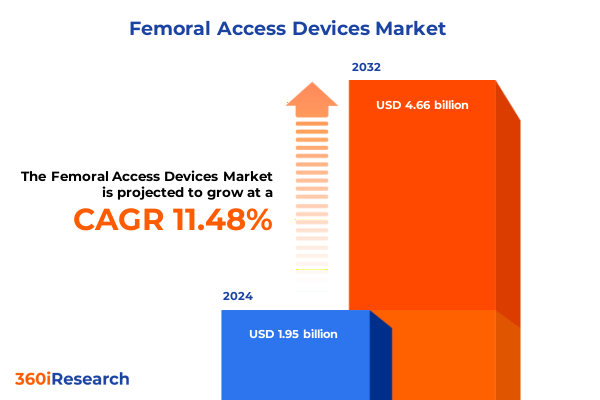

The Femoral Access Devices Market size was estimated at USD 2.17 billion in 2025 and expected to reach USD 2.41 billion in 2026, at a CAGR of 11.49% to reach USD 4.66 billion by 2032.

Launching a Comprehensive Exploration of Femoral Access Devices Revealing Their Pivotal Role in Modern Vascular Interventional Therapies

In the evolving landscape of vascular intervention, femoral access devices serve as the cornerstone of minimally invasive therapies. Over four decades, the femoral artery has provided a reliable entry point for a diverse array of procedures ranging from diagnostic angiography to complex peripheral interventions. Fueled by the demand for precision and safety, device innovators have engineered tools that streamline vascular entry while minimizing complications.

Despite the surge in alternative entry routes such as radial access, which rose from 17.5% to 60.4% in diagnostic angiography between 2001 and 2018, the sheer versatility and anatomical advantages of femoral access ensure its continued dominance in specific procedural domains. As procedure volumes grow worldwide and interventional techniques become more sophisticated, the ecosystem of sheaths, dilators, guidewires, and hemostasis valves must evolve in tandem to meet ever-higher expectations for reliability and performance.

This report initiates a holistic exploration of the femoral access devices market by examining transformative shifts, analyzing trade policy impacts, decoding segmentation insights, and profiling regional and corporate strategies. Each subsequent section deepens our understanding of how technological, economic, and regulatory forces converge to shape the future of this critical interventional segment.

Transformative Innovations and Material Advances Rewriting the Paradigm of Femoral Access Devices for Enhanced Safety, Efficacy, and Supply Chain Resilience

Recent years have witnessed groundbreaking innovations in femoral access devices that have redefined procedural safety and efficacy. Advances in material science have yielded high-performance polymers such as medical-grade PTFE blends and hydrophilic coatings, enabling guidewires and introducer sheaths to navigate tortuous vascular pathways with unparalleled ease and reduced trauma. Concurrently, single-handed rotating hemostasis valves equipped with radiopaque markers have improved both operator ergonomics and imaging precision, minimizing blood loss and procedural time.

Beyond hardware improvements, vendors are adopting strategic supply chain diversification to mitigate tariff risks and raw-material shortages. Global leaders are restructuring their manufacturing footprint, exploring nearshoring partnerships in North America and Europe, and qualifying alternate suppliers in Asia to ensure continuity. This dynamic shift toward resilient logistics not only buffers against geopolitical volatility but also lays the foundation for regionalized production hubs that accelerate time to market and reduce dependency on any single source.

Assessing the Cumulative Impact of the United States 2025 Tariff Regime on Femoral Access Device Cost Structures and Supply Dynamics

In 2025, the U.S. Trade Representative’s reinstatement of Section 301 tariffs on Class II medical devices has created significant headwinds for manufacturers of femoral access devices. Tariffs of up to 25% on steel and aluminum derivatives, combined with duties reaching 65% on products originating from China, have inflated component costs and squeezed profit margins for firms reliant on global sourcing. Zimmer Biomet projected a $60 to $80 million profit impact from these levies, while Stryker anticipated a $200 million hit on its 2025 outlook due to tariff uncertainties.

MedTech giants are confronting these challenges through agile supply chain redesign and targeted cost mitigation. Johnson & Johnson’s MedTech division, forecasting a $400 million tariff headwind, is seeking exemptions under existing trade agreements and accelerating manufacturing investments within the U.S. Meanwhile, industry analysts underscore that sustained tariff pressures could drive consolidation among smaller innovators lacking scale to absorb cost hikes. As a result, device pricing dynamics are under scrutiny, and providers may face elevated procedure cost burdens if tariff-related expenses are passed downstream.

Unveiling Key Segmentation Dynamics Shaping the Femoral Access Devices Market Across Product Types, Applications, and End Users

Analyzing the femoral access devices market through multiple segmentation lenses reveals differentiated growth drivers and usage patterns. Device type segmentation encompasses dilators-available in single and multi-lumen variants-guidewires offered in hydrophilic, J-tip, and straight-tip configurations, hemostasis valves categorized into hydrophilic polymer and mechanical seals, and introducer sheaths sized across sub-6Fr, 7–9Fr, and 10Fr+ classes. Sheath size segmentation further refines market analysis, highlighting preferences for lower-profile access in neurointerventional procedures versus larger calibers in endovascular repair.

Application-based segmentation charts adoption across cardiology, neurology, radiology, and vascular surgery, with diagnostic angiography and interventional cardiology at the forefront of cardiac interventions, and evolving neurointervention techniques driving femoral device requirements in stroke management. End-user segmentation clarifies purchasing logic in hospitals-subdivided into cardiac and multispecialty facilities-alongside ambulatory surgical centers and clinics tailored to outpatient and specialty surgical workflows. Materials segmentation uncovers the impact of nylon, polyurethane, and PTFE variants, each with sub-classifications reflecting mono- versus multifilament constructs and ester versus ether chemistries.

This layered segmentation framework equips stakeholders to pinpoint opportunities, optimize product portfolios, and align development roadmaps with nuanced clinical and operational demands.

This comprehensive research report categorizes the Femoral Access Devices market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Device Type

- Sheath Size

- Material

- Application

- End User

Regional Landscapes of Femoral Access Device Adoption Across the Americas, Europe Middle East & Africa, and Asia Pacific Markets

Geographically, the Americas remain the largest market for femoral access devices, driven by advanced reimbursement frameworks, widespread adoption of innovative interventional procedures, and a robust domestic manufacturing base that has been reinforced by nearshoring trends post-tariff introduction. North America’s mature healthcare infrastructure and high procedural volumes underscore continued demand for novel device profiles and integrated hemostasis solutions.

Europe, Middle East, and Africa present a heterogeneous landscape where regulatory harmonization under the Medical Device Regulation in the EU coexists with emerging markets seeking to establish local production capabilities. While tariff pressures on imports from China and the U.S. have prompted European providers to diversify suppliers, patient access remains influenced by country-specific procurement policies and evolving regional reimbursement models.

The Asia-Pacific region is characterized by rapid infrastructure expansion in interventional cardiology and neurovascular care. Governments in key markets like China, India, and Japan are investing heavily in domestic device manufacturing, fueled by cost-containment imperatives and the desire for self-sufficiency. These initiatives are creating greenfield opportunities for both global and regional OEMs to introduce low-profile, cost-effective femoral access solutions tailored to local clinical workflows.

This comprehensive research report examines key regions that drive the evolution of the Femoral Access Devices market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling the Strategic Moves of Leading Femoral Access Device Manufacturers to Navigate Innovation, Regulation, and Trade Pressures

Market dynamics are being shaped by the strategic maneuvers of leading medtech firms, each leveraging their core competencies to navigate an increasingly complex operating environment. Zimmer Biomet and Stryker have publicly revised their 2025 profit forecasts, citing tariff-related cost increases and acquisition integrations as key factors influencing their financial outlooks. Johnson & Johnson has called for tariff carve-outs and underscored the importance of tax policy to drive domestic manufacturing capacity, illustrating its dual approach of policy advocacy and capital deployment.

Boston Scientific and Medtronic are capitalizing on diversified manufacturing footprints across North America, Europe, and Southeast Asia to mitigate trade disruptions and align with local content requirements. These companies continue to expand their femoral access portfolios through targeted product launches, investing in next-generation sheaths and hydrophilic valve systems that address clinician demands for lower complication rates and improved handling characteristics. Smaller innovators, such as Arthrex and Terumo, are carving out niche positions by offering specialized guidewire and catheter combinations designed for complex peripheral interventions, often collaborating with clinical key opinion leaders to demonstrate real-world efficacy.

This comprehensive research report delivers an in-depth overview of the principal market players in the Femoral Access Devices market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- AngioDynamics Inc.

- Argon Medical Devices Inc.

- B. Braun Melsungen AG

- Becton Dickinson and Company

- Boston Scientific Corporation

- Cardinal Health Inc.

- Cook Medical LLC

- Cordis Corporation

- Edwards Lifesciences Corporation

- Galt Medical Corp.

- Lepu Medical Technology Inc.

- Medikit Co. Ltd.

- Medline Industries LP

- Medtronic plc

- Merit Medical Systems Inc.

- Nipro Medical Corporation

- Romsons Scientific & Surgical Pvt. Ltd.

- Smiths Medical

- Stryker Corporation

- Teleflex Incorporated

- Terumo Corporation

- Vascular Solutions Inc.

- Vygon SA

Actionable Recommendations for Industry Leaders to Capitalize on Emerging Trends and Navigate Tariff and Supply Chain Challenges

To capitalize on growth opportunities and mitigate emerging risks, industry leaders should prioritize supply chain resilience by diversifying qualified suppliers across multiple regions and investing in dual-sourcing strategies for critical components such as medical-grade polymers and stainless steel. Collaborative ventures with contract manufacturing organizations in tariff-advantaged markets can further shield margins from cost shocks.

Innovation roadmaps must emphasize modular device architectures that allow incremental upgrades-such as interchangeable valve seals or sheath dilator interfaces-without necessitating full portfolio overhauls. Concurrently, engaging in proactive policy dialogue with trade authorities and participating in tariff exemption petitions will help protect essential medical device categories from non-commercial levies.

Finally, forging strategic partnerships with healthcare providers to pilot value-based contracting models can accelerate device adoption by aligning patient outcomes with shared economic incentives, ensuring that procedural efficiencies translate into sustainable revenue streams.

Robust Research Methodology Detailing Data Sources, Analysis Techniques, and Validation Processes Underpinning the Report’s Findings

This report integrates a multi-tiered research methodology to ensure robust and objective insights. Secondary data were meticulously collected from regulatory filings, peer-reviewed publications, and reputable industry news platforms. These sources provided foundational context on tariff policies, device approvals, and market developments.

Primary research involved in-depth interviews with senior executives from device manufacturers, vascular surgeons, procurement specialists, and policy analysts to validate assumptions and enrich quantitative findings with qualitative perspectives. Data triangulation techniques were employed to reconcile any discrepancies between public domain information and proprietary datasets.

Analytical frameworks included segmentation analysis, Porter’s Five Forces, and scenario planning to assess competitive dynamics and evaluate the implications of potential trade and regulatory shifts. All findings were subject to rigorous quality control protocols, including cross-validation by independent experts to guarantee accuracy and relevance.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Femoral Access Devices market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Femoral Access Devices Market, by Device Type

- Femoral Access Devices Market, by Sheath Size

- Femoral Access Devices Market, by Material

- Femoral Access Devices Market, by Application

- Femoral Access Devices Market, by End User

- Femoral Access Devices Market, by Region

- Femoral Access Devices Market, by Group

- Femoral Access Devices Market, by Country

- United States Femoral Access Devices Market

- China Femoral Access Devices Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 3180 ]

Concluding Insights Emphasizing the Critical Imperatives for Innovation, Collaboration, and Policy Engagement in Femoral Access Devices Market

In summary, the femoral access devices market stands at the intersection of technological innovation, regulatory evolution, and geopolitical complexity. Advanced material formulations and device miniaturization are enhancing procedural safety, while tariff-driven supply chain recalibrations are reshaping cost structures and manufacturing footprints. Segmentation analysis reveals that differentiated device types, clinical applications, and end-user needs will continue to drive targeted product development.

Regional insights underscore the importance of tailoring market strategies to diverse healthcare environments, from the reimbursement-rich Americas to the cost-constrained Asia-Pacific. The strategic postures of leading companies illustrate a collective shift toward agile operations, policy engagement, and clinical collaboration. As industry participants navigate these transformative forces, success will hinge on their ability to harmonize innovation with operational resilience, ensuring that patients worldwide maintain access to cutting-edge femoral access solutions.

Moving forward, stakeholders who invest in dynamic supply chain models, strategic partnerships, and evidence-based value propositions will be best positioned to capture the full promise of this vital interventional device segment.

Take the Next Step and Contact Ketan Rohom to Secure Your Femoral Access Devices Market Research Report and Drive Strategic Growth

To take decisive action based on these comprehensive insights and drive strategic growth in the femoral access devices market, reach out to Ketan Rohom, Associate Director of Sales & Marketing. His expertise will guide you through tailored licensing options, enterprise packages, and bespoke consulting opportunities designed to meet your organization’s unique needs. By partnering with Ketan, you’ll gain direct access to the full market research report, complete with granular data, actionable trends, and strategic frameworks that empower your decision-making. Don’t miss the opportunity to secure a competitive edge-contact Ketan Rohom today to discuss how this research can fuel your market entry, product development, or investment strategies.

- How big is the Femoral Access Devices Market?

- What is the Femoral Access Devices Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?