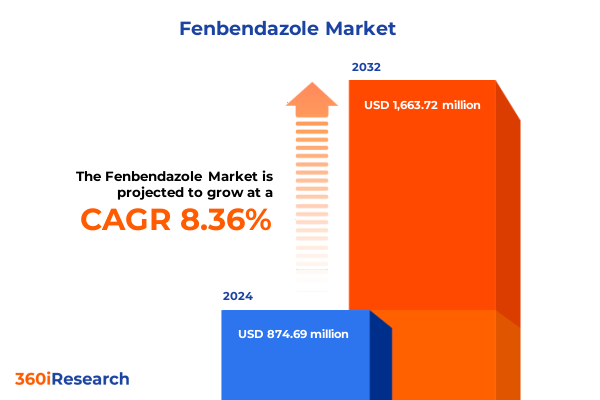

The Fenbendazole Market size was estimated at USD 946.65 million in 2025 and expected to reach USD 1,020.52 million in 2026, at a CAGR of 8.38% to reach USD 1,663.72 million by 2032.

Charting the Evolution of Fenbendazole from a Foundational Veterinary Anthelmintic to a Catalyst Driving Innovative Off-Label Research Across Species

Fenbendazole, a benzimidazole anthelmintic first approved in dogs in 1983 and centuries in principle rooted in tubulin binding mechanisms, has become an indispensable tool in parasite management across diverse animal populations. Its mechanism of action involves the disruption of microtubule formation within nematode cells, leading to nutrient absorption failure and eventual parasite death, rendering it effective against both adult and larval stages of many helminths. Over the decades, its labeled use has expanded to livestock species, poultry, companion animals, and even wildlife, underscoring its remarkable versatility and safety profile when administered according to approved regimens.

In recent years, interest has surged in off-label and compounded applications, with veterinarians employing fenbendazole alone or in combination therapies to treat conditions beyond the originally labeled indicia. While such practices have drawn regulatory attention and cautionary communications from the FDA regarding extra-label durations and dosages, the robust evidence supporting its core efficacy has remained unchallenged when used per label guidelines. As we embark on a detailed exploration of fenbendazole’s multifaceted role-spanning aquaculture to companion animals, evolving regulatory frameworks to shifting geopolitical trade barriers-this report establishes a foundational understanding of the drug’s journey from a cornerstone dewormer to a focal point of innovative application research.

Navigating Scientific Breakthroughs, Regulatory Adaptations, and Supply Chain Realignments That Are Redefining Fenbendazole’s Industry Footprint

The fenbendazole landscape has undergone transformative shifts as stakeholders navigate evolving scientific, regulatory, and digital ecosystem dynamics. Breakthrough preclinical studies and case reports published in 2024 have reignited conversation around fenbendazole’s role as a moderate microtubule destabilizing agent with potential anticancer benefits, spurring new university collaborations and exploratory clinical trials. Simultaneously, social media platforms have amplified anecdotal success stories in oncology forums, challenging industry leaders to differentiate substantiated research from unverified claims and to engage proactively in education campaigns.

Meanwhile, regulatory ecosystems have adapted to support targeted minor species approvals and to mitigate risks of extra-label misuse. In May 2024, the FDA granted supplemental approval for fenbendazole to treat gastrointestinal parasites in wild quail populations, marking its first authorization in wildlife management and reflecting confidence in its safety profile across novel animal groups. This milestone signals a deeper integration of fenbendazole into conservation medicine and wildlife health strategies. Concurrently, the U.S. veterinary compounding sector has expanded access through customized suspension formulations, prompting FDA guidance on quality controls to ensure consistent dosing and reduce adverse event reports.

Supply chains have also evolved as global trade tensions shape API sourcing. Manufacturers in India and China, which supply a majority of fenbendazole active ingredients, have responded to U.S. and European import regulations by augmenting domestic capacity and pursuing geographical diversification, thereby reshaping procurement strategies and risk management frameworks.

Assessing the Layered Effects of Section 301 and IEEPA Tariffs on Fenbendazole API Imports and Domestic Supply Chain Resiliency

United States tariff policies in 2025 have exerted cumulative pressures on fenbendazole’s API imports and finished product flows, compelling industry leaders to reassess sourcing strategies and cost structures. Although fenbendazole typically enters the U.S. under HTS 2933.90.4600 as a duty-free chemical compound, it faces overlay tariffs enacted under Section 301 and the International Emergency Economic Powers Act (IEEPA). As a result, additional ad valorem duties applied to Chinese and Hong Kong API exports rose from 25% to 50% in early June 2025, further compounded by a 10% universal reciprocal tariff on all imports effective April 5, 2025, driving total levies on certain generics to historic highs.

Broader U.S. trade data indicates that average applied import duties climbed from 2.5% to 15.8% in the first half of 2025 and are projected to remain elevated amid ongoing appeals regarding the constitutionality of IEEPA-based measures. Additionally, temporary exemptions and drawback mechanisms for pharmaceutical inputs have tightened, reducing relief avenues for manufacturers seeking to reclaim duties. Consequently, fenbendazole producers and distributors are increasingly exploring regional contract manufacturing and localized packaging to mitigate rising border costs and maintain supply continuity.

Leveraging Animal Type, Formulation, Channel, and Application Interplay to Illuminate Emerging Opportunities in Fenbendazole Deployment

In dissecting fenbendazole’s market dynamics through segmentation lenses, animal type categorization underscores distinct value pools spanning aquaculture-where fish and shrimp farming rely on oral suspensions to control trematode and nematode burdens-to companion animals such as cats and dogs, where granular and tablet formulations ensure versatile administration in both clinical and home environments. Livestock applications, including cattle, sheep & goat, and swine, reveal a robust preference for powder and bolus tablets integrated into feed or as drench formulations, reflecting on-farm operational efficiencies.

Form-based analysis further highlights performance versus convenience trade-offs: granules and powders offer stability and lower cost per dose, while tablets deliver precision dosing and safety assurances favored in veterinary hospital settings. Oral suspensions, often compounded in pharmacies, provide flexible concentration adjustments but require stringent quality controls to ensure consistent active ingredient dispersion.

Distribution channel dynamics emphasize the rise of online pharmacies, which have capitalized on digital platforms to offer direct-to-veterinarian deliveries and competitive pricing, while retail pharmacies and veterinary hospitals & clinics maintain dominance in prescription dispensing and professional oversight. Application-based segmentation brings to light differentiated treatment protocols across parasitic indications: hookworm and roundworm interventions often necessitate higher dosages over extended durations, whereas lungworm and whipworm treatments prioritize rapid onset of action and minimal off-target effects, influencing formulation preferences and promotional strategies.

This comprehensive research report categorizes the Fenbendazole market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Animal Type

- Form

- Application

- Distribution Channel

Comparative Overview of Regulatory Precision, Residue Governance, and Aquaculture-Driven Demand Trends Across Major Global Regions

Regionally, the Americas lead in companion animal and backyard poultry deworming innovations, as evidenced by the November 2024 FDA approval of an oral suspension designed exclusively for backyard chicken flocks-the only FDA-approved home use chicken dewormer-underscoring North American emphasis on small-scale poultry health and consumer convenience. The regulatory agility in permitting compounded formulations and addressing safety concerns in canine pancytopenia cases reflects a responsive governance framework attentive to veterinary community needs.

In Europe, Middle East & Africa, a harmonized residue management regime governs fenbendazole use in food-producing species, with EU Regulation 1161/2012 extending maximum residue limits to chickens and establishing clear withdrawal periods for muscle, fat, liver, kidney, milk, and eggs. This comprehensive MRL framework drives compliance requirements for feed-through and drench treatments, ensuring harmonized trade and consumer safety across member states.

Asia-Pacific markets display a pronounced focus on aquaculture integration, particularly in shrimp health management, where rapid population density increases and climate-driven parasite proliferation have elevated fenbendazole’s role in feed additive strategies. Regional regulatory bodies in Australia and New Zealand are evaluating MRL extensions for fin fish, while emerging economies like Vietnam and India ramp up domestic API capacity to meet both local and export demands, signaling a shift toward regional self-reliance in supply chains.

This comprehensive research report examines key regions that drive the evolution of the Fenbendazole market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Industry Titans, Niche Innovators, and API Suppliers Forging the Future of Fenbendazole Accessibility and Formulation Diversity

Key players shaping the fenbendazole ecosystem span established animal health divisions of multinational pharmaceutical firms to specialized contract manufacturers and compounding pharmacies. Merck Animal Health’s introduction of a home-use chicken suspension positioned the company as an innovator in minor species approvals, reinforcing its leadership in delivering targeted formulations for backyard producers. Meanwhile, compounding entities like Vetr LLC have leveraged formulation flexibility to expand beyond label limitations, albeit under unapproved drug designations subject to ongoing regulatory scrutiny.

Generic API suppliers in India and China have scaled production capacities to serve global demand, with vertically integrated firms offering dossier support for emergent markets. In parallel, veterinary distributors and digital platform operators are intensifying collaborations to streamline ordering processes and bolster professional education initiatives, thereby addressing both supply reliability and responsible use imperatives.

This comprehensive research report delivers an in-depth overview of the principal market players in the Fenbendazole market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alivira Animal Health Ltd

- AMGIS Lifescience

- Ashish Life Science Pvt Ltd

- Aurora Industry Co Ltd

- Boehringer Ingelheim International GmbH

- Ceva Santé Animale S.A.

- Changzhou Comwin Fine Chemicals Co Ltd

- Chr Olesen Group

- Dechra Pharmaceuticals PLC

- Elanco Animal Health Incorporated

- Hindustan Therapeutics Pvt Ltd

- Huvepharma

- LGM Pharma

- Merck & Co Inc

- NGL Fine-Chem limited

- Norbrook Laboratories Limited

- Orex Pharma Pvt Ltd

- Phibro Animal Health

- Rakshit Drugs Pvt Ltd

- Rochem International Inc

- Vetoquinol S.A.

- Virbac S.A.

- Xi'an Tian Guangyuan Biotech Co Ltd

- Zoetis LLC

Implementing Integrated Regulatory Partnerships, Regional Production Strategies, and Segment-Focused Commercial Models to Sustain Growth

Industry leaders should prioritize proactive engagement with regulatory authorities to anticipate shifts in minor species approvals and residue management guidelines, ensuring uninterrupted market access. Establishing regional manufacturing hubs in tariff-sensitive jurisdictions can mitigate import duties while enhancing supply chain agility. Strategic partnerships with contract compounding laboratories should be governed by rigorous quality assurance protocols to uphold dosage accuracy and minimize adverse event liabilities.

From a commercial standpoint, differentiated marketing programs tailored to distinct segmentation clusters-such as custom feed-through solutions for livestock integrators or premeasured suspension packs for aquaculture operations-will drive deeper market penetration. Simultaneously, embracing digital outreach platforms to disseminate evidence-based educational content on safe off-label applications will strengthen brand authority and support responsible stewardship among veterinary professionals.

Deploying a Rigorous Multi-Source Framework Combining Regulatory Filings, Scientific Publications, and Expert Consultations to Ensure Insight Integrity

This research synthesizes comprehensive secondary data from government publications, peer-reviewed scientific literature, and regulatory filings sourced from agencies including the U.S. FDA, USTR, EMA, and WTO databases. Tariff structures were analyzed via HTSUS revisions and presidential proclamations retrieved from official Federal Register notices. Market dynamics and segmentation outlooks were validated through expert consultations with veterinary clinicians, aquaculture specialists, and API manufacturers between March and June 2025.

Data triangulation involved cross-referencing global MRL regulations with regional feed additive guidelines, evaluating product labels and package inserts for formulation characteristics, and mapping distribution channel footprints through industry association reports. All insights were reviewed for consistency and relevance by internal subject matter experts to ensure factual accuracy and actionable applicability.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Fenbendazole market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Fenbendazole Market, by Animal Type

- Fenbendazole Market, by Form

- Fenbendazole Market, by Application

- Fenbendazole Market, by Distribution Channel

- Fenbendazole Market, by Region

- Fenbendazole Market, by Group

- Fenbendazole Market, by Country

- United States Fenbendazole Market

- China Fenbendazole Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

Converging Scientific Innovation, Evolving Regulations, and Complex Trade Dynamics to Define Fenbendazole’s Future Trajectory in Veterinary Health

Fenbendazole’s enduring legacy as a cornerstone anthelmintic has evolved into a dynamic landscape shaped by scientific innovation, regulatory fine-tuning, and global trade complexities. The drug’s broad spectrum of use across aquaculture, companion animals, and livestock, coupled with expanded minor species approvals and emergent off-label research, underscores its adaptability and relevance in modern veterinary medicine.

Simultaneously, elevated import tariffs and residue governance frameworks have introduced new operational considerations, catalyzing supply chain diversification and strategic regional manufacturing initiatives. As industry stakeholders navigate these transformative forces, a nuanced understanding of segmentation dynamics and regional regulatory environments will be pivotal to sustained success in fenbendazole development and distribution.

Unlock Exclusive Fenbendazole Market Intelligence and Connect Directly with Ketan Rohom to Propel Your Decision-Making and Strategy

To uncover the full spectrum of insights and gain a competitive edge, reach out today to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch, and secure your comprehensive market research report on the fenbendazole landscape

By engaging with our in-depth analysis, you will leverage expert guidance to navigate evolving market dynamics and regulatory landscapes. Contact Ketan Rohom now to customize your stakeholder presentation and accelerate strategic decision-making in the fenbendazole market.

- How big is the Fenbendazole Market?

- What is the Fenbendazole Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?