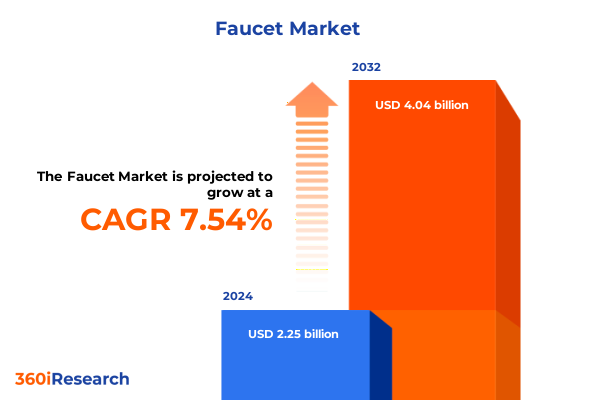

The Faucet Market size was estimated at USD 2.40 billion in 2025 and expected to reach USD 2.57 billion in 2026, at a CAGR of 7.67% to reach USD 4.04 billion by 2032.

Exploration of Emerging Innovations and Market Dynamics Shaping the Global Faucet Industry Landscape Informed by Sustainability Focus and Consumer Preferences

The global faucet industry is experiencing an unprecedented convergence of sustainability imperatives, consumer experience expectations, and rapid technological innovations. As water conservation remains a top priority for both residential and commercial end users, faucet manufacturers are challenged to develop designs that minimize consumption without compromising performance or style. Simultaneously, heightened consumer demand for sleek aesthetics and intuitive functionality has driven the proliferation of smart technologies, including voice control and cloud connectivity, into even the premium price ranges. These dynamics are further accelerated by regulatory and environmental frameworks that incentivize low-flow fixtures and sensor-activated controls, prompting a wave of product diversification across brass, stainless steel, and plastic materials.

Against this backdrop, the competitive landscape is more complex than ever. Traditional manufacturers are adapting to digital sales channels and forging new partnerships with online marketplaces and specialty retailers, while emerging players are leveraging direct-to-consumer models to capture value through enhanced margins and quicker product feedback loops. Together, these shifts set the stage for a transformative period in which companies that effectively integrate sustainability, smart technology, and omni-channel distribution will emerge as clear market leaders. This introduction lays the foundation for a deeper exploration of the key forces driving this evolution, from tariff impacts to granular segmentation insights.

Uncovering the Revolutionary Trends Reshaping the Faucet Market Through Digital Integration, Sustainability Adoption, and Supply Chain Resilience

The faucet market landscape is being reshaped by a trio of transformative trends that demand strategic adaptation. First, digital integration has moved from a differentiator to a requirement, with sensor-activated and voice-enabled faucets becoming table stakes in high-end residential and commercial projects. These advancements not only elevate user experience by enabling touchless operation and remote monitoring, but also offer valuable data analytics for facility managers seeking to optimize water usage patterns. At the same time, sustainability adoption remains a powerful force, with manufacturers integrating eco-friendly materials and low-flow designs to meet increasingly stringent regulations and consumer expectations for environmental stewardship.

In concert with technology and sustainability, supply chain resilience has emerged as a critical competitive lever. The pandemic underscored vulnerabilities in component sourcing and logistics, compelling companies to diversify supplier networks, invest in nearshoring, and employ digital tracking systems for real-time visibility. These measures have fortified operational agility, enabling manufacturers to respond more swiftly to demand fluctuations and geopolitical disruptions. Looking ahead, those who balance innovation with robust supply chain strategies will be best positioned to capitalize on emerging opportunities and maintain market leadership.

Analyzing the Far Reaching Cumulative Effects of Newly Implemented United States Tariffs on Faucet Imports and Domestic Production in 2025

In early 2025, the United States implemented a unified 15% tariff on imported faucet components and finished fixtures as part of broader trade measures aimed at reducing reliance on foreign manufacturing. This policy shift has had cascading effects on both import-dependent suppliers and domestic producers. On the import side, increased duties have driven cost inflation for centerset, widespread, and wall-mounted faucet categories, compelling resellers to adjust pricing or absorb margin erosion. Conversely, domestic manufacturers have seen a short-term uplift in demand as buyers seek to circumvent tariff costs, leading to capacity expansions and strategic inventory build-up.

However, the cumulative impact extends beyond pricing. Retailers operating through direct-to-consumer and marketplace channels have grappled with stock shortages and extended lead times, while wholesale distributors have scrambled to renegotiate terms with domestic partners and update their logistics frameworks. At the same time, downstream customers have explored alternative materials-such as plastic and stainless steel-that are less affected by existing tariff classifications. As the market continues to adjust, companies that proactively manage tariff pass-through, diversify their material mix, and strengthen local supply agreements will secure a distinct competitive edge.

Deriving Segmentation Insights to Highlight Market Opportunities Across End Use, Product Types, Distribution Channels, Materials, Technology, and Price Ranges

A nuanced understanding of market segmentation reveals critical pathways for growth across varied customer needs. In the end-use segment, the commercial sector’s emphasis on durability and water-usage analytics aligns with a preference for sensor-activated solutions, while residential consumers increasingly prioritize aesthetic customization and user-friendly installation, driving single-hole and centerset configurations. Diverging product preferences are further evident when examining distribution channels: DIY stores continue to attract budget-conscious buyers seeking economy-priced faucets, whereas online retail platforms-both direct-to-consumer websites and third-party marketplaces-cater to tech-savvy customers looking for mid-range to premium sensor and smart fixtures.

Material choices play a pivotal role in product strategy, with brass remaining the standard for high-end segments due to its longevity and premium feel, while stainless steel and plastic variants offer cost-effective alternatives in mid-range and economy tiers. Within the technology landscape, manual faucets retain a strong foothold in basic installations, but capacitive and infrared sensors are driving growth in commercial retrofits, and cloud-connected, voice-enabled products are redefining luxury benchmarks. Finally, price range segmentation highlights clear value strata: economy models appeal to volume-focused projects, mid-range offerings blend features and affordability, and premium faucets encompass cutting-edge materials, advanced technology, and bespoke finishes, unveiling targeted opportunities for differentiated positioning.

This comprehensive research report categorizes the Faucet market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Handle Type

- Technology Level

- Material Composition

- Distribution Channel

- End Use Sector

- Application Area

Highlighting Key Regional Dynamics and Growth Drivers Shaping Faucet Market Evolution Across Americas, Europe Middle East & Africa, and Asia Pacific Regions

Regional dynamics underscore a varied pace of adoption and growth drivers across global markets. In the Americas, robust infrastructure investment and sustainability mandates are accelerating the uptake of low-flow and sensor-activated faucets in commercial real estate and public facilities. Meanwhile, established distribution networks through wholesale and specialty stores continue to support mid-range and economy segments, even as online retail gains traction in urban centers.

The Europe, Middle East & Africa region presents a mosaic of regulatory environments that favor water-efficient solutions, particularly in northern and western Europe, where environmental policies incentivize smart metering integration. In emerging markets across the Middle East and Africa, rapid urbanization and hospitality sector growth spur demand for premium stainless steel fixtures, although supply chain complexities and tariff sensitivities remain significant considerations.

In the Asia-Pacific region, the intersection of advanced technology adoption and a thriving residential construction market drives demand for cloud-connected and voice-enabled faucets, especially in East Asia. Southeast Asian markets are increasingly driven by mid-range offerings as disposable incomes rise, while cost-effective plastic and economy brass fittings dominate price-sensitive segments in South Asia. These regional contrasts highlight the importance of localized strategies that align product portfolios, pricing structures, and distribution partnerships with distinctive market characteristics.

This comprehensive research report examines key regions that drive the evolution of the Faucet market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Strategic Positioning and Competitive Strengths of Leading Faucet Manufacturers and Influential Industry Stakeholders Driving Market Progression

Leading manufacturers have adopted differentiated strategies to secure market share and reinforce brand equity. Established global players are investing heavily in smart technology collaborations, integrating voice assistants and cloud-based analytics into their most advanced product lines. These alliances not only foster product innovation but also reinforce ecosystem lock-in, as customers gravitate toward unified home automation platforms. At the same time, mid-tier companies are leveraging cost-optimized manufacturing processes and strategic partnerships with specialty stores to deliver feature-rich sensor-activated faucets at accessible price points, appealing to both commercial and residential buyers.

Smaller disruptors are capitalizing on direct-to-consumer models, offering highly customizable finishes and rapid product iteration cycles in response to consumer feedback. Their agility enables them to experiment with sustainable materials in pilot markets, generating insights that inform broader rollouts. Moreover, alliances between regional distributors and global suppliers are emerging as pivotal channels for navigating tariff complexities, aligning local expertise with global product portfolios. Collectively, these varied approaches underscore the importance of strategic alignment between technology adoption, distribution reach, and brand positioning for sustainable competitive advantage.

This comprehensive research report delivers an in-depth overview of the principal market players in the Faucet market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ALTON Bath Decor Private Limited

- American Standard Brands, LLC

- CERA Sanitaryware Limited

- Dornbracht GmbH & Co. KG

- Duravit AG

- Eczacıbaşı Holding A.Ş.

- Fortune Brands Innovations, Inc.

- Franke Holding AG

- Geberit AG

- Globe Union Industrial Corp.

- Hansgrohe SE

- Hindware Home Innovation Limited

- Jaquar & Company Limited

- Kingston Brass, Inc.

- Kohler Co.

- Kraus USA Plumbing LLC

- LIXIL Group Corporation

- Masco Corporation

- Oras Ltd

- Paini S.p.A. Rubinetterie

- Roca Sanitario S.A.

- Sloan Valve Company

- TOTO Ltd.

- Vigo Industries, LLC

- Villeroy & Boch AG

- Zurn Elkay Water Solutions Corporation

Outlining Actionable Strategies for Industry Leaders to Capitalize on Emerging Opportunities, Mitigate Risks, and Foster Sustainable Growth in the Faucet Sector

To thrive in this dynamic environment, industry leaders must adopt a multifaceted strategy that balances innovation, operational resilience, and customer engagement. First, prioritizing strategic investments in smart technology partnerships will enable the development of integrated faucet ecosystems that enhance user experience and foster recurring service revenue through analytics and predictive maintenance. Concurrently, forging closer ties with local suppliers and distributors can mitigate tariff exposure and logistics risks, ensuring continuity of supply and stable margin performance.

Next, a targeted approach to segmentation will unlock new growth pathways: commercial customers will respond positively to data-driven water management solutions, while residential buyers will gravitate toward customizable smart and sensor-activated offerings in the premium segment. Bolstering digital sales channels-particularly direct-to-consumer platforms-will enhance visibility into end-user preferences and accelerate product iteration cycles. Finally, embedding sustainability across the value chain, from material sourcing to product end-of-life recycling programs, will resonate with environmentally minded stakeholders and reinforce brand credibility in increasingly eco-conscious markets.

Detailing Research Methodology Incorporating Primary Interviews, Secondary Data Analysis, and Rigorous Validation Procedures Ensuring Analytical Integrity

This analysis is grounded in a rigorous methodology combining primary interviews with key executives across manufacturing, distribution, and end-user segments, supplemented by field surveys of procurement managers in commercial and residential projects. Secondary data sources include industry white papers, regulatory filings, and trade association publications that contextualize tariff developments and technology adoption curves. Data validation was achieved through triangulation, ensuring consistency between reported shipment volumes, trade statistics, and company-level financial disclosures.

The research process also incorporated scenario planning exercises to evaluate the impact of varying tariff rates, supply chain disruptions, and regulatory shifts on product portfolios. Quality control measures, including peer review by subject-matter experts, were applied throughout to guarantee analytical integrity and minimize bias. Together, these methodological components provide a comprehensive, reliable foundation for the insights and recommendations presented.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Faucet market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Faucet Market, by Product Type

- Faucet Market, by Handle Type

- Faucet Market, by Technology Level

- Faucet Market, by Material Composition

- Faucet Market, by Distribution Channel

- Faucet Market, by End Use Sector

- Faucet Market, by Application Area

- Faucet Market, by Region

- Faucet Market, by Group

- Faucet Market, by Country

- United States Faucet Market

- China Faucet Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 3975 ]

Concluding Insights Synthesizing Key Findings to Illuminate Strategic Imperatives and Future Outlook for Stakeholders in the Global Faucet Market

This executive summary synthesizes critical findings that illuminate strategic imperatives for stakeholders across the faucet industry. Rapid technological integration, evolving sustainability mandates, and shifting tariff landscapes have collectively redefined competitive benchmarks. Companies that align their product innovation with robust supply chain strategies and localized market insights will outpace slower-moving competitors. Moreover, targeted segmentation and regional customization will be essential to capture diverse end-user needs and navigate complex distribution networks. Looking ahead, the ability to harness actionable data from smart fixtures and optimize operational resilience in the face of trade policy shifts will determine long-term market leadership. This research underscores the urgency for proactive, integrated strategies that leverage both digital capabilities and environmental stewardship to unlock growth in the global faucet market.

Engage with Associate Director Ketan Rohom to Secure Comprehensive Faucet Market Research Report Unlocking Actionable Intelligence and Competitive Advantage

Unlock unparalleled market foresight by engaging directly with Associate Director Ketan Rohom to access a comprehensive faucet market research report tailored to your strategic needs. This exclusive resource delivers actionable insights into dynamic tariff landscapes, evolving consumer preferences, and advanced technological innovations shaping the industry. With Ketan’s guidance, you can customize report deliverables to address specific end-use segments, regional dynamics, and competitive benchmarks that matter most to your business objectives. Reach out now to learn how this detailed analysis can empower your decision-making process, drive revenue growth, and secure a sustainable competitive advantage in the rapidly shifting global faucet market

- How big is the Faucet Market?

- What is the Faucet Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?