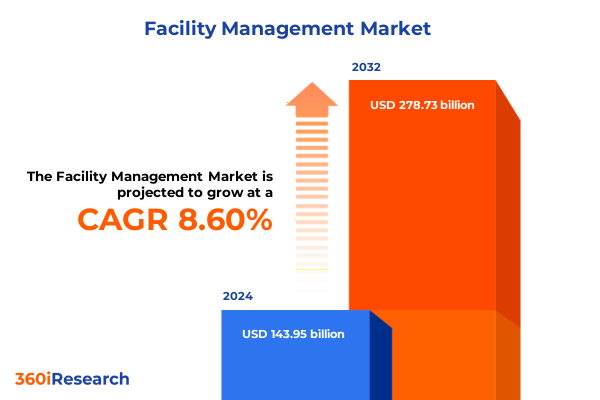

The Facility Management Market size was estimated at USD 156.15 billion in 2025 and expected to reach USD 169.53 billion in 2026, at a CAGR of 8.62% to reach USD 278.73 billion by 2032.

Setting the Stage for Facility Management Excellence Through a Comprehensive Overview of the Industry’s Scope and Strategic Imperatives

Facility management has evolved into a critical strategic function that underpins operational resilience, tenant satisfaction, and organizational sustainability. As enterprises seek to optimize costs and streamline their estates, the role of facility management extends beyond routine maintenance to encompass proactive planning, risk mitigation, and performance benchmarking. This introduction provides a cohesive overview of the industry’s broad scope, highlighting how integrated approaches unify technology, human capital, and service delivery into a synchronized operational framework.

Organizations now recognize the importance of aligning facilities with core business goals. Rather than viewing physical assets as isolated cost centers, progressive leaders see these infrastructures as catalysts for innovation and productivity. This shift necessitates a holistic understanding of facility life cycles, encompassing design considerations, energy efficiency measures, and adaptive maintenance protocols. In this context, facility management emerges as both a strategic enabler and a competitive differentiator, bridging the gap between physical spaces and digital ecosystems.

Moreover, evolving regulatory environments and heightened accountability for environmental performance push facility teams to adopt sustainable practices. The introduction of rigorous reporting standards and certification programs reinforces the demand for integrated data management and continuous improvement. By grasping this foundational context, stakeholders can navigate the complexities of the field and anticipate the forces shaping its trajectory.

Exploring the Convergence of Technological Innovation and Service Integration That Is Redefining Facility Management Practices Across Diverse Organizational Models

The landscape of facility management is undergoing a profound transformation driven by technological convergence and changing organizational expectations. At the heart of this evolution lies the integration of Internet of Things sensors, predictive analytics, and mobile workforce platforms that enable real-time visibility into asset performance. By harnessing these advancements, facility operators move from reactive troubleshooting to predictive and prescriptive maintenance models, significantly reducing downtime and extending asset lifespan.

Concurrently, stakeholder demands have shifted toward more personalized and flexible service offerings. Tenants and occupants now expect environments that adapt to their needs, from workspace reservations to indoor air quality monitoring. This dynamic environment fosters the adoption of hybrid service models that blend digital interfaces with on-site expertise, creating a seamless user experience. As a result, facility management teams are reconfiguring traditional roles, blending data scientists, sustainability specialists, and occupant experience managers into their core structures.

Interoperability also plays a pivotal role in this transformative phase. Open architecture platforms and standardized communication protocols break down silos between building management systems, security, and energy controls. This interoperability not only drives operational efficiencies but also creates opportunities for innovation through third-party integrations and open application programming interfaces. Ultimately, facility management is evolving from discrete service silos into a unified ecosystem that balances operational rigor with adaptive agility.

Unpacking the Layered Consequences of 2025 Tariff Adjustments on Domestic Facility Management Operations Supply Chains and Procurement Strategies

The introduction of new United States tariffs in early 2025 has reverberated across the facility management supply chain, reshaping procurement strategies and operational priorities. With increased duties on imported maintenance equipment and security hardware, organizations have confronted higher acquisition costs for key assets. This shift has heightened scrutiny of sourcing decisions, prompting decision-makers to explore alternative suppliers, local manufacturing partnerships, and longer equipment lifecycles to mitigate budgetary pressure.

These tariff-driven adjustments have also influenced capital planning cycles. Facility leaders now balance the need to upgrade aging systems with the imperative to manage cash flow under tighter import constraints. In many cases, this has accelerated the adoption of modular and scalable solutions that can be easily retrofitted, reducing dependence on fully imported assemblies. Additionally, procurement teams have revised vendor contracts to include flexible pricing clauses and multi-year maintenance agreements, allowing for greater cost predictability amid evolving trade regulations.

Crucially, the tariff landscape has encouraged closer collaboration between procurement, finance, and operational teams. Cross-functional task forces evaluate the total cost of ownership for each asset category, factoring in import duties, installation logistics, and maintenance schedules. By fostering such alignment, organizations protect service quality and maintain uptime, even as external pressures reshape the cost structures underpinning facility management operations.

Delineating the Critical Service Type Delivery Model Business Size and End-Use Market Segments to Illuminate Strategic Opportunity Pathways

Insight into service type segmentation reveals that hard services-comprising building maintenance, cleaning, energy management, and security systems-form the operational bedrock of facility management. These backbone services ensure structural integrity, operational continuity, and occupant safety. On the flip side, soft services such as catering and food provision, help desk support, landscaping, relocation management, reception functions, sustainability initiatives, and waste management enrich the user experience and reinforce brand reputation.

When delivery models are examined, a clear dichotomy emerges between in-house facility management structures and outsourced service arrangements. Organizations opting to maintain dedicated internal teams benefit from direct control, cultural alignment, and proprietary knowledge retention. Conversely, outsourcing partners bring specialized expertise, scalable resources, and performance-based contracts that can unlock efficiency gains and cost containment. Decisions in this realm often hinge on organizational priorities and risk tolerance.

Understanding business size dimensions further refines the landscape. Large enterprises typically engage multi-national service providers to ensure standardized practices across portfolios, leveraging global best practices and technology investments. Small and medium enterprises, however, tend to favor local or regional partners that offer flexibility, personalized attention, and streamlined scorecard reporting. Tailoring strategies to organizational scale enables optimized resource deployment and contractual agility.

Finally, the diversity of end-use sectors-from banking, financial services, and insurance to construction, education, government, healthcare, IT, manufacturing, retail, telecommunications, and hospitality-drives service customization. Each vertical imposes distinct compliance requirements, occupant expectations, and asset profiles. Recognizing these variances is essential for crafting targeted delivery models and specialized service frameworks that align with sector-specific demands.

This comprehensive research report categorizes the Facility Management market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Offering

- Delivery Model

- Deployment Mode

- Business Size

- End-use

Navigating Regional Dynamics by Investigating Americas Europe Middle East Africa and Asia-Pacific Drivers Shaping Facility Management Priorities

Regional dynamics play a pivotal role in shaping facility management strategies across the Americas, Europe, Middle East & Africa, and Asia-Pacific. In the Americas, market maturity and regulatory rigor drive demand for advanced energy management and sustainability reporting. North American organizations often lead in green building certifications and decentralized facility models, while Latin American markets increasingly integrate digital monitoring to address infrastructure gaps.

Across Europe, Middle East & Africa, regulatory harmonization and economic diversification spur investment in multi-site management platforms. European Union directives on environmental performance foster sophisticated building automation deployments and circular economy initiatives. In the Middle East, rapid infrastructure development and high standards for occupant comfort catalyze investments in smart cooling and security solutions. Meanwhile, Africa’s emerging markets exhibit growing interest in modular service offerings to support expanding industrial and commercial zones.

In Asia-Pacific, urban density and technological adoption converge to create one of the most dynamic facility management arenas. Government-led smart city initiatives drive integrated infrastructure ecosystems, while private sector players focus on leveraging IoT frameworks for predictive maintenance and occupant wellness. Regional supply chains offer both challenges and opportunities, as organizations balance local sourcing with the benefits of regional logistics hubs and digital collaboration platforms.

This comprehensive research report examines key regions that drive the evolution of the Facility Management market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Moves and Portfolio Developments from Leading Facility Management Providers to Understand Competitive Positioning

A review of leading providers underscores strategic diversity in service portfolios, technology investments, and partnership ecosystems. Some global facility management firms have intensified their focus on digital platforms, acquiring software-enabled maintenance orchestration startups to bolster their predictive analytics capabilities. Others have forged alliances with energy service companies to deliver integrated sustainability solutions, leveraging expertise in renewable energy integration and carbon reporting.

Mid-tier and regional players, by contrast, differentiate through niche specialization-offering deep domain competency in sectors such as healthcare or data centers, where uptime and compliance requirements remain paramount. These organizations often emphasize bespoke service packages and local responsiveness, capitalizing on close client relationships and cultural fit to win competitive bids.

Innovation extends beyond service delivery into workforce management. Several firms have adopted mobile-first field service apps to empower technicians with real-time access to asset histories and maintenance protocols. Meanwhile, pilot programs for autonomous cleaning robots and drone-based inspections are gaining traction among forward-thinking providers, signaling a shift toward hybrid human-machine service models.

Collectively, these strategic moves highlight a competitive landscape where agility, technology integration, and sector-specific know-how determine market positioning. Facility management enterprises that align their offerings with evolving customer expectations and regulatory requirements will establish a durable competitive advantage.

This comprehensive research report delivers an in-depth overview of the principal market players in the Facility Management market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AHI Facility Services, Inc.

- Al Suwaidi Holding Company

- Al Yamama Group

- Allied Universal

- American Facility Services Group

- Apleona GmbH

- Aramark Corporation

- Atalian Group

- CBRE Group, Inc.

- Compass Group PLC

- Cushman & Wakefield PLC

- Dussmann Group

- EFS Facilities Services Group LLC

- ENGIE SA

- Eptura, Inc

- Facilio, Inc.

- Facilities Management Express, LLC

- FacilityOne

- Fortive Corporation

- Infor Inc.

- InnoMaint

- International Business Machines Corporation

- ISS A/S

- Johnson Controls International PLC

- Jones Lang LaSalle Incorporated

- Level Access, Inc.

- Mace Group I.C.S Limited

- Mitie Group PLC

- MRI Software, LLC

- Nemetschek SE

- Nesma Co.

- OCS Group Holdings Ltd.

- OfficeSpace Software Inc.

- Oracle Corporation

- Planon Group

- QuickFMS

- SAP SE

- Saudi Binladin Group

- Savills PLC

- Service Works Global

- Shine & Standard Facility Management Pvt. Ltd.

- SMI Facility Services

- Sodexo Group

- Trane Technologies Company, LLC

- Trimble Inc.

- UpKeep Technologies, Inc.

- Veolia Environnement S.A.

- Zahran Facilities Management

- zLink, Inc.

Formulating Actionable Tactics for Operational Efficiency Sustainability and Technological Adoption to Empower Executive Decision-Makers in Facility Management

Industry leaders should prioritize the implementation of integrated digital platforms that unify maintenance scheduling, asset monitoring, and performance analytics. By consolidating disparate systems into a single interface, organizations reduce manual processes and enhance decision-making through consolidated data dashboards. This harmonization allows executives to identify trends swiftly, allocate resources proactively, and validate service impacts against organizational objectives.

Enhancing sustainability outcomes demands a dual focus on energy efficiency and occupant wellbeing. Leaders can adopt carbon reduction roadmaps alongside indoor environmental quality programs that measure air quality, thermal comfort, and daylight optimization. Embedding these initiatives within corporate social responsibility frameworks not only fulfills regulatory obligations but also boosts brand perception and tenant retention.

On the operational front, workforce optimization remains crucial. Advancing mobile-enabled training modules and gamified learning platforms empowers technicians to stay current with best practices and compliance mandates. Simultaneously, fostering a culture of continuous improvement through cross-functional knowledge-sharing sessions drives innovation at the grassroots level and cultivates employee engagement.

Finally, cross-industry collaboration offers untapped potential. By sharing insights on predictive maintenance algorithms or sustainability metrics within industry consortiums, facility management teams can accelerate collective progress. Such partnerships create economies of scale and accelerate the diffusion of groundbreaking solutions.

Detailing the Structured Research Approach Incorporating Qualitative Interviews Data Validation and Analytical Rigor to Ensure Insightful Outcomes

This study employed a rigorous, multi-faceted research framework designed to ensure the credibility and relevance of insights. Primary research involved in-depth interviews with senior facility management executives, procurement leaders, and technology providers to capture frontline perspectives on emerging trends, service expectations, and regulatory challenges. These qualitative insights were meticulously triangulated with secondary data sourced from industry journals, regulatory reports, and peer-reviewed publications.

Data validation formed a central pillar of the methodology. Survey findings underwent statistical consistency checks and outlier analysis to confirm representativeness. Furthermore, thematic coding techniques were applied to interview transcripts, allowing for the systematic identification of recurring patterns and critical drivers. This approach ensured that anecdotal observations aligned with broader industry narratives.

Analytical rigor was upheld through scenario mapping and cross-sectional comparisons across segmentation dimensions and regions. By overlaying service type, delivery model, business scale, and end-use sector analyses onto regional contexts, the study illuminated high-impact areas for strategic focus. The integration of both qualitative depth and quantitative robustness bolstered the study’s comprehensive view of the facility management ecosystem.

This structured methodology underpins the report’s actionable findings, offering stakeholders a high level of confidence in the recommendations and strategic insights presented.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Facility Management market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Facility Management Market, by Offering

- Facility Management Market, by Delivery Model

- Facility Management Market, by Deployment Mode

- Facility Management Market, by Business Size

- Facility Management Market, by End-use

- Facility Management Market, by Region

- Facility Management Market, by Group

- Facility Management Market, by Country

- United States Facility Management Market

- China Facility Management Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Synthesis of Core Insights Emphasizing Strategic Alignment Operational Agility and Value Creation for Stakeholders in the Facility Management Ecosystem

The facility management industry today stands at a crossroads where strategic alignment with organizational objectives, technological prowess, and sustainable practices drive competitive differentiation. As demonstrated throughout this summary, integrating advanced analytics platforms converts dispersed operational data into strategic intelligence, enabling more accurate resource allocation and performance benchmarking.

Moreover, the interplay between global regulation and regional market dynamics requires facility executives to maintain adaptability. Tariff shifts underscore the importance of resilient procurement strategies, while emerging service models highlight the necessity of workforce flexibility and continuous learning. Collectively, these factors reinforce the value of cross-functional collaboration and proactive planning.

Segmentation insights emphasize that no single approach fits all; organizations must tailor service blends to their unique profiles, whether they leverage modular hard services, curated soft offerings, or hybrid in-house and outsourced arrangements. Regional nuances further demand bespoke strategies that reflect localized regulatory landscapes, tenant expectations, and infrastructure maturity levels.

In sum, facility management leaders who embrace a holistic, data-driven mindset can transform their operational frameworks into strategic assets. By aligning service delivery with evolving market demands and environmental imperatives, they will drive value creation, mitigate risk, and position their organizations for sustained success.

Engaging with Ketan Rohom to Access the Comprehensive Facility Management Market Study That Delivers Strategic Clarity and Competitive Advantage

Unlock unparalleled strategic value by connecting with Ketan Rohom, whose expertise in facility management research offers executives a direct pathway to transformative market intelligence. Engaging with him ensures you receive personalized guidance on how to navigate the report’s comprehensive insights, from tariff impacts and emerging technologies to nuanced regional and segment analyses. His deep understanding of sales and marketing dynamics within the research domain will help you tailor the findings to your organization’s unique objectives, whether optimizing operational frameworks or identifying new service opportunities. By initiating this dialogue, you expedite your access to actionable recommendations and gain clarity in decision-making processes. Reach out to Ketan Rohom to secure the full study and elevate your facility management strategies with data-driven confidence and precision

- How big is the Facility Management Market?

- What is the Facility Management Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?