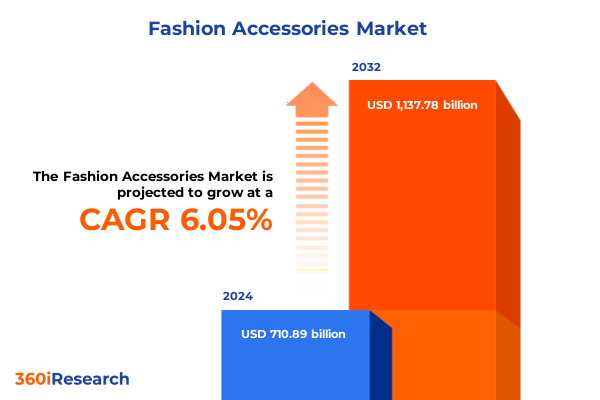

The Fashion Accessories Market size was estimated at USD 741.24 billion in 2025 and expected to reach USD 772.90 billion in 2026, at a CAGR of 6.31% to reach USD 1,137.78 billion by 2032.

Exploring the Evolution and Strategic Significance of Contemporary Fashion Accessories Amidst a Rapidly Transforming Global Marketplace

The fashion accessories market has emerged as a vibrant intersection of creativity and commerce, reflecting an intricate tapestry of consumer desires and design ingenuity. In recent years, accessories such as belts, eyewear, handbags, hats, jewelry, and scarves have transcended their utilitarian origins to become powerful vehicles for self-expression and cultural identity. This expansion has been fueled by rapid shifts in digital engagement, global supply chain transformation, and an ever-growing appetite for personalization among discerning shoppers.

As the market landscape continues to evolve, industry players are challenged to balance artisanal craftsmanship with scalable production, while also addressing sustainability concerns. The intersection of emerging materials and innovative manufacturing techniques has reshaped product portfolios, leading to the rise of smart jewelry and eco-conscious fabric belts. Meanwhile, digital platforms have revolutionized how consumers discover and purchase accessories, emphasizing seamless omnichannel experiences and social commerce integration.

Understanding these dynamics is essential for executives seeking to capitalize on emerging niches and anticipate future disruptions. This executive summary offers a structured exploration of transformative landscape shifts, trade policy implications, segmentation nuances, regional dynamics, and competitive forces. Each section provides strategic insights designed to inform decision-making and amplify growth opportunities within the diverse and fast-paced realm of fashion accessories.

Decoding the Pivotal Technological, Cultural, and Consumer-Driven Shifts Redefining the Fashion Accessories Ecosystem in Recent Years

Over the past decade, the fashion accessories landscape has undergone transformative shifts driven by technological innovation, evolving cultural narratives, and changing consumer behaviors. Personalization technologies now enable brands to offer bespoke eyewear consultations via augmented reality try-ons, while social media platforms shape trend cycles in real time. Such digital connectivity has empowered consumers to co-create product designs, fostering a deeper sense of brand loyalty and community engagement.

Cultural currents, including the resurgence of heritage craftsmanship and a growing emphasis on inclusivity, have also redefined product standards. Brands are increasingly collaborating with artisans to incorporate traditional techniques into modern silhouettes, resulting in limited-edition collections that resonate with authenticity-hungry audiences. Simultaneously, an intensified focus on gender-neutral and adaptive accessories reflects a broader societal commitment to diversity and accessibility.

Furthermore, supply chain resilience has emerged as a critical determinant of competitive advantage. In response to geopolitical disruptions and material shortages, leading manufacturers have adopted nearshoring strategies and diversified supplier networks. These proactive measures not only mitigate risk but also shorten lead times, allowing brands to respond swiftly to market signals. Collectively, these shifts underscore a fundamental recalibration of how fashion accessories are conceived, produced, and consumed.

Evaluating the Comprehensive Repercussions of United States Tariff Measures Enacted Throughout 2025 on the Fashion Accessories Sector

In 2025, the United States implemented a series of tariff adjustments targeting imports across multiple categories, including select fashion accessories. These measures were introduced with the intention of bolstering domestic manufacturing capacity and addressing persistent trade imbalances. While the tariffs have created headwinds for brands reliant on low-cost offshore production, they have simultaneously invigorated domestic artisanal workshops and mid-market manufacturers, which now enjoy a more level playing field.

Importers of handbags, wallets, and eyewear have faced increased costs that have, in some instances, been partially passed on to consumers through modest price adjustments. Consequently, some premium and mid-range brands have accelerated efforts to localize assembly operations and source higher-value components domestically. This strategic pivot has bolstered supply chain transparency and reduced transit times, but it has also necessitated renegotiations with existing suppliers and new investments in automation.

Conversely, tariffs have underscored the appeal of digitally native brands to maintain leaner inventories and implement agile production models. By leveraging demand forecasting algorithms and on-demand manufacturing, these players have minimized exposure to tariff volatility. As a result, the cumulative impact of 2025 trade policies has catalyzed a broader shift toward supply chain resilience, encouraging a long-term rebalancing between cost efficiency and operational agility.

Uncovering Critical Market Drivers Through Multifaceted Segmentation Analysis to Illuminate Nuanced Consumer Behaviors and Product Preferences

A nuanced understanding of market segmentation is indispensable for identifying pockets of growth and tailoring product offerings to distinct consumer cohorts. By dissecting product type categories, one observes that belts-whether crafted from premium leather or innovative fabric blends-appeal to consumers seeking functional statement pieces. Likewise, eyewear segments, from optical glasses to trend-driven sunglasses, capture both wellness-oriented and style-conscious demographics. Within handbags and wallets, a layered portfolio spanning box clutches to spacious tote bags addresses divergent lifestyles, while headwear ranges from performance-focused baseball caps to high-fashion sun hats.

Distribution channels further illuminate pathways to market, as brick-and-mortar brand outlets, department stores, and specialty boutiques continue to serve experiential shoppers even as online retail channels thrive. Brand-owned websites, global e-commerce platforms, and emerging social commerce environments enable direct engagement and facilitate rapid product launches tailored to viral trends. Meanwhile, pricing tiers-from mass-market fast fashion to aspirational premium luxury-reflect divergent consumer value perceptions and purchasing power. Gender-focused collections, whether men’s, women’s, or unisex, cater to shifting identity expressions, while age segmentation highlights the unique style aspirations of young adults, mature consumers, and next-generation families.

Material-based insights reveal that traditional leathers coexist with high-performance synthetics, and natural fabrics such as silk and wool sit alongside recycled polymers. By overlaying these segmentation dimensions, strategic leaders can craft cohesive product roadmaps, optimize channel investments, and align brand positioning with evolving consumer priorities.

This comprehensive research report categorizes the Fashion Accessories market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Distribution Channel

- Gender

- Age Group

- Material

Revealing Key Regional Dynamics and Consumer Predilections Shaping the Diverse Trajectories of the Fashion Accessories Market Worldwide

Regional dynamics in the fashion accessories market have become increasingly pronounced as consumer priorities and economic conditions vary across geographies. In the Americas, a blend of heritage luxury and digitally driven direct-to-consumer brands has reshaped value propositions, with shoppers gravitating toward sustainably sourced materials and transparent supply chains. Retailers in North and South America are experimenting with experiential flagship stores that integrate digital customizations and local artisan collaborations to deepen brand affinity.

Europe, the Middle East, and Africa exhibit a mosaic of traditional craftsmanship hubs alongside rapidly growing online marketplaces. Heritage markets continue to prize fine jewelry and premium leather goods, while emerging economies demonstrate a burgeoning appetite for affordable luxury and functional accessories. Cross-border tourism and trade corridors further influence seasonal demand, prompting brands to adapt their inventories to regional color palettes, cultural motifs, and climate-driven style preferences.

In the Asia-Pacific region, shifting consumer expectations around technology-infused accessories and social commerce proliferation have spurred explosive growth. Young consumers in key markets such as China, India, and Southeast Asia are embracing fashion-forward eyewear and smart jewelry that integrates health tracking. At the same time, local manufacturers are capitalizing on cost efficiencies to serve both domestic and export channels. By understanding these divergent regional characteristics, executives can prioritize market entries, forge strategic partnerships, and tailor marketing narratives that resonate authentically with diverse audiences.

This comprehensive research report examines key regions that drive the evolution of the Fashion Accessories market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Influential Industry Players and Innovators Driving Competitive Advantage and Strategic Partnerships in the Fashion Accessories Landscape

The competitive landscape of fashion accessories is defined by an intricate network of established heritage brands, agile digitally native challengers, and innovative niche players. Legacy fashion houses continue to leverage their storied brand equity to command premium positioning, while simultaneously integrating advanced analytics to refine product assortments. In contrast, emerging direct-to-consumer labels disrupt traditional retail models through data-driven personalization, expedited product cycles, and highly curated social media campaigns.

Strategic alliances and collaborations have become key levers for differentiation. Luxury conglomerates partner with technology firms to introduce smart jewelry collections that merge aesthetic appeal with digital health monitoring. Meanwhile, independent designers collaborate with material science innovators to develop biodegradable synthetic alternatives that address sustainability imperatives. These partnerships extend beyond product innovation, encompassing co-branded retail experiences, licensing agreements, and joint ventures that optimize distribution networks.

Capital investment trends reflect a prioritization of supply chain digitization and circular economy initiatives. Investors are channeling funds into technology platforms that enable real-time inventory management and end-to-end traceability, as well as startups pioneering recycling and upcycling solutions for fabrics and leathers. Through this collective ecosystem of competition and collaboration, the sector continues to advance toward higher margins, deeper consumer engagement, and enduring brand relevance.

This comprehensive research report delivers an in-depth overview of the principal market players in the Fashion Accessories market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adidas AG

- Burberry Group plc

- Capri Holdings Limited

- Chanel Limited

- Compagnie Financière Richemont SA

- EssilorLuxottica SA

- Fossil Group Inc

- Giorgio Armani S.p.A.

- H & M Hennes & Mauritz

- Hermès International S.A.

- Inditex Industria de Diseno Textil S.A.

- Kering SA

- LVMH Moët Hennessy Louis Vuitton

- Michael Kors Holdings Limited

- Nike Inc

- Prada S.p.A.

- PUMA SE

- PVH Corp

- Ralph Lauren Corporation

- Swarovski AG

- Swatch Group AG

- Tapestry Inc

- Titan Company Limited

- Tory Burch LLC

- VF Corporation

Delivering Actionable, Forward-Looking Strategies for Industry Leaders to Capitalize on Emerging Opportunities and Mitigate Sector Challenges Effectively

To navigate the complex terrain of global fashion accessories, industry leaders must embrace multi-pronged strategies that balance innovation, sustainability, and operational resilience. First, forging closer partnerships with material suppliers and technology providers will unlock novel product features, accelerate time to market, and mitigate raw material constraints. Complementarily, investing in advanced analytics will enable real-time scanning of consumer sentiment across social platforms, informing agile product development cycles.

Simultaneously, leaders should expand experiential retail footprints that seamlessly integrate digital and physical touchpoints. Flagship locations outfitted with interactive customization studios can elevate brand experientiality while generating high-margin revenue streams. Parallel to this, strengthening direct-to-consumer channels through optimized e-commerce platforms and targeted social commerce activations will drive higher customer lifetime value and foster community advocacy.

Moreover, embedding circular economy principles across product lifecycles-from design for disassembly to takeback programs-will reinforce brand purpose and mitigate regulatory risks. By articulating transparent sustainability reporting, companies can secure loyalty from ethically minded consumers and preempt emerging environmental mandates. Finally, cultivating a culture of continuous learning and cross-functional collaboration will equip teams to pivot swiftly in response to geopolitical shifts, trade policy changes, and unforeseen supply chain disruptions.

Articulating a Robust and Transparent Research Methodology Designed to Ensure Credibility, Reproducibility, and Actionable Insight Generation

The insights presented in this report derive from a rigorous research methodology designed to ensure both credibility and relevance. Primary research efforts encompassed in-depth interviews with senior executives across leading brands, material suppliers, and retail distributors, as well as targeted consumer focus groups that illuminated evolving preferences and purchasing drivers. These qualitative inputs were reinforced by quantitative surveys administered to a demographically representative sample across key markets.

Secondary research included a thorough review of trade publications, patent filings, and government trade data to contextualize tariff developments and regulatory frameworks. Proprietary databases tracking digital sentiment and social commerce transactions provided real-time indicators of emerging trends and viral products. All data sources were vetted for reliability, and triangulation methods were employed to reconcile any discrepancies and fortify the robustness of the findings.

The analytical framework integrated both bottom-up and top-down approaches, ensuring that high-level market drivers aligned with granular, segment-specific observations. Across each stage, the research adhered to strict quality control protocols, encompassing multi-tier data validation and expert panel reviews. This transparent methodology underpins the actionable insights and empowers stakeholders to make informed strategic decisions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Fashion Accessories market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Fashion Accessories Market, by Product Type

- Fashion Accessories Market, by Distribution Channel

- Fashion Accessories Market, by Gender

- Fashion Accessories Market, by Age Group

- Fashion Accessories Market, by Material

- Fashion Accessories Market, by Region

- Fashion Accessories Market, by Group

- Fashion Accessories Market, by Country

- United States Fashion Accessories Market

- China Fashion Accessories Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 3339 ]

Synthesizing Comprehensive Findings to Reinforce Strategic Imperatives and Illuminate the Future Outlook for Fashion Accessories Stakeholders

Drawing together the key findings, it becomes evident that the fashion accessories market is at an inflection point characterized by technological convergence, supply chain realignment, and shifting consumer value hierarchies. The rise of personalized digital experiences and on-demand manufacturing has elevated expectations for product customization, while sustainability imperatives continue to reshape material sourcing and lifecycle management.

Regional heterogeneity underscores the necessity of market-specific strategies, as players navigate diverse regulatory landscapes and consumer proclivities from the Americas through EMEA to Asia-Pacific. Additionally, the cumulative effects of 2025 tariff policies have catalyzed a strategic rethink of production footprints, prompting a recalibration between cost optimization and operational flexibility.

Amidst this evolving backdrop, companies that integrate advanced analytics with collaborative innovation and purpose-driven sustainability stand to secure enduring competitive advantage. By leveraging the segmentation lenses of product type, distribution channel, price tier, gender, age group, and material composition, decision-makers can tailor offerings that resonate authentically with target audiences. Ultimately, this synthesis of insight and strategy illuminates a forward path for stakeholders committed to leading in the dynamic world of fashion accessories.

Empowering Decision-Makers with Direct Access to a Comprehensive Research Report by Reaching Out to Ketan Rohom for Tailored Strategic Insights

For those poised to transform strategic intent into tangible outcomes, the opportunity to harness a meticulously compiled market research report awaits with Ketan Rohom serving as the primary liaison. As an Associate Director, Sales & Marketing, he facilitates seamless access to comprehensive insights covering product innovation trajectories, regulatory developments, and consumer sentiment trends. Engaging with Ketan ensures that decision-makers receive personalized guidance, enabling them to tailor the report’s findings to specific organizational objectives and competitive contexts.

By partnering directly with Ketan Rohom, stakeholders benefit from an efficient procurement process that aligns their unique requirements with the report’s extensive analysis. This collaboration yields deeper visibility into evolving distribution channels, material preferences, and price sensitivity across market segments. As a result, leaders can confidently allocate resources, refine go-to-market strategies, and fortify supplier relationships based on an evidence-based understanding of the sector’s complexities. Reach out today to obtain your copy of the definitive fashion accessories research report and unlock the strategic clarity needed for sustained market leadership.

- How big is the Fashion Accessories Market?

- What is the Fashion Accessories Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?