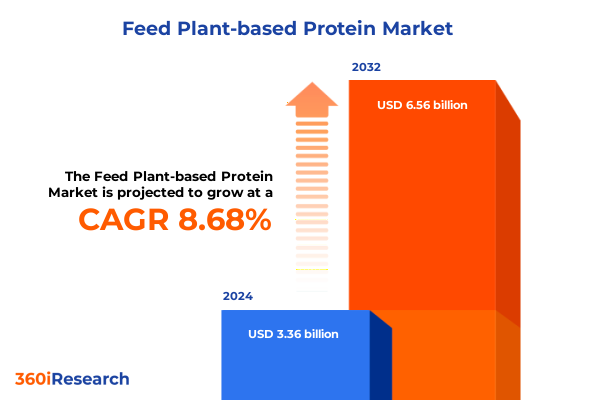

The Feed Plant-based Protein Market size was estimated at USD 3.65 billion in 2025 and expected to reach USD 3.97 billion in 2026, at a CAGR of 8.69% to reach USD 6.56 billion by 2032.

Deep Dive into Drivers Shaping the Feed Plant-Based Protein Market amid Evolving Consumer Preferences and Changing Regulatory Dynamics

The feed plant-based protein market has experienced an unprecedented convergence of factors that are redefining its trajectory. Motivated by rising concerns over sustainability, animal welfare, and cost volatility in conventional feed ingredients, stakeholders across agriculture and feed production are exploring alternatives that deliver both nutritional efficacy and environmental benefits. As regulatory landscapes evolve to incentivize lower greenhouse gas emissions, emerging technologies in plant protein extraction and formulation are coming to the forefront. These technologies are not only optimizing functional performance in aquaculture, ruminant, and monogastric diets, but also reducing reliance on imported protein meals. Moreover, shifting consumer awareness regarding the carbon footprint of animal products has indirectly influenced feed mill formulation strategies as brands seek to communicate sustainable sourcing across the value chain.

Transitioning from proof-of-concept to large-scale adoption, the market is witnessing strengthened collaborations between ingredient suppliers, feed formulators, and research institutions. This has accelerated the translation of lab-scale plant protein concentrates, isolates, and textured products into commercially viable solutions. In parallel, advancements in bioprocessing and enzymatic hydrolysis are enhancing protein digestibility and amino acid profiles, thereby narrowing the nutritive gap with traditional soybean and fish meals. As market participants integrate these drivers into strategic roadmaps, they set the stage for a new era in which economic viability and environmental stewardship converge seamlessly. Consequently, companies that proactively align their R&D and supply chain capabilities to these dynamics will position themselves at the vanguard of a rapidly emerging feed paradigm.

Unveiling Critical Transformations Reshaping the Feed Plant-Based Protein Ecosystem through Technological Innovations and Sustainable Supply Chain Practices

The feed plant-based protein landscape is undergoing transformative shifts propelled by technological breakthroughs and sustainability imperatives. Recent innovations in extraction methods, such as precision fractionation and solvent-free processing, have precipitated a notable improvements in protein yield and purity. These processes not only minimize waste streams but also reduce the energy footprint associated with traditional milling operations. Concurrently, the integration of artificial intelligence in feed formulation platforms is enabling dynamic adjustments in real time, optimizing nutrient delivery according to species-specific and lifecycle requirements.

In addition to processing advancements, the sector is witnessing a surge in circular economy applications. Crop residues, by-product streams from food processing, and underutilized grains are being valorized to produce economically viable protein concentrates. This trend has fostered collaborative ventures between food manufacturers and feed producers, facilitating resource sharing and cost efficiencies. Sustainability certifications and traceability solutions are further bolstering transparency, as end-users demand verifiable claims around origin, carbon emissions, and land use.

Complementary to these technological and sustainable strides, consumer advocacy and NGO initiatives have accelerated the adoption of plant-derived feed ingredients. Their campaigns underscore the link between feed inputs and global environmental targets, thereby influencing purchasing policies at both corporate and governmental levels. As a result, players that embrace these transformative shifts-ranging from green processing techniques to circular sourcing models-will unlock new competitive advantages and contribute meaningfully to the resilience of the global feed chain.

Analyzing the Comprehensive Impact of 2025 United States Tariff Adjustments on the Feed Plant-Based Protein Market Dynamics and Global Supply Chain Resilience

The tariff landscape in the United States has evolved significantly in 2025, shaping the competitive contours of the feed plant-based protein market. Adjustments in import duties on key raw materials, combined with preferential trade agreements for certain agricultural commodities, have altered cost structures and supply chain dynamics. These changes have compelled feed mills to reassess sourcing strategies, balancing the economic trade-offs of domestic procurement against fluctuating global pricing.

Heightened duties on certain plant proteins-particularly those originating from regions with lower production costs-have incentivized investment in local cultivation and processing infrastructure. In parallel, duty reductions on specialist protein isolates have enabled feed formulators to diversify ingredient portfolios, leveraging high-performance fractions in niche segments such as aqua feed and ruminant nutrition. Over time, these policy shifts are expected to drive a recalibration of trade flows, with increased domestic capacity mitigating exposure to tariff volatility.

Moreover, the cumulative impact of these tariff measures extends beyond direct cost implications. Supply chain resilience has become a priority as feed companies seek to secure raw material availability in the face of geopolitical uncertainty. Strategic stockpiling, near-sourcing partnerships, and dual-sourcing arrangements are now commonplace approaches to circumvent tariff-induced disruptions. Overall, the 2025 U.S. tariff adjustments have catalyzed a strategic pivot towards regional self-sufficiency, compelling market participants to innovate procurement models and streamline logistics frameworks in order to sustain margin models and support long-term growth.

Illuminating Detailed Segmentation Insights Revealing How Product Types, Applications, Forms, and Distribution Channels Drive Strategic Positioning in the Feed Protein Sector

An insightful examination of product segmentation reveals that pea protein continues to capture attention for its favorable amino acid profile and neutral flavor characteristics. Rice protein, with its hypoallergenic properties, finds distinct penetration where sensitivities are a concern, particularly in specialized feeds for young or medically sensitive animals. Soy protein remains a stalwart due to its widespread availability and established supply chains, although ongoing debates around allergens and GMO status have prompted formulators to diversify into wheat protein, especially in regions rich in cereal agriculture.

Application-based segmentation highlights an intricate tapestry of end-use categories. Animal feed applications encompass nuanced requirements spanning poultry, ruminant, and swine diets, each demanding specific digestibility metrics and amino acid ratios. Beverage integration, through dairy alternative beverages, meal replacements, and sports drinks, is carving out a specialized niche where solubility and mouthfeel dictate ingredient selection. Within food, the expansion into bakery & confectionery, dairy alternatives, meat analogue products, and snack formulations underscores the versatility of plant proteins as functional enhancers. The nutraceutical domain leverages capsules, liquids, and powders to deliver targeted health benefits, while sports nutrition channels exploit protein bars, powders, and ready-to-drink formats to meet intense exercise recovery needs.

Form-based considerations illustrate that isolates excel in high-protein applications whereas concentrates offer a more cost-efficient balance of protein and functional attributes. Hydrolysates are gaining traction for their rapid bioavailability, particularly in starter feeds and performance diets. Textured proteins are advancing meat analogue development, driving innovation in both end-consumer and industrial protein applications. Distribution channel segmentation demonstrates that foodservice venues-from corporate cafeterias and hotels to restaurant chains-are experimenting with alternative feeds to support sustainability narratives. Digital commerce platforms, including brand websites, e-commerce portals, and online grocery channels, are facilitating direct procurement for mid-sized feed operations. Traditional retail outlets, encompassing convenience stores, specialty shops, and large-format supermarkets, continue to anchor market reach through standardized packaging and private-label offerings.

This comprehensive research report categorizes the Feed Plant-based Protein market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Source

- Form

- Application

- Distribution Channel

Mapping Regional Growth Trajectories and Market Dynamics in the Feed Plant-Based Protein Sector across the Americas, Europe Middle East & Africa, and Asia Pacific Regions

Although the Americas have historically dominated the feed plant-based protein sector through robust agricultural infrastructures and advanced processing synergies, the region is now grappling with both challenges and opportunities. North American manufacturers are investing in precision agriculture to enhance pea and soybean yields, while South American producers are scaling up local extraction facilities to serve growing domestic and export demand. In contrast, Europe, Middle East & Africa present a mixed panorama: driven by stringent sustainability mandates in Europe, the market is witnessing accelerated certification adoption and co-operative R&D frameworks. Middle Eastern feed producers are exploring desalination-resilient crops, while several African nations are strengthening value chains to reduce reliance on imported protein meals.

Turning to Asia-Pacific, the region stands out for its rapid capacity expansion and government-led feed modernization initiatives. Southeast Asian processors are integrating by-products from rice milling and cassava processing into plant protein streams, thereby establishing cost-effective supply networks. Australia and New Zealand leverage their pastoral legacies to pilot hybrid feed formulations that combine plant proteins with local oilseed meals. Meanwhile, Northeast Asian markets are pioneering high-performance isolates tailored for aqua feed applications, reflecting the region’s dominant aquaculture sector.

These regional narratives underscore a critical insight: market trajectories are influenced not only by raw material endowments but also by policy frameworks, infrastructure maturity, and research collaborations. Consequently, stakeholders must adapt regional strategies to align with local production capacities, regulatory landscapes, and consumer expectations in order to achieve market differentiation and resilient growth.

This comprehensive research report examines key regions that drive the evolution of the Feed Plant-based Protein market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Key Industry Players and Their Strategic Moves Driving Innovation, Partnerships, and Market Penetration in the Global Feed Plant-Based Protein Arena

The competitive ecosystem in the feed plant-based protein domain is marked by strategic partnerships, targeted acquisitions, and innovation–led expansions. Prominent agribusiness conglomerates have fortified their portfolios through licensing agreements with biotech startups specializing in enzyme-assisted extraction. Meanwhile, ingredient innovators are forging joint ventures to co-develop customized protein fractions tailored for specific avian, swine, and aquaculture diets. Industry leaders are also establishing pilot plants dedicated to advanced fractionation and texturization processes, thereby accelerating product iteration cycles.

Notable entrants are differentiating through intellectual property in bio-processing technologies, securing patents for eco-efficient solvent-free extraction and novel protein cross-linking techniques. At the same time, several companies are scaling up operations in emerging markets to capitalize on lower feedstock costs and favorable tariff regimes. Collaborative research agreements with academic institutions are becoming more prevalent as players seek to enhance protein bioavailability and reduce anti-nutritional factors through precision enzymology and microencapsulation.

In addition to these technological pursuits, forward-thinking companies are diversifying their distribution footprints. By integrating digital procurement platforms with traditional sales networks, they offer streamlined ordering, customizable formulations, and faster lead times. Such omnichannel approaches not only strengthen customer loyalty but also generate actionable data for predictive demand analytics. As the sector advances, the real competitive advantage will accrue to those organizations that blend technological prowess, strategic alliances, and customer-centric distribution strategies to redefine value creation in feed proteins.

This comprehensive research report delivers an in-depth overview of the principal market players in the Feed Plant-based Protein market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AGRANA Beteiligungs-AG

- AGT Food and Ingredients Inc.

- Archer-Daniels-Midland Company

- Avebe U.A.

- Batory Foods, Inc.

- BENEO GmbH

- Bunge Limited

- Cargill, Incorporated

- CHS Inc.

- COFCO International Limited

- DuPont de Nemours, Inc.

- Emsland Group

- Ingredion Incorporated

- Kerry Group plc

- Kröner-Stärke GmbH

- Louis Dreyfus Company B.V.

- Olam International Limited

- Richardson International Limited

- Roquette Frères S.A.

- Vestkorn Milling AS

- Viterra Inc.

- Wilmar International Limited

Strategic Actionable Recommendations Empowering Industry Leaders to Capitalize on Emerging Trends, Enhance Competitive Advantage, and Foster Sustainable Growth in the Feed Sector

To capitalize on emerging opportunities, industry leaders should first prioritize adaptive supply chain frameworks that incorporate near-sourcing partnerships and strategic stock buffers. By diversifying supplier bases across pea, rice, soy, and wheat protein origins, feed manufacturers can buffer against tariff fluctuations while ensuring consistent raw material quality. In tandem, investment in modular processing units facilitates rapid scale-up of isolates, concentrates, and textured proteins, enabling agile responses to shifting application demands in aquaculture, swine, and poultry sectors.

Furthermore, companies must intensify collaboration with technology providers to integrate digital feed formulation platforms that leverage real-time data on ingredient quality, animal performance metrics, and market pricing. Such integrated systems enhance decision-making precision and reduce formulation cycles. Parallel to this, forming joint ventures with local crop processors and cooperatives can secure long-term feedstock contracts while supporting regional economic development and sustainability objectives.

Innovation roadmaps should also incorporate enzyme-based treatments and hydrolysate R&D to expand functional attributes such as digestibility, solubility, and flavor neutrality. Customized formulations for specialized applications-such as starter feeds for broodstock or high-performance rations for sport fish-will differentiate portfolios and justify premium pricing. Finally, a balanced omnichannel distribution strategy, encompassing foodservice, online commerce, and retail partnerships, will optimize market coverage and strengthen brand presence. By executing these strategic actions, industry leaders will be well-positioned to drive profitability and resilience in a dynamically evolving feed protein market.

Comprehensive Overview of the Research Methodology Employed to Ensure Rigorous Analysis, Data Integrity, and Robust Validation in Feed Protein Market Insights

The research methodology underpinning this analysis is designed to ensure rigorous data collection, validation, and synthesis. Primary research involved in-depth interviews with senior executives, product technologists, and procurement specialists across feed production, ingredient supply, and downstream aquafeed and livestock operations. These firsthand insights were complemented by field surveys at processing facilities and feed mills in key producing regions, capturing operational nuances and technological adoption rates.

Secondary research drew upon publicly available financial reports, regulatory filings, patent databases, and scientific publications to triangulate the proprietary findings. Trade statistics from government agencies and industry trade associations were analyzed to map trade flows, tariff schedules, and import-export classifications. In addition, processing technology white papers and sustainability reports provided contextual understanding of best-practice benchmarks and life-cycle assessments.

Quantitative data was subjected to consistency checks and cross-validation with multiple sources to ensure accuracy. Qualitative data underwent thematic analysis to identify emerging patterns in innovation, supply chain resilience, and market diversification. The methodology further incorporated expert reviews, wherein preliminary findings were presented to a panel of feed nutritionists, agronomists, and trade policy analysts for critique and refinement. This multi-layered approach ensures that the insights presented reflect a balanced, evidence-based perspective of the evolving feed plant-based protein market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Feed Plant-based Protein market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Feed Plant-based Protein Market, by Source

- Feed Plant-based Protein Market, by Form

- Feed Plant-based Protein Market, by Application

- Feed Plant-based Protein Market, by Distribution Channel

- Feed Plant-based Protein Market, by Region

- Feed Plant-based Protein Market, by Group

- Feed Plant-based Protein Market, by Country

- United States Feed Plant-based Protein Market

- China Feed Plant-based Protein Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2067 ]

Summative Conclusions Highlighting Key Takeaways, Market Implications, and Strategic Imperatives for Stakeholders in the Feed Plant-Based Protein Landscape

In summing up the evolving feed plant-based protein landscape, several core themes emerge. Technological advancements in extraction and formulation are not only enhancing protein performance but also driving sustainable practices that align with global environmental goals. At the same time, regulatory changes in the United States and beyond are incentivizing localized production and shaping trade flows, compelling market participants to adopt resilient sourcing and supply chain strategies.

Segmentation analysis underscores that a nuanced understanding of product types, application requirements, form factors, and distribution channels is critical for targeted growth. Regional insights highlight that while established markets in the Americas and Europe are focusing on certification, traceability, and circular sourcing, Asia-Pacific is rapidly expanding capacity and exploring novel feedstock streams. Competitive intelligence reveals that companies excelling in strategic alliances, technology licensing, and digital distribution are gaining first-mover advantages.

Overall, the feed plant-based protein market is poised for significant transformation as stakeholders refine their approaches to sustainability, cost optimization, and performance enhancement. Organizations that integrate these insights into their strategic frameworks will be equipped to navigate tariff headwinds, capitalize on emerging segments, and contribute to long-term sector resilience.

Engage with Associate Director Sales Marketing Ketan Rohom to Acquire In-Depth Feed Plant-Based Protein Market Research Insights and Drive Your Strategic Decisions

If you are ready to transform your strategic planning with deep market intelligence, reach out directly to Associate Director Sales & Marketing Ketan Rohom. His expertise will guide you through the complexities of the feed plant-based protein landscape and facilitate access to comprehensive research that underpins informed decision-making. Whether you seek granular insights on tariff impacts, segmentation nuances, or the competitive outlook, Ketan will tailor a solution that aligns with your organizational objectives. By engaging with Ketan Rohom, you will leverage a partnership designed to accelerate time-to-value and drive sustainable growth. Secure your copy of the full market research report today and ensure your leadership team is equipped with the data, analysis, and recommendations needed to seize emerging opportunities and mitigate risks in the evolving feed protein market.

- How big is the Feed Plant-based Protein Market?

- What is the Feed Plant-based Protein Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?