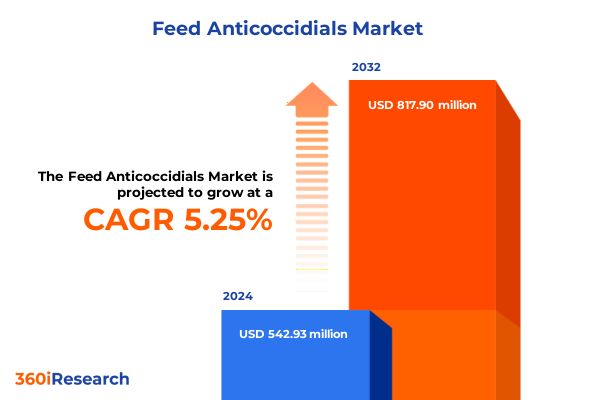

The Feed Anticoccidials Market size was estimated at USD 571.26 million in 2025 and expected to reach USD 599.18 million in 2026, at a CAGR of 5.26% to reach USD 817.90 million by 2032.

Understanding the Crucial Role of Anticoccidial Feed Additives in Enhancing Sustainable Animal Health and Agricultural Productivity

Feed anticoccidial additives play an indispensable role in modern livestock management by mitigating coccidiosis, a parasitic disease that can severely impact animal health, productivity, and overall farm profitability. As the livestock sector intensifies to meet global protein demands, the reliance on effective anticoccidial solutions has grown substantially. These compounds, which include both synthetic chemicals and naturally derived ionophores, not only enhance weight gain and feed conversion ratios but also reduce mortality rates and veterinary costs. The evolving demands for sustainable animal nutrition have further spotlighted anticoccidials as critical tools in achieving efficient, ethical, and environmentally responsible production practices.

This executive summary provides a high‐level overview of current transformative shifts, tariff impacts, segmentation dynamics, regional contrasts, leading company strategies, and actionable recommendations. By synthesizing rigorous research and expert interviews, it equips decision-makers with the strategic context necessary to navigate market complexities. It lays the groundwork for a deeper exploration of scientific advancements, regulatory influences, and competitive positioning that collectively shape the feed anticoccidial landscape.

Exploring the Major Transformative Shifts Reshaping the Feed Anticoccidial Landscape Through Scientific Innovation and Regulatory Evolution

Recent years have witnessed profound shifts in the feed anticoccidial landscape driven by groundbreaking scientific innovations and evolving regulatory frameworks. Advancements in molecular biology have enabled the identification of novel target pathways, leading to the development of precision‐engineered ionophores with enhanced efficacy and safety profiles. At the same time, the rise of natural and botanical extracts reflects growing consumer and regulatory pressure to reduce synthetic residues in animal products. This dual trend toward precision chemistry and natural compounds underscores a broader movement toward tailored, residue-free solutions.

Unpacking the Cumulative Impact of Newly Imposed United States Tariffs in 2025 on Feed Anticoccidial Supply Chains and Pricing Dynamics

The introduction of higher tariff rates by the United States in early 2025 has significantly influenced both the supply chain economics and pricing structures of feed anticoccidials. Imported raw materials, particularly specialized ionophores and precursor chemicals, now carry increased duties that have prompted suppliers to revisit sourcing strategies. In response, several key manufacturers have pivoted toward regional production hubs to mitigate cost escalation and maintain supply continuity. Consequently, logistics streams have been reconfigured, with shorter, more agile routes gaining preference over traditional long-distance shipments.

Pricing pressures have intensified at multiple distribution levels. Feed formulators are negotiating new terms to absorb or offset tariff-influenced price increases, while end-users are redistributing budget allocations toward compounds that offer both efficacy and economic resilience. Overall, the cumulative tariff impact has accelerated localization efforts, spurred partnerships between global and domestic producers, and heightened the focus on supply chain transparency.

Illuminating Key Segmentation Insights Revealing Differential Adoption Trends Across Types Livestock Categories Formulations and Sales Channels

The market exhibits distinct adoption patterns when viewed through the lens of type, livestock application, formulation, and distribution channels. Synthetic chemical anticoccidials continue to dominate due to their long‐established efficacy and predictable dosing parameters, yet ionophore variants have gained traction among integrators seeking broad-spectrum activity and reduced resistance risk. This divergence reflects an industry balancing proven performance against the promise of next-generation molecules.

Livestock type analysis reveals that poultry producers remain the largest consumers of anticoccidials, driven by large-scale broiler and layer operations that demand stringent disease control. Swine and aquaculture sectors, while smaller in volume, show accelerating growth as intensification and global seafood consumption advance. Within ruminants, cattle account for the bulk of usage, but goat and sheep segments increasingly adopt targeted treatments aligned to smaller herd management practices. Formulation trends further delineate market behavior, with liquid preparations offering dosing precision and powder formats favored for feed mill integration. Meanwhile, offline channels, grounded in long-standing distributor relationships, retain core market share, but online procurement platforms are emerging rapidly by offering streamlined ordering, flexible delivery schedules, and digital traceability features.

This comprehensive research report categorizes the Feed Anticoccidials market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Livestock Type

- Formulation

- Sales Channel

Mapping the Critical Regional Landscape to Understand How Americas Europe Middle East Africa and Asia Pacific Drive Divergent Market Dynamics

Regional dynamics significantly influence feed anticoccidial utilization, driven by variations in regulatory oversight, disease prevalence, and industry infrastructure. In the Americas, vertically integrated poultry and swine operations leverage sophisticated biosecurity protocols and high-throughput feed mills, creating robust demand for both synthetic and ionophore‐based solutions. Producers in Brazil and the United States are actively pursuing novel chemistries to combat emerging resistance patterns while optimizing cost efficiencies.

The Europe, Middle East, and Africa region presents a complex mosaic of regulatory environments and livestock systems. European markets lead in natural extract approvals and organic production standards, fueling interest in botanical anticoccidials and combination therapies. Conversely, Middle East and Africa exhibit surging demand in expanding poultry industries, yet logistical constraints and fragmented distribution networks challenge consistent product availability.

In Asia-Pacific, rapid aquaculture expansion in Southeast Asia and intensified poultry operations in China and India underpin a dynamic landscape. Manufacturers are tailoring portfolio offerings to local feed mill capabilities and regional disease pressures, often collaborating with government-backed breeding programs and feed integrators to secure market entry and build long-term adoption.

This comprehensive research report examines key regions that drive the evolution of the Feed Anticoccidials market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players Highlighting Strategic Collaborations Innovations and Competitive Positioning in the Feed Anticoccidial Sector

Key industry participants shape the competitive environment through targeted research investments, strategic alliances, and diverse product portfolios. Leading global animal health corporations have broadened their anticoccidial portfolios by acquiring niche developers of ionophore and botanical compounds, thereby augmenting their capacity to meet stringent safety standards and regional regulatory demands. Their integrated sales networks facilitate rapid product rollout across developed and emerging markets.

Mid-tier companies have differentiated by concentrating on specialized formulations, such as slow-release liquids and customized feed premixes, addressing the precise dosing requirements of different livestock segments. Meanwhile, agile bioprocessing firms are advancing fermentation-derived ionophores, emphasizing sustainable production methodologies that reduce environmental footprint and bolster supply resilience. Collaborative research hubs, often sponsored by consortia of feed manufacturers and academic institutions, accelerate the translation of novel anticoccidial candidates into commercial pipelines. This collaborative ecosystem underscores the sector’s commitment to innovation and market adaptability.

This comprehensive research report delivers an in-depth overview of the principal market players in the Feed Anticoccidials market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adisseo France SAS

- Bayer Animal Health

- Bioproperties Pty Ltd.

- Boehringer Ingelheim International GmbH

- Ceva Santé Animale

- Elanco Animal Health Incorporated

- HIPRA SL

- Huvepharma EOOD

- Impextraco NV

- Innovista Feeding Solutions Pvt Ltd.

- International Animal Health Products Pty Ltd.

- Kemin Industries Inc.

- Merck & Co Inc

- Novus International Inc.

- Phibro Animal Health Corporation

- Qilu Animal Health Products Co Ltd.

- Vetoquinol SA

- Virbac SA

- Zoetis Inc.

- Zydus Animal Health

Delivering Actionable Recommendations to Empower Industry Leaders with Tactical Strategies for Optimizing Feed Anticoccidial Commercialization and Market Adoption

Leaders in the feed anticoccidial market should prioritize a multi-pronged approach to capture growth opportunities and mitigate emerging risks. First, accelerating investment in next-generation ionophore research will differentiate offerings in regions facing rising chemical resistance and strict residue regulations. Concurrently, establishing local production or toll-manufacturing partnerships can circumvent tariff barriers and optimize lead times.

Furthermore, enhancing digital engagement through e-commerce platforms and supply chain traceability solutions will strengthen customer relationships, drive operational efficiency, and provide data-driven insights into real-time usage patterns. Building strategic alliances with feed integrators and livestock associations can facilitate joint pilot programs, demonstrating product performance under field conditions and generating validation data to support broader adoption. Lastly, embedding sustainability metrics-such as carbon footprint reduction and antimicrobial stewardship-into value propositions will resonate with an increasingly socially conscious customer base and regulatory bodies.

Detailing a Robust Research Methodology Integrating Primary Interviews Secondary Data Analysis and Rigorous Validation Protocols

Our research methodology combines rigorous primary and secondary data collection, ensuring both breadth and depth of market insights. In the primary phase, in-depth interviews were conducted with feed mill managers, veterinary experts, and procurement heads across major producing regions to capture frontline perspectives on product efficacy, pricing pressures, and supply chain resilience. These qualitative inputs were supplemented by structured surveys of over 100 industry participants, providing quantitative validation of emerging trends and adoption rates.

Secondary research involved systematic analysis of government regulatory filings, trade association reports, and technical publications to map legislative developments and resistance surveillance data. To enhance reliability, triangulation across multiple sources was performed, reconciling discrepancies and identifying consensus patterns. All data were subjected to stringent validation protocols, including cross-referencing with proprietary databases and independent expert reviews, to uphold the highest standards of accuracy and impartiality.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Feed Anticoccidials market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Feed Anticoccidials Market, by Type

- Feed Anticoccidials Market, by Livestock Type

- Feed Anticoccidials Market, by Formulation

- Feed Anticoccidials Market, by Sales Channel

- Feed Anticoccidials Market, by Region

- Feed Anticoccidials Market, by Group

- Feed Anticoccidials Market, by Country

- United States Feed Anticoccidials Market

- China Feed Anticoccidials Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 954 ]

Concluding Insights Emphasizing the Strategic Imperatives and Future Prospects Guiding Stakeholders in the Feed Anticoccidial Market

The feed anticoccidial market stands at a pivotal juncture, characterized by converging drivers of scientific innovation, regulatory evolution, and shifting demand dynamics. Stakeholders must navigate the interplay between cost containment pressures, sustainability imperatives, and the imperative for residue-free solutions. Manufacturers with diversified portfolios that balance synthetic efficacy and natural alternatives will be best positioned to address varied regional requirements and livestock applications.

As tariff landscapes evolve and digital procurement gains momentum, agility in supply chain design and customer engagement will define competitive advantage. Strategic collaborations across the value chain, underpinned by robust data analytics and pilot validations, can accelerate market penetration and foster long-term loyalty. Ultimately, the capacity to anticipate disease resistance trends and align product innovation with sustainability benchmarks will determine which organizations lead in the next wave of anticoccidial advancement.

Engaging Call To Action Inviting Direct Dialogue with Ketan Rohom Associate Director Sales Marketing to Secure Comprehensive Feed Anticoccidial Intelligence

To ensure your stakeholders gain immediate, comprehensive insights into the feed anticoccidial market, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing. By engaging in a personalized consultation, you will unlock tailored guidance on optimal product positioning, address specific operational challenges, and receive detailed support in aligning research findings with your strategic goals. This collaboration will provide you access to exclusive data sets, custom regional analysis, and early briefings on upcoming regulatory developments.

Initiating dialogue with Ketan Rohom guarantees a seamless procurement process for the full market research report, ensuring you receive the latest intelligence without delay. Take advantage of this opportunity to strengthen your competitive edge, capitalize on emerging trends, and drive sustained growth for your organization.

Contact Ketan Rohom today and transform your understanding of feed anticoccidial solutions into actionable business outcomes

- How big is the Feed Anticoccidials Market?

- What is the Feed Anticoccidials Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?