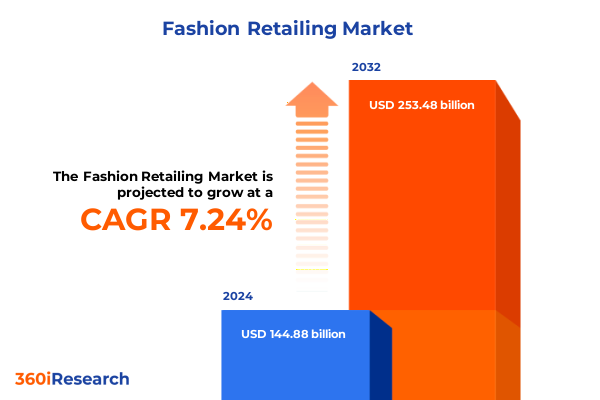

The Fashion Retailing Market size was estimated at USD 154.89 billion in 2025 and expected to reach USD 165.74 billion in 2026, at a CAGR of 7.28% to reach USD 253.48 billion by 2032.

Exploring the Current Dynamism and Foundational Context Shaping the Future Trajectory of the Global Fashion Retail Landscape

In an era defined by rapid technological advances and evolving consumer sensibilities, the fashion retail sector stands at a pivotal juncture. The convergence of digital transformation, heightened sustainability expectations, and shifting global economic dynamics has created a landscape where agility and innovation are no longer optional but imperative. Within this context, stakeholders across the value chain demand not only a nuanced understanding of current conditions but also a forward-looking perspective that illuminates emerging opportunities and potential disruptions. This executive summary serves as an essential primer for executives, strategists, and decision-makers seeking to navigate the complexities of today’s market.

Against this backdrop, understanding the interplay between consumer behavior, regulatory environments, and supply chain configurations is critical. Consumer preferences have evolved from mere brand loyalty to a demand for authenticity, personalized experiences, and ethical transparency. At the same time, global trade policies and tariff landscapes continue to add layers of complexity, influencing sourcing decisions and cost management strategies. By situating these factors within a cohesive analytical framework, this introduction lays the groundwork for deeper examination of transformative shifts, policy impacts, segmentation nuances, and regional divergences that collectively define the fashion retailing environment in 2025.

Identifying the Transformative Shifts Redefining Consumer Behavior Supply Chains and Technological Adoption in Fashion Retailing

The fabric of the fashion retail industry has been rewoven by forces that extend well beyond traditional design and merchandising considerations. Digital acceleration, for instance, has transcended mere e-commerce adoption to become a core tenet of the consumer journey, seamlessly blending virtual showrooms, live-streamed style events, and immersive augmented reality fitting experiences. These innovations have not only redefined convenience but have also elevated expectations for interactive brand engagement.

Concurrently, sustainability has cemented its role as a strategic imperative. Brands today are compelled to rethink material sourcing, production processes, and end-of-life solutions. This shift has given rise to circular business models, resale platforms, and innovative textile technologies aimed at reducing environmental footprints. Moreover, supply chain resilience has arrived at the forefront of executive agendas, driven by pandemic-induced disruptions and geopolitical uncertainties. Companies are increasingly investing in diversified supplier networks, nearshoring initiatives, and real-time analytics to anticipate and adapt to potential interruptions.

Furthermore, consumer empowerment through social media and influencer ecosystems has led to rapidly shifting trend cycles. In response, brands are adopting agile product development methodologies, leveraging data-driven insights to accelerate time-to-market. Taken together, these transformative shifts highlight an industry in motion, where digital dexterity, sustainable innovation, and operational resilience coalesce to shape a new era of fashion retailing.

Assessing the Cumulative Impact of United States Tariff Policies Enacted in 2025 on Production Costs Profit Structures and Strategic Sourcing

The implementation of new United States tariff policies in early 2025 has introduced a significant inflection point for fashion retailers and suppliers alike. By increasing duties on a range of imported apparel, footwear, and accessory categories, these measures have exerted upward pressure on landed costs, compelling organizations to reassess their sourcing matrices and negotiate new supplier agreements. As a result, brands are engaging in cost-containment strategies that include the consolidation of shipments, reconfiguration of manufacturing footprints, and exploration of tariff mitigation tools such as bonded warehouses and free trade zone utilization.

In response to the heightened cost environment, some companies have accelerated their diversification efforts, shifting portions of production to lower-tariff markets or pursuing manufacturing partnerships closer to end markets. This nearshoring trend, while potentially raising unit costs, offers a hedge against future volatility and shorter supply lead times. Additionally, premium and luxury brands have introduced targeted pricing adjustments-balancing margin protection with brand perception-while many mass-market players have leveraged private label expansions to capture incremental value without materially increasing price tags.

Although the immediate impact has manifested as margin compression and recalibrated inventory strategies, the cumulative effect of these tariff policies extends beyond cost considerations. Retailers are increasingly forging deeper collaborations with logistics providers to optimize freight consolidation and customs brokerage processes. At the same time, digital procurement platforms and AI-enabled sourcing tools have gained traction as companies seek granular visibility into landed cost drivers and scenario-planning capabilities to navigate ongoing trade policy uncertainties.

Uncovering Key Segmentation Insights Across Product Types Distribution Channels and End Users to Drive Targeted Market Engagement

When examining the market through the lens of product type, it becomes evident that accessories-encompassing bags, belts, hats, jewelry, and scarves-continue to capture consumer interest through a blend of functional innovation and fashion-forward design. Accessories have demonstrated resilience in an environment where consumers prioritize items that enhance existing wardrobes, driving brands to explore modular designs and limited-edition collaborations. At the same time, the broad clothing category-spanning athleisure, bottoms, innerwear, outerwear, and tops-has experienced divergent trends. Athleisure remains a dominant force, propelled by hybrid work arrangements and health-focused lifestyles, while outerwear innovations emphasize multifunctionality, sustainability, and adaptive insulation technologies. The evolving preferences across tops and bottoms underscore the consumer appetite for versatile silhouettes that transition seamlessly from day to evening settings.

Turning to distribution channels, the dichotomy between offline and online platforms highlights a dynamic interplay between experiential retail and convenience-driven commerce. Offline touchpoints, including brand outlets, department stores, multi-brand stores, specialty stores, and supermarkets hypermarkets, are reinventing the in-store experience through personalized styling services, interactive displays, and omnichannel fulfillment options. Conversely, online channels-spanning brand websites and third-party platforms-have accelerated investments in user experience optimization, AI-driven product recommendations, and frictionless checkout processes. This duality underscores the importance of an integrated omnichannel strategy that harmonizes physical and digital customer journeys.

Evaluating end users reveals distinct trajectories for kids, men, and women segments. The kids market is increasingly influenced by parental purchasing decisions that balance durability, comfort, and brand authenticity. Within the men’s segment, there is a notable uptick in demand for tailored solutions, sustainable materials, and grooming accessories that align with broader lifestyle aspirations. The women’s segment remains a bastion of diversity, with consumers seeking both timeless wardrobe staples and trend-driven designs that facilitate self-expression. By weaving these segmentation insights into product development and marketing strategies, industry players can craft more nuanced value propositions that resonate with each target cohort.

This comprehensive research report categorizes the Fashion Retailing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- End User

- Distribution Channel

Delineating Critical Regional Variations in Consumer Preferences Competitive Dynamics and Growth Drivers across the Americas EMEA and Asia-Pacific

Regional analysis unveils significant variations in consumer preferences, regulatory landscapes, and competitive intensity across the Americas, Europe, Middle East & Africa, and the Asia-Pacific. In the Americas, the convergence of digital innovation and sustainability consciousness has engendered a market where direct-to-consumer brands flourish alongside established omnichannel retailers. The regulatory environment, which includes nuanced state-level regulations and accelerated environmental standards, has compelled market participants to elevate transparency in sourcing and manufacturing practices. Meanwhile, Europe, the Middle East & Africa presents a tapestry of mature markets and emerging economies, each with distinct fashion sensibilities and purchasing power. Western European consumers emphasize eco-friendly materials and artisanal heritage, while Gulf Cooperation Council countries showcase robust demand for luxury and high-end labels, supported by favorable duty-free shopping regimes. African markets, by contrast, are characterized by informal retail channels and an increasing appetite for mass-market branded goods.

In the Asia-Pacific region, fragmentation is a defining attribute. Developed economies such as Japan and South Korea continue to lead in technology integration and premium brand uptake, while Greater China represents a vast landscape where digital ecosystems and social commerce platforms dictate trend cycles. Southeast Asia, buoyed by a rising middle class and urbanization, has become a hotbed for fast fashion and niche luxury brands alike. Across all regions, the intersection of cultural nuance, digital penetration, and evolving policy frameworks demands that global and local players tailor their regional playbooks with surgical precision.

This comprehensive research report examines key regions that drive the evolution of the Fashion Retailing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting the Strategies Innovations and Collaborative Ecosystem of Leading Companies Shaping the Fashion Retail Industry Landscape

Leading companies in the fashion retail space have embraced a multifaceted approach to maintain relevance and drive growth amid disruptive market dynamics. Vertical integration has emerged as a preferred strategy for both heritage brands and digitally native players, enabling tighter control over design, production, and distribution channels. This end-to-end visibility catalyzes innovation by shortening development cycles and fostering rapid iterative testing of new product concepts.

Collaborative ecosystems have also gained prominence, with retailers forging strategic partnerships across technology, logistics, and materials science domains. By integrating advanced analytics platforms, brands are harnessing granular consumer insights to refine assortment planning and optimize inventory flows. Additionally, many companies are co-investing in sustainable raw material ventures, leveraging joint research agreements to scale the adoption of recycled textiles and bio-based fibers.

Furthermore, capital markets have served as both enablers and accelerators of industry transformation. Savvy market entrants have leveraged private equity backing and strategic joint ventures to fund expansion into new markets and channels. At the same time, established players are deploying share buyback programs and selective divestitures to streamline operations and sharpen their strategic focus. The confluence of these strategies underscores a competitive landscape where adaptability, cross-industry collaboration, and financial engineering converge to shape the next chapter of fashion retailing.

This comprehensive research report delivers an in-depth overview of the principal market players in the Fashion Retailing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adidas AG

- ASOS plc

- Boohoo Group PLC

- Burberry Group plc

- Chanel S.A.

- Christian Dior SE

- Gap Inc.

- Gildan Activewear SRL

- H & M Hennes & Mauritz AB

- Hanesbrands Inc.

- Hermès International S.A.

- Inditex, S.A.

- Jockey International, Inc.

- Kering S.A.

- LEVI STRAUSS & CO.

- LVMH

- NIKE Inc.

- Prada S.p.A.

- PVH Corp.

- Ralph Lauren Corporation

- Tapestry, Inc.

- The Swatch Group Ltd.

- Uniqlo Co., Ltd.

- VF Corporation

- Zara

Formulating Actionable Strategic Recommendations to Empower Industry Leaders with Resilient Growth Frameworks and Competitive Advantages in Fashion Retail

To thrive in a market defined by rapid innovation and policy uncertainty, industry leaders must adopt a series of coordinated, high-impact initiatives. A foundational step involves reinforcing omnichannel infrastructures to deliver a seamless customer experience, whether online, in-app, or in-store. This requires not only investment in technology platforms but also cross-functional integration of marketing, inventory, and fulfillment teams to enable real-time responsiveness to demand signals.

Equally critical is the prioritization of sustainable practices across the product lifecycle. By embedding circular design principles and partnering with certified eco-material suppliers, companies can reduce environmental impact while resonating with an increasingly eco-conscious consumer base. In parallel, cultivating agile supply chains-underpinned by modular manufacturing setups and digital twins-will bolster resilience against tariff fluctuations and logistical disruptions.

Leadership teams should also advance personalization capabilities through AI-driven analytics and dynamic pricing models that tailor offers to individual consumers while preserving brand integrity. Augmenting these efforts with immersive brand storytelling-leveraging social media, virtual events, and community building-will foster deeper emotional connections. Finally, investing in workforce upskilling and cross-training initiatives will ensure that teams possess the digital acumen and strategic agility required to execute these transformative agendas effectively.

Outlining a Rigorous Research Methodology Integrating Quantitative Analysis Qualitative Insights and Data Triangulation for Robust Market Understanding

The research underpinning this report is anchored in a rigorous, multi-stage methodology designed to balance quantitative precision with qualitative depth. Secondary research involved systematic reviews of industry publications, trade journals, and regulatory filings to map macroeconomic indicators, policy changes, and thematic trends. This phase was complemented by a detailed audit of publicly available financial statements and corporate sustainability reports to identify evolving business models and strategic priorities.

Primary research constituted in-depth interviews with senior executives, category managers, and supply chain specialists across leading brands, retail conglomerates, and technology providers. These conversations yielded nuanced perspectives on operational challenges, investment priorities, and market sentiment. Simultaneously, retailer surveys and consumer focus groups provided empirical data on purchasing behaviors, channel preferences, and price sensitivity across demographic cohorts.

Data triangulation was achieved by cross-verifying findings from multiple sources and applying statistical normalization techniques to ensure consistency. An expert advisory council-comprising thought leaders in retail strategy, materials science, and digital innovation-further validated the insights and provided strategic context. The culmination of these efforts is a robust analytical framework that delivers a comprehensive, reliable, and actionable understanding of the fashion retail market in 2025.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Fashion Retailing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Fashion Retailing Market, by Product Type

- Fashion Retailing Market, by End User

- Fashion Retailing Market, by Distribution Channel

- Fashion Retailing Market, by Region

- Fashion Retailing Market, by Group

- Fashion Retailing Market, by Country

- United States Fashion Retailing Market

- China Fashion Retailing Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 1749 ]

Concluding with a Synthesis of Core Findings Strategic Implications and the Path Forward for Stakeholders in Fashion Retailing

In synthesizing the core findings of this executive summary, several overarching themes emerge. The interplay between digital innovation and sustainability imperatives is reshaping both consumer expectations and operational models, demanding that retailers become equally adept at technology adoption and ethical stewardship. Meanwhile, evolving trade policies have underscored the importance of supply chain agility and strategic sourcing agility, prompting companies to reassess traditional manufacturing geographies and logistics arrangements.

Segmentation insights reveal that tailored strategies for product categories, distribution channels, and end-user cohorts are essential for maintaining market relevance and driving engagement. Regional nuances further emphasize the need for localized playbooks that reflect cultural preferences, regulatory landscapes, and digital ecosystem maturity. Across the competitive landscape, the most successful companies are those that blur the lines between retail, technology, and sustainability, forging integrated ecosystems that amplify value at every stage of the consumer journey.

As stakeholders look to capitalize on emerging growth corridors and mitigate future disruptions, the strategic levers articulated in this report provide a clear roadmap. By embracing omnichannel orchestration, circular innovation, and data-driven decision making, industry players can navigate complexity with confidence and unlock sustainable, long-term value. This conclusion underscores the essential truth that the future of fashion retailing belongs to those who innovate with purpose and execute with precision.

Engaging with Ketan Rohom to Secure In-Depth Market Research Insights and Unlock Tailored Strategic Intelligence for Fashion Retail Success

To explore the full depth of this comprehensive market research report and to benefit from tailored strategic guidance, engage directly with Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. By partnering with Ketan, you will gain exclusive access to in-depth analysis, custom data interpretations, and expert recommendations designed to address your unique business challenges and growth aspirations. His deep insights into market dynamics and close collaboration with our research team ensure that you receive not just data, but actionable intelligence ready for immediate implementation. Reach out today to secure your copy of the report, discuss bespoke add-on services, and discover how our findings can accelerate your competitive edge. Let this conversation mark the beginning of a strategic alliance that transforms industry knowledge into measurable business impact

- How big is the Fashion Retailing Market?

- What is the Fashion Retailing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?