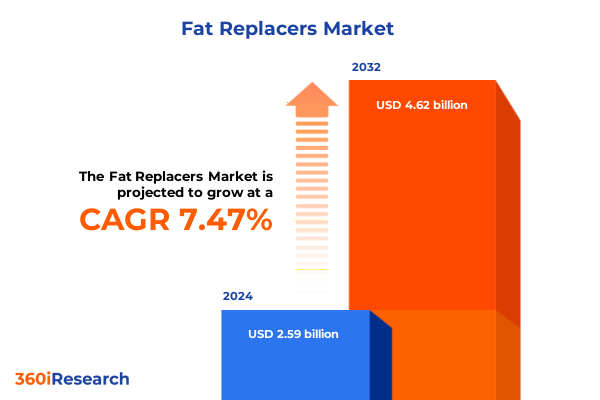

The Fat Replacers Market size was estimated at USD 2.78 billion in 2025 and expected to reach USD 2.98 billion in 2026, at a CAGR of 7.49% to reach USD 4.62 billion by 2032.

Discovering How Advanced Fat Replacer Technologies Are Transforming Consumer Expectations and Driving the Next Generation of Healthy Foods

Fat replacers are redefining the way food formulators balance texture, flavor, and nutritional profile in modern products. Engineered to replicate the functional properties of triglycerides, these ingredients span a range of chemical classes that span lipid-based substitutes, protein-derived mimetics, and carbohydrate-driven bulking agents. While fats traditionally contribute to creaminess, lubricity, and flavor delivery, science-based alternatives enable lower calorie intake and improved health positioning without compromising sensory attributes. As a result, both consumers and manufacturers are converging around low-fat solutions that preserve indulgence while aligning with evolving dietary guidelines and regulatory pressure.

Moreover, the surging demand for healthier product options has driven investment in novel fat analogs that exhibit thermal stability, emulsification capacity, and taste neutrality. Carbohydrate-based replacers leverage polysaccharide networks to trap water and air, protein-based mimetics exploit micro-particle engineering for mouthfeel, and fat-based analogs utilize enzymatic or inter-esterified modifications of triglycerides for one-to-one substitution. This diverse toolbox underscores the multifaceted role of fat replacers in addressing obesity concerns, reducing saturated fat intake, and fulfilling clean label requirements, thereby shaping the future of food innovation across categories.

Exploring How Clean Label Imperatives and Technological Innovations Are Catalyzing a Paradigm Shift in Fat Replacer Development

The fat replacers sector has undergone transformative shifts spurred by consumer demand for transparency, sustainability, and enhanced functionality. Rising awareness of ingredient sourcing and clean label credentials has prompted manufacturers to favor mimetics derived from fruits, vegetables, and legumes, enabling ingredient declarations that resonate with health-conscious shoppers. Additionally, advancements in microencapsulation and emulsification have propelled the development of fat substitutes that closely match the melting, browning, and lubricity characteristics of conventional fats, bridging the gap between healthy formulations and indulgent experience.

Simultaneously, a protein renaissance is evident, as microparticulated whey, micropowdered pea, and egg-derived systems are engineered to restore mouthfeel and creaminess in dairy, bakery, and meat applications. These innovations are supported by consumer appetite for high-protein products, which has accelerated research into dual-function ingredients that both replace fat and boost protein content. In parallel, digital tools such as artificial intelligence and predictive modeling are expediting ingredient discovery and formulation optimization, enabling rapid iteration and customized fat replacer solutions that anticipate texture, stability, and flavor outcomes with unprecedented accuracy.

Assessing the Far-Reaching Consequences of 2025 U.S. Tariffs on Ingredient Sourcing Strategies and Cost Structures Across the Food Industry

In 2025, U.S. trade policy introduced sweeping tariff measures that have reverberated across the food ingredients supply chain. An executive directive imposed a baseline 10% tariff on all imported goods, with escalated rates of up to 46% for select nations deemed protectionist. While most commodities from Canada and Mexico remain exempt under USMCA, ingredients sourced beyond North America, including specialty oils, sweeteners, and protein isolates, now face substantial levies, prompting immediate cost increases for manufacturers and brands.

Rather than being absorbed by foreign exporters, these tariffs are largely shouldered by U.S. corporations. Retailers and consumer goods companies have reported multi-million-dollar tariff bills, choosing in many cases to delay price hikes in hopes of relief but ultimately confronting higher input costs. According to industry analyses, these levies could add up to $100 million in tariff expenses for some leading confectionery and dairy processors once existing inventories are exhausted, compelling them to petition for exemptions on essential imports like cocoa and coffee.

Consequently, supply chain teams are diversifying sourcing to low-tariff markets, ramping domestic procurement, and reevaluating recipes to reduce reliance on heavily taxed ingredients. While imports of staple commodities may hold steady under preferential trade pacts, specialty fat replacer components are increasingly scrutinized, and strategies such as vertical integration and contract renegotiation have become critical to mitigating the cumulative impact of these tariffs on cost structures and product availability.

Decoding the Complex Landscape of Fat Replacer Market Segmentation to Unlock Strategic Opportunity Across Types, Forms, Channels, and Applications

The fat replacers market can be decoded through multiple lenses that reveal strategic avenues for innovation and differentiation. Based on type, it encompasses carbohydrate-based matrices-such as modified starches and polydextrose-that provide bulk and moisture retention, fat-based analogs that chemically mimic triglycerides via enzymatic modification of vegetable oils, and protein-based micelles and microgels that replicate lubricity and mouthfeel. Furthermore, form differentiations between liquid emulsions and powder concentrates reflect unique processing considerations, with liquids offering immediate dispersion and powders enabling extended shelf stability. Distribution channels, ranging from traditional brick-and-mortar networks to emerging direct-to-consumer e-commerce platforms, demonstrate the evolving pathways through which formulators access these ingredients. Additionally, the role of application must not be overlooked; from bakery and confectionery to beverages, convenience foods, dairy and frozen desserts, dressings, margarines, spreads, and processed meats, the need for fat replacers is universal across product developments seeking to reconcile health mandates with sensory performance.

This comprehensive research report categorizes the Fat Replacers market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Form

- Application

- Distribution Channel

Navigating the Diverse Regional Dynamics Shaping Fat Replacer Adoption and Growth in the Americas, EMEA, and Asia-Pacific Markets

Regional dynamics are reshaping how fat replacers are adopted and innovated around the globe. In the Americas, heightened regulatory scrutiny of trans fats and saturated fats has accelerated reformulation initiatives, especially among leading quick service restaurants and packaged food brands, where consumer demand for transparency and low-calorie options continues to climb. Meanwhile, Europe, the Middle East, and Africa (EMEA) present a mosaic of regulatory frameworks and consumer preferences. The European Union’s Nutri-Score labeling and stringent health claims regulations drive manufacturers to prioritize natural, high-performance replacers, while emerging Middle Eastern markets are witnessing rapid growth in dairy and frozen dessert segments that leverage plant-based alternatives for both indulgence and nutritional alignment. Conversely, the Asia-Pacific region is propelled by urbanization and rising disposable incomes, fueling demand for convenience foods, premium dairy substitutes, and functional beverages. Here, innovation centers are exploring rice- and seaweed-derived polysaccharides, alongside protein-based systems tailored to local taste profiles, illustrating a diverse set of market imperatives driven by cultural nuances and growth trajectories.

This comprehensive research report examines key regions that drive the evolution of the Fat Replacers market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Strategic Partnerships Driving Breakthroughs in Fat Replacement Technologies and Sustainable Ingredient Solutions

Key ingredient suppliers and innovators are reshaping the fat replacers landscape through partnerships, technology licensing, and breakthrough research. Cargill’s strategic alliance with CUBIQ FOODS exemplifies this trend, as their co-development agreement has unlocked plant-derived fat technologies that elevate flavor and functionality in dairy and meat alternative applications, enabling structured emulsions that bypass traditional tropical oil sources. This collaboration underscores how global ingredient powerhouses are leveraging startup agility to introduce next-generation fat substitutes with tailored performance profiles.

Food and beverage titans are also investing in internal R&D to tackle fat reduction in legacy products. Nestlé has introduced a novel process for dairy ingredients that slashes fat content in milk powders by up to 60% through protein aggregate engineering, preserving creaminess and mouthfeel without resorting to artificial additives. This science-driven formulation approach highlights the intersection of nutrient optimization and sensory excellence, demonstrating how incumbents can reinvent staple categories.

Meanwhile, pioneering startups are emerging with AI-powered platforms to accelerate discovery of protein-oil composites. Shiru’s OleoPro™ combines plant proteins and unsaturated oils into a self-standing fat analog that browns when cooked and replicates juiciness in alt-meat prototypes, reducing saturated fat by 90% while maintaining structural integrity. Similarly, PolyU researchers have developed AkkMore™, a fungus-derived microcolloid that enhances gut health and extends shelf life in reduced-fat desserts, signaling the potential of biobased fat mimetics in functional foods.

In parallel, lipid-engineering firms like Lypid have commercialized PhytoFat™, a microencapsulated vegan oil system that emulates intramuscular fat tissue, delivers a high melting point for culinary applications, and offers chefs precise control over texture without hydrogenation or trans fats. Complementing these breakthroughs, ingredient specialists such as Kerry Group are bolstering plant protein capabilities through acquisitions, integrating non-allergenic pea and rice protein technologies to expand their portfolio of protein-based fat mimetics. Collectively, these strategic moves illustrate a market in which incumbent scale, startup innovation, and biotechnology converge to redefine fat replacement possibilities.

This comprehensive research report delivers an in-depth overview of the principal market players in the Fat Replacers market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Archer Daniels Midland Company

- Associated British Foods Plc

- AVEBE U.A.

- BENEO GmbH

- Cargill Incorporated

- Corbion N.V.

- DuPont de Nemours Inc

- Epogee

- Fiberstar Inc

- FMC Corporation

- Givaudan SA

- Grain Processing Corporation

- Ingredion Incorporated

- JELU-WERK J. Ehrler GmbH & Co. KG

- Kerry Group plc

- Koninklijke DSM N.V.

- Mycorena

- Nestlé S.A.

- Roquette Freres S.A.

- Tate & Lyle PLC

- Ulrick & Short Ltd

- Wilmar International Ltd

Translating Market Intelligence into Strategic Actions to Enhance Competitiveness and Foster Innovation in Fat Replacer Development

To thrive in this dynamic environment, industry leaders must translate insights into targeted actions. First, companies should diversify their fat replacer portfolios by integrating carbohydrate-, protein-, and lipid-based solutions, thereby mitigating raw material risks exacerbated by tariff volatility and ensuring formulation flexibility across categories. Secondly, prioritizing partnerships with biotech and AI-driven startups can accelerate ingredient innovation while smoothing the path to regulatory approval and scale, as demonstrated by collaborations between major suppliers and disruptors.

Furthermore, companies should enhance supply chain resilience by leveraging nearshoring opportunities and alternative sourcing strategies, optimizing inventory buffers to counteract import delays and inspection backlogs. Simultaneously, investing in digital formulation platforms and advanced analytics will enable rapid iteration, predictive stability assessments, and consumer sensory mapping, ensuring that new fat replacers meet both performance and clean label expectations. Finally, embedding sustainability metrics into product development-such as life-cycle assessments for water use, carbon footprint, and ingredient traceability-will strengthen brand trust and align product portfolios with broader ESG commitments.

Outlining the Comprehensive Mixed-Method Research Approach Behind the In-Depth Fat Replacer Market Analysis and Insights

This report’s findings are grounded in a rigorous mixed-method research framework. The methodology commenced with comprehensive secondary research across scientific literature, patent filings, trade publications, and government databases to map technological advancements and regulatory developments in fat replacer innovation. Concurrently, key market participants, including ingredient suppliers, contract manufacturers, and end-product formulators, were engaged through in-depth interviews to glean qualitative perspectives on market drivers, formulation challenges, and adoption barriers.

Quantitative analyses-encompassing consumption patterns, tariff schedules, and distribution channel trends-were performed using proprietary data models and validated against external data sources. Geographic and application-specific segmentation insights were derived via a combination of consumption data, regulatory frameworks, and end-market surveys. Throughout this process, iterative validation workshops with industry experts and academic advisors ensured the accuracy and relevance of findings, facilitating a robust set of strategic recommendations and actionable insights tailored to stakeholder needs.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Fat Replacers market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Fat Replacers Market, by Type

- Fat Replacers Market, by Form

- Fat Replacers Market, by Application

- Fat Replacers Market, by Distribution Channel

- Fat Replacers Market, by Region

- Fat Replacers Market, by Group

- Fat Replacers Market, by Country

- United States Fat Replacers Market

- China Fat Replacers Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 795 ]

Concluding Insights Emphasizing the Strategic Imperatives for Stakeholders to Leverage Fat Replacer Innovations in Health-Driven Food Trends

In summary, the fat replacers sector is at a pivotal juncture, shaped by stringent health guidelines, ambitious sustainability targets, and rapid technological progress. Segmentation nuances-from ingredient base to distribution channels and end-use applications-present opportunities for tailored innovation, while regional market dynamics underscore the need for adaptable strategies. Leading companies and startups alike are pioneering new frontiers, leveraging collaborations, biotechnological breakthroughs, and digital tools to deliver compelling, health-forward alternatives to traditional fats. As trade policies and consumer demands continue to evolve, stakeholders equipped with deep market intelligence, cross-functional partnerships, and agile R&D capabilities will emerge as the architects of the next generation of low-fat, high-performance food experiences.

Engage with Associate Director Ketan Rohom to Acquire the Comprehensive Fat Replacer Market Research Report and Drive Strategic Growth

Ready to capitalize on actionable market intelligence and secure your competitive edge in the dynamic fat replacers landscape? Ketan Rohom, Associate Director of Sales & Marketing, is your gateway to comprehensive insights, in-depth analysis, and strategic guidance. Reach out today to purchase the authoritative fat replacers market research report and empower your organization with data-driven decision-making and tailored solutions that will drive growth and innovation.

- How big is the Fat Replacers Market?

- What is the Fat Replacers Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?