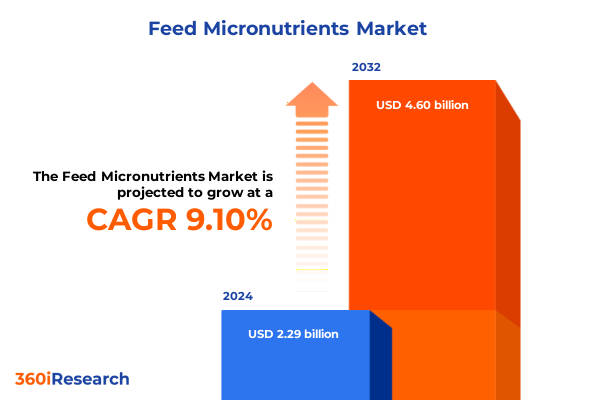

The Feed Micronutrients Market size was estimated at USD 2.49 billion in 2025 and expected to reach USD 2.70 billion in 2026, at a CAGR of 9.17% to reach USD 4.60 billion by 2032.

Discovering the Critical Role of Micronutrient Integration in Animal Feed to Optimize Livestock Health and Performance in a Rapidly Evolving Agricultural Landscape

In an era where global food security, regulatory scrutiny, and consumer expectations converge, the integration of optimized micronutrient solutions within animal feed has never been more critical. Micronutrients-encompassing essential minerals and vitamins-play a foundational role in enhancing physiological processes that drive growth performance, immune resilience, and reproductive efficiency. As livestock producers grapple with volatile input costs, shifting trade policies, and rising demands for sustainable farming practices, the adoption of precise micronutrient formulations emerges as a pivotal factor in maintaining competitive advantage.

This introductory analysis delves into the strategic importance of micronutrient supplementation within feed matrices, illustrating how tailored solutions address key challenges such as nutrient bioavailability, feed conversion efficiency, and environmental impact through reduced mineral excretion. By examining the intersection of animal health science and feed technology innovations, the discussion establishes a clear framework for understanding the downstream effects on production economics and brand differentiation. Ultimately, readers will grasp why a holistic approach to micronutrient integration is indispensable for stakeholders aiming to optimize both yield and ethical performance standards.

Examining the Groundbreaking Shifts Reshaping the Feed Micronutrient Market Under Pressure from Technological, Regulatory, and Consumer-Driven Forces

Across the feed micronutrient sector, technological breakthroughs, evolving regulations, and shifting consumer preferences are catalyzing transformative shifts that redefine competitive dynamics. Advanced delivery systems, such as microencapsulation and chelation technologies, are enhancing nutrient stability and absorption, thereby unlocking new opportunities for precision nutrition. Concurrently, regulatory frameworks are tightening oversight of trace mineral and vitamin inclusion rates, compelling manufacturers to innovate compliant solutions that maintain efficacy without compromising safety thresholds.

Moreover, the rise of sustainability-driven labeling claims and retailer requirements is elevating transparency demands across supply chains. Producers are increasingly pressed to demonstrate traceability of raw material sources while optimizing formulations to reduce environmental excretion of minerals. In conjunction with digitization trends-where data-driven feed management platforms deliver real-time performance analytics-the market is witnessing an unprecedented emphasis on integrated, evidence-based nutritional strategies. As a result, incumbents and new entrants alike must adapt to a landscape defined by heightened complexity and opportunity.

Unpacking the Far-Reaching Consequences of 2025 United States Trade Tariffs on Feed Micronutrient Supply Chains and Industry Cost Structures

In early 2025, the United States implemented targeted tariffs on imported feed micronutrient additives, significantly altering the cost structures for downstream feed manufacturers. These policy amendments introduced duties on key mineral and vitamin inputs originating from select exporting regions, triggering immediate supply chain recalibrations. Domestic producers responded by seeking alternative sourcing strategies and optimizing in-house blending capabilities to mitigate margin erosion.

Over subsequent months, the cumulative impact of these tariff measures has manifested in upward pressure on production costs, compelling end-users to reexamine procurement strategies. Forward-thinking integrators have prioritized strategic partnerships with domestic suppliers and invested in process efficiencies to offset heightened duties. Nevertheless, smaller feed mills with limited hedging capacity face ongoing challenges in maintaining price competitiveness. Consequently, the tariff landscape has underscored the critical importance of flexible sourcing networks and proactive risk management during periods of trade policy volatility.

Unraveling Distinct Market Segmentation Patterns Across Additive Types, Animal Species, Product Forms, Application Stages, and Distribution Channels

The feed micronutrient market is defined by multiple dimensions of segmentation that collectively shape purchasing behaviors and innovation pathways. Based on additive type, the market subdivides into chelated minerals, macrominerals, trace minerals, and vitamins, with further granularity within each category-macrominerals such as calcium, magnesium, phosphorus, and sodium; trace minerals including copper, iron, manganese, and zinc; and vitamins covering vitamin A, the B complex, D3, and E variants. This additive type segmentation illustrates how each nutrient class addresses distinct physiological requirements and performance outcomes, driving variation in adoption rates across different animal husbandry practices.

Animal type segmentation introduces additional complexity, as aquatic species, poultry, ruminants, and swine exhibit varying metabolic pathways and micronutrient demands. While fish and shrimp operations grapple with water-soluble nutrient retention, ruminant formulations must account for rumen stability factors. Likewise, product form segmentation-liquid versus powder-affects handling, mixing accuracy, and feed mill integration, influencing user preference based on operational capacity and storage considerations.

Application stage offers another critical lens for market analysis, as finisher, grower, pre-weaning, and starter feed categories each necessitate tailored nutrient profiles to support growth milestones and health benchmarks. Finally, sales channel segmentation-direct sales through integrated feed producers, distributor networks serving regional end-users, and online sales platforms offering specialty nutrient blends-reflects evolving procurement patterns and the growing importance of digital engagement. Together, these segmentation insights underscore the multifaceted nature of micronutrient integration, guiding suppliers in developing targeted value propositions and go-to-market strategies.

This comprehensive research report categorizes the Feed Micronutrients market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Additive Type

- Animal Type

- Form

- Application

- Sales Channel

Profiling Key Regional Dynamics That Drive Demand Variations Across the Americas, Europe, Middle East & Africa, and Asia-Pacific Markets

Market dynamics vary substantially across geographic regions, shaped by differing regulatory regimes, livestock demographics, and feed production infrastructures. In the Americas, strong demand from North American poultry and swine sectors is driving adoption of next-generation chelated minerals and customized vitamin packages, while Latin American aquaculture operations focus on cost-effective magnesium and phosphorus solutions to improve feed conversion in tilapia and shrimp farms. Meanwhile, Europe, the Middle East, and Africa present a highly regulated environment with stringent nutrient inclusion standards and a growing emphasis on sustainable sourcing, prompting suppliers to advocate for lower environmental footprints and transparent traceability of mineral origins.

In the fast-growing Asia-Pacific region, burgeoning livestock populations in China and India are intensifying demand for balanced trace mineral blends and vitamin D3 supplements to support high-volume poultry production. Emerging Southeast Asian markets are also capitalizing on feed micronutrient programs to elevate productivity in smallholder dairy and swine units, where targeted supplementation can yield rapid health improvements. Despite these regional variations, one common thread is the strategic value attributed to micronutrient optimization as countries strive to satisfy rising protein consumption expectations within the context of environmental and economic sustainability goals.

This comprehensive research report examines key regions that drive the evolution of the Feed Micronutrients market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting the Competitive Landscape Through Strategic Profiles of Leading Feed Micronutrient Providers Shaping Industry Innovation and Growth

Competition in the feed micronutrient arena is anchored by a combination of global chemical conglomerates, specialized nutrition firms, and agile regional players. Leading conglomerates leverage extensive R&D channels to introduce proprietary mineral chelates and vitamin micronization technologies that enhance bioavailability. By contrast, mid-sized specialists differentiate through deep technical service offerings, counseling producers on formulation refinements and on-farm trials that validate product efficacy under local conditions.

Regional firms are equally influential, often capitalizing on proximity to raw material sources or established relationships with feed mills. They excel at delivering tailored formulations that align with endemic feed crop profiles or aquatic farming practices. Across the competitive spectrum, alliances between ingredient suppliers and feed integrators are becoming more commonplace, reflecting a strategic pivot toward end-to-end solutions. These partnerships not only streamline product development but also reinforce customer loyalty through co-marketing and joint technical support initiatives.

This comprehensive research report delivers an in-depth overview of the principal market players in the Feed Micronutrients market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adisseo Company SAS

- Alltech, Inc.

- Archer Daniels Midland Company

- Aries Agro Limited

- BASF SE

- Biochem Zusatzstoffe Handels‑ und Produktionsgesellschaft mbH

- Cargill, Incorporated

- Coromandel International Limited

- Dow Inc.

- Guaranty Group

- Haifa Group

- Kemin Industries, Inc.

- Koninklijke DSM N.V.

- Lallemand Inc.

- Merc er Milling Company, Inc.

- Novus International, Inc.

- Nutreco N.V.

- Orffa International Holding B.V.

- Pancosma S.A.

- Phibro Animal Health Corporation

- QualiTech Corp.

- Ridley Corporation Limited

- Tanke Biosciences Corporation

- Vamso Biotec Pvt Ltd.

- Zinpro Corporation

Delivering Actionable Strategies for Industry Leaders to Navigate Volatile Markets, Enhance Supply Chain Resilience, and Leverage Emerging Opportunities

Industry leaders must calibrate their strategies to balance cost management, innovation acceleration, and market expansion. First, optimizing supply chain resilience through diversified sourcing agreements and strategic inventory buffers can mitigate the impact of trade disruptions. Producers should also invest in collaborative R&D partnerships that harness academic and technology institute expertise, ensuring access to next-generation micronutrient delivery mechanisms.

Simultaneously, companies need to refine their customer engagement models by offering value-added services such as on-site nutritional audits, digital formulation platforms, and comprehensive training programs for feed mill technicians. Embracing a solutions-oriented sales approach that bundles micronutrient products with performance monitoring tools can foster deeper client relationships and facilitate premium pricing. Furthermore, an unwavering focus on sustainability credentials-from responsibly sourced raw materials to reduced mineral excretion protocols-will resonate with both regulators and end consumers, positioning innovators as market leaders in an era of heightened environmental awareness.

Detailing a Robust Research Framework Combining Primary Interviews, Secondary Data Sources, and Rigorous Analytical Techniques to Ensure Data Integrity

This research framework integrates a blend of primary and secondary methodologies to ensure comprehensive market coverage and analytical rigor. Primary research comprised structured interviews with feed mill managers, animal nutritionists, and procurement directors across major producing regions, yielding firsthand insights into formulation challenges and supplier selection criteria. These qualitative inputs were triangulated with quantitative data derived from industry databases, trade flow records, and corporate disclosures to validate key supply chain and cost dynamics.

Secondary research encompassed a systematic review of regulatory filings, technical whitepapers, and conference proceedings relating to micronutrient innovations and policy impacts. All data points underwent rigorous cross-verification to reconcile discrepancies and establish cohesive trend narratives. Advanced statistical techniques and scenario analysis tools were then applied to model the effects of tariff shifts, segmentation variables, and regional demand drivers. This multi-tiered approach ensures that the findings reflect both the current market realities and the potential trajectories of feed micronutrient integration.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Feed Micronutrients market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Feed Micronutrients Market, by Additive Type

- Feed Micronutrients Market, by Animal Type

- Feed Micronutrients Market, by Form

- Feed Micronutrients Market, by Application

- Feed Micronutrients Market, by Sales Channel

- Feed Micronutrients Market, by Region

- Feed Micronutrients Market, by Group

- Feed Micronutrients Market, by Country

- United States Feed Micronutrients Market

- China Feed Micronutrients Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Concluding Insights Emphasizing the Imperative for Integrated Micronutrient Strategies to Sustain Productivity, Profitability, and Animal Welfare

As feed producers confront the dual imperatives of productivity and sustainability, the integration of targeted micronutrient programs stands out as a high-impact lever for performance enhancement. Strategic supplementation not only safeguards animal well-being but also delivers tangible improvements in feed efficiency, immune resilience, and product quality. The insights presented here underscore the necessity of a segmented, data-driven approach to product design and market engagement-one that aligns solution attributes with species-specific physiology, regional conditions, and evolving regulatory requirements.

Through the convergence of advanced delivery technologies, collaborative industry partnerships, and sophisticated analytical frameworks, stakeholders can achieve sustainable growth while minimizing ecological footprints. Ultimately, success in the feed micronutrient sector will hinge on the ability to deliver tailored, value-added solutions that address the nuanced needs of modern animal production systems.

Seize Comprehensive Market Intelligence from an Expert Analyst to Inform Strategic Decisions and Accelerate Business Growth in Feed Micronutrients

If you’re prepared to move forward with a strategic edge in the feed micronutrients space, our expert can guide you through the depth of this analysis and tailor the findings to your unique business context. Reach out to Ketan Rohom, Associate Director, Sales & Marketing, and gain direct access to a comprehensive market research report that equips you with actionable insights and supports your decision-making process. Secure your copy today to capitalize on emerging trends, fortify your supply chain strategies, and drive sustainable growth in an increasingly competitive landscape.

- How big is the Feed Micronutrients Market?

- What is the Feed Micronutrients Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?