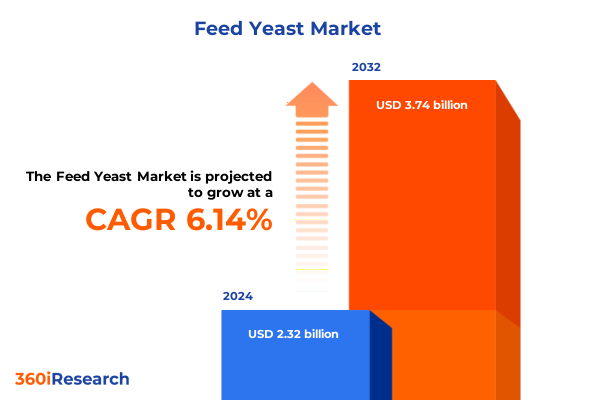

The Feed Yeast Market size was estimated at USD 2.47 billion in 2025 and expected to reach USD 2.60 billion in 2026, at a CAGR of 6.13% to reach USD 3.74 billion by 2032.

Understanding the pivotal role of feed yeast in enhancing animal health, nutritional efficiency, and sustainable practices across the global livestock industry

Feed yeast has emerged as a cornerstone ingredient in modern animal nutrition, offering a spectrum of benefits that enhance health outcomes, improve feed conversion, and support sustainable production systems. Leveraging the unique properties of yeast strains, feed producers can address critical challenges such as gut health disruptions, immune stressors, and the demand for antibiotic‐free formulations. As livestock and aquaculture operations strive to meet rising consumer expectations around product quality and environmental stewardship, feed yeast serves as a versatile solution that aligns with both performance and sustainability objectives.

Moreover, the integration of yeast‐based additives into feed formulations has catalyzed innovation across the value chain. Producers are now exploring synergistic blends of live yeast with probiotic and prebiotic compounds to deliver targeted benefits at the microbiome level. In parallel, the growing emphasis on circular economy principles has elevated interest in utilizing yeast derived from food and beverage industry byproducts, creating new pathways for resource efficiency. Consequently, the feed yeast segment is attracting collaboration between ingredient developers, feed millers, and end‐users seeking to differentiate their offerings through scientifically backed nutritional enhancements.

Against this backdrop, understanding the multifaceted role of feed yeast is critical for stakeholders seeking to harness its full potential. This report provides a holistic overview of prevailing trends, regulatory developments, and market drivers shaping the feed yeast landscape in 2025. By examining technological breakthroughs, tariff influences, segmentation nuances, and regional variations, readers will gain the insights needed to formulate robust strategies and achieve competitive advantage in a rapidly evolving industry.

Exploring transformative shifts in feed yeast innovations fueled by precision fermentation breakthroughs, evolving regulations and novel functional applications

Advancements in precision fermentation have ushered in a new era of feed yeast innovation, enabling developers to fine‐tune strain characteristics for enhanced stress tolerance, metabolite production, and targeted functional benefits. By leveraging gene editing and high‐throughput screening techniques, research laboratories can now identify yeast variants that deliver superior probiotic activity or enzymatic profiles, elevating the performance of feed additives. In turn, feed manufacturers are incorporating these next‐generation yeast strains into specialized formulations designed for specific species and life stages, driving more predictable outcomes in terms of growth rates and health resilience.

At the same time, evolving regulatory frameworks across key markets have accelerated the adoption of feed yeast as a natural alternative to antibiotic growth promoters. Regulatory agencies are increasingly recognizing the safety and efficacy of yeast‐based additives, streamlining approval pathways and setting quality standards for microbial feed ingredients. This shift has encouraged companies to invest in robust dossier submissions and collaborative field trials, establishing a foundation of peer‐reviewed evidence that supports broader market acceptance.

Simultaneously, the convergence of digital agriculture tools with microbial feed solutions is reshaping how end‐users engage with yeast products. Real‐time monitoring of gut health parameters, coupled with predictive analytics, allows nutritionists to adapt feed regimens dynamically, optimizing yeast inclusion rates for varying environmental and management conditions. These transformative shifts are redefining the feed yeast landscape, unlocking performance gains and operational efficiencies that were previously out of reach.

Analyzing the impact of United States tariffs in 2025 on feed yeast trade flows, supply chain resilience and cost structures in the animal nutrition sector

United States tariff measures enacted in 2025 have had marked implications for feed yeast trade flows and cost structures. The imposition of additional duties on key ingredient imports, particularly those originating from select trading partners, has introduced greater volatility into ingredient supply chains. As a result, feed formulators have encountered higher landed costs for specialty yeast grades, prompting some companies to reconsider reliance on distant suppliers and explore closer sourcing options within domestic or allied regions.

In response to tariff‐driven cost pressures, several industry participants have adopted diversified procurement strategies. By establishing buffer stocks and negotiating multi‐year supplier agreements, feed producers seek to mitigate the impact of erratic duty adjustments and exchange rate fluctuations. This approach has underscored the value of strategic inventory management and robust supplier risk assessments. In parallel, growth in domestic yeast production capacity has gained momentum as manufacturers expand fermentation facilities to capitalize on reshoring incentives and import substitution initiatives.

Despite the strain on supply chain resilience, the sector has displayed adaptability through greater collaboration among stakeholders. Producers, logistics providers, and customs experts are aligning on streamlined compliance protocols to reduce delays at ports of entry and optimize tariff classifications. While cost structures have experienced upward pressure, the long-term effect has been a recalibration of sourcing models that prioritizes agility, transparency, and local production partnerships. Stakeholders that proactively navigated the tariff environment have maintained competitive pricing arrangements and preserved service levels, while others recalibrated their product portfolios to offset incremental costs.

Revealing how form variations, yeast types, distribution channels, end use categories and application roles collectively shape the feed yeast market dynamics

Form plays a fundamental role in determining how feed yeast is stored, handled, and incorporated into feed rations. Dry yeast variants offer extended shelf life and simplified logistics for feed mills located in regions with sporadic cold‐chain infrastructure, whereas liquid yeast formulations provide enhanced viability and rapid dispersion, making them suitable for on‐farm mixing systems. Recognizing these differences, manufacturers tailor their production processes and packaging formats to align with customer operational preferences and infrastructure capabilities.

Meanwhile, the type of yeast exerts a pronounced influence on the functional attributes delivered to the animal. Brewers yeast delivers high levels of cell wall components that support immune function, while dried yeast concentrates can serve as economical protein supplements and flavoring agents. Live yeast applications, in contrast, aim to modulate gut microbiota dynamically, offering sustained probiotic benefits when administered at precise inclusion rates. These distinctions guide end-users in selecting the most appropriate yeast type for their targeted nutritional objectives.

Distribution channels further nuance market reach and customer engagement. Offline sales through traditional feed distributors and agronomist networks remain vital for rural operations that value in-person technical support. Conversely, online sales channels, including manufacturer websites and e-commerce platforms, cater to a growing segment of digitally enabled customers seeking rapid ordering, detailed product information, and data-driven recommendations. This dual channel approach enables yeast producers to strike a balance between personalized service and digital convenience.

Different end uses underscore the species-specific needs that drive feed yeast demand. Aquaculture operations leverage yeast supplements to manage water quality and gut health in fish and shrimp, while poultry integrators incorporate yeast to optimize egg quality and broiler performance. Ruminant nutritionists focus on yeast strains that enhance fiber digestibility and rumen stability, whereas swine producers utilize yeast for gut maturation in weanlings and as a flavor enhancer in grow-finish diets. Each category requires tailored yeast formulations to maximize benefit.

Lastly, applications of feed yeast span flavoring agents that improve feed palatability, probiotic feed additives that confer gut health benefits, and protein supplements that contribute to balanced amino acid profiles. By integrating insights across form, type, distribution, end use, and application, producers can develop differentiated yeast solutions that address multifaceted farm challenges and support measurable performance improvements.

This comprehensive research report categorizes the Feed Yeast market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Form

- Type

- Distribution Channel

- End Use

- Application

Highlighting regional feed yeast adoption trends shaped by evolving regulations, production footprints and demand drivers in Americas, EMEA and Asia-Pacific

Regional dynamics play a critical role in shaping feed yeast adoption and commercialization strategies. In the Americas, established livestock and aquaculture sectors benefit from a supportive regulatory environment and well-developed feed infrastructure. United States producers, in particular, leverage advanced mechanization and nutritional science to integrate feed yeast at scale, while Brazil’s growing aquaculture industry demonstrates rising interest in yeast-based gut health supplements tailored to tilapia and shrimp.

Europe, the Middle East and Africa region reflects a diverse regulatory mosaic, where stringent safety standards and sustainability mandates are driving feed yeast uptake among poultry and ruminant producers. European Union directives on antimicrobial stewardship have led to increased trials of live yeast and yeast cell wall products as antibiotic alternatives. Meanwhile, Middle Eastern feed companies are forging joint ventures to localize yeast production, and South African integrators are collaborating with ingredient suppliers to develop specialized formulations for dairy and beef operations.

The Asia-Pacific region, marked by rapidly expanding livestock and aquaculture output, presents significant growth potential for feed yeast suppliers. In China and India, rising protein consumption underpins an urgent need for performance-driven feed solutions. Local yeast manufacturers are scaling fermentation capacities and pursuing strategic alliances with international technology partners to accelerate product development. Southeast Asian markets, with their diverse species profiles and fragmented supply chains, offer opportunities for customized yeast blends that address region-specific challenges such as heat stress and mycotoxin mitigation.

This comprehensive research report examines key regions that drive the evolution of the Feed Yeast market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Delivering company insights into strategic partnerships, innovation pipelines and competitive differentiators that define leadership in the feed yeast market

A handful of pioneering companies have emerged as leaders in the feed yeast space, distinguished by their robust R&D pipelines, strategic collaborations, and commitment to sustainability. Innovators have invested heavily in strain optimization, leveraging proprietary fermentation platforms to unlock enhanced probiotic efficacy and metabolite profiles. Strategic partnerships with agricultural integrators, aquaculture farmers, and nutrition research institutions have accelerated the validation of yeast products under commercial conditions, reinforcing their value proposition.

Collaborative alliances have been forged across the value chain to co-develop turnkey yeast solutions that integrate seamlessly with feed blends and on-farm management systems. Joint research initiatives with universities and technology firms have yielded novel yeast derivatives that address emerging challenges such as mycotoxin detoxification and heat stress tolerance. In parallel, some manufacturers have entered into supply agreements with major feed compounders, embedding their yeast products into premix formulations and broadening distribution reach.

Sustainability has become a competitive differentiator, prompting companies to adopt renewable energy sources in fermentation operations and to valorize agricultural byproducts as fermentation substrates. By enhancing circularity in production, these leaders not only reduce carbon footprint but also create cost efficiencies that can be reinvested in product innovation. Collectively, these company strategies underscore the dynamic interplay between scientific advancement, collaborative ecosystems, and sustainability imperatives that define leadership in the feed yeast market.

This comprehensive research report delivers an in-depth overview of the principal market players in the Feed Yeast market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AB Vista

- Agri-King, Inc.

- Alltech, Inc.

- Angel Yeast Co., Ltd.

- Archer-Daniels-Midland Company

- Associated British Foods plc

- Biomin Holding GmbH

- Cargill, Incorporated

- Chr. Hansen Holding A/S

- Diamond V Mills, Inc.

- ICC Brazil

- Kemin Industries, Inc.

- Lallemand Inc.

- Lesaffre et Compagnie

- Novus International, Inc.

- Nutreco N.V.

- Pakmaya

- Pancosma SA

- Phileo by Lesaffre

- Synergy Flavors

Presenting actionable recommendations for industry leaders to leverage feed yeast opportunities via strategic investments, partnerships and innovation pathways

Industry leaders can position themselves for growth by intensifying investments in strain discovery and precision fermentation techniques. Collaborating with genomics and bioinformatics experts will accelerate the identification of high‐performance yeast variants tailored to specific species and environmental conditions. By establishing dedicated innovation centers or incubator programs, companies can foster rapid prototyping and shorten time-to-market for novel feed yeast solutions.

In parallel, expanding local production footprints will mitigate exposure to tariff volatility and strengthen supply chain resilience. Investing in modular fermentation facilities within key end-use regions reduces transit times and customs complexities, while enabling closer collaboration with livestock and aquaculture integrators. Strategic alliances with regional partners can further streamline regulatory approvals and market entry processes.

Digital engagement represents another avenue for differentiation. Deploying real-time monitoring tools and data analytics platforms will empower nutritionists to optimize yeast inclusion rates based on live performance metrics. Educating end-users through virtual workshops, interactive decision-support tools, and field demonstration programs will reinforce product value and drive adoption.

Finally, forging multi-stakeholder partnerships with feed millers, end-users and sustainability organizations can amplify industry credibility and catalyze new applications. Joint initiatives that integrate yeast solutions into certified sustainable supply chains will resonate with end consumers and brand owners prioritizing environmental stewardship. By aligning innovation, localization and digitalization strategies, industry leaders can capture emerging opportunities and secure long-term competitive advantage.

Outlining the comprehensive research methodology that ensures rigorous data collection, insightful analysis and robust validation within the feed yeast study

The research methodology underpinning this report combines rigorous secondary analysis with in-depth primary engagements to ensure comprehensive and objective insights. Initial data gathering involved extensive review of scientific journals, regulatory frameworks, technical whitepapers and industry publications to map current trends and technological advances. This secondary foundation provided context for subsequent validation and gap analysis.

Primary research encompassed structured interviews with a cross-section of industry stakeholders, including yeast manufacturers, feed producers, livestock nutritionists and aquaculture specialists. These interviews were designed to capture practical perspectives on product performance, supply chain constraints, regulatory complexities and emerging customer needs. Data points from these discussions were triangulated against publicly available trade statistics and company disclosures to deliver balanced conclusions.

Throughout the research process, strict data integrity protocols were observed. Quantitative data underwent consistency checks and plausibility assessments, while qualitative insights were analyzed using thematic coding techniques to identify recurring patterns and divergent viewpoints. A final peer-review stage engaged external subject matter experts to challenge assumptions and refine analytical frameworks, ensuring that the report’s findings remain robust, transparent and relevant to decision-makers.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Feed Yeast market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Feed Yeast Market, by Form

- Feed Yeast Market, by Type

- Feed Yeast Market, by Distribution Channel

- Feed Yeast Market, by End Use

- Feed Yeast Market, by Application

- Feed Yeast Market, by Region

- Feed Yeast Market, by Group

- Feed Yeast Market, by Country

- United States Feed Yeast Market

- China Feed Yeast Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

Summarizing the strategic implications of feed yeast trends, market dynamics and regulatory influences for stakeholders across the animal nutrition value chain

This analysis underscores the integral role of feed yeast as a multifunctional ingredient that drives animal health, production efficiency and sustainability across diverse livestock and aquaculture systems. Technological breakthroughs in strain development and precision fermentation, coupled with supportive regulatory shifts, have expanded the functional scope of yeast additives, enabling tailored solutions for gut health, immune support and nutritional balancing.

The review of United States tariff measures in 2025 highlights the necessity for agile sourcing strategies and local production capacity to mitigate cost volatility and supply chain disruption. By examining form, type, distribution, end use and application segments, stakeholders can refine product positioning and unlock new market niches. Regional insights illustrate how geopolitical, regulatory and infrastructure variables shape feed yeast adoption in the Americas, EMEA and Asia-Pacific.

Leading companies have demonstrated that strategic collaborations, sustainability initiatives and integrated innovation pipelines are critical to maintaining a competitive edge. Actionable recommendations emphasize the importance of targeted R&D, digital engagement, localized manufacturing and multi-stakeholder partnerships to drive growth. Ultimately, feed yeast stands at the forefront of next-generation animal nutrition, offering a pathway to enhanced performance and enduring value across the industry.

Connect with Ketan Rohom to secure your comprehensive feed yeast market research report detailing innovations, trends and strategic growth opportunities

I appreciate your interest in deepening your understanding of feed yeast market dynamics. To gain full access to the extensive analysis of technological innovations, evolving regulatory frameworks, and key growth opportunities, please connect with Ketan Rohom, Associate Director of Sales & Marketing, who can arrange a personalized briefing and provide access to the comprehensive market research report. This report offers actionable insights into strain development trends, end-use segmentation strategies, regional supply chain nuances, and competitive company strategies that will inform and accelerate your growth initiatives.

- How big is the Feed Yeast Market?

- What is the Feed Yeast Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?