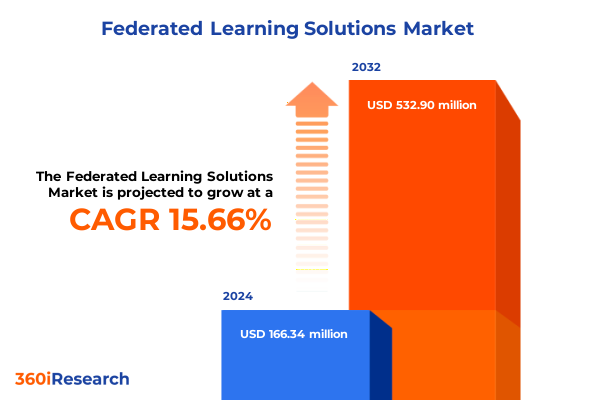

The Federated Learning Solutions Market size was estimated at USD 150.41 million in 2025 and expected to reach USD 163.25 million in 2026, at a CAGR of 8.81% to reach USD 271.70 million by 2032.

Discover how federated learning solutions are redefining data privacy and collaborative intelligence to empower secure, decentralized machine learning applications at scale

The emergence of federated learning marks a new chapter in the quest to leverage distributed data for advanced analytics without compromising privacy or security. By enabling collaborative model training across decentralized nodes, this paradigm transcends traditional centralized approaches and addresses critical concerns around data sovereignty, compliance and confidentiality. In an environment where regulatory frameworks continually evolve and consumer expectations around data protection intensify, federated learning provides a robust foundation to align machine learning initiatives with stringent privacy requirements while preserving analytical performance.

As organizations navigate increasingly complex data landscapes, federated learning has evolved from an experimental concept to a production-grade solution powering cross-silo collaboration in industries such as finance, healthcare and telecommunications. The integration of advanced encryption methods, secure aggregation protocols and hardware-based trusted execution environments underscores the growing maturity of federated architectures. In this dynamic context, industry leaders are seeking deeper insights into technological enablers, strategic trade-offs and competitive differentiators to maximize the value of their AI investments and differentiate themselves in a crowded marketplace.

Exploring the pivotal technological innovations and strategic realignments reshaping the federated learning ecosystem and driving next-generation AI adoption across industries

Recent years have witnessed seismic shifts in both technology infrastructure and organizational mindsets that are reshaping the federated learning landscape. Accelerated by advances in edge computing capabilities and AI-focused hardware accelerators, enterprises are now able to orchestrate complex model training workflows across geographically dispersed devices and data repositories. This transformation not only minimizes latency and bandwidth constraints but also unlocks new use cases in domains that demand real-time insights at the network periphery, such as autonomous systems and smart manufacturing.

Simultaneously, strategic alliances between chipset manufacturers, cloud service providers and software framework vendors are driving a convergence of standards and interoperability, making federated learning more accessible and scalable. Open-source initiatives are fostering a vibrant ecosystem that encourages experimentation and rapid iteration, while commercial platforms emphasize enterprise-grade features like governance controls, policy enforcement and audit trails. The synergy between hardware optimizations, software innovations and collaborative partnerships is catalyzing an era where federated learning becomes an integral component of modern AI strategies, rather than a peripheral experiment.

Assessing the broader economic and technological repercussions of United States tariffs in 2025 on federated learning supply chains and innovation cycles in North America

In 2025, the imposition of new tariffs by the United States on key semiconductor imports and AI-enabled hardware has introduced a layer of complexity for federated learning deployments. With crucial components such as GPU servers, AI accelerators and edge devices subject to increased duties, organizations are encountering higher capital expenditure and longer procurement lead times. These tariff-induced cost pressures are prompting some enterprises to reassess sourcing strategies, shifting toward domestic manufacturing partners or exploring alternative hardware architectures to mitigate financial impact.

Beyond direct hardware costs, the broader supply chain disruptions have influenced the pace of innovation in federated systems. Manufacturers and integrators are responding with dual strategies: diversifying supplier networks to reduce geopolitical exposure, and accelerating research into optimized software frameworks that can deliver comparable performance on lower-cost, locally sourced devices. Although the tariff landscape introduces short-term headwinds, it is also fostering resilience and supply chain agility. Stakeholders who proactively adapt will be well-positioned to capitalize on a more distributed, cost-effective federated learning infrastructure in the post-tariff environment.

Analyzing critical market segments across components, deployment modes, industry verticals and applications to illuminate strategic opportunities in federated learning adoption

An in-depth examination of the federated learning market reveals diverse segments that each present unique strategic considerations for stakeholders. From a component perspective, hardware investments in AI accelerators, edge devices and GPU servers signal the foundational elements required to support distributed training workloads, whereas services such as consulting, integration and ongoing support enable organizations to bridge technical gaps and ensure operational continuity. Software frameworks, platforms and tools provide the essential building blocks for secure aggregation, model orchestration and performance optimization.

Alternative segmentation models further distill this complexity into services and solutions, where consulting, implementation and support functions align to deliver end-to-end federated learning capabilities. Deployment modes, whether cloud-based or on-premises, influence factors such as data residency, scalability and cost structures. Across industry verticals ranging from automotive and manufacturing to healthcare, financial services and retail, federated learning unlocks applications like autonomous vehicle coordination, predictive maintenance, fraud detection and medical imaging analysis. By understanding each segment’s distinct value propositions and adoption barriers, decision makers can tailor their strategies to address specific use cases and maximize return on investment.

This comprehensive research report categorizes the Federated Learning Solutions market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Data Modality

- Deployment Mode

- Organization Size

- Industry Vertical

Evaluating distinct regional dynamics across the Americas, Europe Middle East & Africa and Asia Pacific to uncover growth drivers and challenges in federated learning markets

Regional dynamics play a pivotal role in shaping federated learning adoption, with each geography exhibiting distinct regulatory, technological and commercial contours. In the Americas, data privacy regulations and a strong focus on innovation have catalyzed early deployments in sectors such as healthcare imaging and financial fraud detection. Meanwhile, service providers are leveraging mature cloud infrastructure to offer managed federated learning platforms that seamlessly integrate with existing enterprise ecosystems.

Over in Europe, the Middle East and Africa, stringent data protection frameworks have heightened interest in on-premises federated solutions that guarantee compliance with cross-border data transfer restrictions. Strategic partnerships between local system integrators and global technology vendors are enhancing the availability of specialized consulting and integration services tailored to regional requirements. In the Asia-Pacific region, rapid digital transformation initiatives and burgeoning IoT ecosystems are driving extensive pilot projects in smart manufacturing and telecommunications. Governments across key APAC markets are also investing in AI research programs that prioritize privacy-preserving techniques, creating a supportive policy environment for federated learning proliferation.

This comprehensive research report examines key regions that drive the evolution of the Federated Learning Solutions market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling leading and emerging organizations shaping the federated learning landscape with innovative solutions, strategic partnerships and competitive differentiation

Leading technology companies are at the forefront of federated learning innovation, each bringing unique strengths and strategic focus areas. Semiconductor giants and cloud providers continue to integrate federated capabilities into their hardware and platform portfolios, enabling seamless orchestration of distributed training tasks with enterprise security controls. Specialized software vendors differentiate through advanced encryption schemes, federated optimization algorithms and user-friendly interfaces aimed at broadening accessibility.

Meanwhile, innovative startups and research collaborations are pushing the boundaries of what’s possible in high-privacy AI. These agile players often partner with academic institutions and open-source communities to accelerate the development of novel protocols and performance benchmarks. Additionally, system integrators and managed service providers are scaling their offerings to support large-scale implementations, delivering turnkey solutions that combine professional services with ongoing operational support.

This comprehensive research report delivers an in-depth overview of the principal market players in the Federated Learning Solutions market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Microsoft Corporation

- Google LLC

- NVIDIA Corporation

- International Business Machines Corporation

- Amazon Web Services, Inc.

- Huawei Technologies Co., Ltd.

- Tencent Holdings Limited

- SAP SE

- Qualcomm Technologies, Inc.

- Sony Group Corporation

- Intel Corporation

- Hewlett Packard Enterprise Company

- Alibaba Cloud Computing Co., Ltd.

- Fujitsu Limited

- Snowflake Inc.

- LiveRamp Holdings, Inc.

- SymphonyAI LLC

- Owkin, Inc.

- apheris AI GmbH

- Arcium Verein

- Array Insights, Inc.

- Baidu, Inc.

- Bitfount Ltd.

- Cloudera, Inc.

- Consilient, Inc.

- DataFleets, Ltd.

- Duality Technologies Inc.

- Edge Delta, Inc.

- Enveil, Inc.

- FedML, Inc.

- FLOCK.IO LTD

- Flower Labs GmbH

- Lifebit Biotech Limited

- Samsung SDS Co., Ltd.

- Sherpa Europe S.L.

Outlining strategic imperatives and best practices for industry leaders to capitalize on federated learning trends, optimize investments and future-proof their AI initiatives

To navigate the rapidly evolving federated learning domain, industry leaders should prioritize a strategic roadmap that balances technological innovation with operational resilience. First, investing in proof-of-concept pilots across diverse use cases will help validate performance criteria and cost structures before scaling deployments. Aligning these pilots with specific business objectives, such as reducing inference latency or enhancing data privacy compliance, will ensure clear metrics for success. Second, cultivating partnerships with hardware vendors, cloud providers and cybersecurity specialists can accelerate time-to-value by leveraging established ecosystems and best-practice frameworks.

Furthermore, organizations should adopt a modular architecture that decouples core model development from deployment environments. This approach promotes flexibility to switch between on-premises and cloud modes based on evolving regulatory or budgetary requirements. Continuous monitoring and governance mechanisms must also be embedded to track model drift, ensure policy adherence and safeguard against adversarial threats. Finally, upskilling data science and IT teams through targeted training in federated protocols and privacy-preserving technologies will build internal expertise and sustain long-term innovation.

Detailing the rigorous research framework, data collection processes and analytical methods underpinning the federated learning market study for robust, unbiased insights

The insights presented in this report are grounded in a rigorous research framework designed to deliver robust, unbiased findings. Primary research was conducted through in-depth interviews with C-level executives, data scientists and technology architects from leading enterprises, fostering a nuanced understanding of adoption drivers, technical challenges and procurement processes. Secondary research involved a comprehensive analysis of white papers, academic publications, industry journals and public disclosures to corroborate emerging trends and validate proprietary data points.

Quantitative data was synthesized using advanced analytics techniques, triangulating multiple sources to ensure consistency and reliability. A structured scoring model was applied to evaluate vendor capabilities across dimensions such as feature completeness, security provisions, integration support and total cost of ownership. Regional and segment-specific assessments were informed by geopolitical considerations, regulatory environments and infrastructure maturity estimates. This systematic methodology underpins the actionable insights and strategic recommendations that form the backbone of this executive summary.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Federated Learning Solutions market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Federated Learning Solutions Market, by Component

- Federated Learning Solutions Market, by Data Modality

- Federated Learning Solutions Market, by Deployment Mode

- Federated Learning Solutions Market, by Organization Size

- Federated Learning Solutions Market, by Industry Vertical

- Federated Learning Solutions Market, by Region

- Federated Learning Solutions Market, by Group

- Federated Learning Solutions Market, by Country

- United States Federated Learning Solutions Market

- China Federated Learning Solutions Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 3021 ]

Synthesizing key takeaways from federated learning market insights to reinforce strategic foresight and drive informed decision making for enterprise AI adoption

Federated learning represents a transformative shift in how organizations harness distributed data to drive AI-driven decision making while preserving the highest standards of privacy and security. The convergence of hardware accelerations, software innovations and strategic partnerships has created a fertile environment for scalable, interoperable solutions that address real-world challenges across industries and regions. By understanding segmentation nuances, tariff-related contingencies and diverse regional dynamics, decision makers can craft targeted strategies that maximize the impact of their federated initiatives.

As enterprises continue to navigate regulatory complexities and competitive pressures, the strategic implementation of federated learning will be a key differentiator. Those who adopt a holistic approach-encompassing pilot validation, architectural flexibility, robust governance and cross-functional expertise-will unlock new avenues for innovation, resilience and sustainable growth in the digital economy.

Engage with Ketan Rohom to unlock comprehensive federated learning insights and secure your tailored market research report for strategic advantage

To secure your leadership in the rapidly evolving world of data-driven intelligence, connect with Ketan Rohom, Associate Director, Sales & Marketing, today. Engage in a personalized briefing that unveils deeper insights into federated learning trends, competitive landscapes and regional growth drivers. By partnering with an experienced sales and marketing strategist, you will gain actionable recommendations tailored to your organization’s priorities, ensuring you can harness the full potential of decentralized AI architectures.

Take the next step toward an innovation edge by requesting the complete market research report now. With Ketan’s expert guidance, you will navigate complexities around tariff impacts, segmentation strategies and deployment considerations, achieving a competitive advantage and optimized return on investment. Don’t miss this opportunity to empower your AI initiatives with robust, data-driven intelligence-reach out to Ketan Rohom and transform your strategic vision into tangible outcomes.

- How big is the Federated Learning Solutions Market?

- What is the Federated Learning Solutions Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?