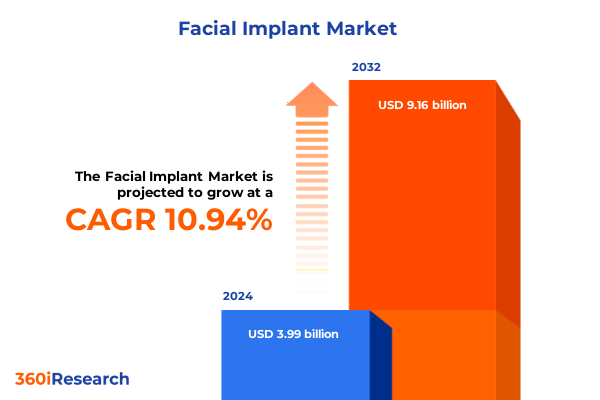

The Facial Implant Market size was estimated at USD 4.42 billion in 2025 and expected to reach USD 4.85 billion in 2026, at a CAGR of 10.97% to reach USD 9.16 billion by 2032.

Unlocking the Future of Facial Implants: A Comprehensive Introduction to Market Dynamics, Material Innovations, and Patient-Centric Trends

The facial implant industry is experiencing an unprecedented convergence of aesthetic ambition and reconstructive necessity, driven by demographic shifts, technological breakthroughs, and evolving patient expectations. Advances in biomaterials, such as hydroxyapatite’s osteoconductive properties and polyetheretherketone’s mechanical resilience, have expanded the palette of surgical options, enabling clinicians to tailor procedures with greater precision and predictability. Concurrently, patient demand for personalized treatments has surged, propelled by social media influence and the pursuit of facial harmony, with chin implants and malar augmentation emerging as prominent procedures in 2025.

In parallel, regulatory landscapes have matured to accommodate bespoke devices and streamlined approval pathways for custom implants, fostering an environment where innovation thrives. The transition from off-the-shelf silicone devices to 3D-printed PEEK constructs underscores a broader industry shift toward data-driven surgical planning and minimally invasive techniques. Together, these factors set the stage for a market defined by both its clinical sophistication and its commitment to patient-centered outcomes.

Transformative Shifts Redefining Facial Implantology: From Customized 3D-Printed Bioceramics to AI-Powered Surgical Planning Innovations

The facial implant landscape is being reshaped by transformative technological and procedural developments that are redefining clinical practice. Customized 3D printing, once a nascent concept, now underpins the creation of patient-specific hydroxyapatite and PEEK implants, offering unprecedented accuracy in reproducing complex craniofacial geometries. Surgeons leverage advanced CAD modeling and CT-based surgical simulation to optimize implant fit and aesthetic balance prior to any operative intervention. Moreover, surface modifications-ranging from microporous PEEK topographies to titanium-coated substrates-are enhancing osseointegration and reducing foreign-body reactions, as demonstrated in preclinical studies highlighting bony ingrowth into porous PEEK constructs.

These material innovations are complemented by the integration of artificial intelligence into preoperative planning and intraoperative guidance. AI-driven imaging platforms analyze facial landmarks and soft-tissue dynamics, enabling predictive outcome modeling and real-time adjustments. Concurrently, minimally invasive delivery systems and advanced endoscopic techniques are reducing surgical trauma and recovery times, further broadening the appeal of facial implants among patients seeking rapid return to daily activities. Collectively, these shifts signal a new era of precision, personalization, and performance in facial reconstructive and aesthetic surgery.

Understanding the Cumulative Impact of 2025 United States Tariffs on Facial Implant Supply Chains, Costs, and Innovation Drivers in Medtech

The reinstatement and expansion of United States tariffs in 2025 have generated significant ripple effects across the facial implant supply chain. Tariffs targeting Class I and II medical devices under Section 301, including orthopedic and craniofacial implants, have notably increased input costs for manufacturers reliant on Chinese and other foreign-sourced components. At the same time, negotiations between the U.S. and the European Union to implement a 15% baseline tariff on medical devices have created additional uncertainty, even as specific exemptions for critical medical apparatus are under discussion.

This cumulative tariff burden is prompting firms to diversify production footprints and nearshore critical manufacturing operations to mitigate cost pressures. Companies with existing U.S.-based or Mexico-based manufacturing facilities report greater resilience, while smaller manufacturers dependent on imports face sharper margin compression and potential delays. Furthermore, the prospect of derivative tariffs on steel and aluminum-containing medical products-imposed at a 25% rate since March 2025-has increased scrutiny on implant design, fostering a push toward alternative, tariff-exempt biomaterials and encouraging vertical integration of key material processes within the United States.

Key Insights into Facial Implant Market Segmentation: Material Science, Clinical Applications, Healthcare End Users, and Distribution Channels

Insights into the facial implant market emerge from a multi-dimensional segmentation framework that captures the nuances of material selection, clinical applications, end-user environments, and distribution pathways. Within the material axis, hydroxyapatite’s natural bone-mimicking attributes coexist alongside the mechanical strength of polyetheretherketone, the integration-friendly architecture of porous polyethylene, and the long-standing versatility of silicone. Each material segment commands distinct adoption rationales based on biocompatibility profiles, imaging compatibility, and cost considerations.

Application-wise, the landscape spans reconstructive interventions such as cheek reconstruction and orbital contouring, aesthetic enhancements including chin augmentation and nasal shaping, and forward-looking innovations that leverage customized 3D printing and minimally invasive delivery platforms. Similarly, the market’s end-user dimension encompasses specialized aesthetic clinics-ranging from day clinics to med spas, both chain-affiliated and independent-alongside ambulatory surgical centers and hospital systems, including both government and private institutions. Distribution channels span direct sales relationships with key opinion leaders, traditional distributor networks, and burgeoning online platforms, from proprietary company websites to third-party e-commerce portals. This segmentation lens reveals where future investments and strategic partnerships can most effectively accelerate growth.

This comprehensive research report categorizes the Facial Implant market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material

- Application

- End User

- Distribution Channel

Evaluating Regional Dynamics in the Facial Implant Market: Americas Leadership, EMEA Regulatory Influences, and Asia-Pacific Growth Opportunities

Regional dynamics in the facial implant market reflect diverse drivers and regulatory environments across the world’s major macrozones. In the Americas, the United States leads in procedural adoption and technological innovation, supported by robust healthcare infrastructure and early reimbursement of advanced implants; North America accounted for over 41% of PEEK implant utilization in 2024, underscoring the region’s dominance in high-value biomaterials. Canada and Brazil contribute through growing aesthetic markets and investments in reconstructive surgery for facial trauma.

Europe, the Middle East, and Africa feature a highly regulated landscape where stringent safety standards and Harmonized Medical Device Regulations shape market entry. Germany, France, and the U.K. serve as regional innovation hubs, with leading institutions advancing custom implant approvals. Regulatory cohesion across the EU, coupled with expanding healthcare access in select Middle Eastern markets, positions this macro-region as a critical battleground for material differentiation and clinical evidence generation.

The Asia-Pacific region exhibits the fastest growth trajectory, fueled by rising aesthetic consciousness in China, India, and Southeast Asia and expanding manufacturing capabilities. Local government initiatives to bolster domestic medical device production further accelerate supply chain localization, enhancing cost competitiveness and improving time-to-market for both standardized and customized implant offerings.

This comprehensive research report examines key regions that drive the evolution of the Facial Implant market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Competitive Landscape in Facial Implant Industry: Strategic Profiles of Leading Global Players Shaping Innovation, Collaboration, and Market Share

A detailed examination of key industry participants highlights a landscape of diversified strategies and competitive positioning. Stryker Corporation and Zimmer Biomet Holdings maintain leadership through integrated portfolios that span craniomaxillofacial and orthopedic implant systems; their strategic investments in R&D and global clinical partnerships drive continuous product enhancements. Johnson & Johnson’s MedTech division further bolsters the market with a broad array of silicone- and polymer-based facial implants, supported by robust distribution networks and extensive surgeon education programs.

Niche specialists such as TMJ Concepts and Wanhe Plastic Materials underscore the value of targeted innovation, focusing on TMJ-specific solutions and advanced polymer processing techniques that differentiate their offerings. Meanwhile, emerging players like Spectrums Design Medical and Medartis AG leverage 3D printing collaborations to deliver bespoke implants, reflecting a shift toward agile manufacturing models. The recent financial restructuring of certain small-cap aesthetics firms, exemplified by the strategic sale proceedings of one surgical device company under Chapter 11 protections, serves as a reminder of the importance of balance sheet strength and operational flexibility in this capital-intensive sector.

This comprehensive research report delivers an in-depth overview of the principal market players in the Facial Implant market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- AbbVie Inc.

- B. Braun Melsungen AG

- BioHorizons Implant Systems Inc.

- Calavera Surgical Design

- Dentsply Sirona Inc.

- GC Aesthetics PLC

- Hanson Medical Inc.

- Henry Schein, Inc.

- Implantech Associates Inc.

- Integra LifeSciences Holdings Corporation

- Johnson & Johnson

- KLS Martin Group

- Matrix Surgical USA

- Medartis AG

- Medtronic plc

- Nobel Biocare Holding AG

- Osstem Implant Co., Ltd.

- OsteoMed L.P.

- POLYTECH Health & Aesthetics GmbH

- RTI Surgical Holdings, Inc.

- Sientra Inc.

- Stryker Corporation

- Surgiform Technologies LLC

- Zimmer Biomet Holdings, Inc

Actionable Recommendations for Industry Leaders to Navigate Digital Innovation, Supply Chain Resilience, and Strategic Growth in Facial Implantology

Industry leaders should prioritize investments in digital design platforms that enable seamless customization from imaging to implant fabrication, fostering closer surgeon-manufacturer collaboration and driving differentiation. Additionally, nearshoring critical material processes and establishing multi-regional manufacturing sites will mitigate tariff risks and enhance supply chain resilience. This approach aligns with recent findings that tariffs on medical devices are accelerating strategic supply diversification and encouraging regional manufacturing partnerships.

Furthermore, forging alliances with technology firms specializing in AI-driven outcome prediction and surgical robotics will expand clinical capabilities and support minimally invasive techniques. Concurrently, companies should engage proactively with regulatory bodies to shape emerging guidelines around custom implant approvals, ensuring rapid market access. Finally, targeting underpenetrated segments-such as orbital reconstruction in specialty hospitals and online distribution channels for select aesthetic clinics-will unlock incremental revenue streams and solidify competitive positioning.

Robust Research Methodology Employed for Facial Implant Market Analysis Integrating Primary Expert Interviews, Scientific Literature, and Trade Data

This analysis is grounded in a rigorous, multi-tiered research methodology combining primary and secondary data. Primary research comprised in-depth interviews with leading craniofacial surgeons, regulatory experts, and C-suite executives, supplemented by surveys of implant manufacturers and healthcare providers. Secondary research involved systematic reviews of peer-reviewed journals, patent filings, regulatory documentation, and tariff schedules, along with analysis of customs data and company financial reports.

Data triangulation ensured consistency across multiple information streams, while both top-down and bottom-up approaches were employed to validate qualitative insights. Expert validation panels reviewed preliminary findings to refine assumptions, and proprietary databases provided supplemental intelligence on material costs and procedural volumes. This structured methodology underpins the credibility and actionable depth of the presented market insights.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Facial Implant market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Facial Implant Market, by Material

- Facial Implant Market, by Application

- Facial Implant Market, by End User

- Facial Implant Market, by Distribution Channel

- Facial Implant Market, by Region

- Facial Implant Market, by Group

- Facial Implant Market, by Country

- United States Facial Implant Market

- China Facial Implant Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1431 ]

Conclusion: Synthesizing Key Findings on Market Dynamics, Tariff Impacts, Segmentation Strategies, and Emerging Innovations in Facial Implants

In summary, the facial implant market stands at the intersection of material science innovation, digital design capabilities, and evolving patient preferences. Advanced biomaterials such as PEEK and porous polyethylene, coupled with AI-enabled planning and 3D printing, are redefining clinical possibilities and enhancing patient outcomes. However, the landscape is equally shaped by external forces, from evolving regulatory frameworks in EMEA to US tariff policies driving supply chain realignment.

Segmentation analysis reveals diverse opportunities across materials, applications, end-user settings, and distribution channels, while regional insights highlight distinct growth drivers in the Americas, EMEA, and Asia-Pacific. Leading companies leverage scale, technical expertise, and strategic partnerships to stay ahead, yet smaller specialist players continue to innovate in niche areas. By adopting the recommended strategic initiatives, industry stakeholders can navigate complexity, capitalize on emerging trends, and deliver greater value to both clinicians and patients.

Take the Next Step with Ketan Rohom to Secure the Definitive Facial Implant Market Research Report and Propel Strategic Decision-Making Today

For expert guidance and to obtain the comprehensive market research report on the facial implant industry, connect directly with Ketan Rohom, Associate Director of Sales & Marketing. Ketan can help you navigate the detailed insights, data-driven analyses, and strategic recommendations tailored to your needs, ensuring you secure the information required to make informed decisions and seize emerging opportunities in this dynamic market. Reach out today to discuss your research objectives and unlock the full potential of this authoritative resource.

- How big is the Facial Implant Market?

- What is the Facial Implant Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?