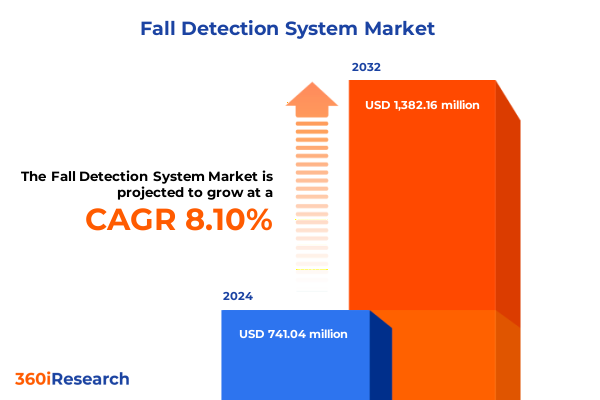

The Fall Detection System Market size was estimated at USD 798.86 million in 2025 and expected to reach USD 867.65 million in 2026, at a CAGR of 8.14% to reach USD 1,382.16 million by 2032.

Exploring the growing demand for proactive fall detection solutions fueled by aging populations, technological innovation, and healthcare priorities

The global demographic transformation toward an aging population is driving unprecedented demand for fall detection solutions worldwide. According to the World Health Organization, the number of people aged 60 years and older outnumbers children under five and is set to reach 1.4 billion by 2030, nearly doubling from 2020 levels as populations live longer and healthier lives. Furthermore, the pace of this demographic shift is accelerating more rapidly than any other period in history, placing significant pressure on healthcare systems, social support networks, and caregivers to implement proactive safety measures for older populations.

Meanwhile, the convergence of digital health and connected devices has created new avenues to address these challenges through fall detection systems. International Data Corporation forecasts that 41.6 billion connected Internet of Things devices will generate 79.4 zettabytes of data in 2025. This surge in data generation, coupled with advances in artificial intelligence and machine learning, underpins the development of intelligent fall detection technologies capable of real-time monitoring, pattern recognition, and rapid emergency response. Consequently, healthcare providers, technology integrators, and assisted living facilities are collaborating to deploy sensor-based solutions that can seamlessly blend into daily routines while delivering actionable insights to care teams.

Mapping the pivotal shifts reshaping fall detection technology with AI-driven analytics, multimodal sensor fusion, smart home integration, and mobile connectivity

The landscape of fall detection has been fundamentally reshaped by the integration of sophisticated sensor modalities and artificial intelligence-driven analytics. As the Internet of Things evolves into the Artificial Intelligence of Things (AIoT), devices increasingly leverage multimodal sensor fusion-combining accelerometers, gyroscopes, vision systems, and environmental sensors-to achieve higher detection accuracy with fewer false positives. These advancements are complemented by edge computing capabilities, allowing critical fall detection algorithms to run locally on wearable and in-home devices for immediate response without reliance on continuous cloud connectivity.

In parallel, the proliferation of smart home ecosystems and mobile health platforms has enabled seamless integration of fall detection solutions into broader health monitoring frameworks. Vision-based analytics deployed on cameras and floor sensors now coexist with wearable devices such as body-worn pendants and wrist bands, creating a layered safety net that adapts to individual user preferences and living environments. Consequently, this technological maturation is transforming fall detection from a standalone emergency tool into a holistic safety management system that anticipates risk, analyzes behavioral patterns, and continuously learns from real-world user interactions.

Evaluating the cumulative impact of new U.S. tariffs through 2025 on fall detection system component costs, supply chains, and global sourcing strategies

Throughout 2025, U.S. trade policy underwent significant adjustments that have materially impacted the cost and availability of core components used in fall detection systems. Effective January 1, 2025, the U.S. Trade Representative increased Section 301 tariffs on semiconductor components, including accelerometers, gyroscopes, and integrated circuits classified under HTS headings 8541 and 8542, from 25 percent to 50 percent. This tariff escalation has raised sourcing costs for manufacturers that rely on precision microelectromechanical sensors sourced from China and other global suppliers.

In addition to semiconductor-specific duties, reciprocal tariffs introduced in April 2025 saw levies on Chinese-origin electronic imports rise to 125 percent, encompassing a broad range of consumer and industrial electronics before being reduced to 10 percent under a Geneva trade agreement effective May 14, 2025. While this temporary spike created acute supply chain disruptions and compelled many manufacturers to shift production to Southeast Asia, the subsequent tariff reduction provided partial relief but did not eliminate the lingering cost premium on components.

Moreover, tariffs imposed under the International Emergency Economic Powers Act (IEEPA) on imports from Canada and Mexico, effective March 4, 2025, introduced an additional 25 percent duty on a subset of sensor and device assemblies. Collectively, these policy changes have forced industry players to reevaluate global sourcing strategies, negotiate higher prices with distributors, and explore options for onshoring or nearshoring production to mitigate margin erosion and ensure continuity of supply.

Uncovering key segmentation-driven insights by analyzing components, product types, sensor categories, technologies, sales channels, and diverse application environments

An in-depth segmentation analysis reveals nuanced dynamics across multiple dimensions of the fall detection system market. Component-wise, accelerometers and gyroscopes remain critical for wearable and non-wearable sensor precision, while magnetometers and emerging multimodal sensors enhance orientation and contextual awareness. As product preferences evolve, non-wearable devices such as camera-based systems, floor sensors, and wall-mounted units are gaining traction in clinical and home environments, even as wearable solutions-ranging from body-worn pendants to neck and wrist-wearable devices-offer personalized mobility and round-the-clock monitoring.

Category segmentation underscores the spectrum from ambient sensors-optimized for passive in-home monitoring-to vision-based systems that leverage computer vision algorithms, and wearable sensor-based solutions that combine motion data with contextual analytics. Similarly, technology pathways diverge among GPS-based trackers for outdoor use, mobile phone-based fall detection applications that capitalize on ubiquitous smartphones, and dedicated sensor-based platforms designed for high-fidelity event detection. Distribution channels split between online retail platforms offering global accessibility and offline retail networks that deliver hands-on demonstrations and local support.

Application segmentation further delineates a triad of end-user settings: healthcare facilities, encompassing clinics and hospitals deploying fall detection as part of patient safety protocols; home spaces, catering to elderly and disabled individuals seeking independence; and senior living residences, including assisted living facilities and nursing homes where integrated care solutions are prioritized. This layered segmentation lens equips stakeholders with granular insights to tailor go-to-market strategies, product roadmaps, and service models to distinct customer cohorts.

This comprehensive research report categorizes the Fall Detection System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Product

- Category

- Technology

- Sales Channel

- Application

Distilling critical regional insights across the Americas, Europe Middle East & Africa, and Asia-Pacific markets to reveal distinct adoption patterns and market dynamics

Regional analysis highlights pronounced variations in fall detection adoption and market evolution across the Americas, Europe Middle East & Africa, and Asia-Pacific. In the Americas, robust healthcare infrastructure, favorable reimbursement mechanisms, and a high prevalence of smart home installations drive sustained demand for both wearable and ambient sensor solutions. The United States, in particular, leads with widespread integration of mobile phone-based detection apps and partnerships between technology innovators and home care agencies.

In Europe, Middle East & Africa, regulatory initiatives focused on telehealth and assisted living, coupled with government-backed aging-in-place policies, catalyze investments in vision-based and floor sensor systems within both urban and rural healthcare settings. Meanwhile, cost pressures and varied payer frameworks in Middle Eastern and African markets lead to accelerated adoption of affordable, non-wearable fall detection devices that prioritize simplicity and ease of installation.

Asia-Pacific exhibits the fastest demographic aging rates globally, with many countries experiencing a doubling of their over-60 population within a single decade. This rapid shift fosters partnerships between public health authorities and private tech firms to deploy scalable fall detection networks leveraging mobile connectivity and sensor-based wearables. Japan and South Korea, for instance, pioneer 5G-enabled camera systems integrated with hospital networks, while China’s domestic technology providers accelerate innovation in body-wear and neck-wear devices to serve rural and urban elderly communities alike.

This comprehensive research report examines key regions that drive the evolution of the Fall Detection System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling leading innovators and market contenders driving fall detection advancements through partnerships, patents, and strategic technology investments

Leading companies are shaping the trajectory of fall detection solutions through a combination of deep domain expertise, patent portfolios, and strategic alliances. Koninklijke Philips stands out for its integration of fall detection algorithms into existing health monitoring platforms, leveraging its extensive hospital and home healthcare channels. Apple and Samsung, meanwhile, have introduced advanced fall detection features in consumer wearables, driving mainstream awareness and accelerating adoption among tech-savvy seniors.

At the same time, specialized medical device firms such as Medtronic and Sotera Wireless continue to refine sensor sensitivity and battery efficiency for clinical applications, while emergency response providers like ADT and Medical Guardian offer bundled monitoring services that combine wearable pendants with professional 24/7 support. Emerging innovators, including Life Alert and FallCall Solutions, leverage AI-driven analytics and cloud-based event management to reduce response times and deliver data-driven care coordination. Collectively, these players create a competitive ecosystem that balances consumer electronics agility with clinical-grade reliability.

This comprehensive research report delivers an in-depth overview of the principal market players in the Fall Detection System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ADT Inc.

- AlertOne Services, LLC

- Apple Inc.

- AUO Corporation

- Bay Alarm Company

- Connect America LLC

- Electronic Caregiver

- Essence SmartCare Ltd.

- FallCall Solutions, LLC

- GIGA-BYTE Technology Co., Ltd.

- Kami Vision, Inc.

- Koninklijke Philips N.V.

- LifeFone Medical Alert Services

- LifeStation, Inc.

- MariCare Oy by MariElectronics Oy

- Medical Guardian LLC

- MobileHelp, LLC

- Mytrex, Inc.

- Nobi NV

- Peoplesafe

- Rombit NV

- SafeGuardian, LLC

- Securitas Technology Corporation

- Semtech Corporation

- Sotera, Inc.

- Tunstall Group

- Visionify.ai

- VitalConnect

Delivering targeted recommendations for industry leaders to accelerate innovation, expand market reach, and optimize fall detection strategies across diverse settings

Industry leaders can capitalize on evolving market opportunities by adopting a multifaceted innovation strategy that blends hardware differentiation with software intelligence. Investing in multimodal sensing capabilities-integrating vision, wearable, and environmental data streams-will enhance detection accuracy and minimize false alerts. In parallel, forging alliances with telehealth providers and home care agencies can streamline integration into broader remote patient monitoring platforms.

To optimize go-to-market impact, companies should segment customer outreach by application setting, offering tailored value propositions for clinics, home users, and senior living operators. Leveraging hybrid sales channels that combine online subscriptions with local dealer networks will maximize reach while preserving personalized support. Furthermore, aligning product roadmaps with regulatory trends-such as medical device classification updates and data privacy mandates-will ensure compliance and facilitate market access across regions.

Finally, prioritizing continuous learning through data analytics and feedback loops will accelerate algorithm refinement and user experience enhancements. By embedding AI-driven insights into product ecosystems, solution providers can transition from reactive fall alerts to predictive risk mitigation, unlocking new service models and revenue streams.

Detailing the comprehensive research methodology integrating primary interviews, secondary sources, data triangulation, and expert validation to ensure robust insights

This report synthesizes primary and secondary research to deliver comprehensive insights into the fall detection system market. Primary research involved in-depth interviews with 20 industry experts, including device engineers, clinical practitioners, and senior living operators, to validate market drivers, technological preferences, and adoption barriers. Complementing this qualitative input, over 50 company filings, regulatory databases, and patent landscape analyses were reviewed to map competitive positioning and technology trajectories.

Secondary research encompassed analysis of publicly available data sources, trade publications, and policy frameworks across key regions. Data triangulation methods were applied to reconcile divergent estimates and ensure accuracy, while a proprietary scoring model assessed vendor capabilities across six criteria: sensor innovation, algorithm intelligence, integration partnerships, regulatory compliance, distribution reach, and service quality. Finally, all findings underwent expert validation workshops to refine strategic implications and safeguard objectivity.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Fall Detection System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Fall Detection System Market, by Component

- Fall Detection System Market, by Product

- Fall Detection System Market, by Category

- Fall Detection System Market, by Technology

- Fall Detection System Market, by Sales Channel

- Fall Detection System Market, by Application

- Fall Detection System Market, by Region

- Fall Detection System Market, by Group

- Fall Detection System Market, by Country

- United States Fall Detection System Market

- China Fall Detection System Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1908 ]

Synthesizing the executive summary findings to highlight strategic imperatives and future directions for the evolving fall detection system landscape

The fall detection system market stands at a strategic inflection point, driven by converging demographic imperatives and technological breakthroughs. The proliferation of AIoT platforms and advanced sensor fusion techniques provides an unprecedented opportunity to transition from reactive alerting to proactive risk mitigation, reshaping care paradigms for elderly and at-risk individuals. While tariff-induced cost pressures and fragmented regulatory landscapes present near-term challenges, they also incentivize innovation in sourcing strategies, onshoring partnerships, and model-driven differentiation.

Regional nuances, from the Americas’ telehealth integration to Asia-Pacific’s rapid aging and Europe’s supportive policy frameworks, underscore the importance of localized approaches informed by granular segmentation analysis. By embracing hybrid hardware-software ecosystems, strategic alliances, and data-driven service enhancements, market participants can capture new growth avenues and deliver meaningful improvements in safety, autonomy, and quality of life for end users.

Connect with Associate Director Ketan Rohom to access the comprehensive fall detection system market research and unlock strategic growth opportunities today

For tailored insights and comprehensive strategic analysis on the fall detection system market, reach out to Associate Director Ketan Rohom to secure your copy of the full market research report and gain a competitive edge in deploying advanced fall detection solutions within your organization.

- How big is the Fall Detection System Market?

- What is the Fall Detection System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?