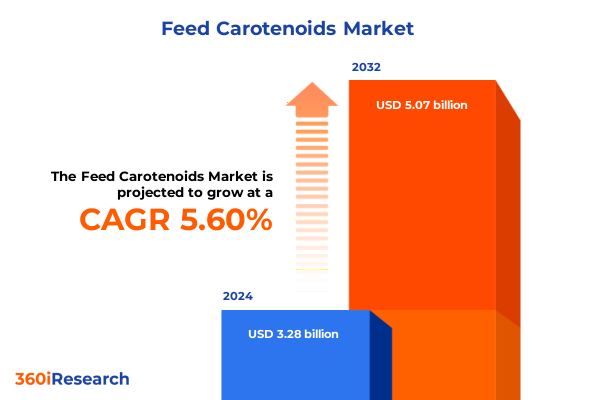

The Feed Carotenoids Market size was estimated at USD 3.47 billion in 2025 and expected to reach USD 3.62 billion in 2026, at a CAGR of 5.59% to reach USD 5.07 billion by 2032.

Setting the Stage for Feed Carotenoids as Essential Nutritional Additives Fueling Animal Health Growth and Sustainable Innovation in Livestock Nutrition

The landscape of animal nutrition has increasingly recognized feed carotenoids as essential bioactive compounds that enhance performance, health, and product quality across diverse livestock sectors. Derived from natural and synthetic sources, these pigments play a fundamental role not only in pigmentation but also in antioxidant defense, immune support, and growth promotion. As producers seek to meet stringent quality standards and consumer demand for vibrant, nutrient-rich animal products, carotenoid fortification has emerged as a strategic lever for competitive advantage.

Within this context, feed formulators and end users are navigating a dynamic environment shaped by technological advances, shifting regulatory frameworks, and evolving consumer expectations. Aquaculture, poultry, ruminant, and swine systems each exhibit unique nutritional requirements, and carotenoids have become integral to tailored feeding strategies that optimize health outcomes. Beyond visual attributes such as egg yolk color or flesh pigmentation, research continues to illuminate the broader physiological benefits that underpin long-term herd and flock resilience.

As the industry moves toward more precise nutritional interventions, integrating carotenoids with advanced delivery systems and data-driven feed management promises to unlock new value. This summary frames the critical drivers, emerging trends, and strategic considerations that decision-makers must weigh when incorporating feed carotenoids into their formulations. By examining supply chain shifts, policy impacts, segmentation nuances, and regional variations, readers will gain a comprehensive understanding of how carotenoids are reshaping animal nutrition and unlocking sustainable growth pathways.

Unveiling the Dynamic Shifts Reshaping Feed Carotenoids Adoption Through Technological Breakthroughs and Shifting Animal Welfare Priorities

The feed carotenoids sector has undergone profound transformation in recent years, driven by breakthroughs in encapsulation technologies and novel extraction methods. Microencapsulation and nanoemulsion techniques have improved stability and bioavailability, enabling more precise dosing and uniform dispersion throughout feed matrices. These innovations have expanded the utility of carotenoids beyond traditional pigmentation roles, positioning them as multifunctional additives that support antioxidant defenses and immune function.

Simultaneously, consumer and regulatory pressure for transparency and traceability have catalyzed shifts toward natural sources, including algal extraction, microbial fermentation, and plant-based yields. Producers are increasingly scrutinizing supply origins and production footprints, driving partnerships with specialty manufacturers capable of delivering certified non-GMO, sustainably produced carotenoids. This pivot not only elevates product integrity but also aligns with broader ESG objectives that investors and brand owners prioritize.

Animal welfare considerations further underscore the landscape shifts, as higher welfare standards encourage formulations that contribute to overall wellbeing. In poultry, for example, carotenoid supplementation supports resilience under heat stress, while in aquaculture it enhances disease resistance in fish and shrimp operations. Through these dynamic shifts, feed carotenoids are cementing their status as strategic ingredients that intersect health, performance, and sustainability imperatives.

Analyzing the Compound Implications of 2025 United States Tariffs on Feed Carotenoids Supply Chains and Cost Structures

The introduction of new United States tariffs in 2025 has created ripple effects across the feed carotenoids supply chain, triggering changes in sourcing strategies and cost structures. Imports of high-purity carotenoid concentrates from key producing regions experienced elevated duty burdens, prompting manufacturers to reassess procurement channels. In response, some formulators have sought alternative suppliers in tariff-exempt jurisdictions or intensified efforts to meet domestic production capabilities.

Cost pressures have translated into tighter margin management and negotiations further upstream, as licensors and raw material vendors revisit contracts to accommodate the new policy environment. To mitigate the impact, several players have accelerated adoption of advanced purification and extraction technologies that reduce dependency on imported intermediates. This drive toward self-sufficiency not only cushions against tariff volatility but also aligns with long-term resilience objectives.

Moreover, industry collaboration has emerged as a key adaptation strategy. Through joint ventures and consortiums, feed additive producers and service providers are pooling resources to develop vertically integrated supply models. By doing so, they can harness economies of scale and more effectively navigate regulatory hurdles. These collective actions underscore a broader trend wherein policy shifts catalyze innovation and lead to more robust, agile value chains.

Deciphering the Multifaceted Segmentation Landscape Driving Diverse Applications and End Users in the Feed Carotenoids Universe

The feed carotenoids market exhibits a rich tapestry of segmentation with distinct implications for formulators and end users. Looking across animal type, nutritive strategies diverge between aquaculture operations, including fish and shrimp applications, and land-based poultry systems with broiler, layer, and turkey flocks. In parallel, ruminant feed incorporates carotenoids to support health in cattle, goat, and sheep herds, while swine feeds target growing pigs, piglets, and sows for optimal performance at every life stage.

Beyond animal classification, formulations vary by physical form. Granules have retained popularity for their ease of blending, while liquid carotenoids, offered as emulsions or solutions, facilitate rapid integration into pelleted feed. Powder carriers, available as microencapsulated or standard powders, offer enhanced stability and targeted release. These form distinctions empower feed producers to tailor delivery mechanisms according to processing capabilities and on-farm handling requirements.

Source-based segmentation further differentiates market dynamics. Natural carotenoids derived through algal extraction, microbial fermentation, or plant extraction contrast with synthetic analogs in both regulatory treatment and cost considerations. Natural routes have gained traction amid consumer preference for clean-label products, whereas synthetic alternatives continue to serve high-purity technical applications. Each pathway presents trade-offs in yield, environmental impact, and supply chain complexity.

Applications span the spectrum from antioxidant support and growth promotion to health supplementation and pigmentation objectives. Carotenoids influence egg yolk depth, flesh coloration in aquaculture, and even skin hues in certain specialty markets. Meanwhile, feed additive companies, farm integrators, and independent farmers each represent unique end user profiles, with direct sales, distributor networks, and e-commerce channels furnishing different engagement models. Underlying all variations, manufacturing through biotechnology, chemical synthesis, extraction, or fermentation shapes cost structures and product positioning within the competitive landscape.

This comprehensive research report categorizes the Feed Carotenoids market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Animal Type

- Form

- Source

- Application

- Carotenoid Type

- End User

- Manufacturing Process

Illuminating Regional Nuances and Growth Drivers Across the Americas Europe Middle East and Africa and the Asia Pacific Feed Carotenoids Ecosystem

Regional dynamics play a pivotal role in shaping feed carotenoids trends across global markets. In the Americas, demand is underpinned by expansive poultry and swine industries in North America alongside rapidly growing aquaculture operations in Latin America. Producers on both continents emphasize feed efficiency and animal wellness, spurring investments in tailor-made carotenoid solutions that address climate stressors and regulatory requirements unique to each jurisdiction.

Across Europe, the Middle East, and Africa, stringent regulations on feed additive approvals coexist with robust research initiatives in microbial fermentation and algal extraction. European formulators often prioritize non-synthetic carotenoids to comply with clean-label mandates, while Middle Eastern feed companies leverage strategic partnerships to secure raw material supplies under evolving trade frameworks. African markets, marked by burgeoning livestock sectors, show growing interest in integrated feed solutions that enhance both yield and nutritional quality.

Meanwhile, the Asia Pacific region represents a hotbed of innovation and volume growth driven by major aquaculture hubs and fast-expanding poultry production. In Southeast Asia, smallholder farmers and large commercial feed mills alike are adopting carotenoid-fortified diets to improve product consistency and meet stringent export standards. In East Asia, research into proprietary carotenoid blends and advanced processing techniques is accelerating, with the dual objective of optimizing feed conversion ratios and satisfying rising consumer expectations for premium animal-derived foods.

This comprehensive research report examines key regions that drive the evolution of the Feed Carotenoids market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Spotlighting Leading Innovators and Strategic Collaborators Shaping the Competitive Terrain of Feed Carotenoids Solutions and Offerings

Leading innovators in the feed carotenoids domain are forging new pathways through strategic partnerships, research alliances, and product diversification. Several global specialty ingredient providers have expanded their portfolios to include high-purity carotenoid concentrates optimized for specific species and life stages. These companies have invested in state-of-the-art extraction facilities and advanced encapsulation capabilities, enabling them to deliver formulations with superior stability and efficacy.

Collaborative ventures between feed mill integrators and biotechnology firms are gaining traction, as stakeholders seek to mitigate supply bottlenecks and enhance traceability. Through these alliances, feed producers access proprietary strains of algae or microbial cultures that yield carotenoids with enhanced bioavailability. Other companies have prioritized acquisitions of niche players specializing in microencapsulation, granting them in-house expertise to refine release profiles and improve feed conversion outcomes.

At the same time, a select group of regional champions is carving out strong positions in emerging markets by customizing product offerings to local farming practices. These enterprises leverage deep market intelligence to tailor carotenoid blends that address endemic challenges such as heat stress in poultry or disease susceptibility in aquaculture. By aligning R&D roadmaps with on-ground needs, they have established enduring relationships with commercial feed mills and independent farmers seeking targeted nutrition solutions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Feed Carotenoids market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adisseo S.A.S.

- Algatechnologies Ltd.

- Allied Biotech Corporation

- Archer Daniels Midland Company

- BASF SE

- Cargill Inc.

- Chr. Hansen Holding A/S

- Cyanotech Corporation

- Divi's Laboratories Limited

- Döhler GmbH

- EW Nutrition GmbH

- ExcelVite Sdn Bhd

- Farbest Brands

- Fuji Chemical Industries Co., Ltd.

- Givaudan SA

- Kemin Industries Inc.

- Koninklijke DSM N.V.

- Lonza Group Ltd.

- Lycored Corp.

- Novus International Inc.

- Nutrex NV

- Sensient Technologies Corporation

- Synthite Industries Ltd.

- Valensa International

- Zhejiang NHU Company Ltd.

Empowering Industry Leaders with Targeted Strategies to Navigate Market Complexities and Maximize Value from Feed Carotenoids Innovations

Industry leaders should prioritize integrating cutting-edge encapsulation and delivery systems to enhance carotenoid bioavailability and consistency in feed formulations. By investing in pilot trials that validate performance under realistic farm conditions, organizations can build compelling value propositions that resonate with feed mill integrators and end users alike. As a next step, forging collaborative alliances with raw material suppliers will secure supply continuity and facilitate access to novel carotenoid sources.

Diversification of sourcing strategies is also critical. In light of geopolitical pressures and tariff uncertainties, developing multi-regional procurement frameworks can mitigate risks and streamline compliance efforts. Companies that establish regional production hubs or joint ventures will find themselves better positioned to navigate trade policy shifts while reinforcing supply chain agility.

In parallel, embracing digital platforms for feed management and traceability will empower transparent communication of carotenoid provenance and efficacy. Real-time data on feed composition and animal performance can drive continuous improvement cycles, strengthening the feedback loop between on-farm trials and product development. By leveraging these insights, industry players can refine formulations and differentiate offerings in an increasingly competitive marketplace.

Finally, aligning product strategies with evolving sustainability and animal welfare standards will unlock new market segments and bolster brand reputation. Whether through eco-friendly sourcing practices or targeted nutrition programs that mitigate environmental stressors, companies that demonstrate a commitment to holistic farm health will capture the attention of conscientious consumers and regulatory bodies.

Articulating the Comprehensive Research Framework and Rigorous Approaches Underpinning the Feed Carotenoids Analysis and Insights Generation

The research underlying this analysis combined extensive secondary investigation with primary stakeholder engagement to ensure robust, actionable insights. Initially, a thorough review of academic publications, patent filings, and regulatory databases provided a foundational understanding of carotenoid chemistry, production methodologies, and approval frameworks. Complementary industry reports and trade association data were then cross-referenced to contextualize macro-trends and policy developments.

Subsequent phases involved in-depth interviews with feed formulators, nutritionists, and technology providers. These discussions yielded firsthand perspectives on evolving trial results, processing challenges, and adoption inhibitors. To triangulate findings, quantitative data points were mapped against supply chain case studies, enabling a nuanced examination of tariff impacts and logistics variables across key regions.

The methodology also incorporated expert panels drawn from academia and commercial practice, convened to validate preliminary observations and debate emerging themes. Feedback loops between panel sessions and data analysis fostered iterative refinement of segmentation frameworks and strategic imperatives. Finally, the research was synthesized into a structured framework that aligns segmentation, regional, and competitive dimensions, ensuring coherence and relevance for decision-makers.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Feed Carotenoids market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Feed Carotenoids Market, by Animal Type

- Feed Carotenoids Market, by Form

- Feed Carotenoids Market, by Source

- Feed Carotenoids Market, by Application

- Feed Carotenoids Market, by Carotenoid Type

- Feed Carotenoids Market, by End User

- Feed Carotenoids Market, by Manufacturing Process

- Feed Carotenoids Market, by Region

- Feed Carotenoids Market, by Group

- Feed Carotenoids Market, by Country

- United States Feed Carotenoids Market

- China Feed Carotenoids Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 2385 ]

Synthesis of Key Discoveries and Strategic Imperatives Confirming the Central Role of Feed Carotenoids in Advancing Animal Health and Industry Resilience

This executive summary has outlined the converging forces that are redefining feed carotenoids as indispensable tools for next-generation animal nutrition. From microencapsulation advances and regulatory shifts to regional demand patterns and the ripple effects of new tariffs, the feed carotenoids landscape is marked by both complexity and opportunity. Strategic segmentation insights reveal how tailored formulations can meet precise needs across aquaculture, poultry, ruminant, and swine sectors, while regional nuances underscore the importance of customized market approaches.

Key players are harnessing innovation through strategic partnerships and in-house R&D investments, with a strong focus on supply chain resilience and sustainable sourcing. Industry leaders that adopt multifaceted recommendations-from diversifying procurement frameworks to leveraging digital traceability-will be best positioned to translate research breakthroughs into commercial success. The methodological rigor of this study ensures that the insights presented are grounded in real-world data and expert validation, offering a reliable compass for charting future growth pathways.

As the feed carotenoids sector continues to evolve, stakeholders who embrace a holistic perspective-integrating technological, regulatory, and market intelligence-will unlock new avenues for animal wellness and operational efficiency. The synthesis of discoveries and strategic imperatives herein affirms the central role of carotenoids in driving both nutritional excellence and industry resilience.

Engage Directly with Ketan Rohom to Unlock Exclusive Insights and Secure Your Customized Copy of the Feed Carotenoids Research Report Today

To explore the full breadth of insights and capitalize on emerging feed carotenoids opportunities, we invite you to engage directly with Ketan Rohom, Associate Director of Sales and Marketing. Ketan brings a wealth of expertise in animal nutrition market dynamics and is ready to address your unique challenges and objectives.

By connecting with Ketan, you will gain personalized guidance on how to apply the research findings to your strategic roadmap. Secure your tailored copy of the market research report today and unlock the actionable intelligence that can elevate your competitive advantage.

- How big is the Feed Carotenoids Market?

- What is the Feed Carotenoids Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?