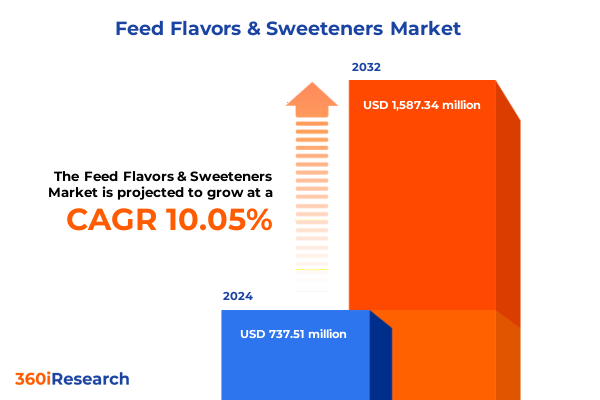

The Feed Flavors & Sweeteners Market size was estimated at USD 813.29 million in 2025 and expected to reach USD 887.92 million in 2026, at a CAGR of 10.02% to reach USD 1,587.34 million by 2032.

Revolutionizing Animal Nutrition Through Cutting-Edge Flavors and Sweeteners That Enhance Feed Palatability, Health, and Performance Across Livestock Industries

The global livestock industry is undergoing unprecedented change as producers and feed manufacturers seek solutions that simultaneously optimize animal performance, enhance feed palatability, and address evolving consumer and regulatory demands. Amidst these pressures, feed flavors and sweeteners have emerged as vital tools for masking undesirable tastes, improving intake rates, and ultimately driving more efficient nutrient utilization. According to recent market research, the animal feed sweetener sector demonstrated robust growth in 2024, underscoring its critical role in modern animal nutrition strategies.

In particular, early-life feed applications have benefited from tailored sweetening solutions that cater to the heightened sensitivity of young livestock. Studies on post-weaning piglets, for instance, reveal that the inclusion of sweeteners such as sucralose and aspartame can increase feed consumption by up to 12%, accelerating weight gain and reducing mortality risks. These enhancements not only improve animal welfare but also translate into measurable economic returns for producers through more predictable growth curves and optimized feed conversion ratios.

Beyond sweeteners, the broader palette of flavor enhancers-from savory notes that encourage feed intake in ruminants to fruit-inspired aromas that appeal to swine-has expanded the toolbox available to nutritionists. The shift towards natural and clean-label ingredients, driven by both regulatory scrutiny and consumer expectations, has further accelerated innovation. Forward-looking enterprises are now leveraging advanced encapsulation, precision dosing, and AI-driven formulation techniques to develop next-generation flavors and sweeteners that meet stringent safety standards while delivering targeted sensory benefits.

As the importance of feed additives grows in parallel with the intensification of livestock operations worldwide, stakeholders across the value chain are recognizing the strategic imperative to invest in R&D pipelines, diversify supplier networks, and engage in collaborative partnerships. This report offers a comprehensive lens through which to examine these dynamics and act decisively in an increasingly competitive and complex market.

Uncovering the Technological, Regulatory, and Consumer-Driven Transformations Redefining the Feed Flavors and Sweeteners Landscape in 2025

The landscape of feed flavors and sweeteners has been reshaped by a confluence of technological breakthroughs, evolving regulations, and shifting consumer priorities. In recent years, the maturation of fermentation-based production platforms has unlocked the large-scale synthesis of high-purity steviol glycosides, notably Reb M, enabling a cleaner taste profile than first-generation extracts and supporting deeper sugar reduction while preserving palatability . At the same time, bioconversion techniques have improved the yield of novel sweeteners, accelerating time-to-market for innovative formulations.

Regulatory developments have introduced new labeling requirements and health claims restrictions, prompting feed additive suppliers to align their offerings with clean-label and non-GMO designations. This has led to a surge in research on plant-derived polyols and rare sugar alternatives, as manufacturers seek to differentiate products through sustainability credentials and functional benefits. Meanwhile, advances in microencapsulation and nanoemulsion technologies are enhancing flavor stability under extreme feed processing conditions, ensuring consistent sensory delivery in pelletized and extruded feeds.

Consumer awareness of animal welfare and traceability has also reverberated through procurement decisions, elevating the importance of ethically sourced flavors and sweeteners. Digital traceability platforms, leveraging blockchain and IoT sensors, now enable real-time tracking of ingredient origin and quality parameters, reinforcing trust in global supply chains. Finally, the integration of data analytics and machine learning into formulation workflows has allowed rapid iteration of flavor profiles tailored to specific species, growth stages, and environmental stress factors, ushering in an era of precision palatability enhancement.

Assessing How 2025 United States Tariffs Are Reshaping Supply Chains, Cost Structures, and Competitive Dynamics in the Feed Flavors and Sweeteners Sector

The implementation of new U.S. tariffs on certain imported sweeteners and feed additives in 2025 has had far-reaching implications for cost structures and sourcing strategies. Natural high-intensity sweeteners like stevia and monk fruit have come under tariff pressure of between 10% and 25%, reflecting the predominantly China- and India-based processing of these extracts. This shift has forced many manufacturers to reevaluate supplier relationships and explore alternative sourcing or ingredient blends that mitigate the impact on reformulation budgets .

In contrast, key synthetic sweeteners such as sucralose and acesulfame-K have been exempted from the latest import levies, presenting a temporary competitive advantage for these ingredients. Industry participants are now considering increased utilization of exempted sweeteners to stabilize ingredient costs, while balancing consumer demands for natural labeling and clean taste profiles. However, reliance on synthetic options introduces its own set of R&D and marketing challenges, particularly in regions with stringent labeling requirements and growing skepticism of artificial additives.

Broader supply chain ramifications have also emerged as tariffs extend beyond sweeteners to encompass acidulants, emulsifiers, and specialty gums sourced from China. U.S. food and feed manufacturers report input cost increases of 20–30% for certain additives, straining margins in value-sensitive categories and driving interest in local production capabilities or regional supplier diversification . As a result, many firms have accelerated contingency planning, stockpiling critical ingredients ahead of tariff escalations and negotiating multi-year contracts to lock in pricing. These evolving dynamics underscore the importance of agile procurement and strategic inventory management in the current trade environment.

Unlocking Market Potential by Analyzing Sweetener Types, Ingredient Sources, Product Forms, and Distribution Strategies Driving Industry Segmentation

The feed flavors and sweeteners market can be dissected into distinct sweetener categories, each offering unique functional and sensory attributes. High intensity sweeteners such as aspartame, saccharin, and sucralose deliver a potent sweetness with minimal caloric contribution, while novel high-purity steviol glycosides like Reb M and monk fruit extracts cater to consumer preferences for natural, zero-calorie options. Polyols including sorbitol and xylitol provide a balance of sweetness and humectancy, supporting improved feed texture and moisture retention. Traditional sugars such as fructose and sucrose continue to play a role in targeted formulations where energy density and cost considerations align.

Source origins further refine market segmentation, distinguishing animal-derived ingredients-including dairy- and fish-derived flavor extracts-from plant-derived options drawn from fruits, spices, and vegetables. Synthetic sweeteners, produced via chemical synthesis or fermentation processes, offer scalability and price stability but require careful compliance with non-GMO and clean-label standards. Meanwhile, the choice of product form-liquid concentrates, oil-based oleoresins or essential oil blends, and spray-dried or spray-chilled powders-affects handling, dosing accuracy, and stability across diverse feed manufacturing processes.

Distribution channels complete the segmentation landscape, with direct sales enabling customized technical support for large-scale feed mills. Distributors serve as critical intermediaries in regional markets, providing inventory buffers and logistical reach. The emergence of e-commerce platforms has introduced a new direct-to-small-farm channel, democratizing access to specialized flavor and sweetener solutions for niche and artisanal producers.

This comprehensive research report categorizes the Feed Flavors & Sweeteners market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Sweetener Type

- Source

- Form

- Distribution Channel

Exploring How Regional Dynamics across the Americas, Europe, the Middle East, Africa, and Asia-Pacific Influence Demand, Regulation, and Innovation

Regional dynamics exert a profound influence on the feed flavors and sweeteners market, as local regulatory frameworks, production capacities, and consumer trends vary significantly. In North America, stringent animal welfare regulations and a well-developed industrial farming infrastructure have spurred adoption of advanced premix solutions. The United States market for feed sweeteners alone is projected to grow steadily, supported by a robust pet and domestic animal care culture and renewed investment in local extraction and processing capabilities.

Across Europe, the Middle East, and Africa, regulatory emphasis on clean labels and reduced antibiotic use has elevated demand for natural sweeteners and flavor enhancers that comply with strict EU directives. In EMEA, sodium and sugar reduction initiatives in processed foods have driven parallel opportunities in feed formulations, as manufacturers leverage Tastesense natural blends to maintain palatability while meeting health-driven mandates. Meanwhile, emerging markets in the Middle East and Africa are characterized by rapid growth in intensive poultry and aquaculture industries, creating pockets of heightened demand for functional feed additives.

Asia-Pacific continues to represent the fastest-growing regional segment, fueled by rapid urbanization, rising protein consumption, and government programs supporting sustainable livestock development. Nations such as China, India, and Southeast Asian economies are investing in local flavor and sweetener production capacities to reduce import dependency and enhance supply chain resilience. The APAC region’s dynamic livestock expansion has positioned feed flavors and sweeteners as essential components of national food security strategies.

This comprehensive research report examines key regions that drive the evolution of the Feed Flavors & Sweeteners market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Inside the Strategic Initiatives of Leading Flavors and Sweeteners Companies Driving Innovation, Growth, and Sustainability in a Competitive Market

Leading global ingredient suppliers are positioning themselves at the forefront of innovation through strategic investments, partnerships, and product launches. Cargill has leveraged its joint venture Avansya to commercialize EverSweet, a next-generation stevia sweetener produced via proprietary fermentation techniques that yield high-purity Reb M and Reb D without leaf extraction. This launch supports deeper sugar reduction in feed and pet food formulations, while preserving clean taste and supply chain transparency. Concurrently, Cargill’s recognition at the 2025 Edison Awards underscores its commitment to breakthrough solutions-from precision nutrition to climate-smart agricultural practices-reinforcing its leadership in food and ag innovation.

Kerry Group has expanded its global footprint through targeted acquisitions and the rollout of its 2025 Taste Charts, an interactive tool delivering real-time flavor trend insights across 13 regions. The opening of a new taste manufacturing facility in Rwanda enhances capacity to serve local markets with authentic, sustainable flavor solutions. Kerry’s strategic direction emphasizes proactive health, exemplified by the launch of its Tastesense Sweetness suite to enable one-to-one sugar replacement, and LC40® probiotics to support animal gut health, reflecting the company’s holistic approach to sustainable nutrition.

Tate & Lyle’s transformative acquisition of CP Kelco for $1.8 billion has broadened its pectin, gellan gum, and hydrocolloid capabilities, culminating in an expanded ingredient portfolio showcased at IFT FIRST 2025. The debut of its Mouthfeel Lab demonstrates tactile applications of multi-layered textures, aeration systems, and fiber fortification, while the launch of All-Americas Stevia Reb M and Optimizer Stevia® 8.10 underscores its leadership in high-potency, cost-efficient sweetness solutions.

ADM Animal Nutrition, an established agribusiness powerhouse, has doubled down on research into healthy indulgence, securing top honors at the 2025 BIS Awards for its natural extracts, stevia, and sucralose solutions. Its acquisition of Revela Foods has augmented its dairy flavor capabilities, while its 2025 strategy emphasizes protein and fiber enrichment, gut-microbiome innovations, and regional flavor adaptations, setting a clear path to meet evolving producer and consumer demands.

This comprehensive research report delivers an in-depth overview of the principal market players in the Feed Flavors & Sweeteners market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adisseo

- Alltech Inc

- Archer Daniels Midland Company

- Aromatech Group

- Barentz

- Bell Flavors & Fragrances

- Cargill Incorporated

- CBS Bio Platforms Inc

- Diana Pet Food

- DSM Nutritional Products AG

- Evonik Industries AG

- Grupo Ferrer Internacional

- Impextraco NV

- International Flavors & Fragrances Inc

- Kaesler Nutrition GmbH

- Kemin Industries Inc

- Kerry Group plc

- LABORATOIRES PHODE

- Layn Natural Ingredients

- Lucta

- Norel S.A

- Palital Feed Additives B.V

- Phytobiotics Futterzusatzstoffe GmbH

- Prinova Group LLC

- Sensient Technologies Corporation

- Solvay S.A

- Symrise AG

- Tate & Lyle PLC

Strategic Imperatives for Industry Leaders to Harness Innovation, Sustainability, and Partnership Opportunities in the Flavors and Sweeteners Arena

To maintain a leading position in the rapidly evolving feed flavors and sweeteners arena, industry players should integrate a series of strategic actions. Organizations must prioritize R&D investments in next-generation production methods such as precision fermentation and biocatalysis, enabling cost-competitive, high-purity sweeteners that align with natural labeling requirements. Simultaneously, formulating multi-functional flavor-sweetener systems that deliver synergistic sensory and performance benefits can differentiate offerings in crowded markets.

Supply chain resilience must be fortified through diversification of raw material sources and regional processing capabilities, mitigating tariff risks and logistical disruptions. Stakeholders should establish strategic partnerships with upstream growers and biotechnology innovators to secure proprietary ingredient pipelines and reinforce quality control. Additionally, embracing digital tools for supply chain transparency-including blockchain traceability and AI-driven demand forecasting-will enable more agile procurement and reduce exposure to price volatility.

Commercial success hinges on tailored customer engagement, leveraging data-driven insights to develop regional flavor profiles and application-specific formulations. Organizations should collaborate directly with feed manufacturers and animal nutritionists to co-create solutions that address species-specific taste preferences, health considerations, and cost targets. Finally, proactive regulatory alignment-through active participation in industry working groups and early adoption of emerging feed additive standards-will minimize compliance burdens and position companies as trusted partners in sustainable animal production.

Rigorous Multi-Method Research Approach Integrating Secondary Analysis, Expert Interviews, and Quantitative Techniques to Inform Industry Decisions

This study employed a rigorous multi-method research framework to ensure comprehensive, data-driven insights. Secondary research included the analysis of peer-reviewed journals, industry white papers, patent filings, and regulatory filings from the FDA, USDA, and European Food Safety Authority. Proprietary databases and market intelligence platforms provided historical and real-time data on production volumes, trade flows, and price trends.

Primary research encompassed in-depth interviews with C-suite executives, R&D directors, and purchasing managers across leading feed additive manufacturers and end-users. Expert panels and focus groups comprising nutrition scientists, formulation specialists, and supply chain experts validated market assumptions and refined segmentation hypotheses.

Quantitative analysis leveraged statistical modeling and scenario planning to assess the impact of 2025 tariff changes, regional regulatory shifts, and technological adoption rates. A three-tiered segmentation approach examined sweetener type, source, product form, and distribution channel, while geospatial analytics highlighted regional demand patterns and growth drivers. Cross-validation of multiple data sources ensured consistency and accuracy, providing a robust foundation for actionable recommendations.

This methodology underscores an unwavering commitment to objectivity, transparency, and methodological rigor, delivering insights that enable informed decision-making for stakeholders across the feed flavors and sweeteners value chain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Feed Flavors & Sweeteners market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Feed Flavors & Sweeteners Market, by Sweetener Type

- Feed Flavors & Sweeteners Market, by Source

- Feed Flavors & Sweeteners Market, by Form

- Feed Flavors & Sweeteners Market, by Distribution Channel

- Feed Flavors & Sweeteners Market, by Region

- Feed Flavors & Sweeteners Market, by Group

- Feed Flavors & Sweeteners Market, by Country

- United States Feed Flavors & Sweeteners Market

- China Feed Flavors & Sweeteners Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2385 ]

Reflecting on Market Dynamics, Emerging Trends, and Strategic Imperatives That Will Shape the Future of Feed Flavors and Sweeteners

Throughout this executive summary, we have explored the intricate web of factors redefining the feed flavors and sweeteners market, from transformative technological advances and segmentation complexities to shifting regional dynamics and strategic corporate initiatives. The cumulative effect of U.S. tariffs underscores the critical importance of agile sourcing strategies and cost-management protocols in sustaining competitiveness.

Key segmentation insights highlight the nuanced interplay between sweetener types, source origins, product formats, and distribution channels, each requiring specialized innovation and go-to-market approaches. Regional analyses reinforce the need for tailored solutions that resonate with local regulatory environments, consumer behaviors, and production infrastructures across the Americas, EMEA, and Asia-Pacific.

Leading industry participants have demonstrated a clear commitment to forward-looking R&D, sustainable ingredient sourcing, and collaborative partnerships, setting the stage for continued growth and differentiation. To capitalize on these trends, companies must embrace integrated strategies that balance innovation, operational resilience, and stakeholder alignment.

As market dynamics evolve, the agility to pivot formulations, optimize supply chains, and engage in collaborative co-creation will define competitive leadership. The insights and recommendations presented here serve as a strategic compass for navigating complexity, harnessing emerging opportunities, and delivering tangible value across the feed flavors and sweeteners ecosystem.

Connect with Our Sales Leadership to Secure Access to an Exclusive Feed Flavors & Sweeteners Market Research Report Tailored to Your Strategic Goals

Don’t miss your opportunity to gain an unrivaled competitive edge in the dynamic feed flavors and sweeteners market. Reach out to Ketan Rohom, Associate Director, Sales & Marketing, to explore a tailor-made presentation of our comprehensive research findings. Whether you need a detailed briefing on tariff impacts, segmented analyses, or strategic recommendations, Ketan will guide you through the insights that matter most to your business objectives. Connect with him today to secure your copy of the full market report and empower your decision-making with data-driven clarity and foresight

- How big is the Feed Flavors & Sweeteners Market?

- What is the Feed Flavors & Sweeteners Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?