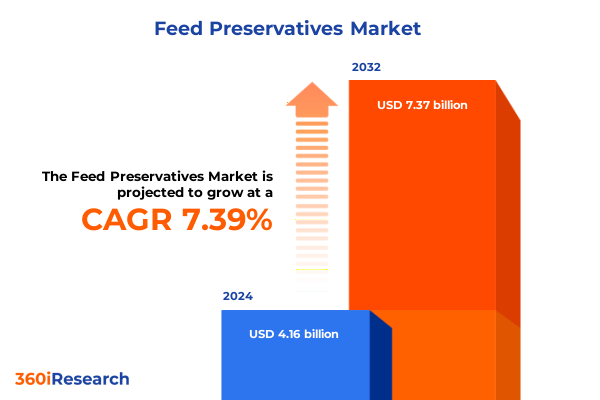

The Feed Preservatives Market size was estimated at USD 4.47 billion in 2025 and expected to reach USD 4.78 billion in 2026, at a CAGR of 7.39% to reach USD 7.37 billion by 2032.

Pioneering Stability and Safety: Unveiling the Imperatives of Modern Feed Preservatives in a Dynamic Agrifood Ecosystem Revolutionizing Feed Quality Assurance

In recent years, the intensification of global livestock production and a growing emphasis on feed quality have converged to elevate feed preservative solutions from optional additives to indispensable components of the agrifood value chain. Emerging concerns around feed spoilage, mycotoxin contamination, and nutritional losses have compelled producers to adopt advanced preservative strategies that safeguard animal health and performance. Simultaneously, heightened regulatory scrutiny and consumer demand for clean-label ingredients have propelled innovation beyond traditional chemical preservatives toward more transparent and sustainable alternatives.

Against this backdrop, industry stakeholders are navigating a complex interplay of scientific breakthroughs, evolving compliance frameworks, and shifting market expectations. Distributors, feed manufacturers, and end users alike are seeking robust preservative systems that balance efficacy with safety, cost considerations with environmental stewardship. This report’s executive summary distills the critical dynamics underpinning this transformation, offering a panoramic view of technological advancements, regulatory catalysts, and value chain disruptions.

By examining the drivers shaping feed preservative adoption, from raw material sourcing to end-market applications, this introduction sets the stage for a deeper exploration of emerging trends and strategic imperatives. Readers will gain clarity on why feed preservatives have become central to risk mitigation, sustainability initiatives, and competitive differentiation across animal agriculture sectors.

Charting the Tectonic Shifts Shaping Feed Preservative Innovation Amidst Regulatory Evolution and Consumer Demand Surges Driving Unprecedented Market Realignment

A wave of transformative shifts is remapping the feed preservative landscape, driven by converging forces of regulatory reform, technological innovation, and shifting stakeholder priorities. Foremost among these is the clean-label movement, which has intensified interest in natural preservative agents derived from botanical extracts and vitamin analogues. As feed formulators prioritize transparency, rosemary extract and tocopherols have surged in prominence, prompting competitors to refine extraction methods and broaden application profiles.

Concurrently, digitalization and precision nutrition initiatives are enabling real-time monitoring of feed stability parameters, enabling more proactive preservation protocols and data-driven decision making. Machine learning algorithms now predict spoilage risk with greater accuracy, fostering more efficient additive dosing and minimizing waste. Moreover, the proliferation of on-farm diagnostic tools is decentralizing quality control, allowing feed millers and integrators to verify preservative performance at every stage of distribution.

On the regulatory front, new guidelines targeting formaldehyde releasers and specific organic acids have triggered a reappraisal of synthetic preservative portfolios, accelerating substitutes’ adoption and driving collaborative trials across industry consortia. Taken together, these developments underscore a broader shift toward integrative preservation strategies that unite natural and synthetic modalities within unified feed safety frameworks.

Analyzing the 2025 US Tariffs on Feed Preservatives and Their Strategic Influence on Supply Chain and Sourcing Reshaping Industry Cost Structures

The implementation of revised United States tariff schedules in early 2025 has exerted a cumulative impact on feed preservative supply chains, compelling suppliers and end users to recalibrate sourcing strategies and cost structures. Import duties on critical synthetic inputs such as formaldehyde-releaser compounds and specific organic acids have increased landed costs, particularly for manufacturers reliant on overseas production hubs. At the same time, duties on natural antioxidant raw materials, including certain tocopherols, have altered competitive dynamics, narrowing margins for global exporters and intensifying domestic sourcing efforts.

In response, preservative producers have pursued strategic stockpiling of key intermediates, negotiated preferential supply agreements with U.S.-based extractors, and explored nearshoring opportunities in the Americas. These adaptive measures have bolstered resilience against tariff-driven price volatility, while also catalyzing innovation in alternative feed preservation chemistries. Additionally, feed manufacturers have reevaluated formulation frameworks to optimize ingredient substitutions and reduce exposure to high-duty categories without compromising efficacy or compliance.

As the industry contends with ongoing trade negotiations and potential further tariff adjustments, stakeholders are prioritizing scenario planning and collaborative consortia to share best practices. This collective approach is fostering a more agile preservation ecosystem capable of absorbing external shocks and sustaining feed quality under shifting geopolitical conditions.

Uncovering Deep Segmentation Insights That Illuminate Feed Preservative Trends Across Animal Types, Ingredient Forms, and Distribution Channels

An in-depth segmentation analysis reveals the multifaceted nature of feed preservative demand, with diverse applications and ingredient preferences shaping the overall dynamic. When examining animal categories, the market encompasses Aquaculture, Pet, Poultry, Ruminant, and Swine segments. Within Aquaculture, freshwater and marine operations exhibit distinct preservation requirements, reflecting variations in moisture content and storage conditions. Pet applications bifurcate into cat and dog feed stabilization needs, driven by evolving pet owner priorities around natural supplements and clean labeling. Poultry preservation strategies differ across broiler, layer, and turkey diets, each demanding precise mycotoxin control and oxidative stability. Ruminant and swine sectors likewise underscore the importance of tailored preservative regimes that align with species-specific gut health and feed intake patterns.

By preservative type, natural variants such as rosemary extract and tocopherols are gaining momentum due to their antioxidant potency and consumer-friendly positioning. In parallel, synthetic options encompassing formaldehyde releasers and organic acids continue to play a critical role in cost-sensitive formulations requiring rapid microbial inhibition. Format preferences further diversify the landscape, with dry concentrates favored for ease of blending in large-scale feed mills and liquid systems offering enhanced dispersion in premix and on-farm applications. Distribution channels split between traditional offline routes-anchored by feed distributors and bulk ingredient suppliers-and emerging online platforms that cater to niche producers seeking customized preservative blends.

These segmentation insights underscore the imperative for preservation strategies that balance efficacy, regulatory adherence, and end-user preferences across a spectrum of animal types and supply chain configurations.

This comprehensive research report categorizes the Feed Preservatives market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Animal

- Type

- Form

- Distribution Channel

Exploring Pivotal Regional Dynamics That Shape Feed Preservative Adoption Across the Americas, EMEA, and Asia-Pacific Growth Axes

Regional dynamics wield a profound influence on feed preservative adoption, reflecting divergent regulatory frameworks, production systems, and growth trajectories across the Americas, Europe, Middle East & Africa, and Asia-Pacific. In the Americas, robust investment in research and development has positioned local producers to lead innovation in both natural and synthetic preservatives. Meanwhile, evolving regulations under federal and state authorities underscore a dual emphasis on product efficacy and environmental safety, prompting market participants to validate preservative performance through rigorous trial data and compliance testing.

Across Europe, the Middle East & Africa, stringent harmonized regulations and advancing sustainability mandates have accelerated the transition toward botanical-derived antioxidants and acidifiers. Dairy and poultry industries in this region place particular emphasis on clean-label credentials, driving partnerships between preservative formulators and feed integrators to co-develop custom solutions. In parallel, regulatory scrutiny around formaldehyde releasers has prompted reformulation efforts in export-oriented feed mills, aligning preservation strategies with both EU directives and local requirements.

Asia-Pacific remains the fastest-growing epicenter, fueled by rapid aquaculture expansion, rising protein consumption, and investment in modern feed milling infrastructure. In China and Southeast Asia, the quest for feed safety intensification has elevated demand for organic acid blends and innovative preservative delivery systems. At the same time, the region’s fragmented distribution landscape encompasses both traditional agribusiness channels and digital marketplaces, reflecting a unique convergence of scale and entrepreneurial agility.

This comprehensive research report examines key regions that drive the evolution of the Feed Preservatives market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Feed Preservative Innovators Their Strategic Differentiators and Collaborative Ecosystem Advancements

Key industry players have distinguished themselves through differentiated portfolios, strategic collaborations, and targeted innovation roadmaps. Leading formulators have expanded their natural preservative lines to include next-generation botanical extracts enriched with synergistic antioxidant compounds, leveraging proprietary extraction and encapsulation techniques to enhance stability and bioavailability. Simultaneously, synthetic preservative specialists have refined formaldehyde-releasing systems for controlled release kinetics, alongside optimized organic acid blends that balance microbial inhibition with palatability and animal health considerations.

Collaborative ventures between preservative producers and ingredient suppliers have accelerated process improvements, while partnerships with academic institutions have bolstered research into synergistic actives and precision delivery mechanisms. In addition, strategic supply agreements with regional extractors and chemical manufacturers have strengthened raw material security, enabling leading companies to maintain uninterrupted production amid global trade fluctuations. To further differentiate their offerings, top-tier players continue to invest in digital support tools, including shelf-life prediction platforms and on-demand analytical services, that empower feed millers to validate preservative efficacy and optimize dosage.

These combined efforts underscore a competitive landscape in which technological leadership and value-added services serve as primary drivers of partner selection and long-term growth.

This comprehensive research report delivers an in-depth overview of the principal market players in the Feed Preservatives market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alltech Inc.

- Anpario plc

- Archer Daniels Midland Company

- BASF SE

- Bentoli, Inc.

- Cargill Incorporated

- Celanese Corporation

- Corbion N.V.

- De Heus Animal Nutrition

- dsm-firmenich

- Eastman Chemical Company

- Evonik Industries AG

- Impextraco NV

- International Flavors & Fragrances Inc

- Jungbunzlauer Suisse AG

- Kemin Industries Inc.

- Kerry Group plc

- Lallemand Inc.

- Novus International, Inc.

- Nutreco N.V.

- Perstorp Holding AB

- Phibro Animal Health Corporation

- Solvay S.A.

Designing Actionable Strategies for Feed Preservative Industry Leaders to Capitalize on Emerging Technologies and Regulatory Trends

Industry leaders can seize emerging opportunities by embracing a multipronged strategy that aligns innovation with regulatory anticipation and supply chain robustness. The first imperative lies in accelerating research into natural preservative actives, focusing on novel antioxidant sources and microbial inhibitors that satisfy clean-label criteria without compromising shelf-life performance. To this end, cross-functional R&D teams should collaborate closely with feed formulators and end users to conduct targeted in vivo and in vitro trials, generating data that substantiate efficacy claims and streamline regulatory approvals.

Next, companies must reinforce supply chain resilience by cultivating partnerships with domestic and regional raw material providers, thereby reducing exposure to tariff fluctuations and geopolitical risks. Multi-sourcing agreements and strategic stockpiling of critical intermediates will further buffer operations against external shocks. Concurrently, integrating advanced analytics and predictive modeling into procurement and inventory processes will enable more agile response to market disruptions.

Finally, forging alliances with digital technology firms and regulatory consultants will facilitate the deployment of compliance management systems and traceability platforms. By embedding these capabilities into product offerings, preservative providers can differentiate themselves through value-added services that enhance transparency and streamline quality assurance for feed manufacturers and integrators.

Taken together, these actionable steps empower industry leaders to navigate complexity, capture emerging niches, and sustain competitive advantage.

Outlining a Robust Research Methodology Integrating Qualitative and Quantitative Techniques for Rigorous Feed Preservative Market Insights

This study employs a comprehensive methodology combining both qualitative and quantitative research techniques to ensure robust and actionable insights. Primary research comprised in-depth interviews with executive leadership at feed mills, ingredient formulators, and regulatory bodies, supplemented by structured surveys capturing the perspectives of quality assurance managers and end users across key geographies. These engagements provided rich context on formulation preferences, compliance challenges, and investment priorities.

In parallel, secondary research drew upon peer-reviewed journals, patent filings, technical bulletins, and industry conference proceedings to map the evolution of preservative chemistries and application technologies. Data triangulation methods were applied to validate market trends and corroborate primary findings, enhancing the reliability of thematic analyses. A dedicated expert advisory panel, composed of veterinarians, feed technologists, and regulatory specialists, convened to review interim results and guide the development of strategic recommendations.

Analytical frameworks included SWOT analysis to assess competitive positioning, PESTEL evaluation for regulatory and environmental factors, and portfolio mapping to identify white-space opportunities. Rigorous quality control protocols-such as data integrity checks and cross-validation exercises-ensured consistency and accuracy throughout the research process. This integrated approach yields a multidimensional understanding of the feed preservative landscape, equipping decision makers with evidence-based intelligence for strategic planning.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Feed Preservatives market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Feed Preservatives Market, by Animal

- Feed Preservatives Market, by Type

- Feed Preservatives Market, by Form

- Feed Preservatives Market, by Distribution Channel

- Feed Preservatives Market, by Region

- Feed Preservatives Market, by Group

- Feed Preservatives Market, by Country

- United States Feed Preservatives Market

- China Feed Preservatives Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1590 ]

Concluding with Strategic Perspectives on the Future of Feed Preservatives Emphasizing Sustainability, Safety, and Supply Chain Resilience

The landscape of feed preservatives is poised for continued evolution as the intersection of sustainability imperatives, regulatory requirements, and technological breakthroughs reshapes industry norms. Natural antioxidants and microbial inhibitors will gain further traction, buoyed by consumer and regulatory demand for cleaner ingredient profiles. At the same time, strategic adaptation to geopolitical shifts-including tariff adjustments and trade policy reforms-will remain critical to safeguarding supply chain stability and cost efficiency.

Digital transformation and precision monitoring tools will play an increasingly central role in feed preservation, enabling real-time validation of shelf-life performance and more nuanced formulation adjustments. Collaborative ecosystems, encompassing feed integrators, technology partners, and regulatory experts, will foster more agile innovation cycles and streamline market introductions. Ultimately, the convergence of these forces will drive a new era of feed preservative solutions that prioritize animal health, feed safety, and environmental stewardship.

As industry stakeholders chart their strategic roadmaps, this executive summary serves as a compass, highlighting the key drivers, obstacles, and opportunities that will define the next chapter in feed preservative advancement.

Seize Unparalleled Market Intelligence Now Engage with Ketan Rohom for Tailored Feed Preservative Research That Drives Competitive Advantage

Elevate your strategic edge by acquiring the definitive feed preservative research report today. To unlock tailored insights, connect directly with Ketan Rohom, Associate Director of Sales & Marketing at our firm. Ketan’s extensive expertise and consultative approach ensure that your organization gains actionable intelligence aligned with its unique objectives. Whether you seek to optimize your supply chain resilience, pioneer natural preservative innovations, or adapt to shifting regulatory landscapes, Ketan will guide you through the report’s comprehensive findings. Embark on a journey to drive competitive advantage and fortify your feed preservative strategy by reaching out to Ketan for a personalized briefing and exclusive purchasing options.

- How big is the Feed Preservatives Market?

- What is the Feed Preservatives Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?