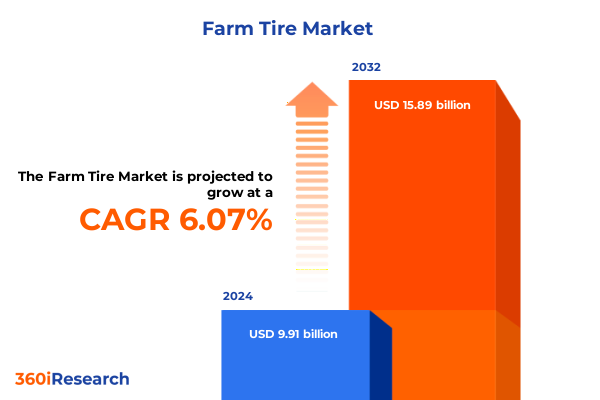

The Farm Tire Market size was estimated at USD 9.91 billion in 2024 and expected to reach USD 10.49 billion in 2025, at a CAGR of 6.07% to reach USD 15.89 billion by 2032.

Unveiling the Vital Role of Farm Tires in Modern Agriculture and Their Critical Influence on Productivity, Sustainability, and Food Security

In the intricate world of modern agriculture, farm tires serve as the unsung heroes that drive efficiency, productivity, and sustainability across global food production systems. These specialized tires are meticulously engineered to balance load-bearing capacity with soil preservation, ensuring that farms can operate with minimal environmental impact while maximizing crop yields. By reducing soil compaction, advanced farm tire design contributes to healthier root growth and improved water infiltration, directly supporting robust plant development and resilient harvests. This foundational role underscores the critical importance of understanding the complexities of the farm tire market, from material composition and tread patterns to performance metrics under diverse climatic conditions.

As agricultural machinery evolves towards greater automation and precision, farm tires have become integral to the realization of intelligent farming practices. Tractors equipped with on-tire sensors, for instance, can relay real-time data on ground contact pressure and traction, enabling operators to optimize field operations and minimize downtime. These technological integrations are redefining the parameters of tire performance, elevating expectations for durability and adaptability. Consequently, stakeholders-from original equipment manufacturers to aftermarket distributors-must navigate a landscape shaped by rapid innovation and shifting regulatory frameworks. This introduction establishes the analytical framework for exploring the market’s trajectory, highlighting the intersections between engineering, agronomy, and strategic decision-making that inform competitive advantage.

Exploring the Technological Innovations and Changing Agronomic Practices That Are Redefining the Farm Tire Landscape for Enhanced Performance

The farm tire industry is undergoing transformative shifts driven by technological innovation and evolving agricultural practices. In recent years, digital field operations have transitioned from pilot programs to mainstream adoption, reflecting a broader trend towards precision agriculture. Dealer surveys conducted across major markets, including the United States and Europe, reveal that nearly six out of ten growers now request tires compatible with on-tire sensor technology-a figure that has nearly tripled in just four growing seasons. This integration of telematics and traction management systems underscores a shift from solely mechanical considerations to data-informed performance optimization.

Moreover, tire manufacturers are intensifying investments in research and development to address emerging agronomic demands. For example, Bridgestone’s launch of the VT-Tractor series incorporates advanced compounds that balance fuel efficiency with enhanced soil protection, targeting markets across North America and Europe. Similarly, Michelin’s introduction of Ultraflex Technology in its tractor tire lineup demonstrates a commitment to extending load-bearing capacity while preserving field integrity. These innovations are complemented by efforts to improve the environmental footprint of production, such as the incorporation of sustainably sourced natural rubber and carbon-neutral manufacturing processes.

Consequently, industry players are redefining the farm tire landscape by prioritizing multifunctionality and digital compatibility. As sustainable farming practices continue to gain regulatory emphasis, tires that offer reduced fuel consumption, lower soil compaction, and real-time monitoring capabilities will command premium positioning. This evolution presents both challenges and opportunities, compelling stakeholders to recalibrate strategies and invest in capabilities that align with the next generation of agricultural machinery.

Assessing the Far-Reaching Effects of 2025 United States Tariff Policies on Farm Tire Supply Chains, Pricing Structures, and Market Dynamics

The imposition of United States tariffs in 2025 has introduced significant complexity to farm tire supply chains and pricing dynamics. In April, the administration enacted a universal 10% reciprocal tariff on all imports under the International Emergency Economic Powers Act, effective April 5, 2025, aiming to address persistent trade imbalances. This baseline levy applied across the board was immediately supplemented by targeted higher tariffs for partners with disproportionately large deficits, intensifying cost pressures on imported farm, forestry, and industrial tires. Farm tire importers and distributors have reported that these new levies are layered on top of existing antidumping and countervailing duties, further compounding landed costs and eroding traditional margin structures.

In practical terms, these policy shifts have compelled end users to reassess procurement strategies to mitigate financial strain. Farmers and fleet operators reliant on specific radial and bias tire configurations have encountered longer lead times and elevated retail prices, prompting a pivot towards domestically manufactured alternatives when feasible. However, capacity constraints among U.S.-based producers have limited the extent of this substitution, as highlighted by Michelin’s acknowledgment that 70% of its U.S. sales are locally produced-a factor that moderates exposure but does not fully offset the broader tariff impact. As a result, some organizations are exploring collaborative inventory pooling and forward contracting to stabilize supply and manage price volatility.

Looking ahead, the cumulative effect of these measures may drive accelerated investment in local production infrastructure and incentivize strategic partnerships between OEMs and regional manufacturers. While tariffs aim to protect domestic industries, the immediate outcome has been a recalibration of sourcing models, with stakeholders weighing the trade-offs between cost, quality, and delivery reliability in a rapidly shifting trade environment.

Diving Deep into Farm Tire Market Segmentation to Illuminate Strategic Opportunities Across Product, Application, and Distribution Dimensions

A nuanced understanding of farm tire market segmentation reveals critical insights for tailoring product development and distribution strategies. Distinguishing between bias and radial constructions highlights divergent performance attributes; bias tires, with their layered plies, offer rugged puncture resistance for heavy-duty tasks, while radial variants provide superior ride comfort and reduced soil compaction under high-speed operations. This dichotomy has influenced investment priorities, as manufacturers allocate capital towards optimizing bead and sidewall reinforcement techniques to meet specific application needs without compromising longevity.

Beyond product type, application-based segmentation underscores the complexity of equipment-specific requirements. Tires for combines and harvesters must withstand high abrasion at frequent turning angles, whereas tractor applications span orchard, row crop, and utility operations, each demanding distinct tread patterns and load profiles. Trailer tires, by contrast, emphasize stability and uniform wear across extended tows. These differentiated demands necessitate close collaboration between tire designers and OEM engineers to develop modular tread compounds that can be tailored through adjustable lug geometries and bespoke carcass structures.

Farm size further stratifies market focus, as large-scale operations prioritize uptime and total cost of ownership, medium-sized enterprises balance performance with budget constraints, and smallholdings may lean towards low-cost bias solutions to maximize equipment accessibility. Distribution channels add another strategic dimension: original equipment manufacturers (OEMs) embed tires into new machinery, while aftermarket providers serve both online platforms and traditional retail dealerships. Understanding these layers enables market participants to align product portfolios and go-to-market approaches effectively, ensuring that resource allocations resonate with end-user value propositions and channel requirements.

This comprehensive research report categorizes the Farm Tire market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Category

- Type

- Tyre Type

- Rim Size

- Material

- Application

- End User

- Sales Channel

Mapping the Distinct Regional Dynamics and Growth Drivers Shaping Farm Tire Demand Across the Americas, EMEA, and Asia-Pacific

Regional market dynamics of farm tires reflect divergent agricultural landscapes, infrastructure maturity, and policy environments across the Americas, Europe, Middle East & Africa, and Asia-Pacific. In North and South America, extensive mechanization and high adoption of precision farming drive demand for advanced radial technologies, while the United States maintains significant domestic manufacturing capacity that buffers the impact of import tariffs. Latin American markets, meanwhile, are characterized by growing plantation-scale operations, which are increasingly investing in premium tire solutions to enhance efficiency in vast agronomic expanses.

Across Europe, Middle East & Africa, regulatory emphasis on environmental stewardship and carbon neutrality shapes procurement criteria. European Union initiatives to reduce soil compaction and greenhouse gas emissions have accelerated adoption of low-ground-pressure tire designs, complemented by government subsidies for sustainable farm equipment. In the Middle East and Africa, the focus centers on durability in harsh climatic conditions, with manufacturers offering specialized compounds resistant to ozone degradation and abrasive soil compositions.

Asia-Pacific stands out as a high-growth arena, driven by mechanization trends in China, India, and Southeast Asian markets. Small and medium-scale farms in South Asia increasingly invest in radial and bias solutions tailored to rice and paddy cultivation, while Australia’s broadacre farming opts for ultra-wide tires that distribute load effectively across dry, arid soils. Government support for agricultural modernization in several countries further underpins regional expansion, as tire makers forge joint ventures with local OEMs to access these burgeoning opportunities.

This comprehensive research report examines key regions that drive the evolution of the Farm Tire market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Farm Tire Manufacturers to Highlight Strategic Initiatives, Competitive Positioning, and Value Propositions in the Market

Global farm tire manufacturers are undertaking strategic initiatives to strengthen market presence and address evolving customer needs. Michelin, for instance, has emphasized a local-to-local production strategy, with approximately 70% of its U.S. farm tire volumes manufactured domestically. This approach mitigates exposure to new import tariffs while ensuring continuity of supply and responsiveness to local specifications. The company’s focus on Ultraflex Technology exemplifies its investment in load-adaptive designs that support both heavy implements and sensitive soil conditions.

Bridgestone has intensified its commitment to sustainability and performance through the launch of its VT-Tractor series, incorporating fuel-efficient compounds and modular tread blocks to balance traction with soil preservation. This product wave is complemented by expanding manufacturing footprints in North America and Europe, aiming to reduce transit distances and align with local environmental regulations. Concurrently, the company is piloting advanced telematics integrations to provide real-time tire monitoring services, enhancing maintenance planning and resource utilization.

Titan International has pursued growth through a combination of brand licensing and capacity expansion. In April 2025, Titan renewed its Goodyear farm tire licensing rights and broadened the partnership into adjacent segments, reinforcing its product portfolio with the Goodyear Optitrac LSW1400/30R46 featuring patented low-sidewall technology. Additionally, capital investments in its Des Moines facility have augmented curing capacity, supporting a faster order-to-delivery cadence and reducing dealer inventory burdens.

Meanwhile, Balkrishna Industries Ltd. (BKT) has outlined an ambitious five-year roadmap to reach $2.6 billion in revenues by 2030, backed by a $400 million investment plan focused on off-highway dominance and expansion into new tire categories. This strategy leverages the company’s proprietary all-steel radial platforms and aims to consolidate leadership by deploying advanced carbon black materials and expanding production hubs across strategic markets. Trelleborg continues to solidify its niche in sustainable farm tire solutions, emphasizing compaction-reducing designs and premium compounds to serve both developed and emerging agricultural regions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Farm Tire market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Apollo Tyres Ltd

- Balkrishna Industries Limited

- Bridgestone Corporation

- CEAT Ltd. by RPG Group

- Cheng Shin Rubber Ind. Co. Ltd.

- Continental AG

- JK Tyre & Industries Ltd.

- Kenda Rubber Ind. Co., Ltd.

- Magna Tyres Group

- Michelin Corporation

- MRF LIMITED

- Nokian Tyres PLC

- Panther Tyres Ltd

- Qingdao Grandstone Tyre Corporation Limited

- Sailun Group Co., Ltd.

- Shandong Linglong Tyre Co.,Ltd.

- Specialty Tires of America, Inc.

- Sumitomo Rubber Industries, Ltd

- Titan International, Inc.

- Trayal Corporation

- TVS Srichakra Limited

- Yokohama Rubber Co. Ltd.

- Zhongce Rubber Group Co., Ltd.

Strategic Recommendations for Industry Leaders to Capitalize on Farm Tire Market Trends and Navigate Emerging Trade and Technology Challenges

Industry leaders in the farm tire market can harness several strategic levers to navigate the dual challenges of trade disruptions and technological evolution. First, investing in localized manufacturing or strategic alliances with regional producers can mitigate tariff exposure and strengthen supply chain resilience. Establishing joint ventures in key markets, particularly within Asia-Pacific and the European Union, will enable companies to capitalize on favorable policy incentives and proximity to agribusiness clusters.

Second, advancing digital integration across the product life cycle-from initial tire design to aftermarket services-will differentiate offerings in an increasingly data-driven ecosystem. Implementing on-tire sensor networks paired with predictive analytics platforms can enhance maintenance scheduling, reduce downtime, and provide compelling value-add to customers focused on operational continuity. Collaborative partnerships with agricultural technology providers can accelerate the deployment of these solutions.

Third, portfolio diversification across segmentation parameters is essential. Balancing bias and radial tire production allows for a broader addressable market, while tailoring tread designs to distinct applications-such as orchard and row crop versus utility operations-ensures alignment with equipment-specific performance benchmarks. Moreover, balancing OEM partnerships with aftermarket channels, including online platforms, will optimize market reach and revenue stability across farm size categories.

Finally, embedding sustainability at the core of innovation roadmaps will resonate with evolving regulatory standards and customer preferences. Prioritizing low-carbon material sourcing, energy-efficient manufacturing processes, and end-of-life tire recycling programs will not only fulfill environmental mandates but also fortify brand reputation. By executing these recommendations, industry stakeholders can secure competitive advantage and foster long-term growth amid a dynamic landscape.

Methodological Framework Underpinning the Farm Tire Market Analysis Incorporating Rigorous Primary and Secondary Research Protocols

The research methodology underpinning this farm tire market analysis integrates both primary and secondary research techniques to ensure comprehensive and reliable insights. Initially, secondary research involved reviewing industry publications, regulatory documents, company financial reports, and credible news outlets. This phase provided foundational knowledge of market structures, tariff policies, and technological advancements, and informed subsequent data collection priorities.

Primary research consisted of structured interviews and surveys with a cross-section of stakeholders, including original equipment manufacturers, tire distributors, agricultural equipment dealers, and farm operators. These engagements offered qualitative perspectives on purchasing criteria, regional demand drivers, and the perceived impact of recent tariff changes. Quantitative surveys captured data on product preferences, lead times, and service-level expectations, enabling triangulation with secondary findings for validation.

Data triangulation was achieved by cross-referencing responses with known industry benchmarks, such as production capacities, trade volumes, and technology adoption rates. Analytical techniques, including SWOT and Porter’s Five Forces frameworks, were applied to synthesize insights and identify market dynamics. Geographic segmentation was evaluated through regional case studies and policy reviews, while competitive analysis leveraged company profiles and recent strategic developments to map positioning and growth trajectories.

Finally, multiple rounds of quality assurance, including expert reviews by agronomy and materials science specialists, ensured the accuracy and relevance of conclusions. This methodological rigor provides confidence in the strategic recommendations and facilitates informed decision-making for stakeholders across the farm tire value chain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Farm Tire market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Farm Tire Market, by Product Category

- Farm Tire Market, by Type

- Farm Tire Market, by Tyre Type

- Farm Tire Market, by Rim Size

- Farm Tire Market, by Material

- Farm Tire Market, by Application

- Farm Tire Market, by End User

- Farm Tire Market, by Sales Channel

- Farm Tire Market, by Region

- Farm Tire Market, by Group

- Farm Tire Market, by Country

- United States Farm Tire Market

- China Farm Tire Market

- Competitive Landscape

- List of Figures [Total: 20]

- List of Tables [Total: 3339 ]

Synthesis of Critical Findings Underscoring the Future Trajectory of the Farm Tire Market and Imperatives for Stakeholder Success

This comprehensive analysis underscores the pivotal role of farm tires in modern agriculture and illuminates the multifaceted forces shaping market evolution. Technological innovations, such as on-tire sensor integration and advanced compound formulations, are redefining performance benchmarks, while segmentation insights highlight the necessity of tailored solutions across tire types, applications, and distribution channels. Moreover, the cumulative impact of United States tariffs in 2025 has prompted a strategic reevaluation of supply chain configurations, with immediate implications for pricing dynamics and sourcing decisions.

Regional dynamics further accentuate the heterogeneity of farm tire demand: the Americas benefit from robust mechanization and domestic capacity, EMEA markets prioritize sustainability and regulatory compliance, and Asia-Pacific continues to expand rapidly through agricultural modernization initiatives. Leading manufacturers are responding with localized production strategies, strategic partnerships, and capital investments to optimize market responsiveness. The actionable recommendations outlined herein equip industry players with the strategic levers required to navigate trade complexities, accelerate technology adoption, and embed sustainability within their operational frameworks.

As stakeholder objectives increasingly converge on enhancing operational efficiency, environmental stewardship, and risk mitigation, the insights presented in this summary serve as a roadmap for securing long-term competitive advantage. By synthesizing market intelligence with methodological rigor, decision-makers are empowered to align investments, refine product portfolios, and cultivate partnerships that will define the future of the farm tire landscape.

Engage with Ketan Rohom to Secure Comprehensive Farm Tire Market Insights and Drive Informed Strategic Decisions Today

Engaging with Ketan Rohom offers a unique opportunity to harness comprehensive insights, grounded in rigorous analysis, to make informed strategic decisions in the farm tire market. As Associate Director, Sales & Marketing at 360iResearch, Ketan oversees the delivery of premium research designed to address the nuanced demands of industry professionals and decision-makers. His team’s expertise spans market intelligence, competitive benchmarking, and trend identification, ensuring that stakeholders are equipped with actionable data tailored to their specific goals. By partnering with Ketan, organizations gain direct access to customized reports, bespoke advisory sessions, and expert-led presentations that distill complex market dynamics into clear, pragmatic strategies. This collaboration empowers leadership teams to optimize supply chains, refine product portfolios, and navigate regulatory environments effectively.

Given the increasingly competitive and trade-sensitive landscape of farm tire supply, the insights curated by Ketan Rohom are crucial for identifying growth trajectories and mitigating risks associated with tariff fluctuations, technological adoption, and evolving customer preferences. His approach ensures that research outputs align with organizational priorities, fostering agility and resilience in decision-making processes. To embark on a partnership that provides unparalleled depth of market understanding and fosters sustainable advantage, contact Ketan Rohom today to secure your copy of the market research report and transform insight into impact.

- How big is the Farm Tire Market?

- What is the Farm Tire Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?