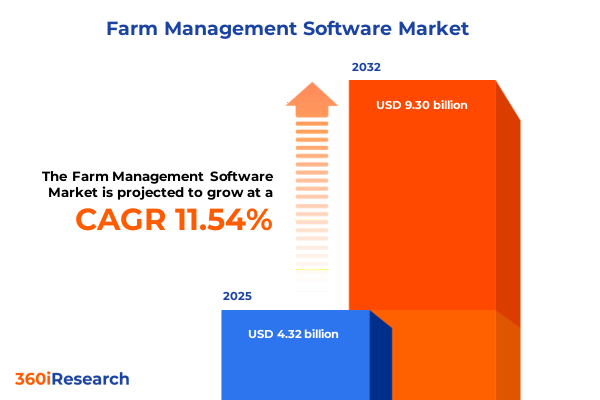

The Farm Management Software Market size was estimated at USD 4.32 billion in 2025 and expected to reach USD 4.80 billion in 2026, at a CAGR of 11.54% to reach USD 9.30 billion by 2032.

Discover how emerging digital tools are reshaping agricultural operations and driving productivity with intelligent farm management solutions

The rapid infusion of digital capabilities into agricultural operations is transforming traditional farm management into a data-driven ecosystem. Modern agriculture increasingly relies on integrated software solutions that provide real-time visibility into field activities, financial performance, and resource utilization. As farms grow more complex, the demand for tools that can aggregate satellite imagery, soil sensor data, and farm equipment telemetry into unified dashboards is surging. These platforms are not merely record-keeping systems; they are intelligent engines that enable predictive planning, optimize input applications, and support compliance with evolving environmental regulations.

This introduction highlights the fundamental shift from manual record-keeping and disparate spreadsheets to cloud-hosted software platforms designed for scalability and ease of collaboration. By automating routine tasks such as planting schedules, inventory tracking, and labor allocation, farm operators can devote more time to strategic decision-making rather than administrative overhead. Additionally, the emergence of mobile interfaces ensures that stakeholders-from operations managers to agronomists-can access critical insights from any location. Consequently, technology adoption is accelerating as growers seek to enhance yields, improve cost controls, and sustainably manage resources. This section sets the stage for understanding how farm management software has become indispensable for agricultural enterprises aiming to thrive in an era defined by precision, connectivity, and data intelligence.

Uncover the pivotal shifts driving digitization from legacy practices to AI-driven farm management ecosystems across the agricultural value chain

Emerging technological advancements are catalyzing a profound transformation in the agricultural landscape. Automation platforms now seamlessly integrate drone-based crop scouting, machine learning algorithms for yield prediction, and blockchain-enabled traceability systems for supply chain transparency. These converging innovations are redefining the expectations of farm management solutions, compelling software developers to pack analytics engines, remote sensing interfaces, and decision-support modules into unified suites.

Simultaneously, the proliferation of 5G networks and edge computing devices is enabling near-instantaneous data transfers between on-field sensors and centralized platforms. This low-latency connectivity reduces reliance on manual data collection and accelerates response times to emerging crop health issues or equipment malfunctions. As a result, agricultural stakeholders are witnessing a transition from reactive problem-solving to proactive, predictive interventions. The farmer of tomorrow can leverage automated nutrient management recommendations, real-time weather-driven irrigation schedules, and AI-powered pest detection with unprecedented precision.

Moreover, the growing emphasis on sustainability and carbon footprint reduction is pushing farm management software to incorporate environmental metrics alongside financial KPIs. By embedding lifecycle assessment tools and emission tracking modules, these platforms support compliance with stringent sustainability standards and help operators optimize resource use. This transformative shift illustrates how next-generation solutions are guiding agriculture toward greater efficiency, resilience, and environmental stewardship.

Analyze how evolving trade policies and cumulative tariffs in 2025 are recalibrating the cost structure and adoption pathways for farm management software

The landscape of farm management is increasingly influenced by global trade policies and evolving tariff structures. In 2025, the cumulative effect of U.S. tariffs on agricultural equipment and technology inputs has introduced new cost variables for software-informed precision agriculture. Many advanced sensors, GPS modules, and automated machinery components critical to software-enabled workflows are sourced internationally and carry duties that raise acquisition and maintenance expenses. These elevated hardware costs can dampen adoption rates, especially among small to medium-sized operations that rely on cost-effective entry points to digital agriculture.

In parallel, retaliatory tariffs imposed by trade partners have targeted a range of agrochemicals and critical inputs, which cascade into higher operational budgets for farm enterprises. As margins tighten, decision-makers may deprioritize investments in comprehensive software platforms in favor of more immediate production needs. This dynamic creates a tension between the long-term productivity gains offered by digital tools and the short-term financial pressures induced by trade barriers.

Despite these headwinds, domestic manufacturers are channeling efforts into localizing component production to mitigate tariff burdens. Partnerships between software providers and U.S.-based equipment firms are giving rise to bundled offerings that feature tariff-insulated hardware and pre-integrated software modules. This convergence provides a pathway for sustained technology adoption while recalibrating cost structures in response to the evolving trade environment.

Examine the nuanced segmentation of farm management software markets through the lenses of agricultural type, functionality, deployment mode, farm scale, and end user needs

The farm management software landscape can be understood through five distinct segmentation dimensions that reveal varying requirements and adoption patterns. When considering agriculture type, solutions must adapt to the nuances of aquaculture’s water-quality monitoring, the cycle-driven workflows of crop farming, the controlled-environment demands of horticulture, the biosecurity protocols of livestock farming, and the high-precision focus of advanced precision agriculture. Platform functionality further differentiates offerings by centering on equipment management for tracking machinery usage, field management for mapping plots and crop rotations, financial management for budget oversight, inventory management for seed and input tracing, and labor management for workforce scheduling.

Deployment mode is equally crucial, as operators weigh the accessibility and scalability of cloud-based platforms against the customization and data sovereignty offered by on-premises installations. Farm size also shapes selection criteria, with large farms seeking enterprise-grade solutions that integrate multi-regional operations, medium farms balancing cost and capability, and small farms prioritizing user-friendly interfaces and core operational features. Finally, end users span academia engaged in research and development of agronomic best practices, agricultural consultants who advise on farm optimization strategies, and farmers who need hands-on tools for daily operations. Understanding these interconnected segmentation layers allows stakeholders to fine-tune software selections to their unique operational profiles and strategic objectives without relying on generic, one-size-fits-all offerings.

This comprehensive research report categorizes the Farm Management Software market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Agriculture Type

- Functionality

- Deployment Mode

- Farm Size

- End-User

Explore the diverse regional dynamics shaping farm management software adoption across the Americas, Europe Middle East & Africa, and Asia-Pacific markets

Regional dynamics have a profound impact on the adoption and evolution of farm management software, driven by differing regulatory frameworks, infrastructure maturity, and agronomic practices. In the Americas, robust cloud connectivity and widespread government incentives for precision agriculture accelerate uptake. Large commercial farming enterprises in North America routinely employ integrated digital platforms to meet environmental compliance and food safety standards while enhancing profitability through data-driven crop planning and resource optimization. Conversely, in Latin America, adoption is growing among medium-scale producers who leverage software to gain market access and manage commodity exports more effectively.

The Europe Middle East & Africa cluster exhibits varied adoption profiles. European operators often face stringent sustainability reporting requirements, prompting software developers to embed carbon tracking and lifecycle assessments. Regulatory pressures on water usage and nutrient leaching reinforce the need for integrated irrigation scheduling and fertilizer management modules. Meanwhile, Middle Eastern innovations focus on managing scarce water resources through smart irrigation and soil moisture analytics. In Africa, pilot programs funded by public-private partnerships are introducing smallholder farmers to mobile-first management platforms that record input usage, facilitate micro-finance applications, and support cooperative-based decision-making.

Asia-Pacific’s growth trajectory is underpinned by expanding mechanization efforts in India, digitization drives in China’s state-sponsored smart-farming initiatives, and Australia’s precision agriculture leadership. Widespread smartphone penetration, coupled with government subsidies for digital extension services, is fueling steady gains in software adoption across a range of farm sizes and crop types. Together, these regional insights underscore the importance of tailored strategies that reflect local market drivers and infrastructure landscapes.

This comprehensive research report examines key regions that drive the evolution of the Farm Management Software market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Identify the strategic positioning and innovation trajectories of leading farm management software companies driving the competitive landscape forward

Leading farm management software vendors are differentiating themselves through specialized capabilities, strategic partnerships, and forward-looking roadmaps. Some firms have established robust ecosystems by integrating satellite imagery analytics with IoT sensor networks, enabling high-resolution crop monitoring and predictive yield modeling. Others prioritize modular architectures that allow operators to incrementally adopt financial management, field operations, and compliance tracking modules, ensuring scalability without upfront complexity. Several players are forging alliances with equipment manufacturers to deliver hardware-software bundles that simplify installation and data integration, reducing time to value for end users.

Innovation is also driven by the alignment of research institutions and private-sector developers in co-creation labs focused on machine learning applications for disease identification and autonomous machinery guidance. Furthermore, some companies are extending platform capabilities to offer marketplace functionalities, connecting farmers with input suppliers, service providers, and commodity buyers within the software environment. This trend toward platformization enhances user stickiness and creates new revenue streams beyond subscription fees.

As competition intensifies, differentiation strategies hinge on delivering open APIs, adopting open architecture principles, and fostering developer communities that create complementary applications. This collaborative approach is accelerating the expansion of software ecosystems and enabling rapid incorporation of emerging technologies such as blockchain-based traceability and advanced robotics. Ultimately, the competitive landscape is shaped by vendors that can blend deep domain expertise with agile innovation to meet the evolving demands of modern agriculture.

This comprehensive research report delivers an in-depth overview of the principal market players in the Farm Management Software market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 365FarmNet GmbH by CLAAS KGaA mbH

- ABACO Group

- Ag Leader Technology

- AGCO Corporation

- agCommander Pty Ltd.

- AgJunction LLC by Kubota Corporation

- Agri Tracking Systems

- AgriChain Pty Ltd.

- AGRIVI d.o.o.

- AgriWebb

- Agroptima S.L. by Isagri S.L.

- AgroVIR Ltd.

- BASF SE

- Boumatic LLC

- Bushel Inc.

- Ceres Imaging, Inc.

- Climate LLC by Bayer AG

- Conservis LLC

- Corteva, Inc.

- Cropin Technology Solutions Pvt Ltd.

- CropX Technologies Ltd.

- Dairy One Cooperative, Inc.

- Deere & Company

- DeLaval by Tetra Laval Group

- eAgronom OÜ

- Ever.Ag Corporation

- Farmbrite

- FarmERP by Shivrai Technologies Pvt. Ltd.

- Farmers Edge Inc.

- FarmRaise Inc.

- GAMAYA

- GEA Group Aktiengesellschaft

- Grownetics, Inc.

- Hexagon AB

- International Business Machines Corporation

- Iteris, Inc.

- Khetibuddy Agritech Private Limited

- Krisol Infosoft Private Limited

- Kurraglen Industries

- ProPak Software

- Raven Industries, Inc. by CNH Industrial N.V.

- SemiosBio Technologies, Inc.

- SourceTrace

- TELUS Agriculture Solutions Inc.

- Topcon Positioning Systems, Inc.

Formulate actionable strategies for farm management software industry leaders to capitalize on emerging technological, regulatory, and market-driven trends

Industry leaders must adopt a multi-pronged strategy to capitalize on burgeoning opportunities and navigate persistent challenges. First, investing in seamless integrations with widely used agricultural machinery brands and sensor networks will enhance platform appeal by reducing deployment friction. Next, prioritizing modular pricing strategies that align costs with incremental value capture enables farms of varying scales to adopt digital capabilities without overextending budgets. This approach fosters broader market penetration, particularly among medium and small operators.

Leaders should also intensify focus on interoperability by championing open standards and APIs, facilitating partnerships with third-party solution providers. This collaborative ecosystem model not only accelerates innovation but also enhances customer retention through value-added services. As trade policies continue to evolve, industry participants need to establish localized sourcing arrangements for critical hardware components to mitigate tariff exposure, thereby stabilizing total cost of ownership for end users.

Finally, emphasizing user-centered design and proactive customer success initiatives will drive adoption and ensure long-term retention. By embedding advanced analytics, mobile-accessible dashboards, and multilingual support, platforms can better serve diverse user groups, including consultants, academia, and on-field managers. These actionable recommendations equip industry leaders with a roadmap to seize market share, strengthen competitive moats, and foster sustainable growth.

Detail the rigorous mixed-method research framework underpinning this farm management software analysis to ensure depth, accuracy, and industry relevance

This analysis is underpinned by a rigorous mixed-method research framework combining primary and secondary data collection. Primary insights were gathered through in-depth interviews with agronomists, farm operators, software executives, and industry consultants, ensuring a holistic understanding of operational pain points and adoption drivers. These qualitative engagements were complemented by a global survey deployed to a representative sample of farm managers across diverse crop types, farm sizes, and geographic regions, capturing quantitative metrics on usage patterns, satisfaction levels, and investment priorities.

Secondary research leveraged reputable industry publications, academic journals, regulatory filings, and government reports to validate market trends and contextualize the competitive landscape. Trade data and tariff schedules from the U.S. Trade Representative and international trade bodies were analyzed to assess the impact of 2025 tariff adjustments on technology procurement costs. In parallel, technology roadmaps, patent filings, and product release announcements from leading software vendors informed the evaluation of innovation trajectories.

Data triangulation techniques were applied to reconcile divergent insights and strengthen the robustness of findings. The research methodology emphasized transparency, reproducibility, and adherence to ethical standards, ensuring that conclusions rest on a sound evidentiary foundation. This comprehensive approach provides stakeholders with confidence in the validity and relevance of the presented analysis.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Farm Management Software market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Farm Management Software Market, by Agriculture Type

- Farm Management Software Market, by Functionality

- Farm Management Software Market, by Deployment Mode

- Farm Management Software Market, by Farm Size

- Farm Management Software Market, by End-User

- Farm Management Software Market, by Region

- Farm Management Software Market, by Group

- Farm Management Software Market, by Country

- United States Farm Management Software Market

- China Farm Management Software Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Synthesize critical findings to underscore the transformative potential of farm management software in fostering sustainable and profitable agricultural practices

The findings underscore that farm management software has evolved into an indispensable asset for modern agriculture, driving efficiency gains, enhancing sustainability, and supporting strategic decision-making. Digital platforms now extend beyond operational record-keeping, serving as comprehensive ecosystems that integrate real-time data feeds, advanced analytics, and marketplace connectivity. By embracing these solutions, growers can optimize resource allocation, mitigate risks through predictive interventions, and ensure compliance with emerging environmental and traceability regulations.

Regional variations and tariff-induced cost pressures necessitate tailored strategies that reflect local market dynamics and regulatory landscapes. Yet, the overarching trend is clear: operators who leverage integrated software platforms achieve measurable improvements in yield quality, input utilization, and financial transparency. As the industry continues to adopt AI-driven tools, IoT-enabled devices, and cloud-based architectures, the competitive advantage will accrue to those who maintain a proactive posture toward technology adoption.

In closing, the transformative potential of farm management software lies in its ability to unify disparate data sources, empower actionable insights, and foster collaboration across the agricultural value chain. Stakeholders who align technology investments with strategic objectives will be best positioned to meet the dual imperatives of productivity and sustainability in the years ahead.

Engage with Ketan Rohom to secure cutting-edge insights and comprehensive analysis by acquiring the definitive farm management software market research report today

To explore comprehensive insights and expert analysis on the farm management software market, reach out to Ketan Rohom, Associate Director of Sales & Marketing. His extensive knowledge and dedication to delivering actionable intelligence can guide your organization toward data-driven decision-making and competitive differentiation. Securing this report will equip your team with in-depth perspectives, strategic guidance, and proprietary research tailored to the evolving needs of modern agriculture. Connect with Ketan Rohom today to discuss customization options, secure early access to market intelligence, and position your business at the forefront of agricultural innovation.

- How big is the Farm Management Software Market?

- What is the Farm Management Software Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?