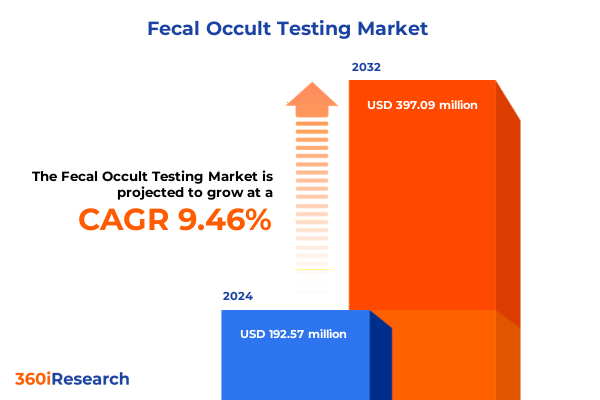

The Fecal Occult Testing Market size was estimated at USD 208.36 million in 2025 and expected to reach USD 230.05 million in 2026, at a CAGR of 9.65% to reach USD 397.08 million by 2032.

Exploring the foundational importance and evolving clinical significance of fecal occult testing as a pivotal tool in disease prevention and healthcare diagnostics

Fecal occult testing serves as a cornerstone in preventive healthcare, offering a noninvasive means to detect hidden blood in stool that may indicate colorectal cancer or other gastrointestinal conditions. Over the years, it has proven its value in both routine screenings and diagnostic follow-ups, enabling clinicians to identify potential issues at an early, more treatable stage. As healthcare systems worldwide emphasize preventative strategies over reactive treatment, the role of fecal occult testing has become increasingly vital to reduce disease burden and enhance patient outcomes.

Advancements in assay chemistry, instrumentation, and clinical protocols have bolstered the reliability and acceptance of fecal occult tests. Initially dominated by guaiac-based methods, the market has progressively shifted toward immunochemical approaches that enhance specificity and sensitivity. Concurrently, methodological refinements have streamlined workflows, reduced preanalytical variables, and facilitated integration with laboratory information systems, promoting broader adoption across diverse clinical settings.

This executive summary synthesizes key developments and actionable insights affecting the fecal occult testing landscape. It highlights transformative technological shifts, examines the implications of new U.S. tariffs, delineates segmentation and regional nuances, profiles leading industry players, and offers strategic recommendations. The sections that follow equip stakeholders with a clear understanding of the current environment and a roadmap for navigating future opportunities and challenges.

Highlighting the groundbreaking technological advancements and procedural transformations reshaping the fecal occult testing landscape for enhanced diagnostic precision

The fecal occult testing landscape has undergone profound transformation through the integration of cutting-edge methodologies and digital innovations that have redefined diagnostic accuracy. Automated platforms now employ advanced image analysis and machine learning algorithms to interpret assay results, substantially reducing manual error and turnaround time. Furthermore, the shift from qualitative to quantitative readouts allows for precise measurement of hemoglobin concentration, unlocking potential for risk stratification and personalized screening intervals.

Simultaneously, molecular diagnostics have emerged as complementary tools, with DNA methylation and mutation detection assays enhancing the sensitivity of traditional immunochemical tests. This convergence of technologies fosters a more comprehensive diagnostic paradigm that not only identifies occult blood but also screens for genetic markers associated with early-stage colorectal malignancies. Moreover, the advent of user-centric collection devices and mobile-enabled reporting systems has improved patient compliance and engagement, thereby expanding the reach of screening programs.

Consequently, these technological and procedural advancements have reshaped both laboratory workflows and clinical decision-making. Laboratories are now equipped to handle higher throughput with minimal hands-on time, while clinicians can leverage richer data to personalize follow-up schedules. By embracing these transformative shifts, the fecal occult testing market is poised to deliver enhanced diagnostic precision and broaden its impact on public health initiatives.

Evaluating the multifaceted impact of United States 2025 tariff implementations on supply chains regulatory compliance and cost structures in fecal occult testing

In January 2025, the United States implemented revised tariff structures that impose increased duties on imported medical reagents, collection devices, and diagnostic equipment used in fecal occult testing. These measures have introduced tangible cost pressures across the supply chain, from reagent manufacturers to diagnostic laboratories. Consequently, providers face higher procurement expenses, which may be partially absorbed through pricing adjustments or operational efficiencies to maintain margin integrity.

The cumulative effect of these tariffs extends beyond direct input costs. Many manufacturers have reevaluated sourcing strategies and accelerated diversification of raw material suppliers to mitigate exposure to tariff-related risks. Some have expanded domestic production capabilities or pursued nearshoring agreements to stabilize supply lines. Simultaneously, regulatory compliance remains a priority as altered trade conditions necessitate updated customs documentation and quality verifications under U.S. Food and Drug Administration guidelines.

Laboratories and healthcare institutions are responding by optimizing inventory management and renegotiating contracts with vendors. These adaptations help preserve service continuity and protect patient access to critical diagnostic services. In parallel, strategic collaborations between diagnostic providers and domestic component manufacturers are emerging as a pathway to reduce import reliance. As these cumulative shifts take hold, stakeholders must continuously assess cost implications and align procurement strategies with evolving trade policies.

Dissecting the market through multiple segmentation lenses to uncover nuanced insights across technology methods end users and diagnostic applications

A nuanced understanding of fecal occult testing requires analysis across multiple segmentation dimensions. Based on technology, the market is studied through the lens of guaiac assays that detect peroxidase activity and immunochemical tests that employ specific antibodies to target human hemoglobin. This technological distinction influences both clinical sensitivity and practitioner preference, as immunochemical methods generally offer superior specificity and reduced dietary interference.

Turning to test method, qualitative approaches provide simple positive or negative results and play a foundational role in broad screening initiatives, whereas quantitative techniques measure hemoglobin levels to inform risk stratification and longitudinal patient monitoring. The choice between these methods shapes laboratory workflows and reporting protocols, as quantitative data demands integrated information systems capable of longitudinal analysis.

Considering end users, the market encompasses community clinics where primary care physicians initiate screening, diagnostic centers specializing in gastrointestinal evaluation, and hospitals that range from large academic health centers to small and medium facilities. Each provider type navigates distinct operational requirements, reimbursement frameworks, and patient populations, driving differential adoption rates and service models.

Finally, application-based segmentation distinguishes between diagnostic and screening contexts. Within diagnostics, routine diagnosis follows established guidelines for patients at moderate risk, whereas symptom-based diagnosis targets individuals presenting with clinical indicators. Screening applications further divide into mass screening organized by public health entities and opportunistic screening conducted during individual healthcare encounters. This layered segmentation approach delivers clarity on market dynamics and informs tailored strategies for product development and clinical integration.

This comprehensive research report categorizes the Fecal Occult Testing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Test Method

- End User

- Application

Assessing key regional performance and opportunities in the Americas Europe Middle East Africa and Asia Pacific to guide strategic market positioning

Regional dynamics in the fecal occult testing market reveal pronounced variations shaped by healthcare infrastructure, regulatory environments, and population health priorities. In the Americas, public and private initiatives have expanded colorectal cancer screening programs, with an emphasis on immunochemical testing due to its ease of use and higher patient compliance. Enhanced reimbursement policies in the United States and Canada have accelerated adoption among primary care networks and integrated health systems, while Latin American markets show growing demand driven by rising awareness and government-led screening campaigns.

Within Europe, the Middle East, and Africa, established cancer control strategies in Western Europe underpin widespread implementation of immunochemical assays, bolstered by harmonized regulatory frameworks. Meanwhile, Middle Eastern and North African countries are investing in screening infrastructure to address increasing colorectal cancer incidence, often collaborating with international partners to import technology and best practices. Sub-Saharan Africa, despite resource constraints, is witnessing pilot programs aimed at integrating low-cost guaiac tests into primary care settings to strengthen early detection efforts.

Across the Asia-Pacific region, a heterogeneous landscape emerges. Developed markets such as Japan and Australia have sophisticated screening protocols that combine fecal immunochemical tests with colonoscopy pathways, prioritizing early intervention. Rapidly developing economies in Southeast Asia and India are at an earlier adoption stage, yet they demonstrate robust growth potential as government health initiatives and private sector investment drive infrastructure expansion. These regional insights guide stakeholders in customizing their market entry and expansion strategies to resonate with localized healthcare imperatives.

This comprehensive research report examines key regions that drive the evolution of the Fecal Occult Testing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing leading industry players strategic initiatives and competitive positioning driving innovation and growth within the fecal occult testing market

Several leading players have strategically positioned themselves to shape the future of fecal occult testing through innovation, partnerships, and targeted product portfolios. One notable company enhanced its automated immunoassay platform by integrating real-time data analytics, thus reducing manual intervention and supporting high-throughput laboratory operations. This initiative underscores the value of digital convergence in improving diagnostic workflows.

Another prominent manufacturer expanded its global footprint by forging distribution agreements in emerging markets, enabling wider access to both guaiac and immunochemical tests. By aligning its sales network with regional healthcare providers, the company capitalized on growing screening demand in Latin America and Asia-Pacific, demonstrating the importance of localized market strategies.

Collaborative ventures have also gained traction, exemplified by a partnership between a reagent supplier and a medical device innovator to co-develop enhanced collection kits that streamline sample stability and transportation. Such alliances reflect the industry’s movement toward end-to-end solutions that address both analytical performance and logistical challenges.

Smaller niche players are making their mark through R&D investments in next-generation molecular assays that detect multiple biomarkers concurrently, aiming to complement traditional occult blood detection. These efforts highlight the competitive imperative to differentiate through specialty offerings. Collectively, the strategic initiatives of these companies offer a roadmap for competitive positioning and future growth trajectories within the fecal occult testing domain.

This comprehensive research report delivers an in-depth overview of the principal market players in the Fecal Occult Testing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- Becton, Dickinson and Company

- BioMérieux SA

- Danaher Corporation

- F. Hoffmann-La Roche AG

- Hologic, Inc.

- Meridian Bioscience, Inc.

- QIAGEN N.V.

- Sysmex Corporation

- Thermo Fisher Scientific Inc.

Presenting actionable strategic recommendations for industry stakeholders to leverage emerging trends optimize operations and strengthen market competitiveness

Industry leaders can harness several strategic imperatives to strengthen their market standing and drive sustainable growth. First, investing in advanced immunochemical technologies and integrating quantitative analytics into assay platforms will meet rising demand for precision diagnostics and personalized screening protocols. Such technological enhancements not only improve clinical outcomes but also foster differentiation amid intensifying competition.

Furthermore, forging strategic partnerships with reagent suppliers and device manufacturers can facilitate the development of comprehensive solutions that address both analytical accuracy and logistical reliability. These collaborations enable providers to offer turnkey packages that simplify sample collection, processing, and reporting, thereby enhancing customer value and operational efficiency.

To mitigate supply chain vulnerabilities in light of recent tariff implementations, organizations should explore nearshoring raw material production and diversifying supplier networks. This approach reduces exposure to trade policy disruptions and secures continuity of critical reagent and consumable supplies.

Lastly, expanding market reach through targeted regional initiatives that align with local healthcare policies and reimbursement frameworks will unlock new growth opportunities. Tailoring product offerings and engagement models to the specific needs of clinics, diagnostic centers, and hospitals ensures resonance with end-user priorities and accelerates adoption. By pursuing these actionable recommendations, industry stakeholders can capitalize on emerging trends and fortify their competitive advantage.

Outlining the rigorous research methodology data collection and analysis framework employed to ensure validity reliability and actionable market insights

The research methodology underpinning this analysis combines rigorous primary and secondary research to ensure robustness and validity. Primary data were collected through structured interviews with key opinion leaders, including gastroenterologists, laboratory directors, and healthcare administrators, providing firsthand perspectives on clinical needs, operational challenges, and technology preferences.

Secondary research involved a comprehensive review of peer-reviewed journals, regulatory publications, and industry analyses to contextualize technological developments and tariff policy impacts. Trade association reports and national screening guidelines informed the regional assessment, while company press releases and patent filings offered insights into competitive strategies and product pipelines.

Data triangulation was achieved by cross-verifying insights from distinct sources, thereby reducing bias and enhancing reliability. The sample selection for primary interviews was purposive, focusing on professionals with direct involvement in fecal occult testing workflows. Quantitative data from laboratory information systems and public health registries supplemented qualitative findings to enrich the segmentation and regional analyses.

Quality control processes, including peer review of draft findings and validation checks against third-party databases, ensured the integrity of conclusions. This multi-faceted methodology delivers a comprehensive understanding of the fecal occult testing market, grounded in empirical evidence and expert judgment.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Fecal Occult Testing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Fecal Occult Testing Market, by Technology

- Fecal Occult Testing Market, by Test Method

- Fecal Occult Testing Market, by End User

- Fecal Occult Testing Market, by Application

- Fecal Occult Testing Market, by Region

- Fecal Occult Testing Market, by Group

- Fecal Occult Testing Market, by Country

- United States Fecal Occult Testing Market

- China Fecal Occult Testing Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

Summarizing the critical takeaways key implications and strategic considerations derived from comprehensive analysis of fecal occult testing dynamics

This comprehensive examination of the fecal occult testing market highlights critical advancements in technology, the profound effects of U.S. tariff policies, and the nuanced dimensions of segmentation and regional dynamics. By synthesizing these elements, the analysis illuminates the pathways through which diagnostic accuracy can be enhanced and patient outcomes improved.

Key takeaways underscore the pivotal role of immunochemical assays and quantitative methods in elevating clinical precision, the necessity of supply chain resilience in response to trade policy shifts, and the strategic importance of tailoring offerings to diverse end-user and regional requirements. Moreover, the review of industry leaders’ initiatives demonstrates that innovation thrives at the intersection of digital integration, collaborative partnerships, and niche molecular developments.

As the market continues to evolve, stakeholders who adopt the outlined strategic recommendations-focusing on technological differentiation, collaborative solution development, supply chain diversification, and regional customization-will be best positioned to navigate emerging opportunities and challenges. This analysis thus provides a foundation for informed decision-making, enabling organizations to optimize their strategies and deliver superior value in the dynamically shifting landscape of fecal occult testing.

Engaging industry leaders with an invitation to connect with Associate Director Sales Marketing Ketan Rohom to acquire detailed market intelligence insights report

To explore deeper insights and secure comprehensive market intelligence on fecal occult testing, reach out to Ketan Rohom, Associate Director of Sales & Marketing, to obtain a tailored copy of the detailed report that empowers your strategic decision-making and accelerates growth initiatives

- How big is the Fecal Occult Testing Market?

- What is the Fecal Occult Testing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?