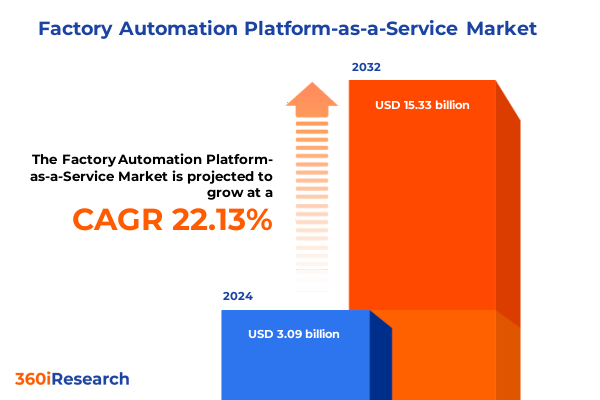

The Factory Automation Platform-as-a-Service Market size was estimated at USD 3.77 billion in 2025 and expected to reach USD 4.60 billion in 2026, at a CAGR of 22.16% to reach USD 15.33 billion by 2032.

Understanding the Emergence and Strategic Imperatives of Factory Automation Platform-as-a-Service in the Modern Industrial Ecosystem

The Factory Automation Platform-as-a-Service model is redefining how manufacturers conceive, deploy, and evolve their automation ecosystems. By offering a cloud-native architecture that unifies control systems, sensor networks, and data analytics under a single operational umbrella, this service-oriented approach eradicates traditional silos and accelerates time to value. Manufacturers can finally bridge the gap between legacy equipment and next-generation digital tools without the substantial capital outlay and lengthy implementation cycles that have historically hampered innovation.

As organizations increasingly prioritize agility and resilience, the PaaS delivery paradigm empowers plant managers and technology leaders to scale computational resources on demand, seamlessly incorporate machine learning algorithms for real-time optimization, and integrate third-party applications at the edge. In essence, this model transforms automation from a fixed capital investment into an evolving strategic asset, capable of adapting to shifting production volumes, dynamic supply chain requirements, and rapidly emerging regulatory mandates. Consequently, early adopters are establishing distinct competitive advantages through improved uptime, superior product quality, and accelerated product-to-market timelines.

Unveiling the Technological and Operational Disruptions Driving the Transformation of Factory Automation Platforms Across Industries

The shift toward cloud-native solutions and edge-enabled architectures represents a profound technological and operational disruption within manufacturing. Industry 4.0 initiatives, once centered on isolated pilot projects, are now converging around integrated PaaS frameworks that facilitate seamless connectivity between enterprise resource planning systems, manufacturing execution systems, and cloud-based analytics platforms. Advances in industrial Internet of Things (IIoT) connectivity have elevated sensor-level data from passive monitoring to proactive, event-driven orchestration, enabling manufacturers to move from reactive maintenance models to predictive and prescriptive maintenance strategies at scale.

Moreover, artificial intelligence and machine learning algorithms have become foundational to these platforms, driving insights that optimize everything from energy consumption to supply chain scheduling. Edge computing further amplifies these capabilities, allowing latency-sensitive control logic to execute locally while still benefiting from centralized intelligence. These developments are catalyzing a transformation where operational technology and information technology teams collaborate in real time, fostering a culture of continuous improvement. In addition, heightened cybersecurity protocols and zero-trust frameworks are being embedded throughout the PaaS stack, mitigating the risk of unauthorized access and safeguarding intellectual property as data traverses between on-premise devices and remote servers.

Assessing the Cumulative Impact of 2025 United States Tariffs on the Cost Structures and Competitive Dynamics of Factory Automation Solutions

Beginning in early 2025, a new wave of United States tariffs has targeted key components integral to factory automation, including advanced sensors, semiconductor microcontrollers, and programmable logic controllers. These levies, enacted under Section 301 and Section 232 authorities, have increased the landed cost of imported automation hardware by up to 25 percent, compelling vendors and end users to reassess their procurement strategies. As a result, total cost of ownership calculations have shifted, placing greater emphasis on software-based efficiencies and reducing reliance on capital-intensive hardware upgrades.

In response, solution providers are pivoting toward flexible consumption models that decouple licensing fees from hardware investments, effectively offsetting tariff-induced cost pressures. At the same time, automation leaders are exploring nearshoring and dual-sourcing strategies to diversify supply chains and mitigate tariff volatility. Although some enterprises have absorbed incremental costs to preserve production continuity, many are renegotiating long-term contracts and leveraging regional trade agreements to secure tariff relief. Consequently, the competitive landscape is evolving, with agile vendors that offer pay-as-you-go pricing structures and comprehensive service bundles gaining traction among cost-conscious manufacturers.

Extracting Key Insights from Component, Deployment, Organizational, Industry, and Application Segmentation of the Factory Automation Platform Service Market

Component-level analysis reveals that consulting services continue to command a substantial share of expenditure, as organizations seek expertise to guide integration of platform software and custom integration tools. Data analytics tools, segmented into descriptive analytics for historical performance reviews, predictive analytics for trend anticipation, and prescriptive analytics for automated decision support, are at the forefront of innovation, enabling manufacturers to translate raw sensor readings into actionable insights. Platform software remains the linchpin of PaaS offerings, providing unified dashboards, role-based access controls, and scalable compute resources.

In terms of deployment, hybrid cloud environments are increasingly favored for their ability to balance data sovereignty and scalability, while private cloud solutions appeal to enterprises with stringent security and compliance mandates. Public cloud deployments support rapid prototyping and pilot initiatives, allowing smaller operations to experiment with automation capabilities without large upfront commitments. Organizational size also influences purchasing behavior: large enterprises leverage extensive in-house IT teams and customized integrations, whereas small and medium enterprises prioritize ease of deployment, bundled support services, and modular pay-per-use models that align with variable production cycles.

End-user industries such as automotive continue to drive platform adoption through advanced robotics and digital twin implementations. The chemicals and petrochemicals sector benefits from real-time performance monitoring, while electronics manufacturers emphasize quality management to reduce defects at high volumes. Food and beverage producers leverage inventory management and asset tracking to ensure compliance and traceability, and pharmaceutical firms adopt predictive maintenance-both condition monitoring and failure prediction-to safeguard critical batch processes and minimize regulatory risk. Across all applications, from performance monitoring to quality management, solutions that integrate seamlessly with existing OT environments are capturing disproportionate attention.

This comprehensive research report categorizes the Factory Automation Platform-as-a-Service market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Application

- End User Industry

- Deployment Model

- Organization Size

Deciphering the Diverse Regional Dynamics Shaping Adoption and Innovation Trajectories for Factory Automation Platforms Across Global Markets

Across the Americas, North American manufacturers are spearheading the adoption of factory automation platforms by integrating advanced machine vision systems and cloud-based analytics into legacy production lines. The United States market, in particular, is witnessing strong collaboration between platform vendors and established automation integrators, driving rapid uptake among both discrete and process manufacturing segments. Brazil and Mexico are following suit, leveraging government incentives aimed at boosting competitiveness and nearshoring production, which has heightened demand for scalable, subscription-based automation services.

In Europe, Middle East, and Africa, regulatory frameworks promoting digital transformation and energy efficiency are catalyzing investments in smart factory initiatives. Germany’s Mittelstand companies are piloting edge-enabled platforms to optimize precision manufacturing, while the United Kingdom is focusing on interoperability standards to streamline cross-border data flows. Meanwhile, oil and gas operators in the Gulf Cooperation Council region are implementing performance monitoring and predictive maintenance solutions to enhance operational uptime and reduce environmental risk. These regional initiatives underscore the varied drivers shaping PaaS adoption across diverse economic landscapes.

Within the Asia-Pacific region, China’s government-driven push toward self-sufficiency in advanced manufacturing has spawned indigenous platform providers that compete alongside global players. Japan’s precision engineering sector prioritizes minimal downtime and lean inventory strategies, leading to widespread deployment of prescriptive analytics engines. India’s growing industrial base is adopting public cloud PaaS models to accelerate digital transformation in small and medium enterprises, while Southeast Asian nations explore hybrid cloud deployments to reconcile data localization mandates with the benefits of centralized analytics.

This comprehensive research report examines key regions that drive the evolution of the Factory Automation Platform-as-a-Service market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Pioneering and Established Companies Influencing the Evolution and Competitive Landscape of Factory Automation Platform-as-a-Service

Siemens continues to leverage its comprehensive automation portfolio by embedding advanced digital services into its Mindsphere platform, enabling clients to harness lifecycle analytics and seamless integration with third-party systems. Rockwell Automation’s FactoryTalk delivers robust edge-to-cloud connectivity, bolstered by strategic alliances with major cloud hyperscalers that extend computing power and AI capabilities. Schneider Electric has distinguished itself through EcoStruxure, an open, interoperable architecture that unifies power management, process control, and analytics under a single PaaS umbrella. ABB’s Ability platform emphasizes collaborative robotics and digital twin simulations, empowering manufacturers to validate process changes virtually before physical implementation. PTC’s ThingWorx stands out for its low-code development environment, which accelerates custom application design and streamlines rollout timelines.

While each of these leaders brings distinct strengths, they all share a commitment to open architecture, modular pricing, and ongoing feature enhancements. Competitive differentiation increasingly hinges on partner ecosystems, with vendors forging alliances across industrial networking, cybersecurity, and AI domains to deliver end-to-end solutions. As these companies continue to invest heavily in research and development, manufacturers can expect a steady cadence of innovations designed to simplify complex integrations, strengthen data security, and enhance operational agility.

This comprehensive research report delivers an in-depth overview of the principal market players in the Factory Automation Platform-as-a-Service market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Advantech Co., Ltd.

- Aptean Group

- AzeoTech, Inc.

- Epicor Software Corporation

- General Electric Company

- HCL Technologies Limited

- Hexagon AB

- Honeywell International Inc.

- Inductive Automation, LLC.

- International Business Machines Corporation

- KaaIoT Technologies, LLC

- MachineMetrics, Inc.

- Microsoft Corporation

- Mingo Smart Factory

- PTC Inc.

- Rockwell Automation, Inc.

- Salesforce, Inc.

- Schneider Electric SE

- Siemens AG

- Telit IoT Platforms, LLC

- Tulip Interfaces, Inc.

- Vorne Industries Inc.

- Worximity Technology Inc.

- Yokogawa Electric Corporation

Actionable Strategies and Best Practices for Industry Leaders to Leverage Platform-as-a-Service Capabilities in Factory Automation for Sustainable Growth

Industry leaders should prioritize the development of flexible pricing models that align with fluctuating production demands and capital budgets. By offering a spectrum of consumption-based tiers, from entry-level analytics modules to fully managed, end-to-end automation suites, vendors can capture a wider range of customers and foster long-term loyalty. Moreover, integrating robust cybersecurity frameworks and zero-trust principles into the core platform design will alleviate customer concerns and position providers as trusted partners in safeguarding critical operational infrastructure.

At the same time, organizations should deepen investments in edge computing capabilities to support real-time decision making and minimize latency. Establishing partnerships with telecommunications providers and network specialists can ensure reliable connectivity for off-site facilities and remote maintenance scenarios. To maximize value, enterprises must also cultivate workforce proficiency through targeted training programs that bridge OT and IT skill sets. Finally, maintaining a proactive posture toward evolving trade regulations-such as tariff exemptions or bilateral agreements-will enable swift adjustments to supply chain strategies and preserve competitive cost structures going forward.

Outlining the Robust Research Methodology Combining Primary Interviews, Secondary Data, and Triangulation Techniques for Reliable Market Insights

This analysis is grounded in a robust, multi-stage research methodology combining both primary and secondary sources. In the primary phase, in-depth interviews were conducted with senior executives from leading manufacturers, platform vendors, and system integrators. These qualitative insights were complemented by structured surveys administered to end users across diverse regions, ensuring representation of small and large organizations. In parallel, secondary research entailed a comprehensive review of regulatory policies, vendor whitepapers, technology patents, and publicly available financial disclosures.

To validate and triangulate findings, multiple data points were cross-referenced using statistical modeling techniques and sensitivity analyses. Quantitative and qualitative inputs were synthesized to identify prevailing trends, emerging use cases, and critical success factors. Rigorous internal quality controls, including peer reviews and data integrity audits, were employed to minimize bias and enhance the reliability of conclusions. Through this blended approach, the report delivers a holistic view of the Factory Automation Platform-as-a-Service market, underpinned by empirical evidence and expert validation.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Factory Automation Platform-as-a-Service market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Factory Automation Platform-as-a-Service Market, by Component

- Factory Automation Platform-as-a-Service Market, by Application

- Factory Automation Platform-as-a-Service Market, by End User Industry

- Factory Automation Platform-as-a-Service Market, by Deployment Model

- Factory Automation Platform-as-a-Service Market, by Organization Size

- Factory Automation Platform-as-a-Service Market, by Region

- Factory Automation Platform-as-a-Service Market, by Group

- Factory Automation Platform-as-a-Service Market, by Country

- United States Factory Automation Platform-as-a-Service Market

- China Factory Automation Platform-as-a-Service Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Summarizing Key Findings and Implications to Guide Strategic Decision-Making in Factory Automation Platform-as-a-Service Adoption and Development

The convergence of cloud-native PaaS architectures, edge computing, and advanced analytics is fundamentally transforming factory automation, enabling manufacturers to achieve unprecedented levels of operational efficiency, quality, and agility. At the same time, recent tariff measures have introduced new cost pressures, prompting a strategic shift toward software-centric consumption models and supply chain diversification. Segmentation analysis highlights dynamic demand patterns across components, deployment models, organization sizes, end-user industries, and applications, while regional insights reveal distinct drivers and adoption pathways in the Americas, Europe, Middle East & Africa, and Asia-Pacific.

Looking ahead, the competitive landscape will be shaped by vendors that can marry open, interoperable platforms with flexible pricing strategies and robust security frameworks. Industry leaders must take a proactive stance on workforce upskilling, strategic partnerships, and regulatory navigation to fully capitalize on the potential of PaaS-driven automation. By integrating these strategic imperatives into their long-term planning, organizations will be well positioned to harness the next wave of industrial innovation, drive sustainable growth, and maintain a decisive competitive edge.

Contact Ketan Rohom to Secure Your Comprehensive Factory Automation Platform-as-a-Service Research Report and Drive Informed Business Decisions

The insights and depth provided in this executive summary represent only a fraction of the comprehensive analysis available in the full report. To gain immediate access to detailed data tables, proprietary vendor assessments, in-depth case studies, and bespoke strategic frameworks, engage directly with Ketan Rohom, Associate Director, Sales & Marketing. His expertise will ensure you secure the precise deliverables and customization options you need to transform strategic planning and execution in your organization. Reach out today to purchase the full market research report and unlock actionable intelligence that empowers confident, data-driven decisions moving forward

- How big is the Factory Automation Platform-as-a-Service Market?

- What is the Factory Automation Platform-as-a-Service Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?