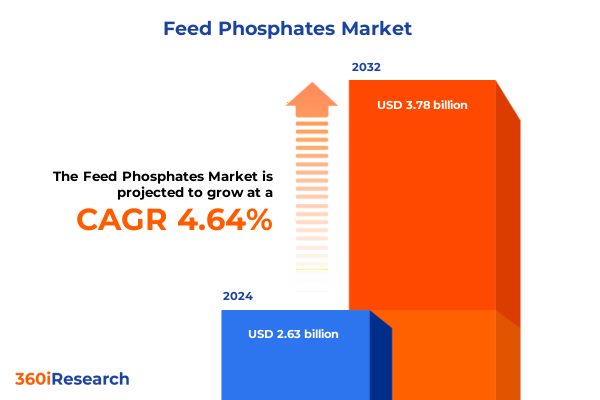

The Feed Phosphates Market size was estimated at USD 2.74 billion in 2025 and expected to reach USD 2.87 billion in 2026, at a CAGR of 4.68% to reach USD 3.78 billion by 2032.

Navigating Complexities of the Global Feed Phosphates Ecosystem to Illuminate Key Drivers Shaping Market Evolution and Strategic Growth Opportunities

Feed phosphates constitute a foundational pillar of modern animal nutrition, delivering essential phosphorus and calcium elements that drive optimal growth, bone development, and metabolic efficiency across livestock and aquaculture sectors. As global meat, dairy, and aquaculture production intensifies to satiate a burgeoning population’s protein appetite, the critical role of feed phosphates in maximizing feed conversion ratios has never been more pronounced. Coupled with evolving consumer preferences for sustainably produced animal protein, the dynamics surrounding sourcing, processing, and distributing feed phosphates now command heightened strategic attention.

In this context, stakeholders must navigate a complex ecosystem shaped by supply chain intricacies, raw material quality considerations, and tightening environmental regulations. Geopolitical factors-from trade tensions to export quotas-further compound market complexity, prompting companies to reevaluate sourcing strategies and invest in innovative production technologies. Transitioning from conventional approaches toward low-impurity, high-bioavailability phosphate products has emerged as a key differentiator.

This executive summary distills the most pertinent developments influencing the global feed phosphates market, weaving together insights on transformational shifts, tariff implications, segmentation dynamics, regional patterns, and competitive intelligence. Decision-makers will find a concise yet comprehensive overview that lays the groundwork for informed strategy development and sustainable value creation in an increasingly competitive landscape.

Uncovering Pivotal Technological, Regulatory, and Sustainability Transformations Reshaping the Feed Phosphates Industry’s Competitive Terrain

The feed phosphates landscape is undergoing seismic shifts as sustainability mandates, technological breakthroughs, and regulatory realignments converge to redefine competitive benchmarks. Producers are increasingly embracing advanced defluorination processes that curb environmental footprints while delivering superior product consistency. Simultaneously, the emergence of biotechnology-driven approaches to enhance phosphorus bioavailability underscores a transformative departure from traditional mineral supplementation techniques.

Parallel to these process innovations, digitalization is accelerating supply chain transparency-from mine to mill-enabling real-time tracking of quality parameters and compliance metrics. Cloud-based platforms and blockchain pilots are beginning to gain traction, empowering downstream feed formulators with verifiable data to support premium positioning and traceability claims. Moreover, tightening regulations around pollutant emissions and waste management in key markets have triggered capital investments in cleaner production facilities and resource recovery systems.

Collectively, these dynamics are reshaping value chains, incentivizing collaboration between phosphate miners, chemical processors, and feed additive specialists. Companies that proactively embed sustainability and technology at the core of their operations will be best positioned to capture the next wave of growth, while conventional players face mounting pressure to accelerate their transformation agendas.

Analyzing the Far-Reaching Consequences of United States 2025 Tariff Measures on Feed Phosphates Trade Flows and Cost Structures Across Supply Chains

In early 2025, the United States implemented a series of tariff adjustments targeting key feed phosphate imports, a response to shifting trade balances and domestic industry lobbying. These measures introduced incremental duties on granular and powdered phosphate shipments originating from select exporting nations, directly influencing procurement costs for feed manufacturers. As import expenses climbed, mid-stream processors encountered margin erosion, catalyzing efforts to redesign supply chain frameworks.

Domestic producers leveraged the tariff environment to boost local output, repurposing existing mineral feedstock facilities and accelerating capacity expansions. However, short-term production ramp-ups struggled to fully offset elevated costs, driving some end users to diversify sourcing toward alternative phosphate grades such as monocalcium and tricalcium variants, which were subject to different levy schedules. This strategic pivot also spurred negotiations for renegotiated long-term contracts with non-tariffed suppliers, creating pockets of supply realignment outside traditional trade corridors.

Downstream feed companies responded by optimizing formulation matrices to balance nutritional efficacy and cost constraints, intensifying research into synergistic feed additives that reduce overall phosphate requirements. While the cumulative impact of the 2025 tariffs elevated unit costs, it simultaneously fostered a more resilient and diversified marketplace, prompting stakeholders to innovate and collaborate in order to sustain margin performance under a new tariff-influenced paradigm.

Revealing Critical Segmentation Perspectives That Illuminate Type, Form, Distribution Channel, and Application Dimensions Driving Feed Phosphates Market Dynamics

A nuanced understanding of market segmentation reveals how each classification within feed phosphates influences purchasing behaviors, product innovation, and value creation. When examining the market by type, defluorinated phosphate has risen to prominence due to stringent impurity standards, whereas dicalcium phosphate maintains its status as the workhorse ingredient for balanced mineral supplementation. Monocalcium phosphate finds particular favor in monogastric feed formulations, and tricalcium phosphate is gaining traction where buffering capacity is prioritized.

Segmentation by form underscores a strategic divergence in handling and logistical preferences: granular products offer streamlined dosing and reduced dust generation, while powdered variants deliver greater solubility and precision in micro-ingredient delivery. Distribution channels likewise reflect evolving procurement strategies, as offline channels continue to dominate in regions with established feed mill networks, even as online brand websites and major e-commerce platforms steadily capture portions of direct sales by offering enhanced convenience and rapid replenishment.

By application, the market’s growth narrative unfolds across specialized domains: aquaculture feed formulations are driving demand for highly bioavailable phosphate variants, pet food producers emphasize ultra-purified grades to meet premium pet wellness standards, poultry integrators prioritize cost-efficient blends, and ruminant and swine feed manufacturers balance phosphorus requirements against environmental nutrient management imperatives. Each application segment demands tailored phosphate characteristics, underscoring the importance of integrated product portfolios and agile supply chain solutions to meet diverse end-user needs.

This comprehensive research report categorizes the Feed Phosphates market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Form

- Distribution Channel

- Application

Exploring Regional Market Variations Across Americas, Europe Middle East and Africa, and Asia Pacific to Uncover Unique Growth Drivers and Industry Challenges

Regional analysis illuminates disparate growth trajectories shaped by local consumption patterns, regulatory environments, and supply chain attributes. In the Americas, established livestock and aquaculture industries benefit from close proximity to native phosphate rock reserves, fostering a competitive advantage in dicalcium and monocalcium phosphate production, alongside rapid adoption of digital traceability tools within animal nutrition value chains.

Europe, Middle East & Africa present a mosaic of market conditions, where stringent environmental regulations and nutrient stewardship programs have elevated demand for defluorinated and ultra-purified phosphate grades. Meanwhile, Middle Eastern investments in integrated mining and processing complexes are redefining export capabilities, and Africa’s developing feed sectors are at the cusp of modernization, with targeted initiatives to upgrade feed mill infrastructures.

Asia-Pacific remains the most dynamic region, driven by explosive growth in aquaculture operations across Southeast Asia, a surging pet food market in China, and government-driven initiatives in India to enhance livestock productivity. The confluence of high feedstock consumption, rising animal protein demand, and public policy support for nutrient efficiency is catalyzing investments in advanced phosphate processing technologies, making the region a hotbed for both domestic expansion and international partnerships.

This comprehensive research report examines key regions that drive the evolution of the Feed Phosphates market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Competitive Strategies, Product Innovations, and Collaboration Models of Leading Feed Phosphates Producers Shaping Industry Competitiveness

Leading feed phosphates producers are deploying differentiated strategies to secure market leadership and foster long-term resilience. One global supplier has prioritized investments in advanced defluorination capacity, establishing partnerships with technology licensors to deliver ultra-low impurity products in high-regulation jurisdictions. Another multinational has embraced digital end-to-end supply chain solutions, leveraging cloud-based analytics and IoT-enabled tracking to guarantee consistent product quality and traceability from mine operations to feed mill delivery.

Strategic collaborations between phosphate processors and global feed additive enterprises have emerged as a cornerstone of innovation, with joint research initiatives aimed at improving phosphate bioavailability and reducing overall inclusion rates in feed formulations. Additionally, vertical integration efforts by select regional players in North America and the Middle East are streamlining raw material sourcing, minimizing exposure to tariff fluctuations, and enhancing logistical efficiencies.

Smaller specialist firms are capitalizing on niche demands-such as high-precision micro-particle grades for pet food and aquafeed-by offering bespoke formulations and rapid lead times. Collectively, these competitive maneuvers underscore a marketplace in which agility, technological prowess, and strategic alliances dictate the pace of value creation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Feed Phosphates market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AB LIFOSA

- Chemische Fabrik Kalk GmbH & Co. KG

- Coromandel International Limited

- DuPont de Nemours, Inc.

- EuroChem Group AG

- FOSFITALIA SPA

- Innophos Holdings, Inc.

- J.R. Simplot Company

- Nutrien Ltd.

- OCP Group

- PhosAgro Group

- Prayon SA

- Reanjoy Laboratories

- The Mosaic Company

- Wengfu Group

- Yara International ASA

Delivering Strategic Roadmap Recommendations to Enable Industry Leaders to Capitalize on Emerging Feed Phosphates Market Trends and Achieve Sustainable Growth

Industry leaders must proactively refine their strategic playbooks to harness emerging market opportunities and mitigate evolving risks. Prioritizing diversification of raw material sources will safeguard operations against geopolitical and tariff-induced supply disruptions, while targeted investments in defluorination and nano-phosphate technologies can unlock new premium segments.

Enhancing digital capabilities across procurement, quality control, and logistics functions will yield improved operational transparency and foster stronger customer relationships through real-time product verification. Concurrently, forging cross-sector partnerships-linking phosphate suppliers with feed additive specialists and sustainability consultancies-can amplify innovation pipelines and accelerate the development of phosphorus-optimized feed solutions.

Leaders should also align their product portfolios with application-specific requirements, deploying bespoke phosphate grades for aquaculture, pet food, and monogastric feed producers to secure loyalty in high-value segments. Finally, embedding circular economy principles-such as phosphate recovery from agricultural runoff and animal waste-will position organizations at the forefront of environmental stewardship, satisfying regulatory mandates and resonating with eco-conscious end users.

Outlining Data Collection, Validation Procedures, and Analytical Frameworks Employed to Ensure Comprehensive Feed Phosphates Market Intelligence Credibility

This analysis is underpinned by a rigorous research framework combining primary and secondary intelligence streams. Primary research encompassed structured interviews with feed mill operators, phosphate processors, technology providers, and regulatory authorities to capture firsthand perspectives on operational challenges, product preferences, and emerging technology adoption.

Secondary research included an exhaustive review of peer-reviewed journals, industry white papers, trade association publications, and governmental policy documents. Global trade data and customs statistics were triangulated to validate shipment trends and tariff impacts. Analytic frameworks were applied to assess supply chain resilience, technology maturity, and competitive positioning, with findings subjected to multi-tiered validation by subject matter experts.

Throughout the process, data integrity was maintained via cross-referencing of quantitative and qualitative inputs, ensuring that conclusions reflect the most current and accurate depiction of the global feed phosphates environment.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Feed Phosphates market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Feed Phosphates Market, by Type

- Feed Phosphates Market, by Form

- Feed Phosphates Market, by Distribution Channel

- Feed Phosphates Market, by Application

- Feed Phosphates Market, by Region

- Feed Phosphates Market, by Group

- Feed Phosphates Market, by Country

- United States Feed Phosphates Market

- China Feed Phosphates Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 954 ]

Synthesizing Key Insights and Strategic Implications to Equip Stakeholders with a Clear Vision for Future Engagement in the Evolving Feed Phosphates Landscape

The convergence of sustainability imperatives, tariff realignments, and technological innovation has created a watershed moment for the feed phosphates industry. Companies that embrace advanced defluorination techniques, reinforce supply chain resilience, and tailor product offerings to specialized applications will seize competitive advantage. At the same time, regulatory shifts-from environmental emission limits to nutrient stewardship mandates-underscore the necessity of proactive compliance and transparent traceability.

Regional disparities highlight the need for adaptable strategies, whether it is leveraging resource proximity in the Americas, navigating stringent regulations in Europe Middle East & Africa, or capitalizing on dynamic growth in Asia Pacific. Competitive success will hinge on strategic partnerships, digital enablement, and a commitment to circular economy principles that transcend traditional production models.

Armed with these insights, industry stakeholders can chart courses that not only optimize today’s operations but also lay the groundwork for sustainable, innovation-driven growth in the years ahead.

Engage with Associate Director Ketan Rohom to Secure Your Customized Market Insights Report and Transform Your Feed Phosphates Strategy Today

To obtain unparalleled strategic insights and unlock untapped opportunities within the feed phosphates arena, engage directly with Associate Director Ketan Rohom. Drawing on extensive industry expertise and deep market intelligence, Ketan will guide you through a tailored presentation of key findings, ensuring you can swiftly integrate actionable intelligence into your operational and commercial strategies. By securing your customized research report, you gain privileged access to nuanced analysis of supply chain dynamics, regulatory impacts, segmentation performance, and competitor benchmarking-all structured to drive measurable outcomes.

Reach out today to schedule a one-on-one consultation and discover how this comprehensive market report can equip your organization with the clarity and foresight needed to stay ahead in an evolving global landscape. With Ketan’s support, you’ll transform data into decisive action, strengthen your competitive positioning, and confidently chart the course for sustainable growth in feed phosphates.

- How big is the Feed Phosphates Market?

- What is the Feed Phosphates Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?