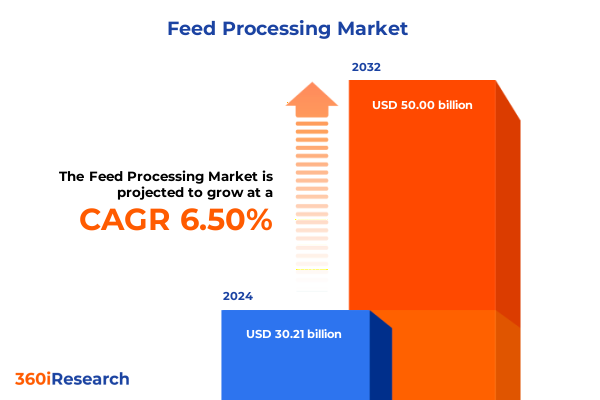

The Feed Processing Market size was estimated at USD 32.22 billion in 2025 and expected to reach USD 34.11 billion in 2026, at a CAGR of 6.48% to reach USD 50.00 billion by 2032.

Discover how evolving market dynamics, technological advancements, and global trade tensions are converging to redefine the future of feed processing

Feed processing stands at the crossroads of agricultural innovation, nutrition science, and global trade dynamics. As demand for animal-derived protein continues to rise, feed manufacturers are compelled to balance nutritional precision with cost efficiency and sustainability. Advanced formulations now integrate bioactive compounds, precision amino acid profiles, and functional additives that support health and productivity across diverse livestock and aquaculture operations. Meanwhile, regulatory scrutiny surrounding feed ingredients has intensified, prompting companies to adopt transparent sourcing practices and rigorous quality controls.

Global trade tensions have introduced new layers of complexity. Tariff shifts and evolving import policies have driven processors to reevaluate supply chains and foster resilience. Technological solutions, ranging from automated handling systems to real-time nutritional analytics, are empowering feed mills to optimize throughput and consistency. At the same time, end-market pressures for cleaner production and reduced environmental impact are catalyzing the adoption of circular economy principles, including the valorization of byproducts and integration of alternative protein sources. Consequently, industry stakeholders must navigate a multifaceted environment that demands agility, innovation, and strategic foresight.

Explore the groundbreaking shifts in automation, sustainability practices, and precision nutrition that are driving unprecedented change in feed processing operations

The current era has ushered in transformative shifts that are fundamentally reshaping feed processing paradigms. Digitalization lies at the core of this evolution, with Internet of Things sensors delivering granular data on moisture content, particle size, and nutritional uniformity. Artificial intelligence–driven mix optimization platforms are now enabling dynamic recipe adjustments based on real-time input costs and performance targets. In parallel, the surge in sustainability mandates has accelerated interest in bio-based additives, insect-derived proteins, and fermentation-based ingredients that offer reduced carbon footprints and enhanced resource efficiency.

Moreover, precision nutrition has moved beyond concept to practice, leveraging data analytics to calibrate micronutrient delivery tailored to specific species, breeds, and production stages. Regulatory frameworks are also adapting, emphasizing transparency and traceability from feed ingredient origin to finished mill operations. Consequently, processing technologies such as extrusion and pelleting are being upgraded with coating modules that enhance palatability and bioactivity. Collectively, these shifts are driving unprecedented operational agility and setting new benchmarks for feed quality and sustainability.

Examine the far-reaching consequences of the United States’ 2025 tariff measures on ingredient sourcing, cost structures, and supply chain realignment in feed processing

In early 2025, the United States implemented a suite of tariffs targeting imported soybeans, corn, and select feed additives. These measures prompted feed processors to rapidly diversify sourcing strategies, fostering increased investment in domestic oilseed crushing and alternative protein development. As a result, many companies established new strategic partnerships with local growers and launched nearshoring initiatives to mitigate cost volatility.

Consequently, supply chains have realigned, with processors integrating vertically to secure critical raw materials. Domestic producers enhanced their infrastructure to accommodate higher volumes of commodity crushing, while research into nontraditional ingredients such as algae oils and single-cell proteins received renewed funding. However, the tariff environment also introduced margin pressures for downstream feed manufacturers who faced elevated input costs. This dual effect underscored the need for operational resilience and drove consolidation among players seeking economies of scale.

Looking ahead, the cumulative impact of these tariffs has set the stage for a more regionally anchored feed processing ecosystem, where adaptability and local partnerships will remain key competitive differentiators.

Uncover insights into differentiated demand drivers and competitive opportunities across animal type, feed form, ingredient, technology, and production method segments

Segmentation analysis reveals that the aquatic category, which includes fish and shrimp, has witnessed a surge in demand for protein-dense pellets formulated to optimize feed conversion ratios in intensive recirculating aquaculture systems. Parallel to this, premium pet nutrition for cats and dogs now emphasizes functional ingredients-such as probiotics and omega-rich oils-that support wellness and align with pet owner preferences for clean-label formulations. In the poultry arena, broiler feed innovations focus on growth performance enhancers, while layer diets are being tailored to improve shell quality and egg nutrient profiles.

Across feed forms, extruded products have become the go-to for value-added applications in both aqua and pet sectors, leveraging texturization to maximize nutrient availability. Liquid blends are preferred in hatchery and starter diets for precise hydration and nutrient delivery, whereas meal and pellet formats continue to dominate large-scale livestock operations due to their handling efficiencies. Ingredient-wise, traditional grains remain foundational for energy, yet byproducts from ethanol and oilseed processing are increasingly integrated to support circular economy goals. Additives that promote gut health and immune support are also gaining traction.

Process technologies such as grinding and pelleting are being enhanced with coating solutions that protect sensitive nutrients, while extrusion platforms are offering greater versatility in ingredient inclusion. Finally, the dichotomy between conventional and organic production methods underscores divergent growth pathways: conventional approaches prioritize cost containment and scalability, whereas organic systems emphasize certified inputs and differentiated end-market premiums.

This comprehensive research report categorizes the Feed Processing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Feed Form

- Feed Ingredient

- Processing Technology

- Production Method

- Animal Type

Analyze regional dynamics shaping feed processing growth across the Americas, Europe Middle East & Africa, and Asia-Pacific with an eye toward localized strategies

In the Americas, feed processing benefits from well-established infrastructure and a mature integration of farm-to-mill networks. North American processors are early adopters of large-scale automation and data-driven operational management, while South American producers are scaling capacity to serve global soybean and corn markets. Sustainability initiatives such as regenerative agriculture pilot projects are gaining momentum across US and Canadian grain belts, supported by incentives for carbon sequestration and soil health improvements.

Turning to Europe, regulatory rigor around feed additives and contaminants has spurred innovation in natural preservative systems and alternative proteins. The European Union’s environmental directives under the Green Deal are guiding feed producers toward carbon neutrality and circularity, even as Middle Eastern markets invest heavily in aquafeed plants designed for high-efficiency shrimp production. In contrast, Africa presents a fragmented landscape where small-scale mills coexist with growing corporate players, creating opportunities for mobile processing units and co-op-based models.

Asia-Pacific remains the most dynamic region, driven by burgeoning protein demand in China, India, and Southeast Asia. Intensive poultry and aqua farms are deploying smart monitoring systems to refine feed formulations and improve feed conversion ratios. Emerging economies prioritize affordable feed solutions, fueling partnerships between global ingredient suppliers and local producers. Across all regions, effective strategies will hinge on adapting to local regulatory frameworks and consumer expectations.

This comprehensive research report examines key regions that drive the evolution of the Feed Processing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Gain perspective on how leading global feed processing companies are leveraging innovation, partnerships, and vertical integration to sustain competitive advantage

Leading feed processing corporations have accelerated R&D initiatives focused on next-generation formulations, such as microencapsulated nutrient delivery systems and precision amino acid balancing technologies. Strategic partnerships with biotechnology startups have enabled the exploration of insect-derived proteins and fermented yeast products, creating alternative protein pathways. Concurrently, major firms are pursuing vertical integration by acquiring raw material suppliers, ensuring supply security amid fluctuating global trade conditions.

Digital platform development has emerged as a critical differentiator, with vendors offering end-to-end analytics that span ingredient traceability, production performance, and nutritional efficacy. Sustainability commitments are now front and center, with ambitious targets to reduce greenhouse gas emissions and incorporate circular feed ingredients. Meanwhile, specialized regional players are capitalizing on niche segments like organic feed and non-GMO formulations, leveraging local market knowledge to outmaneuver larger competitors.

Collaborative ventures between equipment manufacturers and processors are driving automation upgrades across grinding, extrusion, and pelleting lines. In response to these competitive dynamics, human capital investments in process engineering and data science are becoming essential for differentiating performance.

This comprehensive research report delivers an in-depth overview of the principal market players in the Feed Processing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alltech Inc

- Arab Company for Livestock Development

- Archer Daniels Midland Company

- Avanti Feeds Limited

- BRF S.A.

- Cargill, Incorporated

- Charoen Pokphand Foods PCL

- De Heus Animal Nutrition

- ForFarmers N.V.

- Godrej Agrovet Limited

- Guangdong Haid Group Co., Ltd.

- JA Zen-Noh

- Japfa Comfeed

- JBS S.A.

- Kent Nutrition Group

- Land O'Lakes, Inc.

- Muyuan Foodstuff Co., Ltd.

- New Hope Liuhe Co., Ltd.

- Nutreco N.V.

- Purina Mills, LLC

- Shuangbaotai Group

- Skretting

- The Waterbase Limited

- Tyson Foods, Inc.

- Wen's Food Group

Actionable strategies to enhance operational resilience, optimize supply chains, and capitalize on emerging trends for industry leaders in feed processing

To remain at the forefront of industry evolution, leaders must prioritize robust digital transformation programs that integrate IoT-enabled sensors, machine learning–based process control, and real-time performance dashboards. Strengthening supply chain resilience requires diversifying ingredient sources geographically and partnering with local producers to reduce dependence on volatile imports. Embracing sustainable feedstocks-such as agricultural byproducts, insect proteins, and fermentation-based ingredients-can mitigate environmental impacts and fortify cost stability.

Engagement with regulators and industry associations is essential for influencing emerging standards around additive approvals and sustainability reporting. Forming alliances with agritech innovators will accelerate the adoption of next-generation processing platforms and circular economy models. Moreover, targeting high-potential niches-such as certified organic feed and precision nutrition solutions-can unlock premium market segments. Embedding a culture of continuous improvement and cross-functional collaboration will fuel operational excellence and rapid innovation.

By aligning these strategic imperatives with clear performance metrics and governance structures, organizations can translate insights into decisive actions that drive long-term profitability and sustainable growth.

Discover the rigorous research approach combining primary interviews, expert validation, and multi-source data triangulation that underpins these actionable insights

This analysis is underpinned by a rigorous research framework designed to ensure methodological transparency and validity. The foundation comprised more than 30 in-depth interviews with C-suite executives, plant operations managers, and upstream ingredient suppliers across the Americas, EMEA, and APAC regions, providing direct insights into strategic priorities and operational challenges. Comprehensive secondary research drew on technical publications, regulatory filings, industry association reports, and proprietary customs databases to contextualize macro and micro trends.

Findings were subjected to dual-stage validation workshops involving independent agricultural economists and process engineering consultants, facilitating robust hypothesis testing. Quantitative triangulation leveraged data from national statistics bureaus and trade flows to corroborate qualitative observations. Advanced data analytics and visualization tools were employed to identify correlations between feed processing parameters and performance outcomes. Iterative peer reviews with internal subject matter experts and external advisors ensured coherence and fidelity of the narrative. Detailed documentation of sources, assumptions, and analytical methodologies is provided in the appendix to enable reproducibility and facilitate further research.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Feed Processing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Feed Processing Market, by Feed Form

- Feed Processing Market, by Feed Ingredient

- Feed Processing Market, by Processing Technology

- Feed Processing Market, by Production Method

- Feed Processing Market, by Animal Type

- Feed Processing Market, by Region

- Feed Processing Market, by Group

- Feed Processing Market, by Country

- United States Feed Processing Market

- China Feed Processing Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Synthesize critical findings and strategic imperatives that will guide decision-makers through the evolving landscape of feed processing toward sustainable growth

Feed processing is poised for sustained transformation under the confluence of technological innovation, sustainability imperatives, and shifting geopolitical landscapes. The 2025 tariff developments have accelerated regional supply chain realignment, leading to a more localized and resilient infrastructure. Meanwhile, segmentation analysis highlights clear growth trajectories in aquatic, pet, poultry, ruminant, and swine feeds, each demanding bespoke nutritional and processing solutions.

Regional insights underscore distinct competitive environments across the Americas, EMEA, and Asia-Pacific, necessitating nuanced market entry and expansion strategies. Leading companies have attained differentiation through investment in novel feed technologies, digital platforms, and strategic acquisitions, setting a performance benchmark for the industry. To capitalize on emerging opportunities, decision-makers must embrace digital twin simulations, bio-based additive sourcing, and circular economy principles.

This executive summary offers a comprehensive foundation for strategic planning, but ongoing agility and innovation will determine success. As regulatory frameworks evolve and consumer expectations shift toward greater transparency and sustainability, industry players are well positioned to chart a path that balances productivity, environmental stewardship, and profitability.

Connect with Ketan Rohom, Associate Director of Sales & Marketing, to unlock the full-spectrum report and strategic intelligence for feed processing success

By collaborating with Ketan Rohom, Associate Director of Sales & Marketing, you can secure access to the comprehensive research report that delivers in-depth analyses, proprietary data visualizations, and real-world case studies tailored to your strategic objectives. Engaging with Ketan will enable you to receive personalized briefings on market entry strategies, competitive benchmarking, and emerging technology assessments. You’ll gain direct insight into the methodologies that underpin our findings and the opportunity to discuss how these insights translate into actionable plans for your organization. Seize this opportunity to equip your leadership team with the competitive intelligence necessary to navigate the complexities of the feed processing landscape. Reach out to Ketan Rohom today to transform these insights into strategic initiatives that drive growth and operational excellence.

- How big is the Feed Processing Market?

- What is the Feed Processing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?