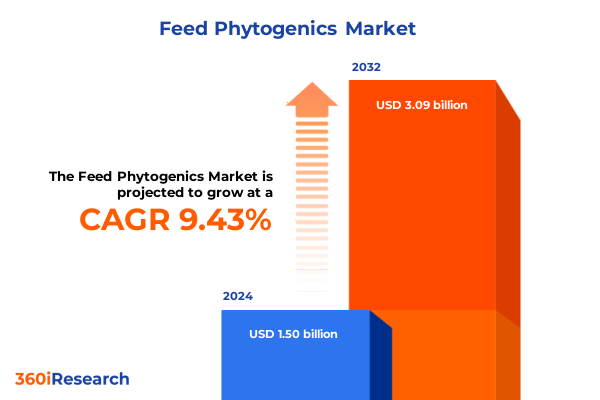

The Feed Phytogenics Market size was estimated at USD 1.64 billion in 2025 and expected to reach USD 1.78 billion in 2026, at a CAGR of 9.43% to reach USD 3.09 billion by 2032.

Exploring the Rise of Plant-Based Feed Additives and Their Role in Revolutionizing Animal Nutrition and Performance Across Modern Livestock Systems

Animal nutrition is undergoing a fundamental transformation as global stakeholders seek solutions that deliver both performance benefits and sustainable outcomes. In this dynamic environment, feed phytogenics have emerged as a pivotal technology, leveraging the bioactive power of plant-derived compounds such as essential oils, flavonoids, and tannins to support animal health and growth. Unlike synthetic additives or antibiotics, phytogenic ingredients offer a natural alternative that aligns with tightening regulations, consumer demand for clean-label products, and the industry’s shift toward reduced chemical dependency.

Transitioning from conventional feed strategies, nutritionists and feed formulators are exploring how antimicrobial, antioxidant, and digestive-stimulating properties inherent in certain plant extracts can reinforce gut integrity, modulate immune response, and enhance nutrient utilization. These benefits translate into improved feed conversion ratios, reduced mortality, and more predictable weight gain across diverse livestock segments. As the global population climbs and protein demand escalates, the role of phytogenics in bridging productivity with sustainability becomes ever more crucial.

Through this executive summary, you will gain an in-depth perspective on how feed phytogenics are reshaping industry paradigms. By examining recent regulatory shifts, tariff impacts, and granular segmentation insights, stakeholders can better understand where opportunities lie, how leading companies are innovating, and what strategies can be deployed to stay ahead in a market defined by rapid change and escalating performance expectations.

How Regulatory Restrictions on Antibiotics and Technological Breakthroughs Are Propelling Plant-Derived Additives to Center Stage in Animal Feed

The landscape for animal feed additives is experiencing transformative shifts driven by multifaceted forces. Regulatory authorities in major markets, including North America and Europe, have progressively tightened restrictions on antibiotic growth promotors, compelling feed developers to identify alternatives that deliver comparable benefits without the risk of antimicrobial resistance. Simultaneously, consumer awareness around food safety and clean-label requirements has created a ripple effect through supply chains, incentivizing producers to adopt phytogenic solutions that resonate with end-user preferences for natural ingredients.

On the innovation front, advances in extraction technologies have enabled the standardization and stabilization of bioactive phytogenic compounds, substantially improving their efficacy in feed formulations. Nutrigenomic research is shedding light on precise modes of action, from modulation of gut microbiota to upregulation of endogenous antioxidant pathways, thereby underpinning more targeted product designs. Moreover, digital analytics and precision feed management platforms now allow real-time monitoring of animal performance metrics, facilitating data-driven optimization of phytogenic inclusion rates.

In parallel, sustainability imperatives are reshaping feed ingredient sourcing, with environmental and social governance criteria guiding procurement of botanical raw materials. Traceability systems are being implemented to ensure ethical supply chains for plant extracts, reinforcing brands’ environmental credentials. As industry players adapt to these integrated pressures, feed phytogenics have moved from niche innovation to mainstream strategic tool, propelling a new era of evidence-based, nature-inspired nutrition solutions.

Understanding the Far-Reaching Consequences of New United States Import Tariffs on Botanical Extracts for Animal Feed Production

In 2025, the United States implemented additional tariffs on imported botanical extracts used in feed applications, a decision that has reverberated across the phytogenic supply chain. These incremental duties have led to upward pressure on raw material costs, particularly for essential oils sourced from key exporting regions. As a consequence, domestic producers and formulators are reevaluating supplier portfolios, with some pivoting toward local cultivation programs to mitigate tariff exposure and secure more stable cost structures.

Beyond cost implications, the tariff landscape has influenced innovation trajectories. Feed additive manufacturers are exploring novel sourcing of underutilized plant families, conducting agronomic partnerships to cultivate high-yield phytogenic crops domestically, and investing in bioreactor-based production techniques for select compounds. These strategic responses aim not only to circumvent tariff-related price increases but also to shorten lead times and strengthen supply chain resilience.

Farm-level stakeholders are feeling the effects in their procurement budgets, and nutritionists are recalibrating formulations to balance cost and performance. Despite immediate challenges, the tariff-driven realignment is fostering a more localized and diversified production network for feed phytogenics in the United States. Over the medium term, this realignment is expected to enhance supply security, drive innovation in alternative raw materials, and support a more sustainable feed additive ecosystem.

Dissecting the Diverse Segmentation of Feed Phytogenic Products to Uncover Strategic Opportunities Across Types, Functions, and Applications

Effective segmentation of the feed phytogenic market reveals nuanced insights that guide product development and commercialization strategies. When examining formulations by type, essential oils dominate due to their broad-spectrum antimicrobial and flavor-enhancing properties, while flavonoids are prized for their potent antioxidant capacities. Oleoresins offer a concentrated mix of volatile and nonvolatile constituents, saponins deliver targeted digestive stimulation, and tannins contribute to protein binding and pathogen control in the gut.

Function-based segmentation underscores how antimicrobial action remains the most demanded attribute, especially in production systems seeking antibiotic-free claims. Antioxidant functions follow closely, supporting cellular integrity under oxidative stress conditions. Digestive stimulants are increasingly valued to optimize nutrient absorption in intensive feeding regimes, and dedicated growth promoters round out the landscape by directly enhancing weight gain metrics through metabolic modulation.

Form-based analysis shows that granules are preferred for ease of blending into premixes, liquids allow rapid dispersion in drinking systems, and powders provide the highest dosage flexibility across species. Segmenting by livestock reveals distinct application patterns: aquatic animals benefit from water-soluble extracts, poultry diets leverage essential oil blends for gut health, ruminants require tannin-rich formulations to modulate rumen fermentation, and swine nutritionists exploit saponin-based products for optimized digestive enzyme activity.

From an application standpoint, replacement of antibiotic growth promotors remains the largest driver, closely followed by targeted antimicrobial effect claims. Digestion enhancement solutions cater to both monogastric and ruminant feed programs, and growth promotion supports intensified production targets. Distribution channel segmentation highlights the prominence of animal production operations as direct purchasers, while e-commerce platforms and retail outlets serve smaller farms and specialty segments, and academic institutions engage in collaborative research to validate emerging phytogenic innovations.

This comprehensive research report categorizes the Feed Phytogenics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Function

- Form

- Livestock

- Application

- Distribution Channel

Mapping How Regional Variations in Regulation, Production Systems, and Supply Chains Shape the Adoption of Phytogenic Feed Additives Globally

Geographic analysis of feed phytogenics highlights variable adoption dynamics driven by regulatory frameworks, production systems, and market sophistication. In the Americas, early movers in North America are leveraging robust research infrastructures and domestic botanical resources to pioneer proprietary phytogenic blends, while Latin American feed producers are responding to consumer demand for antibiotic-free meat by integrating natural additives at scale.

Within Europe, Middle East & Africa, stringent EU regulations on antibiotic use have accelerated the shift toward phytogenics, with Germany, France, and the Netherlands at the forefront of standardized product validation and commercial adoption. In the Middle East, feed mills are exploring phytogenic ingredients to bolster supply chain resilience amid import restrictions, and African markets are demonstrating nascent growth potential as local cultivation of high-value botanicals expands.

The Asia-Pacific region presents a dichotomy of mature markets such as Australia and New Zealand, which emphasize traceability and sustainability in phytogenic sourcing, and rapidly growing production hubs in China and Southeast Asia, where scale advantages support cost-efficient manufacturing of plant extracts. Across regional markets, partnerships between multinational feed additive suppliers and local distributors are forging pathways for tailored formulations that respect feed traditions, species requirements, and regulatory nuances.

This comprehensive research report examines key regions that drive the evolution of the Feed Phytogenics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining the Strategies of Industry Leaders and Emerging Innovators That Are Defining the Competitive Dynamics in Feed Phytogenic Solutions

Leading stakeholders in the feed phytogenics space are distinguished by their commitment to research-driven product development, strategic alliances, and integrated supply chain management. These companies maintain proprietary extraction technologies that ensure consistent potency of bioactive compounds, alongside robust quality control frameworks that comply with international feed additive standards. Their R&D pipelines are enriched by collaborative studies with academic institutions, exploring novel phytochemical synergies and delivery mechanisms.

Strategic acquisitions and joint ventures have enabled market leaders to expand geographic footprints, secure critical botanical raw materials, and accelerate time-to-market for new formulations. Their distribution networks combine direct partnerships with large-scale feed mills and digital commerce platforms catering to specialty and small-scale producers. Marketing strategies emphasize empirical efficacy, supported by field trial data on gut health parameters, performance enhancements, and resilience under stress.

In parallel, emerging challengers are differentiating themselves through niche botanical portfolios, such as unique essential oil chemotypes or rare flavonoid-rich extracts, targeting specialized segments like aquaculture or ruminant nutrition. By offering customized blending services, these innovators address precision feeding demands, reinforcing the breadth and depth of competitive offerings within the phytogenics arena.

This comprehensive research report delivers an in-depth overview of the principal market players in the Feed Phytogenics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- A&A Pharmachem Inc.

- Ayurvet Limited

- BIOMIN Holding GmbH

- Cargill, Incorporated

- Delacon Biotechnik GmbH

- Dostofarm GmbH

- DSM-Firmenich AG

- DuPont de Nemours, Inc.

- Growell India

- Himalaya Wellness Company

- Igusad Feed Specialties

- Indian Herbs Specialties

- Jefo Nutrition Inc.

- Kemin Industries, Inc.

- MIAVIT GmbH

- Natural Remedies Private Limited

- Nor-Feed Sud

- Novus International, Inc.

- Nutrex NV

- Pancosma SA

- Phytobiotics Futterzusatzstoffe GmbH

- Silvateam S.p.A.

- Synergy Flavors, Inc.

Actionable Strategies for Strengthening R&D, Supply Chain Resilience, and Market Penetration in the Feed Phytogenics Sector

To capitalize on the momentum of phytogenic adoption, industry leaders should deepen investments in translational research that bridges laboratory findings to on-farm performance outcomes. By establishing multifaceted field trial programs across diverse production systems, companies can generate compelling efficacy data that resonates with feed formulators and livestock producers. Moreover, forging partnerships with agritech platforms enables real-time performance monitoring, supporting evidence-based product positioning.

Supply chain resilience should be bolstered through strategic sourcing agreements and in-house cultivation initiatives for high-demand botanicals. Vertical integration of extraction and formulation processes can mitigate cost volatility associated with tariffs and global logistics challenges. Additionally, embedding traceability technologies-from blockchain-enabled provenance tracking to digital certificates of analysis-will strengthen brand trust and satisfy evolving regulatory and consumer transparency requirements.

In the commercial arena, tiered product offerings that cater to large commercial operations, specialty producers, and research institutions can maximize market penetration. Collaborations with feed additive distributors and e-commerce channels should be optimized to ensure seamless product availability across geographies. Finally, targeted education campaigns that translate complex phytogenic mechanisms into practical feeding guidelines will empower nutritionists and farm managers to adopt these solutions with confidence.

Adopting a Rigorous Mixed-Methods Research Framework to Illuminate Market Dynamics and Validate Feed Phytogenic Efficacy Across Segments

This research leverages a mixed-methods approach combining primary interviews, secondary data review, and field validation studies. Key stakeholders consulted include feed additive manufacturers, livestock nutritionists, agricultural extension specialists, and regulatory authorities across major regional markets. These qualitative insights were triangulated with quantitative performance data sourced from peer-reviewed journals, industry whitepapers, and proprietary field trial reports.

A rigorous taxonomy was developed to standardize segmentation parameters based on type, function, form, livestock application, distribution channel, and geography. Each segment was analyzed through the lens of market drivers, barriers, and enabling technologies. Supply chain mapping techniques were employed to trace material flows from botanical cultivation and extraction through to feed mill integration.

To ensure data integrity, multiple rounds of expert validation were conducted, and all findings were benchmarked against regulatory filings, patent databases, and trade association statistics. The outcome is a comprehensive, balanced view of the feed phytogenics landscape, designed to support strategic decision-making across R&D, commercial, and operational teams.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Feed Phytogenics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Feed Phytogenics Market, by Type

- Feed Phytogenics Market, by Function

- Feed Phytogenics Market, by Form

- Feed Phytogenics Market, by Livestock

- Feed Phytogenics Market, by Application

- Feed Phytogenics Market, by Distribution Channel

- Feed Phytogenics Market, by Region

- Feed Phytogenics Market, by Group

- Feed Phytogenics Market, by Country

- United States Feed Phytogenics Market

- China Feed Phytogenics Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1113 ]

Synthesizing Key Takeaways on How Natural Feed Additives Are Redefining Performance, Sustainability, and Competitive Positioning in Animal Nutrition

The convergence of regulatory constraints on antibiotics, consumer demand for natural ingredients, and technological advancements in extraction and analytics has propelled feed phytogenics from emerging niche to mainstream adoption. Throughout this executive summary, you have explored how transformative shifts in policy and innovation are reshaping the competitive landscape, how new tariffs are realigning supply chains, and how granular segmentation and regional dynamics inform targeted strategies.

Industry leaders are responding with integrated R&D investments, supply chain diversification, and evidence-based commercial tactics, while challengers carve out specialized niches. The road ahead will require continued collaboration between technology developers, feed formulators, and producers to translate phytogenic potential into consistent performance outcomes under commercial farm conditions.

Overall, feed phytogenics represent a strategic imperative for any organization seeking to align productivity, animal welfare, and sustainability objectives. By leveraging the insights contained in this summary, stakeholders can make informed decisions, anticipate emerging trends, and seize opportunities in one of the most dynamic segments of animal nutrition.

Secure Expert Guidance on Harnessing Phytogenic Feed Additives by Engaging Directly with an Industry Leader to Acquire the Full Research Report

If you are ready to harness the power of feed phytogenics to elevate your animal nutrition strategy and gain a competitive edge in a rapidly evolving market, connect with Ketan Rohom, the Associate Director of Sales & Marketing at 360iResearch. With deep expertise in livestock feed additives and a track record of guiding global organizations toward data-driven decisions, Ketan can provide you with tailored insights, answer your questions in detail, and facilitate access to the full market research report. Schedule a confidential consultation today to explore how phytogenic innovations can drive performance improvements, enhance sustainability credentials, and unlock new growth opportunities across your operations. Don’t miss this chance to position your organization at the forefront of one of the most dynamic shifts in animal nutrition.

- How big is the Feed Phytogenics Market?

- What is the Feed Phytogenics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?