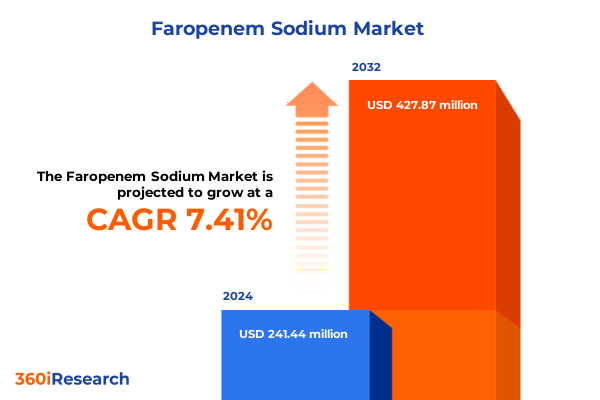

The Faropenem Sodium Market size was estimated at USD 258.60 million in 2025 and expected to reach USD 277.10 million in 2026, at a CAGR of 7.45% to reach USD 427.87 million by 2032.

Discover the Critical Role and Clinical Potential of Faropenem Sodium as an Oral Penem Antibiotic in Addressing Resistant Bacterial Infections Globally

Faropenem sodium represents a pivotal advancement in oral penem therapies, combining broad-spectrum antibacterial efficacy with robust stability against a variety of β-lactamases. First introduced in Japan in 1997 under the trade name Farom, this orally bioavailable sodium salt has delivered a critical option for outpatient management of both aerobic and anaerobic bacterial infections, offering an alternative to intravenous carbapenems in community settings

Clinical investigations have demonstrated faropenem’s capacity to address common and resistant urinary pathogens. In a randomized, multicenter trial comparing three- and seven-day treatment regimens for acute uncomplicated cystitis, seven days of faropenem achieved a 66.7% microbiological eradication rate versus 58.9% for three days, while maintaining comparable safety profiles with adverse events reported in fewer than 10% of participants

Despite its proven clinical promise in Asia, faropenem sodium has yet to receive marketing approval in the United States, underscoring an unmet need for an effective oral penem to address escalating resistance trends. Consequently, multinational pharmaceutical innovators and generic manufacturers alike have continued exploring faropenem medoxomil and novel formulations to expand therapeutic options for outpatient antimicrobial therapy and stewardship protocols

Understanding How Evolving Antibiotic Resistance, Regulatory Mandates, and Technological Innovations Are Reshaping the Faropenem Sodium Therapeutic Landscape

Antimicrobial resistance remains one of the most urgent public health crises, with the CDC reporting over 2.8 million antibiotic-resistant infections and at least 35,000 deaths in the United States each year. Extended-spectrum β-lactamase (ESBL)-producing Enterobacterales and carbapenem-resistant pathogens have surged during the COVID-19 pandemic, driving a combined 20% increase in hospital-onset resistant infections compared to pre-pandemic levels

In response, healthcare systems have elevated antibiotic stewardship requirements, embedding tighter prescribing guidelines and rapid diagnostic algorithms to curb inappropriate use. Concurrently, international regulatory bodies are aligning on harmonized susceptibility breakpoints and evidence requirements for novel penem agents. These policy shifts reinforce the necessity of antibiotics like faropenem sodium that demonstrate both broad activity and stability against key resistance mechanisms.

Technological innovation is further transforming therapeutic approaches. Point-of-care molecular diagnostics now enable early detection of resistance genes, facilitating targeted therapy initiation and preserving broad-spectrum agents for confirmed cases. Meanwhile, advances in oral prodrug design-illustrated by faropenem medoxomil’s progression through non-approval status toward renewed clinical development-underscore how formulation science can overcome bioavailability challenges and support outpatient care transitions.

Analyzing the Cumulative Effects of the 2025 United States Pharmaceutical Tariffs on Faropenem Sodium Supply Chains, Manufacturing, and Pricing Dynamics

The United States’ 2025 imposition of tariffs on active pharmaceutical ingredients (APIs) and key drug intermediates has had a pronounced impact on the cost structure of antibiotic manufacturing. Specifically, bulk penem APIs sourced from China are now subject to a 25% duty, while Indian-sourced intermediates face a 20% levy. These measures have introduced immediate inflationary pressures on production expenses, compressing margins for any manufacturer reliant on imported raw materials

These duties collide with a supply chain already strained by high dependence on foreign sources; recent analysis indicates that up to 80% of U.S. API needs-and as much as 90% of generics-originate from China. As a result, U.S. and global producers have accelerated diversification strategies, including near-shoring of key processes and establishment of tariff taskforces to renegotiate contracts and secure alternative suppliers. Hospital systems and payers, anticipating cost pass-through, are also revisiting formulary commitments and exploring collective purchasing arrangements to mitigate price volatility and sustain patient access

Unveiling Segmentation-Based Insights to Optimize Faropenem Sodium Strategies Across Formulations, Indications, Channels, and Care Settings

Faropenem sodium’s formulation landscape spans both liquid and solid oral dosage formats, with syrup formulations addressing pediatric and dysphagia-prone populations while tablet strengths above and at or below 100 mg support flexible dosing regimens. This dual-format strategy ensures alignment with stewardship objectives by enabling tailored therapy across age groups and clinical scenarios.

Therapeutically, faropenem sodium extends utility into multiple infection categories, encompassing gynecological infections, respiratory tract indications such as community-acquired pneumonia, skin and soft tissue disorders-including diabetic foot infections-and urinary tract infections. This diversified application portfolio underscores its role as an outpatient carbapenem substitute in cases where resistance or organism profile justifies broad coverage.

Distribution channels for faropenem sodium are bifurcated between digital and traditional models. Online pharmacies facilitate direct-to-patient delivery, enhancing convenience for outpatient regimens, while offline pharmacies-in both hospital and retail settings-support inpatient and transition-of-care dispensing. This omnichannel presence is critical for managing adherence and responding to localized demand shifts.

End-user engagement further spans ambulatory care centers and hospitals and clinics, reflecting faropenem’s adaptability to both acute institutional care pathways and outpatient infusion or oral therapy programs. This segmentation enables highly targeted commercialization and ensures broad coverage across diverse healthcare delivery settings.

This comprehensive research report categorizes the Faropenem Sodium market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Form

- Therapeutic Application

- Distribution Channel

- End User

Examining Regional Dynamics Impacting Faropenem Sodium with a Deep Dive into Opportunities and Challenges Across the Americas, EMEA, and Asia-Pacific Regions

In the Americas, regulatory bodies have yet to approve faropenem sodium for marketing, creating an opportunity gap for an oral penem antibiotic even as generic antibiotic manufacturers explore abbreviated pathways for similar β-lactam agents. U.S. and Canadian healthcare systems continue to emphasize stewardship directives, yet remain constrained by shortages of injectables and limited oral alternatives for resistant infections.

Europe, the Middle East, and Africa (EMEA) display a more dynamic landscape. European Commission opposition to the U.S. tariff probe has underscored the interdependence of transatlantic drug supply, while EU regulatory harmonization has accelerated generic approvals of penem derivatives. Emerging economies within the Middle East and Africa seek to strengthen local API capacity to reduce import reliance and mitigate supply disruptions in vital antibiotics.

Asia-Pacific emerges as the most mature market for faropenem sodium, with first-line approval achieved in Japan and widespread use in India under various brand names. High volumes of generic production, coupled with domestic R&D into extended-release and pediatric formulations, position the region as both a consumer and exporter of faropenem APIs. Rapid healthcare infrastructure expansion in Southeast Asia further underscores the region’s critical role in global antibiotic supply chains.

This comprehensive research report examines key regions that drive the evolution of the Faropenem Sodium market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Companies and Strategic Partnerships Driving Innovation, Manufacturing, and Distribution in the Faropenem Sodium Ecosystem

The commercial journey of faropenem sodium began with Daiichi Asubio Pharma’s development and Japanese launch in the late 1990s, later supplemented by licensing agreements for prodrug formulations such as faropenem medoxomil with Replidyne and Forest Pharmaceuticals. Incepta Pharmaceuticals extended geographic reach by marketing Orfanem in Bangladesh, illustrating a model for regional partnerships.

Generic competitors have since entered the field, notably Meiji Seika Pharma in Japan, Lupin Limited and Zydus Lifesciences in India, and Sandoz International in global markets. Leading API suppliers, including Shandong Chenlong Pharmaceutical, underpin cost-competitive production, while contract manufacturing organizations work closely with branded and generic firms to tailor batch release and formulation support.

Strategic alliances are also emerging between clinical diagnostic innovators and pharmaceutical manufacturers to integrate rapid resistance gene detection with faropenem prescribing algorithms. Meanwhile, digital therapeutics firms collaborate with key industry players to develop adherence monitoring tools that enhance real-world outcomes and strengthen hospital adoption of oral penem therapies.

This comprehensive research report delivers an in-depth overview of the principal market players in the Faropenem Sodium market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adooq Bioscience LLC

- Angle Bio Pharma

- Arlak Biotech Pvt. Ltd.

- Asterisk Laboratories (I) Pvt. Ltd.

- Canagen Pharmaceuticals Inc

- Casca Remedies Pvt. Ltd.

- Cipla Limited

- Conscientia Industrial Co., Ltd.

- Fawn Incorporation

- G-Biosciences

- Glenmark Pharmaceuticals Limited

- Hunan Warrant Chiral Pharmaceutical Co., Ltd.

- Jabs Biotech PVT LTD

- Lunan Pharmaceutical Group

- Neuracle Lifesciences Private Limited

- Shandong Chenlong Pharmaceutical Co., Ltd.

- SimSon Pharma Limited

Actionable Recommendations for Industry Leaders to Strengthen Faropenem Sodium Development, Supply Resilience, and Clinical Adoption Strategies

To navigate tariff headwinds and ensure supply continuity, industry leaders should prioritize supplier diversification by qualifying alternate API producers in low-tariff jurisdictions and establishing dual-source agreements. Concurrently, investment in localized fill-finish capacity will reduce import exposure and support rapid response to demand surges.

Clinical adoption can be accelerated through real-world evidence generation, including post-marketing cohort studies that document faropenem’s comparative effectiveness in resistant infections. Collaboration with stewardship committees and payers to develop value-based contracting models will further solidify formulary placement and minimize patient cost burden.

Innovation efforts should focus on advanced oral formulations, including sustained-release tablets and pediatric suspensions, to expand patient segments and enhance adherence. Finally, proactive engagement with regulatory authorities in the United States to address FDA approval requirements-leveraging existing international data and new trial designs-can unlock a substantial unmet need for oral penem therapy.

Demystifying the Comprehensive Research Methodology Employed to Gather Rigorous Clinical, Regulatory, and Supply Chain Insights on Faropenem Sodium

This analysis synthesizes publicly available clinical trial data, regulatory filings, trade policy announcements, and industry press releases. Peer-reviewed studies from PubMed and NCBI provided efficacy and resistance-mechanism insights, while government sources such as the CDC furnished antibiotic resistance burden and stewardship context.

Trade and tariff impacts were assessed using recent U.S. policy coverage and expert commentary, ensuring accuracy on specific duty rates and implementation timelines. Company and supply chain profiling leveraged corporate announcements, CPHI listings, and market intelligence reports to map key participants and partnership models.

Regional dynamics were informed by official approval databases and international trade statements, with cross-referencing between EMEA regulatory updates and Asia-Pacific product launches. This multi-source methodology ensures a comprehensive, fact-based perspective without reliance on proprietary market sizing or financial projections.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Faropenem Sodium market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Faropenem Sodium Market, by Form

- Faropenem Sodium Market, by Therapeutic Application

- Faropenem Sodium Market, by Distribution Channel

- Faropenem Sodium Market, by End User

- Faropenem Sodium Market, by Region

- Faropenem Sodium Market, by Group

- Faropenem Sodium Market, by Country

- United States Faropenem Sodium Market

- China Faropenem Sodium Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 954 ]

Drawing Conclusions on the Strategic Imperative of Faropenem Sodium Amidst Resistance Threats and Supply Chain Challenges in the Global Healthcare Landscape

Faropenem sodium emerges as a versatile oral penem antibiotic that addresses critical gaps in outpatient management of resistant infections, combining proven clinical efficacy with stability against β-lactamase-producing organisms. Its established use in Asia underscores the potential clinical and commercial benefits of an FDA-approved product in the U.S.

Transformative shifts in antibiotic resistance patterns, regulatory frameworks, and technological capabilities reinforce faropenem’s strategic relevance, while the 2025 U.S. tariff landscape highlights the need for robust supply chain diversification. Segmentation insights reveal targeted approaches across formulation types, therapeutic indications, distribution channels, and care settings.

Regional analysis demonstrates divergent market maturity, with untapped opportunities in the Americas, regulatory support in EMEA, and manufacturing leadership in Asia-Pacific. Key industry players-from originators to generic suppliers-are shaping the ecosystem through alliances and R&D investments.

Collectively, these factors underscore the imperative for coordinated strategies in development, approval, and commercialization. Stakeholders equipped with these insights will be well positioned to enhance patient access, uphold stewardship principles, and secure competitive advantage in the evolving antibiotic landscape.

Take the Next Step: Partner with Ketan Rohom to Secure Your Comprehensive Market Research Report on Faropenem Sodium and Inform Your Strategic Decisions

To secure comprehensive and actionable intelligence on the Faropenem Sodium market landscape-including detailed analyses of supply chain risks, segmentation dynamics, regional drivers, and competitive positioning-reach out directly to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. His expertise will ensure your organization gains immediate access to the full market research report, tailored to support informed decision-making and strategic planning. Engage now to obtain in-depth insights, customized data solutions, and expert guidance that will empower your next steps in antibiotic development and commercialization.

- How big is the Faropenem Sodium Market?

- What is the Faropenem Sodium Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?