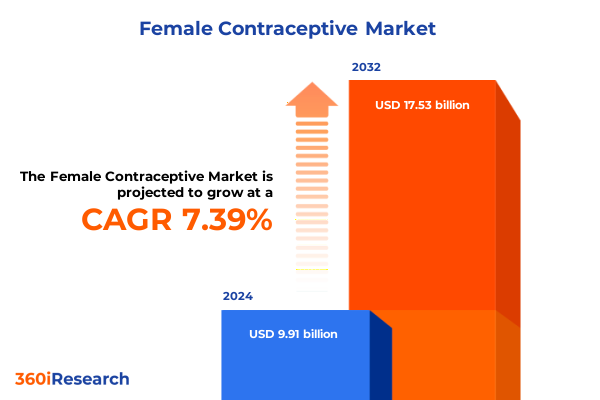

The Female Contraceptive Market size was estimated at USD 10.57 billion in 2025 and expected to reach USD 11.28 billion in 2026, at a CAGR of 7.49% to reach USD 17.53 billion by 2032.

Setting the Stage for the Future of Female Contraceptive Market with Evolving Demographics, Innovations, and Policy Drivers

The female contraceptive market stands at an inflection point, shaped by a confluence of demographic, technological, and policy drivers that underscore its strategic importance for healthcare stakeholders. Amid shifting societal attitudes toward family planning and rising demand for personalized solutions, manufacturers and service providers are compelled to reassess their value propositions and delivery models. This executive summary offers an authoritative lens through which decision-makers can navigate the complexities inherent in regulatory environments, supply chain disruptions, and evolving consumer expectations. It sets the stage for a deep dive into the forces propelling market growth and highlights the critical intersections of innovation and access.

Within this evolving framework, stakeholders must balance innovation in product development with equitable distribution and cost considerations. The introduction of advanced delivery systems, coupled with enhanced digital health platforms, is redefining patient engagement and adherence. Regulatory landscapes continue to adjust, reflecting broader public health objectives and aligning with global commitments to reproductive rights. In this context, the insights presented here are designed to equip industry leaders with a comprehensive understanding of market dynamics, enabling the formulation of robust strategies that respond to real-world challenges and capitalize on emerging opportunities.

Uncovering the Fundamental Shifts Redefining the Female Contraceptive Landscape through Technology, Access, and Patient Empowerment

Over the past decade, the female contraceptive landscape has undergone transformative shifts catalyzed by scientific breakthroughs, digitalization, and patient-centric care models. The advent of long-acting reversible contraceptives has expanded the conversation beyond traditional daily regimens, while telemedicine platforms have bridged geographical gaps, enabling remote consultations and prescription fulfillment. These developments have fostered a paradigm where convenience and personalization are paramount, and end users increasingly expect seamless integration between physical and digital care channels.

Parallel to technological advancements, policy reforms have played an instrumental role in reshaping market accessibility and affordability. Progressive health mandates at federal and state levels have broadened insurance coverage for contraceptive services, reducing out-of-pocket costs and dismantling barriers to access. Advocacy-driven campaigns have further elevated public awareness of reproductive health, empowering individuals to make informed choices. Collectively, these shifts underscore a broader societal movement toward holistic wellness and patient empowerment, positioning female contraception as a focal point in preventive healthcare strategies.

Analyzing How United States Tariff Changes in 2025 Are Reshaping Supply Chains, Pricing Structures, and Stakeholder Strategies

In 2025, a series of newly implemented tariffs imposed by the United States government on imported pharmaceutical ingredients and medical devices have begun to reverberate throughout the female contraceptive supply chain. Manufacturers dependent on international raw materials have reported increased production costs, prompting a reevaluation of sourcing strategies and cost-containment measures. Simultaneously, distribution partners are grappling with altered freight dynamics, as customs duties shift the calculus of inventory management and transportation planning.

These tariff-driven cost pressures have led some industry players to accelerate investments in domestic manufacturing capacities, seeking to reduce exposure to import levies and secure supply continuity. Conversely, smaller innovators reliant on niche suppliers face heightened vulnerability, necessitating strategic partnerships or alternative procurement models to preserve product viability. The overall effect of these cumulative tariff changes has been a recalibration of pricing strategies across contraceptive modalities, influencing formulary negotiations and reimbursement frameworks. Stakeholders must now incorporate tariff sensitivity into their financial projections and explore collaborative approaches to mitigate the downstream impacts on patient affordability and market access.

Illuminating Critical Segmentation Trends Highlighting How Product Types, Mechanisms, Age Groups, and Distribution Channels Influence Market Dynamics

Within the female contraceptive domain, nuanced segmentation reveals critical insights into product preferences and distribution behaviors. The market encompasses implants alongside injectables, intrauterine devices-distinguished by copper IUD and hormonal IUD variants-and an extensive range of oral contraceptives, including combined pills segmented across first through fourth generations as well as progestin-only formulations. Each of these product types resonates differently with patient subgroups, dictated by efficacy profiles, side effect considerations, and dosing convenience.

Mechanism-based analysis further delineates hormonal options, subdivided into combined and progestin-only pathways, contrasted against non-hormonal alternatives that appeal to patients seeking minimal systemic exposure. Age-based segmentation highlights distinct adoption patterns: younger cohorts aged 15 to 24 often gravitate toward long-acting reversible options for minimal maintenance, while the 25 to 34 and 35 to 49 brackets exhibit higher utilization of daily oral regimens. Distribution channel insights reveal a diversification of access points, encompassing traditional clinics and hospital pharmacies alongside growing demand through online pharmacies and retail outlets. Understanding these intersecting dimensions is essential for tailoring marketing strategies, optimizing supply chain allocations, and designing patient education initiatives that resonate with diverse user profiles.

This comprehensive research report categorizes the Female Contraceptive market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Mechanism

- End User Age

- Distribution Channel

Examining Regional Variations in Female Contraceptive Adoption and Growth Patterns across Americas, Europe Middle East Africa and Asia Pacific

Geographic analysis uncovers pronounced regional variations in contraceptive adoption, driven by regulatory frameworks, cultural factors, and healthcare infrastructure. In the Americas, robust public health initiatives and insurance reforms bolster widespread access to both prescription and over-the-counter contraceptive options, with digital platforms further enhancing reach in underserved areas. Northern and Southern American markets diverge in modality preferences, as long-acting reversible devices dominate in segments with strong clinical outreach, while oral contraceptives maintain traction in urban retail channels.

Across Europe, the Middle East, and Africa, heterogeneity in economic development and healthcare funding translates into varied uptake rates. Western European nations benefit from established reimbursement systems and clinical guidelines that prioritize advanced hormonal and non-hormonal alternatives. In contrast, emerging markets within the MENA region and sub-Saharan Africa emphasize affordability and supply chain resilience, often facilitated through public-private collaborations. Meanwhile, Asia-Pacific presents a tapestry of opportunities underpinned by rapid urbanization, expanding middle-class populations, and evolving regulatory landscapes. Markets such as Japan and Australia exhibit high adoption of next-generation oral contraceptives, whereas Southeast Asian and South Asian regions are experiencing surges in implant and injectable utilization as governments pursue family planning mandates.

This comprehensive research report examines key regions that drive the evolution of the Female Contraceptive market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Exploring Key Industry Players Shaping the Contraceptive Market through Strategic Collaborations, Pipeline Innovations, and Competitive Differentiation

Leading pharmaceutical companies and medical device innovators continue to drive market evolution through strategic alliances, research collaborations, and targeted acquisitions. Major players with established contraceptive portfolios leverage economies of scale to negotiate favorable supplier contracts, while agile biotechnology firms focus on niche formulations or novel delivery platforms. Competitive dynamics are further shaped by emerging digital health entrants that integrate telemedicine, remote monitoring, and patient engagement tools into traditional contraceptive offerings.

Collaboration between incumbents and start-ups is increasingly common, enabling accelerated development timelines and shared risk management. Partnerships with contract manufacturing organizations support scalable production of hormonal implants and injectables, whereas licensing agreements facilitate geographic expansion of proprietary devices. Additionally, investments in real-world evidence studies help companies demonstrate product value to payers and providers, fostering formulary inclusion. This competitive mosaic underscores the importance of strategic portfolio diversification, technological differentiation, and an agile approach to regulatory challenges in maintaining market leadership.

This comprehensive research report delivers an in-depth overview of the principal market players in the Female Contraceptive market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbvie Inc.

- Acme Generics Pvt. Ltd.

- Afaxys, Inc.

- Agile Therapeutics, Inc.

- Amneal Pharmaceuticals LLC

- ASKA Pharmaceutical Co., Ltd.

- Aurobindo Pharma Limited

- Bayer AG

- Church & Dwight Co., Inc.

- Cipla Limited

- HLL Lifecare Limited

- Insud Pharma, S.L.

- Johnson & Johnson Services, Inc.

- Lupin Limited

- Mayne Pharma Group Limited

- Merck & Co., Inc.

- Mithra Pharmaceuticals S.A.

- Okamoto Industries, Inc.

- Organon & Co.

- Perrigo Company PLC

- Pfizer Inc.

- Piramal Pharma Ltd.

- Reckitt Benckiser Group PLC

- Ritex GmbH

- Sanofi S.A.

- Say It With A Condom, LLC

- Syzygy Healthcare Solutions LLC

- Teva Pharmaceutical Industries Ltd.

- TherapeuticsMD, Inc.

- TTK Healthcare Limited

- Veru Inc.

- Viatris Inc.

Providing Actionable Recommendations for Industry Leaders to Navigate Market Complexities, Regulatory Landscapes, and Emerging Consumer Expectations

To thrive in an environment characterized by regulatory complexity and evolving consumer expectations, industry leaders must adopt multifaceted strategies. First, diversifying supply chains and investing in domestic manufacturing capabilities can mitigate risks associated with import tariffs and global disruptions. Simultaneously, enhancing digital engagement through telehealth platforms and mobile applications will deepen patient relationships and improve adherence metrics. Strategic alliances with technology providers and academic institutions can accelerate the co-development of next-generation delivery systems and data-driven support tools.

Furthermore, proactive engagement with policymakers and advocacy groups is essential for shaping favorable reimbursement frameworks and ensuring equitable access. Companies should prioritize real-world evidence generation to substantiate clinical and economic value propositions, facilitating streamlined formulary inclusion and payer negotiations. Internally, fostering an organizational culture that embraces agility and cross-functional collaboration will empower teams to respond rapidly to emerging market signals. By integrating these recommendations into core strategic plans, stakeholders can navigate market complexities with confidence and drive sustainable growth.

Detailing a Robust Research Methodology Integrating Primary Insights, Secondary Data Analysis, and Qualitative Expert Perspectives

This research is grounded in a robust methodology combining primary and secondary data sources to ensure comprehensive and accurate insights. Primary research involved in-depth interviews with stakeholders across the value chain, including clinicians, payers, distributors, and end users, to capture nuanced perspectives on product preferences, access barriers, and emerging trends. Qualitative engagement sessions and advisory boards provided granular context around clinical decision-making processes and patient behavior.

Secondary research encompassed rigorous analysis of regulatory filings, clinical trial outcomes, patent databases, and industry publications to validate market trajectories and competitive landscapes. Data triangulation techniques were employed to reconcile discrepancies between sources, ensuring consistency in thematic findings. Additionally, advanced analytical frameworks were leveraged to model supply chain impacts, tariff sensitivities, and segmentation patterns. This multidisciplinary approach underpins the credibility of the insights presented and equips decision-makers with the empirical evidence needed to inform strategic choices.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Female Contraceptive market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Female Contraceptive Market, by Product Type

- Female Contraceptive Market, by Mechanism

- Female Contraceptive Market, by End User Age

- Female Contraceptive Market, by Distribution Channel

- Female Contraceptive Market, by Region

- Female Contraceptive Market, by Group

- Female Contraceptive Market, by Country

- United States Female Contraceptive Market

- China Female Contraceptive Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1431 ]

Summarizing the Core Insights and Strategic Implications Driving the Future Trajectory of the Female Contraceptive Market Landscape

As the female contraceptive market continues its dynamic evolution, stakeholders stand at the crossroads of opportunity and complexity. The interplay of technological innovation, shifting demographics, and regulatory momentum creates an environment ripe for strategic investment and differentiation. However, challenges such as tariff-induced cost pressures and diverse regional adoption patterns necessitate agile and informed approaches.

Drawing on segmentation insights, regional analyses, and competitive intelligence, industry leaders can craft targeted strategies that resonate with distinct patient cohorts and distribution networks. The imperative for collaboration-whether through partnerships with digital health innovators or alliances with local manufacturing entities-cannot be overstated. By leveraging a holistic understanding of market drivers and deploying the actionable recommendations outlined, organizations are well-positioned to deliver value-driven solutions, enhance patient outcomes, and secure long-term growth in this vital healthcare domain.

Engaging with Ketan Rohom for Tailored Market Insights and Strategic Guidance to Secure Your Competitive Edge with the Comprehensive Report

As the demand for actionable insights intensifies, Ketan Rohom stands ready to guide industry leaders through the complex and rapidly evolving female contraceptive ecosystem. By reaching out directly, organizations can gain privileged access to in-depth market dynamics tailored to specific strategic objectives, whether optimizing product portfolios, evaluating partnership opportunities, or anticipating regulatory shifts. Leveraging his extensive expertise in sales and marketing, Ketan can facilitate personalized consultations, bespoke data packages, and interactive workshops aimed at translating high-level research findings into operational imperatives.

Engaging with Ketan not only unlocks access to the comprehensive market research report but also enables dynamic scenario modeling and real-time market intelligence updates, ensuring that stakeholders stay ahead of emerging trends and potential disruptions. This direct collaboration offers an avenue for granular discussions on competitive positioning, pricing strategies, and go-to-market approaches that resonate with evolving patient preferences and healthcare provider needs. Reach out to secure a strategic advantage and transform insights into decisive action to propel growth, drive innovation, and ensure long-term success in the competitive landscape of female contraceptives.

- How big is the Female Contraceptive Market?

- What is the Female Contraceptive Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?