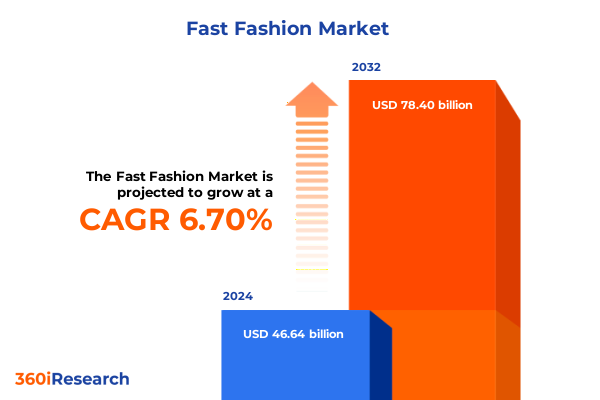

The Fast Fashion Market size was estimated at USD 49.67 billion in 2025 and expected to reach USD 52.89 billion in 2026, at a CAGR of 6.73% to reach USD 78.40 billion by 2032.

Setting the Stage for the Fast Fashion Narrative by Outlining Core Market Drivers, Consumer Preferences, and Industry Evolution in a Digitally Connected Era

Fast fashion has emerged as a defining force in the apparel industry, reshaping not only how consumers shop for clothing but also how brands conceptualize design, production, and distribution processes. In this dynamic arena, speed to market and cost efficiency are paramount, fueled by a voracious consumer appetite for the latest trends at accessible price points. With every season accelerated to monthly or even weekly cycles, brands that fail to innovate risk obsolescence in a landscape where agility and responsiveness increasingly determine market leadership.

Against this backdrop, digital transformation has served as both catalyst and enabler for unprecedented scale and reach. The proliferation of e-commerce and mobile platforms has dismantled traditional retail boundaries, allowing even nascent labels to present curated collections directly to global audiences. At the same time, heightened awareness of environmental and ethical concerns has prompted stakeholders to seek greater transparency and accountability throughout the supply chain. Together, these converging dynamics set the stage for an industry at a critical crossroads, where balancing speed, sustainability, and customer engagement will dictate future success.

Unveiling the Most Disruptive Technological, Social, and Environmental Shifts Redefining Fast Fashion Business Models and Supply Chain Strategies Worldwide

The fast fashion ecosystem is undergoing a profound transformation driven by technological innovations, shifting social paradigms, and mounting environmental imperatives. Artificial intelligence and machine learning now underpin trend forecasting, enabling brands to analyze social media signals and sales data in real time to anticipate consumer demand. This data-driven approach accelerates design iterations, reduces inventory risk, and enhances personalization, thereby reinforcing the industry’s hallmark responsiveness.

Simultaneously, social media influencers and user-generated content continue to redefine brand-consumer interactions, giving rise to micro-communities that shape trends at lightning pace. On the sustainability front, circular economy models are gaining prominence, as brands explore recyclable materials, take-back programs, and garment lifecycles that curtail environmental impact. Emerging partnerships with textile innovators offer biodegradable fibers and low-impact dyeing technologies, further underscoring a shift toward eco-conscious operations. Ultimately, these developments underscore an industry that is not merely accelerating its existing practices but fundamentally reimagining the way fashion is conceived, produced, and consumed.

Analyzing the Far-Reaching Consequences of 2025 United States Tariff Adjustments on Import Costs, Pricing Structures, and Strategic Sourcing Decisions in Fast Fashion

In 2025, the United States introduced substantive tariff adjustments on a range of apparel and textile imports, reshaping cost structures and strategic imperatives across the fast fashion sector. By raising duties on select categories, importers have encountered elevated landed costs that reverberate through pricing strategies, margin optimization and supplier negotiations. These escalated input expenses have prompted many brands to recalibrate their sourcing footprints, exploring nearshoring options in Latin America and diversified manufacturing in Southeast Asia to mitigate exposure to U.S. tariff volatility.

Consequently, the imposition of higher duties has also accelerated the adoption of integrated supply chain solutions, including vertical integration and strategic consolidation of orders to unlock economies of scale. Brands are leveraging tariff engineering-adjusting product specifications or utilizing free trade agreements-to maintain competitiveness. From a consumer perspective, selective price adjustments have been absorbed or strategically offset by promotions, loyalty programs and value-added services to preserve price perception. Overall, the 2025 tariff landscape has compelled fast fashion players to rethink sourcing agility, sharpen cost discipline, and adopt a more nuanced approach to global trade regulations.

Distilling Critical Segmentation Insights Across Distribution Channels, Product Types, Demographic Cohorts and Price Tiers to Guide Targeted Fast Fashion Strategies

Insightful segmentation analysis reveals that distribution channels are evolving in tandem with consumer expectations for convenience and experiential engagement. Offline retail-comprising mall retail, pop up stores, and standalone stores-continues to serve as an essential touchpoint for brand discovery and tactile evaluation, while online retail via brand websites, e-retailer platforms, and mobile apps offers unparalleled scale and personalization. The interplay between these channels underscores the necessity of cohesive omnichannel strategies that seamlessly integrate inventory, merchandising and customer experiences.

When examining product types, the spectrum extends across accessories-such as bags, belts, and scarves-and foundational apparel categories including bottoms across jeans, shorts, and skirts, dresses spanning casual and formal collections, outerwear through coats and jackets, and an array of tops from blouses and shirts to T-shirts. Each category commands differentiated marketing, design priorities and supply chain complexities. Demographic segmentation further refines targeting, as offerings must resonate with kids-divided into boys and girls-and adult consumers segmented into Gen X men, Gen Z men and millennial men, alongside Gen X women, Gen Z women and millennial women. Finally, understanding the nuances of price tiers from entry level and standard low in the low price segment to affordable mid and standard mid in the mid-price band, and premium fast fashion through limited editions and luxury collaborations illuminates distinct value propositions, competitive dynamics and margin considerations.

This comprehensive research report categorizes the Fast Fashion market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Gender

- Distribution Channel

Revealing Regional Nuances and Growth Patterns in the Americas, Europe, Middle East & Africa and Asia-Pacific That Shape Fast Fashion Demand and Competitive Landscapes

Regional dynamics continue to shape fast fashion trajectories, with the Americas market exhibiting robust omnichannel growth fueled by strong consumer spending and digital penetration. North America’s emphasis on direct-to-consumer models and experiential retail concepts has encouraged brands to elevate in-store experiences and expand at-home customization services. In Latin America, distribution networks are adapting to infrastructure challenges, driving investments in local fulfillment hubs and partnerships with last-mile delivery specialists.

Meanwhile, Europe, Middle East & Africa present a mosaic of regulatory environments and cultural preferences. Western Europe’s stringent sustainability standards and circularity regulations are compelling brands to intensify eco-friendly initiatives, while emerging markets in Eastern Europe and the Gulf Cooperation Council benefit from rising disposable incomes and youthful demographics. In Africa, informal retail channels remain significant, highlighting opportunities for digital marketplaces to bridge accessibility gaps. Across Asia-Pacific, rapid urbanization and growing middle-class segments are sustaining demand, with China’s digital ecosystems and India’s e-commerce expansion at the forefront. Southeast Asia’s fragmented landscape demands agile market entry tactics and local partnerships to navigate diverse consumer behaviors and regulatory frameworks.

This comprehensive research report examines key regions that drive the evolution of the Fast Fashion market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Fast Fashion Players and Innovators Spotlighting Their Strategic Moves, Competitive Advantages and Adaptation Approaches in a Challenging Market Environment

Leading fast fashion companies are demonstrating strategic acumen by reimagining business models that balance speed, scale and sustainability. One global retailer has leveraged nearshoring strategies paired with advanced robotics in manufacturing to slash lead times, while another major brand has embedded AI-powered design platforms to accelerate trend-to-shelf cycles and optimize inventory allocations. Meanwhile, digitally native challengers continue to disrupt legacy players by embracing data-driven personalization and influencer partnerships that create highly targeted micro-collections.

Collaborations between established brands and high-profile designers have emerged as a powerful mechanism for capsule drops that drive consumer excitement and premium pricing. Additionally, a growing cohort of stakeholders is pioneering closed-loop initiatives-from garment take-back programs to material recycling ecosystems-that seek to reconcile growth with ecological imperatives. These competitive maneuvers underscore a broader strategic shift: fast fashion companies must excel in operational excellence and innovation while cultivating differentiated brand identities and long-term sustainability credentials.

This comprehensive research report delivers an in-depth overview of the principal market players in the Fast Fashion market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ASOS plc

- Associated British Foods plc

- Boohoo Group plc

- C&A Group GmbH

- Fast Retailing Co., Ltd.

- Gap Inc.

- H&M Hennes & Mauritz AB

- Industria de Diseño Textil, S.A.

- LPP SA

- SHEIN Group Ltd.

Presenting Actionable Recommendations for Industry Leaders to Navigate Disruption, Enhance Resilience and Capitalize on Emerging Opportunities in Fast Fashion Operations

To thrive amidst disruption, industry leaders should pursue a holistic supply chain transformation that emphasizes end-to-end visibility and predictive analytics to anticipate bottlenecks and swiftly reallocate resources. Investing in digital design tools and 3D prototyping capabilities will shorten development cycles and reduce costly overproduction. Concurrently, establishing strategic partnerships with logistics providers and nearshore manufacturers can bolster resilience against geopolitical and tariff uncertainties.

Moreover, brands must deepen consumer engagement through personalized experiences across physical and digital touchpoints, leveraging data insights to tailor offerings and bolster loyalty. Embracing circular practices-ranging from eco-material sourcing to product life-extension services-will not only address regulatory pressures but also resonate with eco-conscious consumers. Finally, cultivating an innovation-driven culture that encourages cross-functional collaboration and rapid iteration will ensure organizations remain agile in the face of evolving market demands.

Outlining the Rigorously Designed Research Methodology Employed to Ensure Comprehensive, Reliable Fast Fashion Market Intelligence and Insight Validity

This research is grounded in a robust methodology that combines primary and secondary data sources to ensure comprehensive and objective insights. Primary research included in-depth interviews with senior executives and subject matter experts across leading retailers, manufacturers and technology providers to validate market trends and strategic priorities. These qualitative engagements were complemented by surveys targeting key consumer segments to capture evolving behaviors and preferences.

Secondary research encompassed an extensive review of industry publications, trade journals, company reports and regulatory documents to contextualize market dynamics and policy impacts. Data triangulation techniques were employed to cross-verify insights, and statistical analyses were conducted to identify correlations between segmentation variables and performance metrics. Rigorous quality checks and internal peer reviews reinforced the reliability of findings, ensuring that conclusions and recommendations are firmly anchored in evidence and reflect the current fast fashion landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Fast Fashion market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Fast Fashion Market, by Product Type

- Fast Fashion Market, by Gender

- Fast Fashion Market, by Distribution Channel

- Fast Fashion Market, by Region

- Fast Fashion Market, by Group

- Fast Fashion Market, by Country

- United States Fast Fashion Market

- China Fast Fashion Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 1749 ]

Drawing Comprehensive Conclusions That Synthesize Market Dynamics, Strategic Imperatives and Key Emerging Trends Guiding the Future Trajectory of Fast Fashion

The fast fashion sector stands at a pivotal juncture, driven by accelerating digital innovation, evolving consumer expectations and intensifying sustainability imperatives. The interplay of transformative technologies, from AI-driven trend forecasting to circular economy frameworks, is reshaping traditional paradigms and elevating agility as a core competitive imperative. Meanwhile, the 2025 U.S. tariff adjustments have underscored the importance of diversified sourcing strategies and strategic tariff engineering to preserve cost efficiency without compromising responsiveness.

Segmentation insights reveal the multifaceted nature of distribution channels, product categories and demographic cohorts, while regional analysis highlights distinct growth opportunities and challenges across the Americas, Europe, Middle East & Africa and Asia-Pacific. Leading companies are forging new pathways through digital personalization, collaborative capsule collections and closed-loop initiatives, signaling an evolution from pure speed-focused models to integrated value systems that balance growth and sustainability. Collectively, these trends form a strategic blueprint for organizations seeking to navigate the fast fashion landscape with confidence and foresight.

Driving Engagement with a Direct Call-To-Action Inviting Executives to Connect with Ketan Rohom for Access to an In-Depth Fast Fashion Market Intelligence Report

Elevate your strategic decision-making and secure a competitive edge by engaging directly with Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch, to gain exclusive access to a comprehensive fast fashion market intelligence report tailored to your unique business needs. Our in-depth analysis, rigorous methodology, and insights-driven recommendations can empower your organization to navigate disruption, optimize supply chain resilience, and capitalize on emerging consumer trends. Reach out today to schedule a personalized consultation and unlock the foresight that will drive your fast fashion strategies forward.

- How big is the Fast Fashion Market?

- What is the Fast Fashion Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?