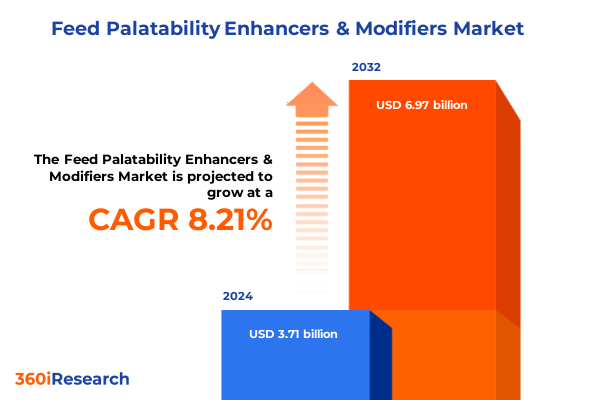

The Feed Palatability Enhancers & Modifiers Market size was estimated at USD 4.02 billion in 2025 and expected to reach USD 4.32 billion in 2026, at a CAGR of 8.18% to reach USD 6.97 billion by 2032.

Unlocking the Future of Animal Nutrition Through Innovative Feed Palatability Enhancers That Drive Intake and Performance Across Livestock Segments

The feed palatability enhancers and modifiers sector has emerged as a pivotal component of modern animal nutrition strategies, driven by producers’ pursuit of optimized intake, improved feed conversion, and heightened animal welfare. As global demand for animal protein intensifies, formulators are increasingly turning to specialized additives-ranging from acidifiers and yeast extracts to advanced flavor and sweetener systems-to ensure consistent consumption and nutrient uptake across livestock species. Notably, the rising emphasis on antibiotic-free and organic production has catalyzed a shift toward natural, clean-label palatability solutions that align with evolving consumer expectations and stringent regulatory frameworks.

Simultaneously, the convergence of technological innovation and sustainability imperatives has inspired a new generation of delivery platforms-such as microencapsulation and controlled-release matrices-that preserve enhancer efficacy while minimizing environmental impact. These breakthroughs are complemented by AI-driven formulation tools, enabling manufacturers to customize blends for species-specific palatability profiles, regional dietary preferences, and lifecycle stages. As a result, the market is witnessing an unprecedented integration of sensory and functional performance, underscoring the strategic value of palatability modifiers in supporting both productivity and animal health outcomes.

Looking ahead, the feed palatability enhancers and modifiers landscape is poised for sustained growth, buoyed by the global drive for efficient, sustainable agriculture. This report provides an executive overview of transformative shifts, tariff impacts, segmentation insights, and regional dynamics to inform stakeholders’ strategic planning and investment decisions. By illuminating the critical forces shaping this dynamic industry, we aim to equip decision-makers with the insights necessary to navigate evolving market demands and emerging opportunities.

How Breakthrough Delivery Technologies and Consumer Demand for Natural Solutions Are Reshaping Feed Palatability for the Next Generation of Livestock Nutrition

The landscape of feed palatability enhancers and modifiers has undergone a paradigm shift, characterized by rapid technological advances and shifting stakeholder priorities. Innovations in microencapsulation and coating technologies now enable formulators to protect flavor and sweetener compounds from oxidative degradation, ensuring controlled release along the digestive tract. This precision delivery not only enhances taste perception but also maximizes functional benefits-such as acidification and gut health support-over extended periods. These transformative technologies have become critical enablers of tailored solutions that cater to the unique sensory and physiological requirements of different species and production stages.

Concurrently, consumer and regulatory pressures are accelerating the adoption of natural and sustainable palatability agents. Ingredient manufacturers are increasingly sourcing plant-derived and animal-derived natural flavors, essential oils, and yeast-based extracts to meet clean-label criteria, reduce environmental footprints, and align with antibiotic stewardship initiatives. In response, strategic partnerships between feed additive suppliers, research institutions, and feed producers have flourished, fostering collaborative development of integrated formulations that blend sensory appeal with bioactive functionalities such as enhanced gut integrity and immune modulation.

Finally, digital transformation and data analytics are redefining market engagement and distribution models. E-commerce platforms, AI-driven formulation software, and real-time feed intake monitoring tools empower stakeholders to optimize product portfolios, fine-tune dosage regimens, and respond swiftly to emerging nutritional trends. These interconnected shifts underscore a market in transition-one where agility, innovation, and sustainability converge to redefine palatability enhancement strategies for the modern era.

Navigating the Ripple Effects of Escalating Agricultural Trade Tensions and U.S. Tariffs on Feed Ingredient Supply and Costs

The cumulative impact of the United States’ tariff measures in early 2025 has reverberated across global feed ingredient supply chains, driving cost escalations and logistical complexities for palatability enhancer production. On March 3, 2025, U.S. authorities imposed a 25% tariff on imports from Canada and Mexico alongside an increase of existing levies on Chinese goods from 10% to 20%. This action targeted raw materials critical to additive manufacturing, including specialty acids and flavor precursors, prompting suppliers to reassess sourcing strategies amid higher landed costs.

Subsequently, China enacted reciprocal tariffs on a broad suite of U.S. agricultural exports beginning March 10, 2025, adding 15% duties on chicken, wheat, and corn, with a further 10% on soybeans, pork, and dairy. These retaliatory measures intensified volatility in global grain markets and compressed ingredient availability for feed applications. In response, U.S. producers announced reciprocal tariffs on April 2, 2025, encompassing imports from the European Union, India, and other key partners-a move that amplified input cost pressures for feed and additive manufacturers dependent on internationally sourced components.

A temporary respite arrived on May 12, 2025, when a 90-day tariff pause agreement between the U.S. and China reduced reciprocal duties by 115%, easing financial burdens for animal feed exporters and ingredient buyers. Nonetheless, the aggregate effect of these policy oscillations underscores the fragility of supply chains and the imperative for industry stakeholders to diversify sourcing, optimize inventory management, and engage proactively in trade dialogue. As tariff landscapes evolve, strategic risk mitigation and adaptive procurement models will be essential to maintaining supply continuity and cost competitiveness in the palatability enhancer sector.

Unveiling Insights from Diverse Market Segmentation Revealing Growth Drivers Across Product, Technology, Formulation, Species, and Channel Categories

Examining the market through the lens of product and application segmentation reveals nuanced growth drivers and adoption patterns that underpin palatability enhancer demand. When dissecting the market by type, acidifiers, flavors, sweeteners, texturizers, and yeast extracts emerge as core categories-each reflecting distinct functional roles. Flavors bifurcate into natural and synthetic options, with natural variants further classified into animal-derived and plant-derived sources to address clean-label mandates. Sweeteners include artificial agents, polyols, and sugar-based alternatives, while texturizers encompass both fibers and hydrocolloids for targeted mouthfeel modulation. Yeast extracts, valued for their umami profiles and nutritional contributions, round out the type-based landscape.

Shifting to product form, liquid solutions, pellets, and powders underpin distribution flexibility. Liquids divide into soluble concentrates and suspensions optimized for rapid dissolution or sustained dispersion, whereas powder formats split into granulated and spray-dried offerings engineered for precise dosing and shelf stability. Pelletized enhancers support on-farm ease of integration, particularly in on-site premixing operations.

Technology segmentation accentuates advanced coating, encapsulation, and microencapsulation techniques, which safeguard labile compounds and enable time-release functionalities. Focusing on the target species dimension, aquaculture, companion animals, poultry, ruminants, and swine constitute principal application verticals, with specialized subcategories-fish and shrimp, cats and dogs, broilers, layers and turkeys, beef cattle, dairy cattle and sheep/goat, as well as grower-finisher, sows and weaners-driving tailored solution development. Lastly, distribution channels span direct sales, distributor networks, and rapidly expanding e-commerce models, the latter split between proprietary websites and third-party marketplaces. This comprehensive segmentation framework illuminates distinct opportunities for targeted innovation and strategic investment across the feed palatability enhancers and modifiers ecosystem.

This comprehensive research report categorizes the Feed Palatability Enhancers & Modifiers market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Form

- Technology

- Animal

- Distribution Channel

Exploring How Regional Dynamics in the Americas, EMEA, and Asia-Pacific Are Shaping Demand and Innovation in Feed Palatability Solutions

Regional market dynamics are pivotal to understanding the trajectory of feed palatability enhancer adoption across major geographies. In the Americas, advanced feed mills and pet food manufacturers spearhead demand for premium palatability agents, particularly aroma boosters in high-end companion animal diets and marine-based attractants in aquaculture. This region’s robust infrastructure and early technology adoption drive rapid integration of microencapsulation and controlled-release systems to optimize feed conversion ratios under intensive production models.

Europe, Middle East and Africa (EMEA) face a distinct regulatory landscape, where antibiotic reduction mandates and sustainability goals catalyze the uptake of natural, plant- and animal-derived flavors alongside acidifiers with gut health benefits. The European livestock sector’s structural protein deficit amplifies reliance on imported soybean meal and essential amino acid additives, intensifying the impact of trade policies and elevating the strategic importance of efficient palatability enhancers in maintaining feed intake and productivity.

Asia-Pacific stands out for its exponential livestock sector expansion, anchored by China and India’s large-scale poultry, swine, and aquaculture operations. Government initiatives promoting modernized animal feeding practices, alongside surging pet ownership in urban centers, are fueling demand for both natural and synthetic palatability solutions. Precision feeding techniques supported by data analytics are emerging as key enablers of region-specific flavor profiles, tailoring enhancer blends to diverse species preferences and dietary formulations. This dynamic interplay of production scale, regulatory emphasis, and consumer trends underscores Asia-Pacific’s critical role in shaping global market directions.

This comprehensive research report examines key regions that drive the evolution of the Feed Palatability Enhancers & Modifiers market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Revealing the Strategic Positions and Innovation Approaches of Leading Global Players Driving Feed Palatability Enhancer Excellence

The competitive landscape of feed palatability enhancers and modifiers features a blend of multinational corporations and specialized ingredient innovators. Industry titans such as Archer Daniels Midland (ADM), Cargill Inc., and DSM Nutritional Products leverage broad distribution networks and extensive R&D capabilities to deliver a full spectrum of acidifiers, flavors, sweeteners, and texturizers. ADM is renowned for its encapsulated flavor systems and collaborative development of aroma enhancers tailored to pet food applications, while Cargill’s strategic partnerships have yielded sustainable sweetening solutions with controlled-release profiles for livestock and aquaculture feeds.

Meanwhile, DuPont Nutrition & Health, Kerry Group, and BASF SE maintain leadership positions through proprietary flavor compounds and functional yeast extracts that support gut health and intake consistency. Emerging players such as Elanco Animal Health and Kemin Industries are expanding their footprints with novel bioactive acidifiers and plant-based flavor portfolios. This competitive mosaic underscores a market in which innovation, regulatory compliance, and sustainability credentials are decisive factors influencing product development and partnership strategies.

Strategic alliances between ingredient suppliers, biotechnology firms, and feed producers are accelerating the co-creation of integrated palatability and nutritional solutions. As differentiation increasingly hinges on clean-label claims and precision performance, market participants continue to invest in microencapsulation technologies, digital formulation platforms, and global supply chain enhancements to meet the evolving needs of livestock and companion animal feed sectors.

This comprehensive research report delivers an in-depth overview of the principal market players in the Feed Palatability Enhancers & Modifiers market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adisseo France SAS

- AFB International

- Alltech Inc

- Archer Daniels Midland Company

- Cargill Incorporated

- DuPont de Nemours Inc

- Elanco Animal Health Incorporated

- Ensign-Bickford Industries Inc

- Evonik Industries AG

- Impextra coNV

- Kemin Industries Inc

- Kent Nutrition Group Inc

- Kerry Group PLC

- Koninklijke DSM N.V.

- Lucta S.A.

- Novus International Inc

- Nutreco N.V.

- Phytobiotics Futterzusatzstoffe GmbH

- Prinova Group LLC

- Solvay S.A.

- Symrise AG

- Tanke Industry Group

- Virbac S.A.

Actionable Strategic Priorities for Advancing Palatability Innovation and Securing Resilient Supply Chains in a Complex Trade Environment

To capitalize on burgeoning opportunities and mitigate ongoing challenges, industry leaders should prioritize a multi-pronged commercial and innovation agenda. First, investing in next-generation delivery technologies-such as advanced microencapsulation and precision coating-will safeguard enhancer integrity and support controlled nutrient release, thereby optimizing feed conversion and cost efficiency.

Second, forging strategic partnerships with specialty raw material suppliers and academic research centers can accelerate development of novel natural flavor and sweetener compounds that align with clean-label standards and regional regulatory requirements. These collaborations will not only enhance product differentiation but also reinforce sustainability narratives critical to brand perception and market acceptance.

Third, expanding digital engagement through e-commerce platforms and AI-driven formulation tools will streamline customer interactions, enable real-time dosage optimization, and support data-backed decisions at the feed mill and farm levels. This digital-first approach can unlock new revenue streams and foster closer customer relationships by delivering tailored palatability solutions.

Finally, in light of recent tariff volatility, stakeholders should embrace diversified sourcing strategies, build regional manufacturing capacities, and engage proactively in trade policy forums to secure stable ingredient supply and competitive pricing. By integrating these recommendations into corporate roadmaps, feed additive producers and feed integrators can position themselves for resilient growth and sustained leadership in the evolving palatability enhancers landscape.

Ensuring Reliability Through a Robust Triangulated Research Methodology Integrating Primary Stakeholder Insights and Secondary Data

This report’s conclusions and recommendations are underpinned by a rigorous research methodology combining both primary and secondary data sources. The process began with an in-depth review of industry publications, regulatory filings, patent databases, and scientific literature to map current technologies, ingredient profiles, and regulatory frameworks governing feed palatability enhancers.

Primary research comprised structured interviews and surveys with key stakeholders-including ingredient suppliers, feed mill managers, nutritionists, and end users-to capture firsthand insights on formulation trends, adoption barriers, and emerging customer needs. These interactions provided qualitative perspectives on market dynamics, technology adoption rates, and strategic imperatives.

Quantitative forecasts and segmentation analyses employed a bottom-up approach, leveraging granular data on production volumes, application doses, and regional feed consumption patterns. Macro-level indicators-such as livestock population growth, protein consumption trends, and tariff schedules-were integrated to calibrate scenario analyses and stress-test growth assumptions.

Finally, the competitive landscape and company profiles were validated through cross-referencing public financial reports, press releases, and patent filings to ensure accuracy and credibility. This triangulated methodology ensures that the insights and projections presented herein reflect both empirical data and practitioner expertise, providing a robust foundation for strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Feed Palatability Enhancers & Modifiers market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Feed Palatability Enhancers & Modifiers Market, by Type

- Feed Palatability Enhancers & Modifiers Market, by Form

- Feed Palatability Enhancers & Modifiers Market, by Technology

- Feed Palatability Enhancers & Modifiers Market, by Animal

- Feed Palatability Enhancers & Modifiers Market, by Distribution Channel

- Feed Palatability Enhancers & Modifiers Market, by Region

- Feed Palatability Enhancers & Modifiers Market, by Group

- Feed Palatability Enhancers & Modifiers Market, by Country

- United States Feed Palatability Enhancers & Modifiers Market

- China Feed Palatability Enhancers & Modifiers Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2703 ]

Synthesizing Critical Insights to Guide Strategic Decisions in the Evolving Feed Palatability Enhancers Sector

This executive summary has traversed the critical dimensions of the feed palatability enhancers and modifiers market-from foundational introductions to transformative technological shifts, cumulative tariff impacts, detailed segmentation insights, regional dynamics, competitive landscapes, and actionable recommendations. The convergence of sustainability mandates, technological innovation, and evolving regulatory environments underscores the sector’s transition toward precision-driven, clean-label palatability solutions designed to maximize animal health and performance.

As global protein demand continues its upward trajectory, the strategic importance of ensuring consistent feed intake through targeted palatability compounds cannot be overstated. Stakeholders who proactively embrace advanced delivery platforms, forge collaborative innovation partnerships, and deploy adaptive sourcing strategies will be best positioned to navigate market volatility and capitalize on growth opportunities across livestock and companion animal segments.

The insights presented here are intended to equip executives, product managers, and investors with a comprehensive understanding of market levers and risk factors. By leveraging this analysis, decision-makers can craft informed strategies that align with both industry imperatives and emerging consumer demands, ensuring sustainable, profitable growth in the dynamic feed palatability enhancers and modifiers landscape.

Secure Your Market Intelligence Today by Partnering with Our Associate Director for Tailored Palatability Enhancer Insights

If you’re ready to gain a competitive edge with in-depth insights into the feed palatability enhancers and modifiers market, reach out to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. He can guide you through our comprehensive report and help tailor the analysis to your strategic objectives. Don’t miss this opportunity to leverage data-driven intelligence and actionable recommendations-connect today to secure your copy and empower your organization’s decision-making.

- How big is the Feed Palatability Enhancers & Modifiers Market?

- What is the Feed Palatability Enhancers & Modifiers Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?