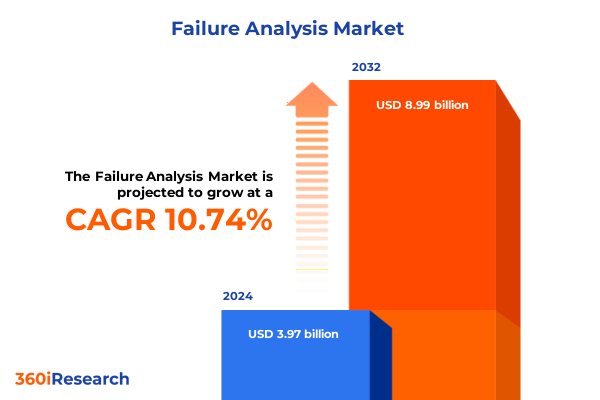

The Failure Analysis Market size was estimated at USD 4.40 billion in 2025 and expected to reach USD 4.81 billion in 2026, at a CAGR of 10.75% to reach USD 8.99 billion by 2032.

Uncovering the Critical Importance of Failure Analysis in Modern Manufacturing to Propel Reliability, Optimize Performance to Drive Strategic Decision Making

In today’s manufacturing and engineering environments, product reliability is no longer a mere operational objective but a cornerstone of brand integrity and customer satisfaction. As systems grow increasingly complex, the repercussions of component failures extend far beyond isolated incidents, impacting supply chains, end-user safety, and corporate reputations. Consequently, organizations across sectors are intensifying investments in failure analysis capabilities to preempt system breakdowns, identify root causes, and implement robust corrective measures. This report explores the critical role of failure analysis as both a diagnostic tool and a strategic asset that shapes design improvements, enhances operational resilience, and drives continuous innovation.

While traditional techniques remain foundational-encompassing visual inspections, metallurgical assessments, and electrical testing-novel advancements are rapidly transforming the practice. High-resolution imaging, accelerated life testing, and digital twin simulations are converging to offer unprecedented clarity on failure mechanisms, enabling engineers to pinpoint latent defects before they escalate. Moreover, the integration of data analytics and machine learning into laboratory workflows facilitates predictive modeling, reducing time-to-failure predictions and optimizing maintenance schedules. Such progressive methodologies underscore a paradigm shift from reactive problem-solving to proactive reliability engineering.

This introduction sets the stage by outlining the evolution of failure analysis from a niche specialty to an enterprise-level function. It highlights the mounting pressures of regulatory compliance, environmental sustainability goals, and the push toward zero-defect manufacturing. The ensuing sections delve into transformative landscape shifts, tariff impacts, segmentation insights, regional trends, competitive dynamics, actionable best practices, methodological rigor, and strategic takeaways. Collectively, these insights equip decision-makers with a comprehensive perspective on failure analysis market dynamics and strategic imperatives for navigating an increasingly demanding technological frontier.

Navigating Transformative Technological Shifts and Emerging Applications that Are Redefining Failure Analysis Approaches Across Industries Globally

The landscape of failure analysis is undergoing transformative shifts driven by technological innovation, regulatory mandates, and evolving customer expectations. Advanced imaging modalities such as scanning electron microscopy and X-ray tomography are now complemented by in situ testing capabilities that replicate real-world stressors within controlled environments. As a result, failure analysts can observe defect initiation and propagation in real time, yielding rich datasets that inform material selection and design optimization.

Simultaneously, the integration of artificial intelligence and machine learning algorithms is redefining how failure data is interpreted and leveraged. By training models on historical failure records, organizations can anticipate fault modes, prioritize inspection protocols, and reduce diagnostic timelines. This shift toward predictive analytics not only enhances operational uptime but also curtails warranty expenditures and maintenance costs.

Another significant trend is the convergence of failure analysis with broader reliability engineering frameworks. Digital twin technology, for instance, creates virtual replicas of physical assets, enabling simulation of failure scenarios under varying loads and environmental conditions. This holistic approach empowers stakeholders to assess system resilience, test mitigation strategies, and refine maintenance roadmaps before implementation on the factory floor.

Taken together, these developments signal a new era of failure analysis-one that transcends traditional postmortem examinations and embraces continuous monitoring, data-driven insights, and cross-functional collaboration. As companies navigate increasingly complex product architectures and stringent quality requirements, they must adapt to these transformative forces to maintain competitive advantage and ensure long-term reliability.

Analyzing the Far Reaching Effects of United States Tariffs Implemented in 2025 on Equipment Sourcing and Operational Costs for Failure Analysis Services

The introduction of new United States tariffs in 2025 has had a pronounced impact on the procurement of failure analysis equipment and the operational budgets of testing laboratories. As levies have been applied to imported analytical instruments, including spectrometers, high-resolution microscopes, and thermal imaging systems, providers have encountered elevated landed costs. These changes have compelled many organizations to reassess sourcing strategies, balancing the need for cutting-edge capabilities against tighter capital allocations.

In response, some failure analysis service providers have begun localizing component assembly and maintenance operations to mitigate exposure to import duties. By forging partnerships with domestic instrument manufacturers and calibration labs, service firms have been able to secure preferential pricing and faster equipment turnaround times. However, this shift also introduces challenges related to technology transfer, quality assurance, and supplier qualification processes, requiring deliberate management of supply chain risks.

Furthermore, the tariff regime has accelerated efforts to extend instrumentation lifecycles through enhanced preventive maintenance programs and modular upgrade paths. Service contracts now emphasize uptime guarantees and rapid part replacement, counterbalancing the higher cost of new equipment. At the same time, there is growing interest in leveraging refurbished instruments and certified equipment leasing models as cost-conscious alternatives, although these options necessitate rigorous validation to satisfy regulatory and customer requirements.

Overall, the cumulative effect of tariffs has reshaped investment priorities, compelling industry players to adopt more agile procurement practices, pursue strategic supplier diversification, and emphasize total cost of ownership in capital planning. In this evolving context, failure analysis operations must remain adaptable, ensuring that analytical rigor and reliability standards are not compromised by external economic pressures.

Unveiling Core Segmentation Insights by Product, End User, Distribution, Application, and Technology to Illuminate Market Dynamics and Strategic Opportunities

The failure analysis market is defined by multiple segmentation dimensions, each offering a lens through which to interpret product demand and service delivery models. When examining the market by product type, hardware solutions form the foundational layer, encompassing desktops suited for basic analysis, specialized laptops that enable field diagnostics, and robust server architectures powering data-intensive analytics. Services complement these systems through expert consulting engagements that guide test protocols, comprehensive maintenance packages ensuring instrument uptime, and support solutions tailored to evolving laboratory needs. On the software front, applications span mobile interfaces for remote monitoring, on-premises deployments offering secure in-house data processing, and SaaS platforms that streamline collaboration and version control across geographically dispersed teams.

Exploring end-user segmentation reveals a tapestry of industries relying on failure analysis to uphold safety, quality, and regulatory compliance. Banking institutions leverage fault detection in critical infrastructure to maintain data center reliability, while government entities deploy failure analysis to oversee public safety equipment and defense systems. The healthcare sector depends on these insights to certify the integrity of diagnostic devices, laboratory instruments, and medical implants. In manufacturing, automotive and electronics producers engage rigorous failure investigations to refine assembly processes and uphold warranty commitments. Retail enterprises, both offline and online, integrate failure analysis into point-of-sale hardware validation and e-commerce fulfillment systems, preventing disruptions that could erode consumer trust.

Distribution channels further nuance the delivery ecosystem. Direct sales channels enable vendors to foster deep client relationships through tailored consultative selling, whereas indirect sales networks engage distributors, retailers, and value-added resellers to expand market reach. Offline retailers offer hands-on demonstrations and immediate product availability, while online retailers cater to rapid procurement cycles and digital ordering preferences.

The application dimension underscores the functional value of failure analysis across enterprise IT and operational domains. Business intelligence tools harness advanced analytics and reporting to unearth failure trends, while customer relationship management platforms integrate failure data to enhance service responsiveness. Enterprise resource planning systems leverage insights from financial management modules, human capital management dashboards, and manufacturing planning suites to align reliability metrics with business objectives. Supply chain management applications employ demand planning and transport management functionalities to preempt logistics failures and optimize part replenishment schedules.

Finally, technological segmentation captures the architectural frameworks underpinning failure analysis solutions. Cloud-based environments-whether private deployments within corporate firewalls or public cloud infrastructures-offer scalable computational resources. Hybrid models with cloud bursting capabilities and multi-cloud strategies provide flexibility to manage peak workloads while maintaining on-premises control. By understanding these layers in concert, industry participants can identify growth corridors, prioritize investment themes, and tailor value propositions to distinct customer segments.

This comprehensive research report categorizes the Failure Analysis market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- End User

- Application

- Technology

Examining Regional Market Characteristics and Trends in the Americas, Europe Middle East and Africa and Asia Pacific to Guide Strategic Expansion Efforts

Regional dynamics exert a profound influence on the development and diffusion of failure analysis solutions. In the Americas, established industrial hubs in North America drive strong demand for advanced analytical instrumentation and services, while Latin American markets show burgeoning interest in reliability engineering as automotive and electronics sectors expand. Economic incentives, such as research tax credits and infrastructure modernization initiatives, further support laboratory investments across the region.

Transitioning to Europe, Middle East and Africa, the landscape is characterized by fragmented regulatory regimes and diverse market maturity levels. Western European nations maintain rigorous standards for product certification, prompting widespread adoption of failure analysis protocols in aerospace, medical devices, and renewable energy sectors. In contrast, emerging markets in the Middle East and select African nations are increasingly allocating resources to laboratory development, yet face challenges related to talent shortages and infrastructure readiness. Collaborative frameworks, cross-border research consortia, and public–private partnerships are emerging to bridge these gaps and accelerate technology transfer.

In Asia Pacific, a confluence of factors catalyzes rapid growth in failure analysis services. The presence of large-scale electronics manufacturing clusters, leading semiconductor fabs, and an expanding consumer device ecosystem drives demand for both in-line and post-failure diagnostics. Additionally, government-led quality enhancement programs in key economies bolster laboratory accreditation and standards compliance. Strategic collaborations between global instrument providers and regional research institutes expedite the localization of cutting-edge techniques, further entrenching the region’s position as a pivotal center for failure analysis innovation.

As a result, industry participants must navigate a complex interplay of regulatory frameworks, infrastructure capabilities, and investment landscapes when expanding regionally. By appreciating the nuanced requirements and growth enablers across these geographies, organizations can optimize market entry strategies, build resilient distribution networks, and tailor service portfolios to local imperatives.

This comprehensive research report examines key regions that drive the evolution of the Failure Analysis market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Competitive Strategies and Innovations by Leading Companies Shaping the Evolution of Failure Analysis Markets Through Strategic Partnerships

Within the competitive terrain of failure analysis, leading companies distinguish themselves through a combination of technological prowess, strategic alliances, and comprehensive service portfolios. Market incumbents invest heavily in research and development to push the boundaries of imaging resolution, accelerate throughput rates, and integrate next-generation analytical modalities. At the same time, these players cultivate global service networks capable of rapid deployment and on-site technical assistance, reinforcing client confidence and fostering long-term partnerships.

Innovation alliances constitute another critical component of corporate strategy. By aligning with academic institutions, materials science consortia, and standards bodies, major providers ensure that their methodologies remain at the forefront of emerging industry norms. These collaborations also enable co-development of specialized testing protocols tailored to nascent applications such as electric vehicle battery validation, additive manufacturing defect analysis, and sustainable material life-cycle assessments.

Moreover, strategic acquisitions and joint ventures amplify competitive reach. In markets where local presence confers regulatory or logistical advantages, multinational firms often partner with regional laboratories or equipment distributors to secure preferential access. This approach accelerates time to market for new offerings and facilitates knowledge exchange between global experts and local stakeholders.

Service diversification further distinguishes top-tier companies. Beyond core failure investigations, these firms offer training programs, software tools for data management, and advisory services that guide continuous improvement initiatives. By delivering end-to-end reliability solutions-from initial root-cause analysis to corrective action implementation-these organizations position themselves as indispensable advisors in clients’ product development and quality assurance workflows.

This comprehensive research report delivers an in-depth overview of the principal market players in the Failure Analysis market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Advantest Corporation

- Agilent Technologies

- ALS Global

- AMETEK Inc.

- Applied Materials Inc.

- Applus+ Laboratories Inc.

- Bruker Corporation

- Carl Zeiss AG

- Element Materials Technology

- Eurofins Scientific SE

- Exponent Inc.

- Hitachi Ltd.

- HORIBA Ltd.

- Intertek Group plc

- JEOL Ltd.

- Keysight Technologies Inc.

- KLA Corporation

- Leica Microsystems GmbH

- Oxford Instruments plc

- Park Systems Corp.

- Presto Engineering Inc.

- Rood Microtec GmbH

- SGS SA

- TESCAN ORSAY HOLDING

- Thermo Fisher Scientific Inc.

- Toray Engineering Co. Ltd.

- TÜV SÜD

- Veeco Instruments Inc

Actionable Recommendations for Industry Leaders to Strengthen Failure Analysis Processes and Drive Innovation Within a Dynamic Market Environment

To maintain a leadership position in failure analysis, industry executives should prioritize the development of integrated diagnostic platforms that amalgamate hardware, software, and expert services into cohesive offerings. By fostering cross-functional collaboration between materials scientists, data analysts, and reliability engineers, organizations can streamline workflows, reduce diagnostic latency, and deliver actionable insights more rapidly.

Investing in scalable digital infrastructures is also imperative. Migrating data repositories to flexible cloud environments allows for the efficient handling of large imaging datasets and the application of advanced machine learning models. In parallel, implementing robust cybersecurity measures ensures that sensitive failure data remains protected, preserving intellectual property and satisfying regulatory requirements.

Furthermore, building strategic partnerships across the value chain can unlock new growth avenues. Collaborations with component manufacturers, design firms, and academic research centers enable the co-creation of industry-specific testing protocols and the development of specialized service lines. Such alliances not only expand addressable markets but also foster a culture of continuous learning and innovation.

Finally, leaders should cultivate talent pipelines by offering specialized training programs and certifications in failure analysis techniques. As the field becomes increasingly interdisciplinary, upskilling initiatives and knowledge-sharing forums will be vital to maintaining a workforce capable of deploying advanced methodologies. By aligning organizational structures, technology investments, and human capital strategies, companies can secure a sustainable competitive edge in an ever-evolving market.

Detailing Rigorous Research Methodology Integrating Primary and Secondary Sources to Deliver Comprehensive Insights on Failure Analysis Industry Trends

This research employs a rigorous methodology integrating both primary and secondary sources to ensure comprehensive market coverage and analytical depth. Secondary data collection involved extensive reviews of peer-reviewed journals, industry white papers, patent filings, and regulatory publications, enabling a foundational understanding of technological trends, compliance frameworks, and competitive landscapes.

Primary research was conducted through in-depth interviews with key stakeholders across the failure analysis ecosystem, including laboratory managers, equipment OEM executives, materials engineers, and procurement specialists. These qualitative discussions provided firsthand insights into purchasing criteria, process challenges, and strategic priorities. Additionally, survey instruments were deployed to capture quantitative perspectives on tool adoption rates, service satisfaction levels, and anticipated investment shifts over the medium term.

Data triangulation techniques were applied to reconcile discrepancies between secondary research and primary inputs, ensuring that findings reflect real-world experiences and emerging market signals. Analytical frameworks such as SWOT, Porter’s Five Forces, and value chain analysis were leveraged to interpret competitive dynamics and identify growth levers. All sources underwent stringent validation protocols to maintain accuracy, with cross-referencing employed to verify critical data points.

This multifaceted approach guarantees that the resulting insights are both robust and actionable, equipping decision-makers with a clear, evidence-based perspective on failure analysis market drivers, challenges, and strategic opportunities.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Failure Analysis market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Failure Analysis Market, by Product Type

- Failure Analysis Market, by End User

- Failure Analysis Market, by Application

- Failure Analysis Market, by Technology

- Failure Analysis Market, by Region

- Failure Analysis Market, by Group

- Failure Analysis Market, by Country

- United States Failure Analysis Market

- China Failure Analysis Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2544 ]

Summarizing Key Findings and Strategic Takeaways to Illustrate the Evolving Landscape and Future Imperatives in the Failure Analysis Domain

The failure analysis domain is characterized by rapid technological evolution, shifting procurement landscapes, and diverse end-user requirements that collectively drive innovation and strategic investment decisions. Key findings reveal that organizations are transitioning from reactive, postfailure examinations to proactive reliability engineering paradigms fueled by advanced analytics and digital twin simulations. This shift underscores the importance of integrating real-time monitoring, predictive modeling, and cross-disciplinary expertise to anticipate and mitigate failure modes before they escalate.

Tariff-induced cost pressures have prompted a renewed focus on local sourcing, preventive maintenance, and modular upgrade strategies, ensuring that analytical capabilities remain accessible without compromising quality. Segmentation analysis highlights distinct demand patterns across product types, end-user industries, distribution channels, application domains, and technology architectures, presenting a roadmap for tailored market approaches. Regional insights further illustrate how regulatory environments, infrastructure maturity, and industry concentration shape investment priorities in the Americas, Europe Middle East and Africa, and Asia Pacific.

Competitive landscapes are increasingly defined by strategic partnerships, innovation alliances, and service diversification, as leading firms seek to deliver holistic reliability solutions that address complex client imperatives. Amid these developments, industry leaders must adopt integrated platforms, invest in scalable digital ecosystems, and cultivate specialized talent to stay ahead. These strategic imperatives form the cornerstone of sustainable growth in an environment where reliability is synonymous with competitive advantage.

In conclusion, failure analysis stands at the nexus of technology, process, and strategy. By embracing a forward-looking approach grounded in data-driven insights and collaborative innovation, organizations can transform failure analysis from a diagnostic necessity into a strategic differentiator.

Driving Engagement through Consultation with Ketan Rohom to Secure Customized Failure Analysis Market Research Report Acquisition

The landscape of failure analysis is intricate and fast-paced, demanding tailored insights that align with specific organizational challenges. Engaging directly with Ketan Rohom creates an opportunity to articulate unique requirements, discuss scope, and clarify how the research report can address critical pain points. By fostering this dialogue, stakeholders gain clarity on methodology, deliverables, and customization options, ensuring that the final report delivers maximum relevance and impact.

A consultation guided by Ketan Rohom bridges knowledge gaps and expedites decision-making processes. His expertise in Sales and Marketing provides nuanced recommendations on package options, licensing models, and complementary services. Through this personalized approach, potential clients can secure a comprehensive understanding of report frameworks, navigate pricing structures, and tailor ancillary consulting engagements to bolster internal capabilities.

Ultimately, this call-to-action transcends a mere transaction; it establishes a partnership geared toward long-term strategic value. Organizations are empowered to leverage deep-dive analyses, benchmark performance against industry leaders, and craft data-driven initiatives. Prospective buyers are encouraged to initiate a conversation today, unlocking a wealth of insights that will propel their failure analysis strategies forward.

- How big is the Failure Analysis Market?

- What is the Failure Analysis Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?