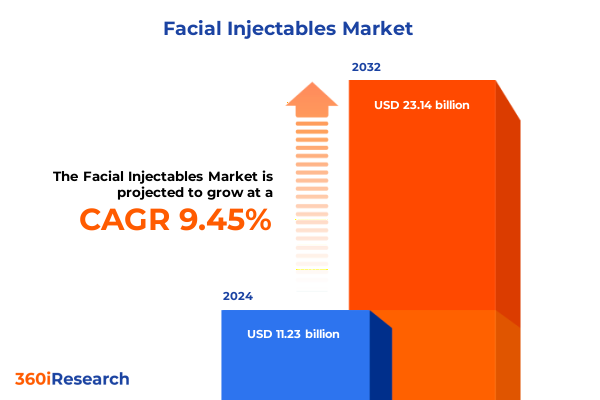

The Facial Injectables Market size was estimated at USD 12.09 billion in 2025 and expected to reach USD 13.02 billion in 2026, at a CAGR of 9.71% to reach USD 23.14 billion by 2032.

Unveiling the Rising Horizon of Facial Injectables: Market Dynamics, Clinical Innovations, and Consumer Expectations Shaping Tomorrow’s Aesthetic Landscape

The field of facial injectables has undergone a remarkable evolution, driven by an interplay of scientific innovation, aesthetic aspirations, and changing consumer attitudes. In recent years, the convergence of advanced formulation technologies and heightened patient sophistication has accelerated the mainstream acceptance of minimally invasive treatments. This introduction offers a panoramic view of the market’s origin, its current momentum, and the critical factors shaping its trajectory.

Initially, facial injectables were largely confined to niche clinical applications, often perceived as a luxury reserved for a limited demographic. However, as clinical safety profiles improved and social acceptance broadened, injectables transitioned from experimental procedures to essential tools in modern dermatology and plastic surgery practices. At the same time, the demographic base expanded as younger patients sought preventive interventions, while older cohorts adopted treatments for rejuvenation. Consequently, market dynamics now reflect a spectrum of aesthetic objectives rather than a singular focus on wrinkle reduction.

Moreover, the interplay between clinical efficacy and consumer experience has become paramount. Patients increasingly demand personalized treatment plans that respect individual anatomy, lifestyle factors, and long-term goals. This shift underscores the importance of comprehensive consultation protocols and ongoing patient education initiatives. As digital platforms facilitate peer-to-peer sharing of treatment experiences, brand reputation and practitioner expertise have emerged as critical differentiators. Through this lens, the present analysis aims to provide an authoritative foundation, setting the stage for deeper exploration of transformative trends, policy influences, and strategic opportunities.

Mapping the Evolutionary Currents in Facial Aesthetics: From Minimally Invasive Breakthroughs to Digital Personalization Driving Industry Transformation

The facial injectables sector is experiencing transformative shifts that extend far beyond incremental improvements in product formulations. Fueled by breakthroughs in biomaterials science and digital health integration, the industry is witnessing the emergence of next-generation treatments that promise enhanced precision, durability, and patient satisfaction. These paradigm shifts are redefining the competitive landscape and recalibrating stakeholder expectations at every level.

Firstly, the refinement of Botulinum Toxin subtypes and the optimization of crosslinked hyaluronic acid platforms have elevated efficacy benchmarks. Innovations such as novel peptide conjugation and tailored molecular weights are resulting in more predictable diffusion profiles and longer-lasting outcomes. Concurrently, advancements in imaging technologies, including high-resolution ultrasound guidance and artificial intelligence–driven facial mapping, are empowering clinicians to achieve precise volumetric placement with minimal downtime. This fusion of science and digital tools is transforming procedures from empirical art forms into standardized protocols.

Secondly, the focus on patient-centric customization is spurring the development of modular treatment kits and subscription-based maintenance programs. Such offerings leverage data-driven insights to adapt dosage and injection patterns over time, thereby addressing both static and dynamic facial lines more holistically. As a result, practitioners can foster deeper patient relationships and generate recurring revenue streams. In turn, this ecosystem is attracting strategic investment from digital therapeutics firms, signaling a convergence between aesthetic medicine and consumer health technology.

Assessing the Layered Consequences of Recent United States Tariff Policies and Trade Measures on the Facial Injectables Market in 2025

In 2025, the cumulative effects of United States tariff policies are reshaping the cost structures and supply chains underpinning facial injectables. Over the last several years, multiple trade actions have targeted key raw materials and components, introducing additional layers of complexity for manufacturers and end users alike. This section dissects the nuanced ramifications of these measures on pricing, availability, and strategic sourcing practices.

Initially, the extension of Section 301 tariffs on specialty chemical intermediates - including crosslinking agents for hyaluronic acid production - resulted in incremental cost increases for dermal filler manufacturers. These raw materials, often sourced from European and Asian producers, experienced duty additions in the range of 7.5 to 15 percent, depending on their country of origin. Consequently, some regional suppliers redirected exports to alternative markets, tightening global availability and exerting upward pressure on procurement lead times.

Additionally, tariffs on precision medical devices such as sterile syringes and microcannulas have introduced further cost burdens for clinical end users. Import duties of up to 10 percent on these components have prompted practices to evaluate local sourcing and bulk procurement strategies in order to mitigate pricing volatility. As a transitional response, several large-scale providers renegotiated volume-based agreements with domestic distributors and invested in vertical integration initiatives to secure critical device supply.

Furthermore, the cumulative tariff environment has accelerated exploration of adjacent markets for ingredient sourcing, particularly within Latin America and Southeast Asia. While such diversification offers potential cost relief, it also raises regulatory compliance considerations and quality assurance challenges. In sum, the 2025 trade landscape underscores the imperative for agile supply chain management and anticipatory procurement planning, as industry participants navigate tariff-induced headwinds.

Decoding Multifaceted Consumer and Clinical Segmentation Trends That Illuminate Diverse Pathways in the Facial Injectables Market

A nuanced understanding of segmentation frameworks is essential to accurately capture the breadth and depth of the facial injectables market. By examining product types, treatment areas, end-user channels, application methods, and patient demographics, stakeholders can pinpoint growth pockets and tailor offerings to evolving demand dynamics.

Within the product type dimension, Botulinum Toxin variants such as AbobotulinumtoxinA, IncobotulinumtoxinA, and OnabotulinumtoxinA coexist alongside a diverse portfolio of dermal fillers featuring Calcium Hydroxylapatite, Collagen, Hyaluronic Acid, and Poly-L-Lactic Acid technologies. Each subcategory addresses distinct aesthetic needs - from high-precision wrinkle amelioration to volumetric tissue augmentation - demanding specialized marketing narratives and clinician training protocols. Transitioning audiences from toxin-based neuromodulation to volumizing strategies requires an integrated educational approach that highlights relative benefits and application nuances.

When mapping by treatment area, clinicians target regions ranging from cheek augmentation and nasolabial folds to more delicate zones like crow’s feet and glabella lines. Precision in these zones demands mastery of injection depth, dosing intervals, and tissue biomechanics. Consequently, training programs now emphasize region-specific techniques and risk mitigation tactics, fostering greater procedural consistency and patient satisfaction.

End-user segmentation further reveals divergent adoption curves across dermatology clinics, hospitals, medical spas, and plastic surgery clinics. Medical spas are pioneering lower-cost packages designed to appeal to younger cohorts, while hospital-based practices leverage multidisciplinary expertise to manage complex cases. Clinicians deploying advanced imaging and robotic assistance often cluster within specialized clinics, reflecting a premium service tier that commands higher pricing. Application method also bifurcates between microcannula injection and traditional needle injection, with practitioners selecting techniques based on safety profiles, recovery timelines, and desired tissue remodeling effects.

Finally, age group segmentation delineates patient populations under 30, those aged 30 to 50, and the over-50 demographic. Preventive neuromodulation has gained traction among the younger cohort, whereas volumization and bio-stimulatory fillers are increasingly adopted by mature patients seeking restorative solutions. Aligning product formulations, promotional messaging, and aftercare protocols with each age bracket ensures resonance and maximizes patient retention.

This comprehensive research report categorizes the Facial Injectables market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Treatment Area

- Age Group

- Application Method

- End User

Exploring Regional Adoption Patterns and Growth Dynamics That Define the Global Facial Injectables Landscape Across Major Geographies

Regional dynamics continue to play a pivotal role in steering both innovation adoption rates and market expansion strategies. In the Americas, the United States remains the epicenter of clinical research, regulatory approvals, and premium-priced treatments, supported by a mature payer ecosystem and a dense concentration of leading aesthetic practices. Meanwhile, Latin American markets are experiencing an acceleration in elective procedures driven by rising middle-class incomes and a cultural emphasis on personal appearance.

Conversely, Europe, Middle East & Africa exhibit a heterogeneous landscape. Western European countries benefit from established reimbursement frameworks for reconstructive procedures, often cross-leveraging those pathways for aesthetic applications. In contrast, Eastern Europe and select Middle Eastern hubs are gaining traction through medical tourism, offering competitive procedure bundles and luxury service experiences. Africa, although nascent in its uptake, is demonstrating emerging potential in urban centers where private clinics cater to high-net-worth individuals.

In the Asia-Pacific region, markets such as South Korea and Japan maintain global leadership in innovation, having pioneered advanced neuromodulators and bespoke filler formulations. Southeast Asian cities are rapidly embracing simulatenous digital consultation platforms and telemedicine initiatives to broaden access among younger consumers. Moreover, regulatory harmonization initiatives within the ASEAN bloc are poised to streamline cross-border product registrations, further catalyzing growth. Collectively, these regional insights underscore the importance of localized strategies and cross-market learning loops in shaping global competitiveness.

This comprehensive research report examines key regions that drive the evolution of the Facial Injectables market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Strategic Players That Are Steering Monumental Advances in the Facial Injectables Industry

The competitive arena for facial injectables is characterized by fierce rivalry among established pharmaceutical giants, nimble biotech innovators, and vertically integrated aesthetic equipment suppliers. Key players have distinguished themselves through differentiated R&D pipelines, strategic partnerships, and targeted mergers and acquisitions aimed at bolstering market presence and technological capabilities.

At the forefront, leading pharmaceutical firms have leveraged deep expertise in peptide chemistry and biologics manufacturing to expand their neuromodulator portfolios. These incumbents have also invested heavily in next-generation delivery systems, including prefilled, single-use injection pens designed to simplify dosing accuracy. Meanwhile, midsized specialty companies are carving niches within bio-stimulatory fillers, emphasizing sustained collagen regeneration and autologous cell integration techniques.

Furthermore, the strategic landscape is punctuated by collaborations between device manufacturers and academia, fueling co-development programs that integrate robotics and AI for automated injection guidance. These alliances underscore a broader trend toward platform-based ecosystems that transcend single-product offerings. In parallel, private equity involvement has increased, financing bolt-on acquisitions aimed at consolidating fragmented aesthetic service chains and enhancing distribution reach. Collectively, these strategic maneuvers are redefining competitive boundaries and shaping the future direction of product innovation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Facial Injectables market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AbbVie Inc.

- Anika Therapeutics, Inc.

- Bloomage Biotech Co., Ltd.

- Croma-Pharma GmbH

- Evolus, Inc.

- Galderma S.A.

- Hugel, Inc.

- Ipsen S.A.

- Medytox, Inc.

- Merz Pharma GmbH & Co. KGaA

- Prollenium Medical Technologies Inc.

- Revance Therapeutics, Inc.

- Sinclair Pharma Limited

- Suneva Medical, Inc.

- Teoxane Laboratories SA

Outlining Strategic Imperatives and Tactical Recommendations for Industry Leaders to Navigate Complexity and Capitalize on Growth Opportunities

For industry leaders seeking to navigate the evolving facial injectables landscape, proactive strategic measures are imperative. First, organizations should invest in integrated supply chain visibility platforms that enable real-time monitoring of raw material flows, tariff exposures, and regulatory changes. By forecasting potential disruptions and implementing contingency plans, companies can maintain consistent product availability and optimize cost structures.

Second, prioritizing investments in digital and data-driven patient engagement tools is essential for sustaining competitive advantage. Customizable teleconsultation applications, outcome-tracking portals, and AI-powered facial analysis platforms can all contribute to deeper client relationships and enhanced retention. At the same time, practitioners should embed continuous education modules within these interfaces to reinforce procedural safety and best practices.

Third, diversification of product portfolios through strategic partnerships or targeted acquisitions can capture high-growth niches, such as bio-stimulatory injectables and combination therapy kits. Collaborating with academic institutions or biotech startups can unlock early access to breakthrough technologies, while alliances with device manufacturers can yield co-branded delivery systems that strengthen market differentiation.

Lastly, aligning corporate social responsibility initiatives with community education and access programs will cultivate broader public trust. By sponsoring accredited training workshops for emerging practitioners and facilitating philanthropic aesthetic services, companies can reinforce ethical leadership and bolster brand equity across diverse stakeholder groups.

Unraveling the Rigorous and Comprehensive Research Methodology Underpinning Our Insights into the Facial Injectables Market

The insights presented in this analysis are grounded in a robust and comprehensive research methodology, integrating both primary and secondary sources to ensure accuracy and depth. Initially, extensive secondary research was conducted, encompassing peer-reviewed journals, regulatory filings, and patent databases to map historical technology advancements and prevailing clinical practices.

Subsequently, primary research involved structured interviews with board-certified dermatologists, plastic surgeons, and lead formulators to capture frontline perspectives on product efficacy, procedural trends, and patient preferences. These qualitative inputs were supplemented by quantitative surveys distributed to referral networks across key geographic regions, enabling triangulation of adoption rates and market sentiments.

Further validation was achieved through advisory panel reviews, where independent experts assessed preliminary findings, challenged underlying assumptions, and provided contextual commentary on emerging risks and opportunities. This iterative feedback loop ensured that the final deliverables reflected real-world complexities and accounted for potential regulatory and trade developments.

Finally, data synthesis employed advanced analytics techniques, including trend extrapolation models and scenario planning frameworks, to identify high-impact variables and stress-test strategic hypotheses. The resulting multi-dimensional view combines empirical rigor with strategic foresight, offering stakeholders a reliable foundation for informed decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Facial Injectables market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Facial Injectables Market, by Product Type

- Facial Injectables Market, by Treatment Area

- Facial Injectables Market, by Age Group

- Facial Injectables Market, by Application Method

- Facial Injectables Market, by End User

- Facial Injectables Market, by Region

- Facial Injectables Market, by Group

- Facial Injectables Market, by Country

- United States Facial Injectables Market

- China Facial Injectables Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Synthesizing Key Insights into a Cohesive Narrative That Highlights Critical Findings and Future Trajectories for Facial Injectables

As this executive summary draws to a close, the overarching narrative coalesces around several pivotal themes. The convergence of scientific innovation, from refined neurotoxins to bio-stimulatory fillers, and the integration of digital personalization platforms are repositioning facial injectables as a core component of aesthetic wellness rather than a niche luxury. This transformation is underpinned by evolving patient expectations, which demand seamless clinical experiences and demonstrable long-term benefits.

At the same time, the cumulative impact of tariff policies and supply chain realignments highlights the necessity for agile operational strategies and diversified sourcing. Organizations that proactively adapt to trade fluctuations and regulatory shifts will be best positioned to maintain cost competitiveness and product accessibility.

Moreover, the segmentation framework unveils untapped growth corridors, particularly among younger demographic cohorts and underpenetrated treatment areas. Strategic alignment of product development and physician education programs can unlock these markets, driving incremental revenue streams and fostering sustained patient engagement.

Lastly, regional comparisons reveal that success hinges on localized execution, whether through digital outreach in the Americas, medical tourism integration in EMEA, or regulatory harmonization in Asia-Pacific. By synthesizing these insights into cohesive strategies, industry participants can chart a clear path forward. In essence, the facial injectables market stands at the cusp of a new era defined by precision, personalization, and purposeful innovation.

Engage with Our Expert Associate Director to Unlock Exclusive In-Depth Intelligence and Secure Your Definitive Facial Injectables Market Report Today

To explore deeper insights, tailor-made analyses, and granular data on the facial injectables market, reach out to our Associate Director of Sales & Marketing, Ketan Rohom. His expertise will guide you through customized solutions, demonstrate how the findings align with your strategic priorities, and outline the customizable options available to suit your specific organizational needs. Engage with him directly to secure priority access to the definitive market research report, position your enterprise to capitalize on emerging trends, and empower your decisions with unrivaled intelligence tailored for optimal market performance.

- How big is the Facial Injectables Market?

- What is the Facial Injectables Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?