary that encapsulates key findings and underscores the strategic implications of facial fat transfer developments

In summary, facial fat transfer stands at the crossroads of innovation and clinical necessity, driven by evolving technological capabilities, patient-centric preferences, and dynamic economic conditions. The confluence of advanced processing systems and diversified application segments has broadened the technique’s appeal across cosmetic and reconstructive domains, reinforcing its role as a versatile therapeutic modality.

Looking ahead, agile adaptation to tariff fluctuations, strategic adoption of digital planning solutions, and continued collaboration between industry stakeholders will be essential to sustaining momentum. By aligning operational strategies with emerging patient demands and technological trajectories, practitioners and manufacturers alike can unlock new growth avenues and deliver superior outcomes. Ultimately, the insights presented here will serve as a roadmap for informed decision-making and strategic investment within the facial fat transfer landscape.

Contact Ketan Rohom today to secure exclusive access to the comprehensive facial fat transfer market research report for strategic clinical insights

To secure access to the comprehensive facial fat transfer market research report and unlock critical clinical insights, contact Ketan Rohom today. His expertise in sales and marketing support will ensure you receive personalized guidance on leveraging this research to inform strategic decisions and enhance competitive positioning.

- How big is the Facial Fat Transfer Market?

- What is the Facial Fat Transfer Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?