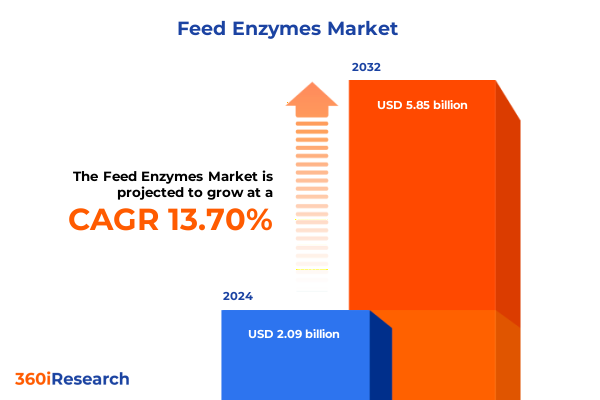

The Feed Enzymes Market size was estimated at USD 2.38 billion in 2025 and expected to reach USD 2.68 billion in 2026, at a CAGR of 13.66% to reach USD 5.85 billion by 2032.

Elevating Feed Efficiency and Animal Health Through Innovative Enzyme Solutions Tailored to Diverse Nutritional Requirements

The evolving world of animal nutrition has placed an unprecedented spotlight on feed enzymes as essential catalysts for enhancing feed efficiency and promoting optimal animal health. As the global population rises and protein demand intensifies, the integration of exogenous enzymes into feed formulations has shifted from a specialized tactic to a mainstream necessity. These biocatalysts break down complex macronutrients into bioavailable constituents, reduce environmental excretion of undigested compounds, and elevate growth performance, collectively transforming livestock management.

Key drivers-ranging from the pursuit of sustainable production systems to the tightening of environmental regulations-have accelerated feed enzyme adoption across continents. Producers are now seeking enzymatic solutions that align with precision nutrition philosophies, enabling tailored facilitation of carbohydrate, protein, and lipid hydrolysis for diverse animal types. This trend underscores the industry’s shift toward maximizing feed conversion ratios while minimizing waste, reflecting a dual commitment to economic viability and ecological stewardship.

Against this backdrop, feed enzyme portfolios have expanded both in depth and breadth. Innovation pipelines are increasingly populated with next-generation phytases that liberate bound phosphorus, cellulases that disrupt complex fiber matrices, and proteases that optimize amino acid availability. Transitioning beyond singular enzyme addition, formulators now design synergistic enzyme blends calibrated to address multifaceted digestive challenges. As a result, feed enzymes have emerged not merely as performance enhancers but as strategic levers for unlocking nutritional value and reinforcing competitive resilience.

Unveiling the Revolutionary Transitions Reshaping Feed Enzyme Adoption from Production to Performance Across the Animal Nutrition Sector

The feed enzyme landscape is undergoing transformative shifts that extend well beyond incremental productivity gains. At the forefront is the transition from one-size-fits-all formulations toward precision enzyme inclusion informed by data-driven decision support tools. Harnessing advances in animal genomics, microbiome profiling, and in vivo digestibility assays, nutritionists can now customize enzyme blends to specific production systems, dietary substrates, and performance targets. This evolution amplifies feed-to-meat conversion while mitigating variability in nutrient utilization.

Simultaneously, the industry has witnessed a paradigmatic move toward holistic gut health management. Feed enzymes are no longer relegated to mere nutrient breakdown; they actively contribute to modulating microbial populations, strengthening mucosal integrity, and reducing the prevalence of deleterious pathogens. The convergence of enzyme technology with probiotics and prebiotics has spawned multifactorial additive strategies aimed at bolstering immune responses and curtailing antibiotic reliance.

Moreover, digital and automation technologies are catalyzing rapid innovation cycles. Real-time monitoring of feed mill operations, remote sensing of animal performance metrics, and AI-driven predictive analytics empower stakeholders to refine enzyme dosing protocols on the fly. This integration of biotechnology and information technology not only drives continuous improvement in feed efficiency but also fosters adaptive supply chains capable of responding swiftly to shifts in raw material quality, regulatory frameworks, and market demands.

Analyzing the Multifaceted Effects of 2025 United States Tariffs on Enzyme Imports Cost Structures and Supply Chain Resilience in Feed

The implementation of new tariff measures in early 2025 has reverberated across the feed enzyme supply chain, compelling stakeholders to reassess cost structures and procurement strategies. Increased duties on select imported enzyme preparations have raised landed costs, prompting manufacturers to explore alternative sourcing routes and renegotiate supplier contracts. Consequently, some integrators have accelerated forward contracts to lock in lower prices, while others have diversified their vendor base to include strategic allies within friendly trade jurisdictions.

These tariff-induced pressures have also magnified the value of domestic enzyme production capabilities. Localized fermentation facilities are receiving heightened attention as they offer tariff insulation coupled with reduced logistical lead times. This shift has galvanized investment in scale-up initiatives, enabling regional producers to cater to proximate demand centers while mitigating currency volatility and cross-border compliance hurdles.

In response to evolving regulatory landscapes, many feed formulation enterprises are optimizing their enzyme blend designs to achieve comparable efficacy at lower inclusion rates, thereby cushioning the financial impact. Meanwhile, upstream raw material suppliers are partnering with enzyme manufacturers to co-develop tailored substrates that enhance enzyme activity and reduce dependency on tariff-exposed imports.

Through strategic realignment of supply chain models and product formulation practices, the industry is fostering greater resilience. By reassessing partnership frameworks, prioritizing regional production capacity, and embracing innovative dose-sparing technologies, feed enzyme stakeholders are better positioned to navigate fluctuating tariff regimes without compromising performance or profitability.

Deep Dive into Key Feed Enzyme Market Segments Revealing How Enzyme Characteristics and Delivery Channels Drive Value Creation

The feed enzyme market’s complexity is best understood through a multifaceted segmentation lens that reveals how distinct product characteristics and end-user applications shape strategic priorities. The category encompassing enzyme classification includes Carbohydrases, Lipase, Phytase, and Protease, with Carbohydrases further comprising specialized types such as Amylase, Beta-Glucanase, Cellulase, Mannanase, and Xylanase. Each subset addresses targeted macronutrient challenges, whether breaking down alpha‐linked polysaccharides or liberating cellulose-bound energy fractions.

Equally significant is the segmentation by animal species, spanning Aquaculture, Poultry, Ruminant, and Swine. In aquaculture, enzyme incorporation is revolutionizing plant-based feed formulations by enhancing digestibility of complex carbohydrates, whereas poultry operations leverage phytases to unlock phosphorus from plant phytate. Ruminant nutritionists are refining fiber-degrading enzyme blends to support rumen microflora efficiency, and swine producers are emphasizing proteases to maximize amino acid utilization in grain-rich diets.

The source of enzyme production adds another layer of nuance: Animal-derived, Microbial-origin, and Plant-based preparations cater to regulatory preferences and functional efficacy. Microbial sources, in particular, are subdivided into Bacterial, Fungal, and Yeast, each offering distinct activity profiles, thermal stability, and substrate affinity. Enzyme form and distribution channel further inform market dynamics, with Dry and Liquid preparations enabling different inclusion options and Offline versus Online channels facilitating varied procurement pathways. Understanding these interwoven segments is critical for designing differentiated product strategies and aligning supply chains with evolving customer expectations.

This comprehensive research report categorizes the Feed Enzymes market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Enzyme Type

- Animal Type

- Source

- Form

- Distribution Channel

Exploring Regional Dynamics Influencing Feed Enzyme Demand Patterns and Growth Drivers across Major Global Territories

Regional analysis illuminates dynamic growth trajectories and investment opportunities across three key territories. In the Americas, innovative feed enzyme adoption continues to be driven by large-scale livestock and aquaculture operations in North and South America. Producers are increasingly integrating enzyme blends to unlock plant-derived feedstocks, enhance nutrient utilization, and respond to stringent environmental regulations governing nitrogen and phosphorus runoff.

Shifting focus to Europe, the Middle East & Africa, regulatory frameworks emphasizing antibiotic reduction and environmental sustainability are creating fertile ground for enzyme advancements. European protein producers are aggressively investing in next‐generation phytases and fiber-digesting enzymes, while Middle Eastern and African feed mills are beginning to adopt proven enzyme technologies as they modernize and scale operations to meet rising protein consumption.

Asia-Pacific remains the fastest-evolving market, propelled by rapid expansions in poultry and swine production, particularly in China and India. The region’s burgeoning aquaculture sector is also fueling demand for specialized enzyme solutions capable of optimizing alternative feed ingredients. Ongoing infrastructure investments, government incentives for local manufacturing, and strategic collaborations are further accelerating the establishment of regional enzyme production hubs, fortifying supply security and reducing lead times for end users.

This comprehensive research report examines key regions that drive the evolution of the Feed Enzymes market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Feed Enzyme Innovators Highlighting Strategic Investments and Competitive Differentiation in the Global Arena

The competitive arena for feed enzymes is marked by strategic alliances, robust research portfolios, and an unwavering focus on product performance. Leading biotechnology enterprises continue to channel substantial resources into R&D programs aimed at enhancing enzyme thermostability, broadening pH tolerance ranges, and fine-tuning substrate specificity. These efforts are complemented by collaborative partnerships with academic institutions and specialized contract research organizations, accelerating the translation of laboratory breakthroughs into commercial-scale solutions.

Strategic differentiation is also achieved through vertical integration of upstream fermentation capabilities, ensuring consistent quality of microbial or fungal strains and enabling flexible scale adjustment in response to market fluctuations. Select companies are forging joint ventures with raw material suppliers to co-develop optimized enzyme-substrate pairings, further reinforcing the value proposition of their offerings.

In parallel, a wave of targeted acquisitions is reshaping the vendor landscape, as multinationals absorb niche players to fill gaps in their product portfolios and geographic coverage. This consolidation trend is intensifying competition, compelling all players to accelerate innovation cycles and broaden their customer support services. Ultimately, the interplay of research-driven product differentiation, strategic integration, and portfolio diversification will define the leaders of tomorrow’s feed enzyme market.

This comprehensive research report delivers an in-depth overview of the principal market players in the Feed Enzymes market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AB Enzymes GmbH

- Adisseo

- Advanced Enzyme Technologies Ltd

- Aum Enzymes

- BASF SE

- Beldem SA

- Biovet JSC

- Bluestar Adisseo Company

- Chr Hansen Holding A/S

- DSM Firmenich

- DuPont de Nemours Inc

- Enmex SA de CV

- Jinan Tiantianxiang Co Ltd

- Kemin Industries Inc

- Megazyme Ltd

- Novozymes A/S

- Novus International Inc

- Nutrex Besloten Vennootschap

- Rossari Biotech Ltd

- Sunson Industry Group Company

Actionable Strategic Imperatives for Stakeholders to Capitalize on Emerging Feed Enzyme Trends and Strengthen Market Positioning

To thrive amid changing regulatory, environmental, and economic pressures, industry leaders must embrace strategic imperatives that balance innovation with operational resilience. First, investment in advanced R&D capabilities is essential; by prioritizing the development of robust enzyme blends that address emerging nutritional challenges, organizations can reinforce their competitive differentiation and foster long-term customer loyalty.

Second, diversifying supply chain footprints by establishing regional production sites and cultivating partnerships with local fermentation specialists will mitigate the volatility associated with import tariffs and geopolitical disruptions. This approach not only reduces lead times but also enhances cost predictability and regulatory compliance.

Third, integrating digital solutions-including predictive analytics for enzyme efficacy, real-time quality monitoring systems, and decision-support platforms-will enable rapid response to shifts in feedstock composition and animal performance requirements. By leveraging data-driven insights, stakeholders can optimize dosing strategies and maximize return on enzyme investments.

Finally, forging collaborative alliances with feed formulators, producers, and regulatory bodies fosters knowledge sharing and co-creation of next-generation solutions. Engaging proactively in sustainability initiatives and contributing to industry standards accelerates market acceptance of enzyme innovations, ensuring that organizations remain at the forefront of the rapidly evolving animal nutrition landscape.

Comprehensive Research Methodology Combining Primary Interviews and Robust Secondary Data to Ensure Analytical Rigor and Insight Accuracy

A robust methodological framework underpins the insights presented in this executive summary, combining extensive secondary research with targeted primary investigations. Secondary research involved systematic review of peer-reviewed journals, technical white papers, industry publications, and regulatory filings to capture the full spectrum of technological advancements and market developments related to feed enzymes.

Complementing this, primary research entailed in-depth interviews with a cross-section of stakeholders, including feed mill operators, enzyme formulators, academic researchers, and regulatory experts. These discussions provided nuanced perspectives on practical efficacy, operational challenges, and future adoption trajectories across diverse production systems.

Data triangulation was applied rigorously, reconciling quantitative findings from secondary sources with qualitative inputs from primary engagements. Insights were further validated through expert panels convened in key regions, ensuring that regional specificities and emerging trends were accurately interpreted.

Throughout the research process, quality assurance protocols-such as cross‐validation of data points, third-party reviews, and iterative feedback loops-were maintained to safeguard the integrity and reliability of the conclusions. This comprehensive approach ensures that decision-makers can rely with confidence on the analytical depth and actionable intelligence of the report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Feed Enzymes market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Feed Enzymes Market, by Enzyme Type

- Feed Enzymes Market, by Animal Type

- Feed Enzymes Market, by Source

- Feed Enzymes Market, by Form

- Feed Enzymes Market, by Distribution Channel

- Feed Enzymes Market, by Region

- Feed Enzymes Market, by Group

- Feed Enzymes Market, by Country

- United States Feed Enzymes Market

- China Feed Enzymes Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Synthesis of Critical Insights Underscoring Feed Enzymes as Cornerstone of Sustainable and Efficient Animal Nutrition Strategies

As the feed enzyme landscape continues its trajectory toward greater sophistication, the ecosystem of stakeholders-ranging from enzyme developers and raw material suppliers to feed mill operators and end-user producers-must remain agile and forward-thinking. The convergence of precision nutrition, gut health management, and digital integration underscores the role of enzymes as pivotal enablers of sustainable, efficient animal production.

Emerging tariff considerations and shifting regulatory paradigms highlight the importance of diversifying supply chains and reinforcing domestic manufacturing capabilities. Likewise, deep segmentation by enzyme type, animal species, source, form, and distribution channel equips organizations with the insights needed to tailor strategies that resonate with specific market demands.

Regional disparities offer both challenges and opportunities, with the Americas emphasizing environmental compliance, EMEA driving innovation through stringent regulations, and Asia-Pacific expanding at a rapid pace fueled by growing protein consumption. Navigating these nuances requires a balanced approach that synergizes global best practices with localized solutions.

Collectively, these insights crystallize the transformative potential of feed enzymes as not only performance enhancers but also as strategic levers for risk mitigation, cost management, and environmental stewardship. Embracing the actionable imperatives outlined herein will equip industry leaders to seize emerging opportunities and cement their position at the vanguard of animal nutrition innovation.

Engage with Ketan Rohom to Secure Your Definitive Feed Enzyme Market Research Report and Propel Strategic Decision-Making

In today’s competitive landscape, securing comprehensive insights can mean the difference between strategic agility and missed opportunities. By connecting with Ketan Rohom, Associate Director, Sales & Marketing, you gain direct access to an expert who understands the nuances of the feed enzyme sphere and can guide you through the complexities of report acquisition and application. Engaging in a dialogue ensures that your organization secures the right scope of analysis, tailored to your unique business objectives and operational realities.

Whether you are seeking detailed breakdowns of enzyme type applications, assessment of tariff implications, or region-specific growth levers, Ketan is prepared to facilitate an end-to-end procurement experience that is both efficient and highly customized. His deep knowledge of the feed enzyme market, combined with a client-focused approach, ensures swift alignment on deliverables and timelines.

Take the next step in solidifying your organization’s competitive edge. Reach out to schedule a personalized consultation with Ketan Rohom to discuss your specific needs, request supplementary data samples, or finalize the purchase of the definitive feed enzyme market research report. Partner with an industry insider committed to empowering your decision-making and unlocking new avenues of growth.

- How big is the Feed Enzymes Market?

- What is the Feed Enzymes Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?