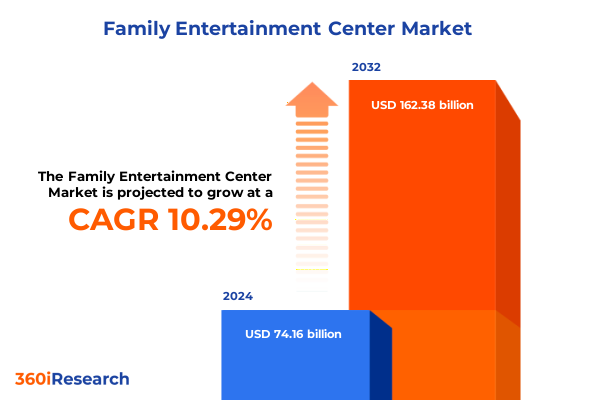

The Family Entertainment Center Market size was estimated at USD 74.16 billion in 2024 and expected to reach USD 81.55 billion in 2025, at a CAGR of 10.29% to reach USD 162.38 billion by 2032.

Building Engaging Family Destination Experiences Amid Evolving Consumer Expectations and Competitive Dynamics in Entertainment Centers

Family entertainment centers are redefining the leisure landscape by bringing together immersive attractions, diverse social experiences, and culinary offerings under one roof. As consumer preferences evolve toward more interactive, shareable activities, operators are challenged to craft holistic environments that foster long-lasting memories and repeat visits. In recent years, the convergence of physical and digital entertainment, coupled with increasing demand for convenience and personalization, has propelled these centers into a critical growth segment within the broader leisure and hospitality industry.

Against this dynamic backdrop, executives and investors require a clear understanding of emerging trends, competitive pressures, and regulatory developments that shape the trajectory of family entertainment centers. This executive summary distills key transformational forces, demographic shifts, and market drivers that are influencing strategic planning across each segment of the value chain. By examining consumer motivations, competitive benchmarks, and macroeconomic considerations, this introduction lays the groundwork for a deeper exploration of opportunities and challenges that lie ahead.

Harnessing Next-Generation Technologies and Design Principles to Elevate Guest Engagement and Operational Efficiency

The family entertainment center sector has undergone profound change as operators leverage cutting-edge technologies and reimagine traditional attractions. Augmented reality overlays, virtual reality simulations, and gamified loyalty platforms are now integral to delivering differentiated experiences that resonate with a digitally native audience. Simultaneously, the rise of hybrid venue models-combining indoor and outdoor attractions within a single footprint-has broadened the appeal of multi-attraction complexes and fostered all-weather resilience.

Moreover, the imperative of operational agility has accelerated adoption of data-driven decision-making tools. Real-time analytics platforms enable site managers to optimize throughput, predict peak demand periods, and tailor promotional offerings in alignment with consumer behavior patterns. In parallel, heightened awareness of environmental sustainability and public health considerations is shaping facility design, with low-energy lighting systems, contactless check-in technologies, and enhanced air filtration becoming industry best practices. These transformative shifts underscore the need for operators to balance innovation with practical considerations around cost management and safety compliance.

Navigating the Financial and Operational Repercussions of 2025 Tariff Adjustments on Imported Amusement and Attraction Equipment

In 2025, newly enacted United States tariffs on imported amusement rides, recreational equipment, and specialized electronic components have introduced significant cost pressures across the family entertainment center ecosystem. These levies have driven import costs upward, compelling operators to reassess capital expenditure strategies and negotiate supply chain adjustments. Equipment manufacturers and operators alike are navigating these changes by exploring alternative sourcing options from domestic suppliers, although capacity constraints and lead-time variability remain hurdles to seamless transition.

The cumulative impact of these tariffs has rippled through both procurement and pricing structures, influencing budget allocations for property development, equipment refresh cycles, and maintenance schedules. As inflationary pressures intensify, some operators have begun passing incremental costs to end consumers through tiered pricing schemes and dynamic ticketing models, while others are absorbing a portion of the tariff burden to preserve competitive positioning. In response, strategic alliances with equipment manufacturers and collaborative leasing arrangements have emerged as viable approaches to mitigate upfront capital requirements and stabilize operational margins amidst the evolving policy landscape.

Decoding Comprehensive Segmentation Dimensions to Illuminate Activity Preferences Revenue Drivers and Facility Strategies

Activity-based analysis reveals that while traditional arcades and video game offerings continue to appeal to a broad demographic spectrum, more experiential attractions such as laser tag, go-kart racing, and roller coasters are driving elevated dwell times and ancillary spending. Meanwhile, the integration of virtual and augmented reality experiences is unlocking new engagement pathways, appealing particularly to teenagers and young adults seeking interactive, immersive forms of entertainment. Operators are consequently recalibrating floor plans and capital allocations to strike an optimal balance among classic and cutting-edge attractions.

Revenue streams are undergoing similar evolution, where food and beverage concessions have transformed from ancillary services into central revenue generators driven by premium snack options, themed dining concepts, and beverage subscription models. Advertising partnerships with consumer brands provide supplementary income, particularly in high-traffic venues, while merchandising of branded apparel and collectibles fosters deeper emotional connections with guests. Facility size considerations have become strategic levers: sprawling large-scale entertainment hubs deliver comprehensive, destination-style experiences, whereas compact medium- and small-scale venues offer agility for urban infill locations and neighborhood markets.

The interplay between facility type and ownership structure is further reshaping competitive dynamics. Indoor and outdoor configurations cater to distinct regional appetites-indoor hybrid venues thrive in colder climates, while outdoor-focused offerings capitalize on temperate geographies. Chain-operated centers benefit from standardized operational protocols and national marketing campaigns, but independent venues leverage local community ties and bespoke programming to carve out niche appeal. Finally, applications range from integrated attractions within resorts and shopping mall entertainment zones to standalone destinations, each presenting unique operational imperatives and partnership opportunities.

This comprehensive research report categorizes the Family Entertainment Center market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Attraction Mix

- Facility Type

- Technology Stack

- Facility Size

- Ownership Type

- Age Group

- Booking Channel

Understanding How Regional Economic Dynamics and Cultural Preferences Shape Diverse Growth Pathways in Entertainment Centers

Across the Americas, the United States remains the preeminent market, where a mature ecosystem of family entertainment centers is characterized by high per capita visitation rates and robust consumer spending on experiential leisure. Latin American markets are witnessing accelerated growth as rising disposable incomes and urbanization fuel demand for accessible, family-friendly recreation. Operators in the region must navigate varied regulatory landscapes and logistical complexities, yet there is fertile ground for expansion, particularly through franchising and joint ventures with local stakeholders.

In Europe, Middle East, and Africa, diverse economic profiles shape fundamentally different growth trajectories. Western Europe’s saturated markets prioritize experiential differentiation and sustainable practices, while emerging economies in Eastern Europe and parts of the Middle East exhibit untapped potential for new-format centers. Regulatory compliance and land-use planning in the EMEA region necessitate tailored site-selection frameworks and robust community engagement strategies. Turning to Asia-Pacific, rapid urbanization and tourism-driven demand have catalyzed a proliferation of large-scale entertainment complexes, particularly within China, India, and Southeast Asia. Here, operators are investing heavily in themed attractions, technology integration, and cross-promotional partnerships with cultural and hospitality entities to capture diverse consumer segments seeking immersive recreational experiences.

This comprehensive research report examines key regions that drive the evolution of the Family Entertainment Center market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Competitive Strategies Including Alliances Acquisitions and Technology Partnerships Driving Industry Leadership

Leading organizations are differentiating themselves through a blend of strategic partnerships, technological innovation, and operational excellence. Prominent nationwide chains have leveraged harmonious branding across multiple locations to deliver consistent guest experiences, while adopting omnichannel marketing ecosystems that seamlessly link digital promotions with on-site activations. At the same time, regional operators are capitalizing on localized offerings, such as themed events and seasonal programming, to strengthen community ties and drive repeat visitation.

In terms of strategic movements, several key players have undertaken mergers and acquisitions to accelerate market penetration and diversify their geographic footprints. Collaborative alliances with technology providers have enabled the rapid rollout of augmented reality attractions and touchless service models, while joint ventures with hospitality groups have fostered co-located resort and entertainment packages. These concerted maneuvers underscore a broader industry imperative: to cultivate resilient business models that integrate entertainment, food and beverage, and retail under a unified experiential umbrella.

This comprehensive research report delivers an in-depth overview of the principal market players in the Family Entertainment Center market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Atech Group International

- Bandai Namco Holdings Inc.

- CEC Entertainment, LLC

- Cinergy Entertainment Group, Inc.

- Clip ‘n Climb by ABEO Company

- Connect&GO Inc.

- Dave and Buster'S, Inc.

- Dynamite Disc Jockey's Inc.

- Five Star Parks & Attractions

- Funco

- Funriders Leisure & Amusement Pvt. Ltd.

- Gametime Lanes & Entertainment

- Global Fun Sports

- Go Play Systems

- Guangzhou Wonka Playground Co., Ltd.

- Head Rush Technologies

- Innovative Concepts in Entertainment, Inc.

- KidZania Operations S.A.R.L.

- Landmark Group

- Launch Entertainment

- Legoland Discovery Center by Merlin Entertainments Limited

- Lucky Strike Entertainment

- Majid Al Futtaim Holding LLC

- Pathfinder Software, LLC

- Playlife-System GmbH

- Scene75 Entertainment Centers

- Semnox Solutions Pvt Ltd

- Shaffer Distributing

- Smaaash Entertainment Private Limited

- Tenpin Limited by Ten Entertainment Group Plc

- The Entertainment and Education Group

- The Walt Disney Company

- Toy Town

- Two Bit Circus, Inc.

- Walltopia AD

Empowering Decision-Makers with Strategic Procurement Models Data-Driven Frameworks and Sustainability Imperatives

To thrive in a landscape marked by rapid innovation and shifting policy parameters, industry leaders must prioritize flexible capital deployment and strategic collaboration. By forging long-term agreements with equipment suppliers and investing in asset-light leasing structures, operators can reduce exposure to tariff-driven cost increases while preserving the ability to refresh attractions in alignment with evolving consumer tastes. Moreover, cultivating strategic partnerships with technology firms will accelerate deployment of immersive offerings without the operational burden of in-house development.

Equally important is the adoption of advanced analytics frameworks that transform raw guest data into actionable insights. By harnessing customer behavior patterns, sentiment analysis, and dwell-time metrics, operators can optimize attraction mixes, personalize promotional campaigns, and dynamically allocate staff resources to peak demand periods. In parallel, embedding sustainability initiatives-ranging from energy-efficient infrastructure to waste reduction programs-will enhance brand reputation and align with the growing consumer preference for environmentally conscious entertainment options.

Outlining a Robust Multi-Method Research Protocol Combining Executive Interviews Surveys and Case Study Analysis

This study integrates both qualitative and quantitative research methodologies to ensure rigor and reliability. Primary research consisted of structured interviews with senior executives from leading entertainment operators, equipment suppliers, and industry consultants, complemented by on-site visits to a representative sample of venues across key regions. Quantitative data was collated through proprietary surveys capturing consumer preferences, spending behaviors, and visitation frequencies, which were then triangulated against third-party datasets and regulatory filings to validate accuracy.

Secondary research involved a comprehensive review of industry publications, trade association reports, patent filings, and financial disclosures to map competitive activities and technology adoption trends. Case studies of landmark venue launches and retrofit projects provided contextual insights into best practices for design, operations, and guest engagement. Data synthesis was facilitated by statistical modeling and scenario analysis, enabling robust cross-segmentation comparisons and trend extrapolation without reliance on predictive market sizing. Throughout the research process, methodological integrity was maintained through peer review and continuous data quality checks.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Family Entertainment Center market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Family Entertainment Center Market, by Attraction Mix

- Family Entertainment Center Market, by Facility Type

- Family Entertainment Center Market, by Technology Stack

- Family Entertainment Center Market, by Facility Size

- Family Entertainment Center Market, by Ownership Type

- Family Entertainment Center Market, by Age Group

- Family Entertainment Center Market, by Booking Channel

- Family Entertainment Center Market, by Region

- Family Entertainment Center Market, by Group

- Family Entertainment Center Market, by Country

- United States Family Entertainment Center Market

- China Family Entertainment Center Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 3657 ]

Consolidating Strategic Insights to Inform Adaptive Business Models and Competitive Positioning in the Entertainment Sector

The family entertainment center industry stands at a pivotal moment, where the confluence of technological innovation, shifting consumer demands, and trade policy developments is reshaping competitive dynamics. Operators who embrace data-driven decision-making, cultivate strategic alliances, and maintain operational agility will be best positioned to capture emerging growth opportunities. By carefully balancing investment in immersive attractions with prudent cost management strategies, industry leaders can navigate evolving tariff environments and consumer expectations alike.

Ultimately, success in 2025 and beyond will depend on a holistic approach that integrates engaging guest experiences, sustainable operational practices, and adaptive business models. This report has illuminated critical pathways for differentiation, from nuanced segmentation insights to regional performance analyses, offering a comprehensive framework for actionable strategy formulation. As the sector continues to evolve, stakeholders who leverage these insights to inform investment decisions and operational enhancements will solidify their status as frontrunners in the dynamic world of family entertainment centers.

Unlock In-Depth Strategic Intelligence by Connecting with Ketan Rohom to Secure Your Family Entertainment Center Market Research

Engaging with a trusted market intelligence partner is essential for industry leaders who aspire to stay ahead of rapid changes in consumer behavior, technological innovation, and trade policy dynamics. Ketan Rohom, Associate Director, Sales & Marketing, is ready to guide you through an in-depth consultation on how this comprehensive report can empower your strategic planning and operational decision-making while aligning with your organization’s growth objectives.

By securing the full report, you gain immediate access to actionable insights, detailed segmentation analyses, regional performance breakdowns, and competitive benchmarking that will illuminate untapped opportunities and potential threats in the family entertainment center ecosystem. Reach out to Ketan to discuss customized research packages, group licensing options, and ongoing advisory support designed to maximize your return on investment in 2025 and beyond.

- How big is the Family Entertainment Center Market?

- What is the Family Entertainment Center Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?