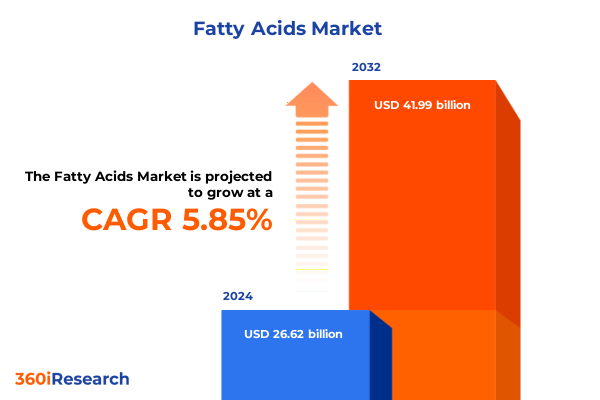

The Fatty Acids Market size was estimated at USD 28.11 billion in 2025 and expected to reach USD 29.68 billion in 2026, at a CAGR of 5.89% to reach USD 41.99 billion by 2032.

Unveiling the Pivotal Role of Fatty Acids in Modern Industry and Their Strategic Importance Across Nutritional Health, Sustainability, and Industrial Innovation

Fatty acids have emerged as indispensable building blocks in a wide range of industries, underpinning applications in food, pharmaceuticals, cosmetics, and industrial formulations. Beyond their traditional role as energy substrates and structural components in biological systems, these molecules now serve as the backbone for high‐value specialty chemicals, biofuels, and functional ingredients that drive innovation in health and sustainability. As the global emphasis on eco‐friendly processes intensifies, the fatty acid sector has responded with a surge in green production techniques, aligning with regulatory requirements and consumer demand for cleaner, naturally derived products.

In response to these evolving dynamics, manufacturers and research institutions have deepened their focus on purity, performance, and traceability across supply chains. This shift has catalyzed significant investments in advanced refining, enzyme‐catalyzed reactions, and integrated biorefinery platforms designed to deliver tailored fatty acid profiles. Moreover, a growing understanding of lipid biochemistry and material science has unlocked novel functionalities-from structured lipids that enhance nutritional profiles to dimeric and oligomeric derivatives that improve polymer performance. Consequently, decision‐makers now face the dual challenge of balancing cost pressures with the imperative to capture premium margins through innovation, positioning fatty acids as a critical lever in tomorrow’s value‐driven markets.

Transformative Advances in Bio-Based Production Technologies and Digital Optimization Driving a New Era of Sustainable Fatty Acid Manufacturing

Over the past few years, biocatalysis has redefined lipid modification, offering manufacturers the promise of highly selective, energy‐efficient pathways to functionalize fatty acids. Through protein engineering techniques such as directed evolution and rational design, enzyme stability and activity have improved markedly, enabling industrial-scale synthesis of specialized derivatives under milder conditions with minimal byproducts. Academic and industry reviews have highlighted successful pilot applications in biodiesel production and hydroxy fatty acid generation, showcasing yields exceeding 90 percent and demonstrating clear environmental benefits over conventional chemical routes.

In parallel, synthetic biology strategies have advanced the metabolic engineering of microbial strains to biosynthesize long-chain and polyunsaturated fatty acids, unlocking new opportunities for high-purity nutraceuticals and bioactive lipids. Researchers have identified and expressed novel oxygenases and hydratases that convert oleic and linoleic acids into hydroxy derivatives with precision, achieving product concentrations above 40 grams per liter in whole‐cell biotransformations. Meanwhile, gas chromatography and proteomic analyses have refined feedstock optimization, supporting continuous process intensification in enzymatic reactors. Collectively, these developments are transforming fatty acid manufacturing into a platform for sustainable, tailor‐made solutions that meet growing regulatory and consumer demands for green chemistry.

Cumulative Impact of Ongoing U.S. Trade Measures on Fatty Acid Supply Chains Highlighting Increased Costs and Strategic Sourcing Shifts Through 2025

Since the initial imposition of trade measures under Section 301 in 2018, U.S. tariffs have reshaped chemical supply chains, driving companies to reassess sourcing strategies for key fatty acid feedstocks. Tariffs of up to 25 percent on certain Chinese chemical imports have elevated input costs substantially, prompting manufacturers to explore tariff engineering techniques such as routing purchases through Southeast Asian intermediaries to mitigate duties while maintaining supply continuity. The cumulative effect has been a diversification of procurement channels, with a notable shift towards suppliers in India, Europe, and Latin America.

Moreover, American Chemistry Council data indicate that higher tariffs have increased raw material costs by over 30 percent in sectors reliant on imported monomers and intermediates, squeezing downstream margins and accelerating investment in domestic capacity expansions. At the same time, the uncertainty around exemption renewals has compelled firms to maintain elevated inventory levels and negotiate longer-term contracts with non‐Chinese vendors. While some specialty producers benefit from protected domestic output, downstream processors face pressure from reduced tariff relief and evolving trade policy reviews, underscoring the need for proactive supply chain resilience planning.

Comprehensive Segmentation Perspectives Unveiling Type, Source, Form, and Application Insights to Navigate the Diverse Fatty Acid Landscape

Market participants segment fatty acids by type into saturated and unsaturated categories, with saturated fatty acids encompassing Arachidic, Behenic, Lauric, Myristic, Palmitic, and Stearic acids, each delivering distinct melting profiles and oxidative stabilities for applications in food formulation and candle production. In contrast, unsaturated fatty acids divide into monounsaturated and polyunsaturated families, offering fluidity or bioactive functionality essential for nutraceuticals and emulsifiers.

Equally important is the segmentation based on source: natural fatty acids derive from animal-based streams, microbial fermentation, and plant-based oils such as coconut, palm, or castor, while synthetic fatty acids originate through chemical or biocatalytic processes tailored for specific performance criteria. Form classification distinguishes liquid oils used in low-temperature applications from solid fats favored for structural integrity in personal care and polymer additives. Finally, applications span adhesives and sealants that require tunable tackiness, agricultural formulations for controlled-release herbicides, cosmetics and personal care products boasting emollient properties, food and beverage ingredients that enhance mouthfeel, pharmaceuticals and nutraceuticals targeting controlled delivery, plastics and polymers demanding improved flexibility, and textile finishing agents that impart hydrophobicity and softness.

This comprehensive research report categorizes the Fatty Acids market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Source

- Form

- Application

Key Regional Dynamics Shaping Fatty Acid Market Development in the Americas, Europe Middle East & Africa, and Asia-Pacific Amid Evolving Demand Drivers

In the Americas, established infrastructure and proximity to key oilseed-producing regions underpin robust demand for both edible and industrial fatty acids. North American innovators leverage integrated crushing and refining plants to serve food, feed, and renewable energy sectors, while Latin American producers focus on castor and palm derivatives for export. Shifting trade patterns within the hemisphere reflect nearshoring initiatives that capitalize on USMCA benefits and mitigate trans-Pacific tariff risks.

Europe, Middle East & Africa (EMEA) features a regulatory environment accelerating the adoption of bio-based and non-toxic alternatives, with the European Green Deal catalyzing biorefinery investments and incentivizing low-carbon feedstock sourcing. Meanwhile, the Middle East invests oil revenues in oleochemical clusters, and Africa’s developing markets emphasize smallholder engagement for sustainable castor cultivation. Asia-Pacific continues to lead in feedstock availability, particularly palm and coconut oils, driving cost-competitive production for global export. Rapid industrialization in China and Southeast Asia fuels growth in lubricant and detergent sectors, while local regulations increasingly mirror global commitments to sustainable sourcing and manufacturing.

This comprehensive research report examines key regions that drive the evolution of the Fatty Acids market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Moves by Leading Companies Highlight Capacity Expansions, Innovation Investments, and Sustainable Initiatives Driving Growth in the Fatty Acid Industry

Cargill has embarked on a series of strategic capacity expansions to bolster its specialty fats portfolio. In Malaysia, the company initiated a multi-year investment to install dry palm fractionation capacity at Port Klang, enhancing its hydroxy stearic acid and tailored fat delivery capabilities while upgrading R&D infrastructure to support product innovation. Additionally, Cargill’s recent modernization of its Sidney, Ohio soybean processing plant nearly doubled crush capacity, improving feedstock throughput and reinforcing supply for food, feed, and bio-based fuel markets.

Oleon has intensified its global expansion through acquisitions and new facility launches. The acquisition of Brazil’s A.Azevedo Óleos strengthened its castor oil derivative portfolio in South America, while the grand opening of a Conroe, Texas blending facility marked its first North American production site, aligning local responsiveness with sustainable practice commitments. Emery Oleochemicals expanded its research footprint by establishing a laboratory unit in Rayong, Thailand, and forging a partnership with PTT Global Chemical to accelerate biocatalytic process development and innovation in oleochemical synthesis.

This comprehensive research report delivers an in-depth overview of the principal market players in the Fatty Acids market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Ashland Inc.

- Baerlocher GmbH by MRF Michael Rosenthal GmbH

- BASF SE

- Cailà & Parés, S.A.

- Cargill, Incorporated.

- Croda International PLC

- Daesang Corporation

- Dalian Daping Oil Chemicals Co., Ltd.

- Eastman Chemical Company

- Emery Oleochemicals LLC

- Godrej Industries Limited

- IOI Oleochemical

- KD Pharma Group SA

- KLK OLEO

- Kraton Corporation by DL Chemical Co., Ltd.

- LG Household & Health Care

- Merck KGaA

- Mitsubishi Chemical Corporation

- Musim Mas Group

- Oleon NV

- Pacific Oleochemicals Sdn Bhd

- Sichuan Tianyu Oleochemical Co., Ltd.

- Taiyo Kagaku Co., Ltd.

- Tallow Products Pty Ltd.

- The Seydel Companies Inc

- Thermo Fisher Scientific, Inc.

- Twin Rivers Technologies Inc. by FGV Holdings Berhad

- Wilmar International Limited

Actionable Recommendations for Industry Leaders to Accelerate Innovation, Enhance Resilience, and Capture Opportunity in a Rapidly Evolving Fatty Acid Ecosystem

Industry leaders must prioritize investment in green biocatalysis platforms, leveraging enzyme engineering and microbial synthesis to unlock high‐value derivatives while reducing environmental impact. By establishing partnerships between R&D centers, feedstock suppliers, and end‐user consortia, companies can accelerate time to market for novel functional fatty acids and share the burden of capital-intensive process development. Moreover, strategic collaborations with technology providers can facilitate digitalization of production processes, enabling real‐time optimization of reaction conditions and predictive maintenance to drive efficiency.

In parallel, organizations should diversify supply chains to hedge against trade policy volatility, cultivating supplier networks across multiple regions to secure essential feedstocks. Implementing risk management frameworks, including tariff exposure assessments and scenario planning, will support resilient procurement strategies. Finally, senior executives should engage proactively with regulatory bodies to shape favorable policies that support sustainable oleochemical production, ensuring that legislative frameworks incentivize low-carbon pathways and nurture domestic manufacturing capabilities.

Robust Research Methodology Combining Primary Interviews and Secondary Data Analysis to Ensure Insightful Coverage of the Fatty Acid Landscape

Our analysis integrates extensive secondary research, drawing from peer‐reviewed journals, industry association reports, and corporate disclosures to map current and emerging trends in fatty acid production and application. We conducted qualitative interviews with senior executives, R&D directors, and procurement specialists to gain firsthand perspectives on technological breakthroughs, regulatory developments, and supply chain challenges. This combination of desk research and expert consultation ensures a holistic view of market dynamics.

Data points were cross‐verified through triangulation, aligning publicly available import-export statistics, patent filings, and production capacity announcements to validate strategic shifts and competitive positioning. Additionally, case studies of biocatalytic implementations and tariff impact assessments were analyzed to quantify operational implications. By employing this mixed‐methods approach, our report delivers robust insights that inform strategic decision‐making across the fatty acid value chain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Fatty Acids market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Fatty Acids Market, by Type

- Fatty Acids Market, by Source

- Fatty Acids Market, by Form

- Fatty Acids Market, by Application

- Fatty Acids Market, by Region

- Fatty Acids Market, by Group

- Fatty Acids Market, by Country

- United States Fatty Acids Market

- China Fatty Acids Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

Synthesizing Key Insights and Strategic Imperatives to Navigate the Fatty Acid Market’s Dynamic Future and Drive Sustainable Growth

Synthesizing technological innovation, trade policy dynamics, and segmentation insights reveals a fatty acid landscape poised for continued transformation. Advances in biocatalysis and synthetic biology are expanding the realm of feasible derivatives, while evolving U.S. tariffs underscore the necessity for agile supply chain strategies. Regional demand patterns highlight diverse growth drivers, from regulatory pressures in EMEA to resource-driven expansion in Asia-Pacific and integrated capacities in the Americas. Leading companies have responded with targeted expansions and strategic alliances, underscoring the value of scale, local responsiveness, and sustainability commitments. As market participants seize these opportunities, a proactive stance on innovation, resilience, and collaboration will be paramount to capturing the next wave of growth in this dynamic sector.

Contact Ketan Rohom to Unlock Comprehensive Fatty Acid Market Insights and Secure Your Customized Research Report for Strategic Decision Making

I invite you to connect with Ketan Rohom, Associate Director of Sales & Marketing, to secure your tailored market research report. His expertise will guide you through detailed analysis, customized to your strategic priorities and growth objectives. Reach out today to unlock actionable insights that empower informed decision-making in fatty acid supply chains, product innovation, and competitive positioning. With this comprehensive resource at your disposal, you can confidently navigate emerging opportunities and challenges in the global marketplace

- How big is the Fatty Acids Market?

- What is the Fatty Acids Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?