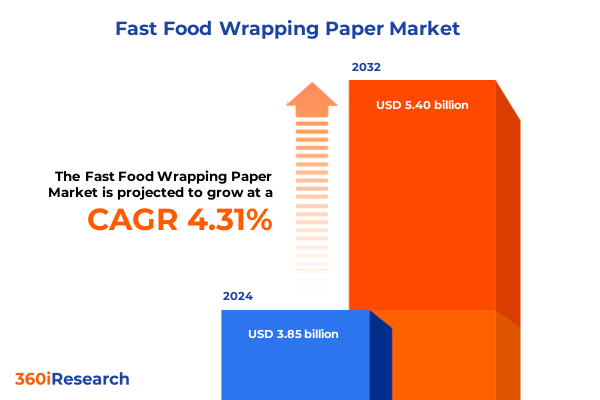

The Fast Food Wrapping Paper Market size was estimated at USD 4.00 billion in 2025 and expected to reach USD 4.16 billion in 2026, at a CAGR of 4.37% to reach USD 5.40 billion by 2032.

Discover How Fast Food Wrapping Paper is Evolving to Meet Sustainability Mandates, Technological Innovations, and Shifting Consumer Preferences in the Modern Era

In the fast-paced world of quick service restaurants and street food vendors, packaging serves as both a functional necessity and a critical touchpoint with consumers. Fast food wrapping paper, a seemingly simple commodity, has evolved into a sophisticated medium that communicates brand identity, ensures product integrity, and responds to ever-heightening environmental expectations. Recent shifts in consumer behavior reveal an increased willingness to pay a premium for sustainable packaging options, underscoring the growing importance of eco-friendly materials. Innovative coatings and barrier technologies now allow wrappers to retain food freshness without relying on traditional plastics, while plant-based and compostable materials are gaining traction among major chains looking to demonstrate corporate responsibility. These market dynamics signal an inflection point where material science and brand differentiation intersect to reshape the industry’s approach to disposable packaging.

As fast food outlets expand globally and delivery channels proliferate, the demands placed on wrapping paper have intensified. Beyond grease resistance and heat retention, modern wrappers must integrate seamlessly with digital experiences, including scannable QR codes that offer consumers transparency on sourcing and disposal guidelines. Meanwhile, regulatory landscapes-from California’s recyclable packaging mandates to Virginia’s 2025 Styrofoam ban-are accelerating the adoption of paper-based and bio-derived solutions, compelling manufacturers to innovate rapidly to maintain compliance and avoid disruptions. In this landscape, the ability to align operational efficiency with environmental stewardship is no longer optional; it is a defining competitive advantage for brands poised to thrive in a market where values and convenience converge.

Explore the Major Transformative Shifts Reshaping the Fast Food Wrapping Paper Landscape Through Innovation, Regulation, and Consumer-Driven Sustainability

The fast food wrapping paper landscape is undergoing transformative shifts driven by intersecting forces of legislation, technology advancement, and heightened consumer consciousness. Sustainability has emerged as the north star for many brands, prompting a transition from traditional wax-coated and plastic laminated substrates to greaseproof papers, compostable wraps, and biofilms derived from polylactic acid (PLA). These eco-centric materials tackle the challenge of single-use waste while maintaining functional performance, marking a departure from legacy reliance on non-recyclable films. Concurrently, advanced barrier coatings utilizing water-based and nano-technologies are enabling seamless recyclability without sacrificing protective qualities, illustrating how science is responding to ecological imperatives.

In parallel, technological integration has redefined how wrapping paper connects with end users. Packaging now serves as a platform for digital engagement, embedding QR codes and NFC tags that allow consumers to trace ingredient origins, verify certification claims, and access dynamic promotions. This shift toward smart packaging enhances the perceived value of the dining experience and fosters trust through transparency. Aesthetic trends have also evolved; minimalist designs with bold typography and limited color palettes convey authenticity, while custom printed patterns and vintage-inspired motifs tap into nostalgia to deepen emotional resonance. As brands navigate this era of personalization, the convergence of material innovation and digital functionality stands as the most consequential paradigm shift reshaping fast food wrapping paper design and utility.

Uncover the Cumulative Effects of 2025 United States Tariffs on Raw Material Costs and Fast Food Wrapping Paper Supply Chains Nationwide

The ripple effects of new United States tariff policies in 2025 have permeated every tier of the fast food wrapping paper supply chain, cumulatively elevating costs and reshaping sourcing strategies. Steel and aluminum levies under existing trade measures have indirectly driven up the price of barrier coatings and foil substrates, as food-grade aluminum foil and certain proprietary barrier materials hinge on commodity metal inputs. Many domestic converters reliant on imported base materials have faced a squeeze between absorbing these increases and passing costs to customers. As a result, some manufacturers have accelerated investments in localizing production or reformulating wraps to reduce metal content, illustrating an industry-wide recalibration of cost structures.

In addition to commodity hikes, logistical disruptions stemming from reciprocal tariffs on Chinese imports have triggered extended lead times and inventory volatility. Packaging firms are increasingly diversifying supplier portfolios and exploring alternative substrates-including recycled fibers and PLA films sourced from within North America-to mitigate exposure to tariff shocks. While this pivot demands upfront capital for new equipment and certification processes, it positions businesses to navigate future trade volatility with greater resilience. The integrated impact of these trade measures underscores a broader strategic inflection: manufacturers and end users must adapt procurement models to balance cost containment with the imperative for sustainable, high-performing materials in a complex geopolitical environment.

Gain Strategic Insights from Key Segmentations Based on Material, Application, End User, and Distribution Channels Driving the Wrapping Paper Market

Segmentation analysis reveals distinct trajectories for fast food wrapping paper materials as emerging standards and performance requirements evolve. Aluminum foil, once valued for its exceptional barrier properties, is contending with cost pressures and environmental scrutiny, while paper substrates-coated, greaseproof, and uncoated-are gaining prominence through enhanced barrier coatings that preserve recyclability. PLA film represents a growing niche for compostable offerings, enabling brands to tout cradle-to-grave biodegradability, and wax paper continues to serve legacy applications where moisture resistance is essential. Each material category carries unique implications for cost, performance, and sustainability credentials, underscoring the necessity of a tailored approach to meet diverse operational and regulatory mandates.

When examining applications, burger wraps remain the core driver of volume demand, with customization and print quality as key differentiators for quick service chains seeking brand visibility. Sandwich wraps and snack wraps present opportunities for premium wrapper formats, leveraging specialty papers and film laminations to address product-specific challenges such as grease migration and aroma retention. Dessert wraps, though smaller in scale, demand moisture-resistant substrates that preserve delicate textures. Across these application types, convergence of consumer expectations for taste integrity, packaging aesthetics, and environmental responsibility drives innovation, guiding material selection and wrapper design towards multifaceted performance profiles.

The end user landscape further refines market segmentation. Quick service restaurants anchor steady high-volume consumption, while food trucks and street food vendors often prioritize cost-effective, mobile-optimized solutions that balance durability with compact storage. Cafeterias and canteens, spanning educational institutions to corporate campuses, demand wrappers that support bulk operations and align with institutional sustainability policies. Finally, distribution channels influence supply chain dynamics: direct sales foster close collaboration on custom solutions, distributors and wholesalers offer broad market reach, and online channels enable smaller operators to access niche or sustainable materials with minimal lead times. Collectively, these segmentation dimensions illuminate the complex interplay between functional demands, purchasing behaviors, and distribution preferences across the fast food wrapper market.

This comprehensive research report categorizes the Fast Food Wrapping Paper market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material Type

- Application Type

- End User

- Distribution Channel

Understand Regional Dynamics Driving Growth in the Fast Food Wrapping Paper Market Across Americas, Europe Middle East Africa, and Asia Pacific

Geography shapes demand patterns and regulatory pressures in the global fast food wrapping paper market. In the Americas, heightened awareness of single-use waste and state-level regulations-like California’s post-consumer recycled content mandates and Virginia’s ban on expanded polystyrene-have propelled rapid adoption of paper-based and compostable alternatives. North American quick service operators are forging partnerships with suppliers specializing in fiber-based wraps, reflecting a collective push towards tangible sustainability goals and reduced carbon footprints.

Across Europe, the Middle East, and Africa, ambitious Extended Producer Responsibility (EPR) frameworks and the European Union’s Packaging and Packaging Waste Regulation demand aggressive recycling targets, spurring innovation in fiber recovery and material traceability. Brands are leveraging smart packaging solutions to meet transparency requirements and secure circularity credentials under evolving standards. Simultaneously, growth in emerging Middle Eastern markets is driving demand for cost-effective wrappers that satisfy both performance and sustainability requirements, while African markets exhibit opportunities for low-cost, biodegradable formats tailored to informal food service sectors.

The Asia-Pacific region stands at the forefront of consumption expansion, underpinned by rapid urbanization, a burgeoning middle class, and the proliferation of international fast food chains. Nations like China, India, and Southeast Asian economies are witnessing heightened interest in eco-friendly packaging solutions, propelled by government incentives and high visibility of plastic pollution concerns. Local material refiners and converters are investing in capacity to produce greaseproof paper and PLA films domestically, reducing dependency on imported substrates and positioning APAC suppliers as competitive global players in sustainable wrapping paper solutions.

This comprehensive research report examines key regions that drive the evolution of the Fast Food Wrapping Paper market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Explore In-Depth Company Strategies, Competitive Positioning, and Innovation Approaches from Leading Fast Food Wrapping Paper Manufacturers and Suppliers

Market consolidation and strategic alliances among key players are shaping competitive dynamics in the fast food wrapping paper space. The recently announced acquisition of Berry Global by Amcor, valued at $8.4 billion, exemplifies the drive toward scale and diversification, enabling combined R&D investments of $180 million annually in sustainable packaging innovations. This consolidation underscores the importance of cost synergies and expanded geographic reach, as the merged entity leverages complementary product portfolios to serve diverse market segments worldwide.

Beyond M&A activity, innovation leadership remains a critical differentiator. Companies like Huhtamaki and Smurfit Kappa are advancing compostable paper technologies and water-based coatings that enhance barrier performance while preserving recyclability. Meanwhile, global giants such as Mondi and Georgia-Pacific are scaling production of greaseproof and coated papers, balancing cost efficiency with environmental mandates. Niche players-twin Rivers Paper and Pudumjee Paper Products, for instance-are focused on specialized high-grade wrappers for premium and artisanal segments. This spectrum of participants, from multinationals to agile specialists, underscores a market where strategic partnerships, differentiated product development, and sustainability commitments define leading competitive positioning.

This comprehensive research report delivers an in-depth overview of the principal market players in the Fast Food Wrapping Paper market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amcor Plc

- Berry Global, Inc.

- BillerudKorsnäs AB

- DS Smith Plc

- Georgia-Pacific LLC

- Graphic Packaging Holding Company

- Holmen AB

- Huhtamäki Oyj

- International Paper Company

- Klabin S.A.

- Metsä Board Oyj

- Mondi Plc

- Nippon Paper Industries Co., Ltd.

- Oji Holdings Corporation

- Packaging Corporation of America

- Pactiv Evergreen Inc.

- Rengo Co., Ltd.

- Smurfit Kappa Group plc

- Sonoco Products Company

- WestRock Company

Implement Strategic Recommendations for Industry Leaders to Enhance Sustainability, Optimize Costs, and Capitalize on Emerging Opportunities in Wrapping Paper

Industry leaders must align packaging innovation with both environmental imperatives and cost optimization strategies to sustain growth and regulatory compliance. First, prioritizing R&D partnerships that accelerate development of advanced barrier coatings-such as nano-cellulose and water-based emulsion technologies-can reduce reliance on metallic laminates while preserving functional performance. These collaborations can also expedite certifications for recyclability and compostability, boosting brand credibility among sustainability-minded consumers. Engaging with academic institutions and material science startups can unlock novel solutions that balance cost and ecological impact, driving differentiation in a crowded marketplace.

Second, optimizing supply chains through strategic localization of raw material sourcing and converter partnerships is essential to mitigate tariff exposure and logistical delays. Establishing regional production hubs for greaseproof papers and PLA films can reduce lead times and buffer against geopolitical risks. Complementing this with digital supply chain management tools-leveraging real-time data analytics and demand forecasting-will enable more agile responses to fluctuating market conditions and regulatory changes. Finally, fostering transparency through smart packaging integrations and clear labeling builds consumer trust, elevates brand distinction, and supports compliance with evolving global waste management mandates.

Delve into the Comprehensive Research Methodology Covering Data Collection, Validation Processes, and Analytical Frameworks Underpinning the Market Study

This research employs a multi-phase methodology combining secondary and primary data collection to ensure robustness and accuracy. Secondary research involved a comprehensive review of industry reports, regulatory documents, financial filings, and reputable publications to establish contextual understanding and identify key market dynamics. Sources included packaging industry journals, sustainability whitepapers, and trade association releases, providing a broad spectrum of perspectives and quantitative data points. Chapter outlines from leading market intelligence providers were referenced to validate segmentation frameworks and competitive landscapes.

Primary research comprised in-depth interviews with stakeholders across the value chain, including materials suppliers, converter executives, brand procurement managers, and sustainability officers. Qualitative insights from these discussions were triangulated with quantitative data to refine market trends, validate cost drivers, and assess adoption barriers. Data triangulation techniques were applied to reconcile discrepancies, enhance predictive accuracy, and deliver actionable findings. Finally, the collected data were synthesized using advanced analytical frameworks-such as SWOT and Porter's Five Forces-to elucidate competitive positioning, market attractiveness, and strategic imperatives guiding fast food wrapping paper innovation and adoption.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Fast Food Wrapping Paper market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Fast Food Wrapping Paper Market, by Material Type

- Fast Food Wrapping Paper Market, by Application Type

- Fast Food Wrapping Paper Market, by End User

- Fast Food Wrapping Paper Market, by Distribution Channel

- Fast Food Wrapping Paper Market, by Region

- Fast Food Wrapping Paper Market, by Group

- Fast Food Wrapping Paper Market, by Country

- United States Fast Food Wrapping Paper Market

- China Fast Food Wrapping Paper Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 954 ]

Summarize Critical Findings Highlighting Market Trends, Challenges, and Opportunities Shaping the Future of Fast Food Wrapping Paper Across Multiple Dimensions

The fast food wrapping paper market stands at a crossroads where ecological expectations, technological possibilities, and economic realities converge. Our analysis reveals that sustainability-oriented materials-ranging from greaseproof papers to compostable PLA films-are rapidly superseding legacy substrates, driven by consumer demand and tightening regulations. Technological innovations in barrier coatings and digital integrations are redefining wrapper functionality, enabling more transparent and engaging consumer experiences. Meanwhile, geopolitical factors, notably the cumulative impact of 2025 US tariffs, are reshaping cost structures and prompting a strategic shift toward localized production and diversified sourcing models. These dynamics collectively underscore a market in evolution, where agility, collaboration, and focused investment determine competitive advantage.

Looking ahead, the interplay of regional regulatory landscapes and global consolidation trends will continue to shape opportunities for both established players and newcomers. Growth in emerging markets, especially within Asia-Pacific, presents significant volume potential, while mature regions demand higher-value, compliant solutions. Key success factors include the ability to anticipate legislative shifts, invest in R&D for next-generation coatings, and embrace digital tools that enhance supply chain visibility and consumer engagement. Organizations that navigate these currents with strategic foresight will be best positioned to capture market share and deliver the sustainable, high-performance wrapping paper solutions demanded by tomorrow’s consumers.

Connect with Ketan Rohom to Secure Your Comprehensive Fast Food Wrapping Paper Market Research Report and Drive Strategic Decision Making with Expert Insights

For personalized guidance on leveraging the comprehensive insights within this report and to discuss tailored solutions for your organization, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. His expertise will help you transform findings into strategic actions that address your unique challenges and objectives.

Secure your copy of the exhaustive fast food wrapping paper market research report today and equip your team with data-driven intelligence that drives efficiency, optimizes costs, and enhances sustainability in packaging operations.

- How big is the Fast Food Wrapping Paper Market?

- What is the Fast Food Wrapping Paper Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?