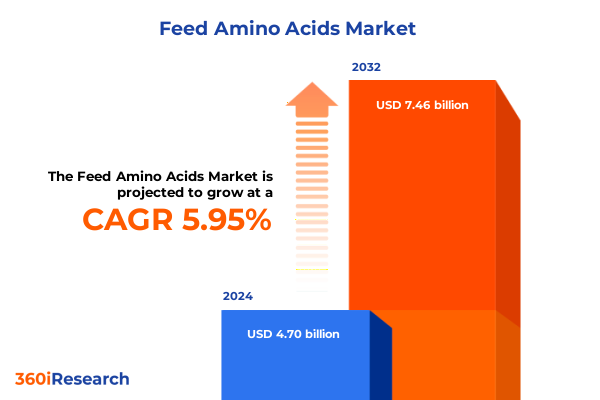

The Feed Amino Acids Market size was estimated at USD 4.98 billion in 2025 and expected to reach USD 5.25 billion in 2026, at a CAGR of 5.94% to reach USD 7.46 billion by 2032.

Unveiling the pivotal function of feed amino acids in revolutionizing animal nutrition and driving superior growth across livestock sectors

The global feed amino acid sector serves as a pivotal cornerstone in modern animal nutrition, underpinning the health and productivity of livestock across the food chain. As supply chains grow increasingly complex and nutritional standards become more stringent, the role of amino acids such as lysine, methionine, threonine, and tryptophan has never been more pronounced. These essential nutrients not only correct dietary imbalances but also drive muscle development, enhance feed efficiency, and support immune function, thereby influencing both economic returns and animal welfare.

Amid rising consumer demand for high-quality protein and sustainability mandates, producers and nutritionists are turning to optimized amino acid supplementation to reduce feed costs, curtail environmental footprints, and meet evolving regulatory requirements. This introductory section frames the strategic imperative of feed amino acids by highlighting how targeted nutritional interventions can unlock growth potential, improve feed conversion ratios, and foster resilience in production systems - setting the stage for a deeper exploration of the market’s transformative shifts, tariff impacts, segmentation nuances, and regional variations.

Exploring the dynamic transformations reshaping the feed amino acids landscape through technological breakthroughs and evolving regulatory frameworks

The feed amino acids landscape is undergoing seismic shifts fueled by advancements in biotechnology, evolving policy frameworks, and dynamic consumer expectations. Innovations in precision fermentation and synthetic biology now enable manufacturers to produce highly pure, targeted amino acids at scale, while digital feed-tracking platforms enhance formulation accuracy and real-time performance monitoring. Concurrently, environmental regulations demanding reduced nitrogen excretion and carbon footprints are compelling stakeholders to adopt refined formulations that maximize nutrient uptake and minimize waste.

Assessing the far-reaching implications of 2025 United States tariffs on feed amino acid supply chains and cost structures across the industry

The cumulative effect of the 2025 United States tariff regime on feed amino acid imports has reverberated across global supply chains, driving cost recalibrations and strategic realignments. With import duties applied to a broad range of amino acids and precursor chemicals originating from key production hubs, domestic buyers have navigated higher landed costs, prompting a shift toward local production and alternative sourcing strategies. This shift has accelerated investments in North American fermentation capacity and incentivized collaborative ventures aimed at securing long-term supply stability.

In parallel, the tariff-induced cost pressures have catalyzed enhanced focus on process optimization and yield improvement. Producers have scaled pilot projects for advanced fermentation pathways and explored partnerships for technology licensing to offset tariff burdens. As trade policies continue to evolve, market participants must remain agile, balancing short-term operational adjustments with long-range capacity expansions to navigate the complex interplay between cost management and sustainable growth.

Decoding market dynamics through type variations, advanced production methods, product form distinctions, and nuanced application benefits in feed amino acids

A nuanced understanding of feed amino acid consumption emerges when dissecting the market through multiple segmentation lenses. Based on amino acid type, lysine maintains its dominance by correcting lysine limitations in cereal-based diets, while methionine commands attention for its role in supporting feather growth and antioxidant function. Threonine and tryptophan, critical for gut health and neurotransmitter synthesis respectively, have demonstrated growing uptake as precision nutrition gains traction.

When viewed through the prism of production method, fermentation processes have surged ahead of extractive and synthetic chemical approaches, owing to their scalability, cost efficiencies, and lower environmental footprints. Equally, product form distinctions-crystalline formulations offering ease of blending versus liquid solutions enabling high-concentration delivery-shape purchasing decisions across feed mills. Application-based differentiation further reveals that aquaculture and pet food manufacturers are prioritizing specialized amino acid blends, while poultry producers leverage tailored profiles for broiler, layer, and turkey operations, and ruminant and swine integrators emphasize amino acid combinations that support optimal growth and health outcomes.

This comprehensive research report categorizes the Feed Amino Acids market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Amino Acid Type

- Production Method

- Product Form

- Application

Unraveling regional performance patterns in feed amino acids across the Americas, Europe, Middle East & Africa, and Asia-Pacific markets

Regional disparities in feed amino acid adoption reflect divergent production systems, regulatory philosophies, and investment trajectories. In the Americas, a confluence of rising domestic fermentation capacity, integrated value chains, and sustainability mandates has underpinned robust growth. North American operators are championing localized production to hedge against imported tariff volatility, while Latin American feed producers intensify their collaboration with global technology partners to enhance amino acid portfolio offerings.

In Europe, Middle East & Africa, stringent environmental directives and animal welfare standards have elevated the importance of precise amino acid inclusion, driving demand for tertiary feed management services. Regulatory harmonization across the European Union continues to shape product approvals, whereas Middle Eastern and African markets present high-growth potential due to expanding livestock sectors and evolving feed quality benchmarks. Across Asia-Pacific, high-volume consumption hubs such as China and India are accelerating investment in fermentation infrastructure, with Southeast Asian nations emerging as key players adopting integrated poultry and aquaculture models that prioritize nutrient optimization.

This comprehensive research report examines key regions that drive the evolution of the Feed Amino Acids market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing competitive strategies, innovation trajectories, and partnership networks of the foremost players shaping the global feed amino acids industry

Leading companies in the feed amino acids sphere are consolidating their market positions through robust R&D pipelines, strategic partnerships, and sustainability initiatives. Industry frontrunners are investing in next-generation bioprocessing platforms that enhance yield, reduce energy consumption, and lower carbon emissions. Collaborative agreements with biotechnology firms and academic institutions have become commonplace as stakeholders seek to co-develop proprietary strains and enzyme systems that drive production efficiencies.

Moreover, many key players are broadening their portfolios through selective acquisitions and joint ventures, integrating downstream distribution networks to ensure seamless delivery of both crystalline and liquid formulations. Sustainability credentials have emerged as a differentiator, with top-tier firms committing to net-zero targets and circular economy principles. By leveraging digital supply chain management and IoT-enabled production oversight, these companies are setting new benchmarks for operational transparency, traceability, and customer responsiveness.

This comprehensive research report delivers an in-depth overview of the principal market players in the Feed Amino Acids market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adisseo France S.A.S.

- Ajinomoto Co., Inc.

- Archer-Daniels-Midland Company

- Avena Nordic Grain Oy

- Balchem Corporation

- Bluestar Adisseo Company

- Cargill, Incorporated

- CJ CheilJedang Corporation

- Evonik Industries AG

- Global Bio-Chem Technology Group Company Limited

- Jefo Nutrition Inc.

- Kemin Industries, Inc.

- Kyowa Hakko Bio Co., Ltd.

- Meihua Holdings Group Co., Ltd.

- METabolic EXplorer S.A.

- Novus International, Inc.

- Phibro Animal Health Corporation

- Shijiazhuang Donghua Jinlong Chemical Co., Ltd.

- Sumitomo Chemical Co., Ltd.

- Uniscope Inc.

Strategic recommendations to capitalize on feed amino acid innovations, optimize production methods, and navigate evolving trade policies

Industry leaders aiming to capitalize on the evolving feed amino acid landscape should prioritize strategic investments in advanced fermentation technologies that enhance yield while reducing environmental impact. Establishing collaborative research partnerships with synthetic biology pioneers and local feed integrators can accelerate product development cycles and diversify raw material sourcing options. By linking formulation software with real-time performance analytics, companies can fine-tune amino acid blends tailored to specific livestock segments, driving both nutritional precision and cost-effectiveness.

Furthermore, stakeholders must proactively engage with policymakers to inform tariff negotiations and regulatory frameworks, ensuring balanced trade conditions that support both domestic manufacturing and import diversification. Embracing carbon neutrality goals through green energy integration in production facilities and exploring byproduct valorization pathways will not only mitigate regulatory risk but also bolster brand reputation in sustainability-conscious markets.

Detailing rigorous methodologies and data validation processes employed to ensure robust research outcomes in amino acid feed analysis

The research underpinning this analysis integrates a blend of primary and secondary methodologies designed to ensure comprehensive, high-fidelity insights. Primary research encompassed in-depth interviews with feed mill specialists, formulation scientists, and regulatory authorities, alongside site visits to fermentation facilities and commercial feed operations. Concurrently, secondary data was collated from industry whitepapers, patent registries, and academic publications to validate emerging technology trends and production benchmarks.

To enhance data reliability, triangulation techniques were applied, cross-referencing empirical yield metrics, historical trade data, and end-user consumption patterns. Rigorous quality control measures-including peer reviews by subject-matter experts and iterative data audits-guarantee that findings reflect current market realities. This multifaceted approach establishes a robust evidentiary foundation for strategic decision-making and underscores the rigor of the conclusions drawn herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Feed Amino Acids market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Feed Amino Acids Market, by Amino Acid Type

- Feed Amino Acids Market, by Production Method

- Feed Amino Acids Market, by Product Form

- Feed Amino Acids Market, by Application

- Feed Amino Acids Market, by Region

- Feed Amino Acids Market, by Group

- Feed Amino Acids Market, by Country

- United States Feed Amino Acids Market

- China Feed Amino Acids Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 954 ]

Synthesizing key insights and future directions to reinforce the significance of feed amino acids in advancing global animal nutrition strategies

Through this comprehensive exploration of feed amino acids, key trends have emerged: the ascendancy of fermentation-based production, the critical role of precision nutrition in regulatory compliance, and the transformative potential of digital and biotechnological innovation. Recognizing the differentiated needs of livestock segments-from aquaculture and pet food to specialized broiler, layer, turkey, ruminant, and swine operations-enables stakeholders to prioritize targeted product development and differentiated value propositions.

As tariff landscapes continue to shift, regional production capacities and strategic partnerships will dictate market resilience and growth trajectories. By synthesizing segmentation insights, competitive benchmarking, and actionable recommendations, this report lays the groundwork for informed strategic planning. The confluence of innovation, policy, and sustainability imperatives heralds a new era in animal nutrition, one in which feed amino acids stand at the forefront of both productivity gains and environmental stewardship.

Empower your strategic planning with comprehensive feed amino acid insights—connect with Ketan Rohom to access the full authoritative research report today

The depth and breadth of analysis within the comprehensive market research report on feed amino acids provides strategic insights that can drive informed decision-making and sustainable growth across your operations. By examining supply chain dynamics, segmentation drivers, regional performance patterns, and competitive landscapes in unparalleled detail, this report empowers stakeholders to anticipate shifts, mitigate risks, and capitalize on emerging opportunities in a rapidly evolving industry.

To secure your copy of the full research report and gain direct access to these actionable findings, connect with Ketan Rohom, Associate Director, Sales & Marketing, to discuss tailored solutions that align with your organizational objectives. Elevate your strategic planning and position your business at the forefront of feed amino acid innovation-reach out to Ketan today through his professional network profile or our inquiry portal to initiate the acquisition process and unlock the insights that will shape tomorrow’s animal nutrition landscape

- How big is the Feed Amino Acids Market?

- What is the Feed Amino Acids Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?