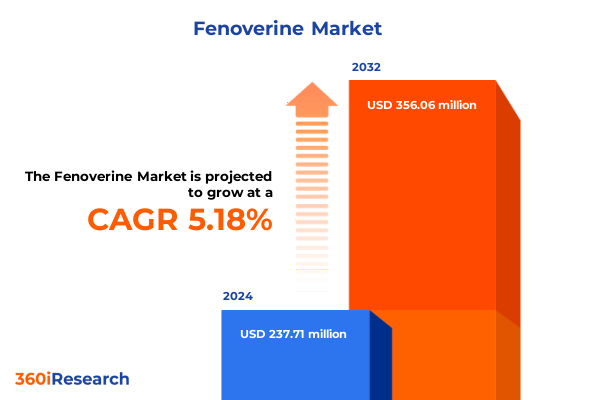

The Fenoverine Market size was estimated at USD 250.30 million in 2025 and expected to reach USD 261.98 million in 2026, at a CAGR of 5.16% to reach USD 356.06 million by 2032.

Unveiling Fenoverine’s Role in Modern Gastrointestinal Therapeutics to Establish a Comprehensive Foundation for Strategic Decision-Making

Fenoverine is an established antispasmodic agent characterized by its unique mechanism of calcium channel inhibition specifically targeting intestinal smooth muscle, which enables effective relief of abdominal cramps and spasms without exerting cardiovascular effects typical of antianginal therapies. Its mode of action involves modulation of calcium influx in gastrointestinal muscle fibers, resulting in a reduction of hypercontractility and symptomatic relief in functional bowel disorders. This therapeutic profile has earned fenoverine recognition in diverse regulatory jurisdictions, where it is prescribed to alleviate the discomfort associated with irritable bowel presentations and other spastic gastrointestinal conditions.

The growing burden of functional gastrointestinal disorders, particularly irritable bowel syndrome, underscores the imperative for safe, non-opioid-based treatments that address chronic abdominal pain and motility disturbances. Recent epidemiological analyses estimate that approximately 11.2% of the global population experiences irritable bowel syndrome, with symptom severity and diagnostic criteria varying by region, which highlights persistent unmet needs in patient care pathways and real-world outcomes. As stakeholders seek to optimize therapeutic interventions, a comprehensive understanding of fenoverine’s clinical positioning, regulatory environment, and supply chain dynamics is critical for informed decision-making. This executive summary lays the groundwork for strategic insights into market drivers, segmentation nuances, and competitive imperatives that will shape the future of fenoverine commercialization.

Exploring Paradigm-Shifting Dynamics That Are Redefining Patient Engagement Product Development and Market Access in the Antispasmodic Sector

The landscape for gastrointestinal therapeutics is experiencing paradigm-shifting dynamics driven by digital health integration, precision medicine approaches, and patient-centric care models that are reshaping product development and market access strategies. The expansion of telemedicine and remote monitoring platforms has facilitated continuous symptom tracking, enabling clinicians to tailor treatment regimens and optimize fenoverine dosing schedules based on individualized patient profiles and real-world evidence. This shift toward data-driven care has fostered collaboration between healthcare providers, technology vendors, and pharmaceutical stakeholders to co-develop software-as-a-medical-device adjuncts that enhance medication adherence and capture longitudinal safety and efficacy metrics.

Assessing the Ripple Effects of 2025 Trade Measures on Pharmaceutical Supply Chains and Cost Structures Impacting Fenoverine Manufacturing

In April 2025, a global tariff regime was introduced, imposing a 10% duty on all imported goods entering the United States, including critical healthcare products such as active pharmaceutical ingredients and finished drug formulations. This across-the-board duty has immediately heightened input costs for manufacturers, prompting supply chain realignments and cost-containment measures within the fenoverine value chain. The universal tariff underscores a broader policy emphasis on domestic manufacturing, yet it also introduces operational complexities for product owners reliant on international sourcing networks.

Supplementing the blanket levy, targeted Section 301 tariffs have been applied to essential APIs based on country of origin. Specifically, a 25% ad valorem duty on APIs sourced from China and a 20% tariff on those imported from India took effect in early May 2025, reflecting trade tensions and security considerations related to pharmaceutical supply chains. These differentiated duties have directly influenced procurement strategies and risk management practices, as fenoverine producers reassess supplier portfolios, negotiate long-term agreements, and explore nearshoring options to mitigate cost volatility.

Concurrent with Section 301 measures, the U.S. Department of Commerce initiated an investigation under Section 232 into pharmaceutical and medical product imports, introducing the prospect of additional duties tied to national security assessments. Moreover, reciprocal tariffs on Chinese-origin goods previously escalated to as high as 34% were temporarily suspended in May 2025 under a 90-day de-escalation agreement, though standard MFN and other statutory duties remain in place. These evolving trade actions necessitate vigilant monitoring to anticipate further adjustments and to safeguard uninterrupted production and market supply of fenoverine-based therapies.

Illuminating Multidimensional Insights from Formulation to Administration Routes Highlighting Demand Drivers Across Diverse Treatment Modalities

A nuanced understanding of product form and release characteristics reveals distinct patient and provider preferences across fenoverine offerings. Injectable formulations, available as both aqueous solutions and suspensions, cater to acute care settings requiring rapid onset of action, while oral dosage formats span capsules, liquid solutions, and tablets. Within the tablet segment, immediate-release variations satisfy demands for swift symptomatic relief, whereas modified-release designs support sustained therapeutic exposure, optimizing tolerance and dosing convenience. Parallel to formulation considerations, route-of-administration pathways delineate clinical indications and logistical requirements, with parenteral administration reserved for hospitalized patients or those with compromised gastrointestinal absorption, and oral delivery dominating outpatient and self-administration scenarios.

Clinical presentations inform targeted therapy selection, with fenoverine prescribed for generalized abdominal pain as well as for specifically diagnosed irritable bowel syndrome. This bifurcation in indication supports differentiated marketing and formulary positioning strategies, enabling tailored messaging and value propositions that resonate with distinct patient cohorts and payer frameworks.

Distribution network optimization underscores channel-specific engagement, spanning hospital pharmacies that stock parenteral supplies, retail pharmacies catering to acute prescriptions, and online platforms that deliver medications directly to patients via e-commerce portals or manufacturer-supported patient services. Home care environments and outpatient clinics complete the end-user spectrum, reflecting the full continuum of care from inpatient intervention to chronic management outside traditional healthcare facilities.

This comprehensive research report categorizes the Fenoverine market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Form

- Indication

- Distribution Channel

- End User

- Dosage Strength

- Route Of Administration

Navigating Regional Variability from the Americas to Asia-Pacific Illuminating Nuanced Market Drivers and Regulatory Environments

Regional market dynamics for fenoverine vary widely, shaped by regulatory frameworks, healthcare infrastructure maturity, and payer mechanisms. In the Americas, established reimbursement pathways and growing emphasis on non-opioid pain management have driven favorable uptake of antispasmodic therapies, with manufacturers forging partnerships to leverage integrated delivery models that extend from acute care settings into community-based clinics. Simultaneously, localized production incentives and public–private collaborations aim to fortify API and finished-dosage manufacturing capacities, aligning with national priorities for pharmaceutical self-reliance.

In the Europe, Middle East and Africa region, fragmented regulatory landscapes present both challenges and opportunities. European Union harmonization fosters streamlined market access, yet variations in national formularies and tendering systems demand targeted pricing strategies and evidence generation that address country-specific health technology assessment requirements. Meanwhile, emerging markets in the Middle East are investing in healthcare infrastructure modernization, creating avenues for fenoverine adoption as a component of gastrointestinal care protocols. African territories, despite facing distribution hurdles, represent nascent opportunities underpinned by increasing healthcare expenditure and evolving treatment guidelines.

The Asia-Pacific region encompasses diverse economies from highly regulated markets to rapidly developing healthcare ecosystems. Japan and South Korea epitomize sophisticated regulatory environments where localized clinical data and real-world evidence underpin formulary inclusion. In contrast, markets such as India and Southeast Asian nations emphasize cost-efficiency and generic penetration, prompting competitive pressures that drive down price points. These regional variations necessitate adaptive launch strategies and supply chain flexibility to balance scale economies with compliance obligations.

This comprehensive research report examines key regions that drive the evolution of the Fenoverine market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Deciphering Strategic Moves of Prominent Industry Players Shaping Competitive Advantage Through Innovation Partnerships and Market Penetration for Antispasmodic Therapies

Leading stakeholders in the antispasmodic segment are leveraging differentiated strategies to secure market share and sustain growth momentum. Prominent generic pharmaceutical companies are capitalizing on fenoverine’s patent expirations to introduce cost-effective, high-quality alternatives, while branded innovators pursue lifecycle management via novel extended-release formulations and combination therapies. Collaborative alliances between global manufacturers and specialized CDMOs are enhancing production scalability and ensuring accelerated time-to-market, underpinned by investments in advanced formulation technology and regulatory expertise.

Parallel to manufacturing synergies, strategic partnerships with digital health firms are emerging as a key competitive differentiator, enabling integration of medication tracking and patient engagement platforms that bolster adherence and generate real-world patient insights. Some market leaders are also forging licensing agreements to expand geographic footprints, accessing international distribution networks and local market intelligence to navigate complex regulatory landscapes. These concerted efforts reflect a concerted industry drive to optimize value-chain efficiency, support access initiatives, and reinforce product differentiation in a rapidly evolving therapeutic category.

This comprehensive research report delivers an in-depth overview of the principal market players in the Fenoverine market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- American Custom Chemicals Corporation

- Dayang Chem (Hangzhou) Co.,Ltd.

- Enomark

- JoinHub Pharma

- LGC Limited

- Mars Therapeutics Private Limited

- Medical Isotopes, Inc.

- Micro Labs Limited

- Sri Krishna Pharmaceuticals Ltd.

- Synmosa Biopharma Corporation

- Taj Pharmaceuticals Ltd.

Formulating Executable Strategies for Stakeholders to Capitalize on Emerging Opportunities and Mitigate Supply Chain and Regulatory Risks in 2025

Industry stakeholders can unlock new opportunities by diversifying API sourcing to establish multi-country supply networks that mitigate geopolitical and tariff-related disruptions. Strengthening relationships with contract manufacturing partners capable of rapid scale-up and localized production will enhance resilience against regulatory shifts and trade policy fluctuations. Concurrently, investment in digital therapeutics integration can differentiate fenoverine offerings by aligning them with value-based care objectives and outcome-based contracting models.

To navigate complex payer environments, manufacturers should develop robust health economics and outcomes research programs that quantify the real-world impact of fenoverine on healthcare resource utilization and quality-of-life metrics. Tailored value narratives, buttressed by region-specific cost-benefit analyses, can facilitate favorable formulary positioning across diverse reimbursement systems. Moreover, a patient-centric approach that incorporates feedback loops from end-users, clinicians, and payers will drive continuous improvement in product design and service delivery, fostering brand loyalty and adherence.

Finally, sustained dialogue with regulatory agencies and trade authorities is essential to anticipate policy developments and secure tariff relief or exemptions where feasible. Engaging in multi-stakeholder forums and industry associations can yield early insights into impending trade measures, enabling proactive adjustments to sourcing strategies and pricing frameworks.

Detailing a Robust Mixed-Method Research Framework Integrating Secondary Data Synthesis and Expert Validation to Ensure Actionable Market Intelligence

This analysis was developed using a rigorous mixed-method research framework combining comprehensive secondary research and primary expert engagement. Initial desk research synthesized publicly available regulatory documents, peer-reviewed literature, trade publications, and policy announcements to establish a foundational understanding of fenoverine’s clinical profile, tariff landscape, and regional market contexts. Key data points were corroborated across multiple sources to ensure accuracy and reliability.

To validate emerging trends and strategic imperatives, in-depth interviews were conducted with senior industry executives, clinical thought leaders, and supply chain specialists. These engagements provided nuanced perspectives on operational challenges, patient adherence dynamics, and competitive tactics. Quantitative insights were triangulated with qualitative findings to construct actionable recommendations and scenario analyses.

Throughout the research process, data integrity was maintained via iterative review cycles, cross-functional expert panels, and adherence to established market intelligence standards. This methodological rigor ensures that the resultant insights are both robust and practically relevant for decision-makers seeking to navigate the evolving fenoverine marketplace.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Fenoverine market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Fenoverine Market, by Form

- Fenoverine Market, by Indication

- Fenoverine Market, by Distribution Channel

- Fenoverine Market, by End User

- Fenoverine Market, by Dosage Strength

- Fenoverine Market, by Route Of Administration

- Fenoverine Market, by Region

- Fenoverine Market, by Group

- Fenoverine Market, by Country

- United States Fenoverine Market

- China Fenoverine Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1272 ]

Synthesizing Key Findings to Articulate a Cohesive Strategic Outlook Unveiling Opportunities and Challenges for Sustainable Growth in Fenoverine Therapeutics

The cumulative analysis presented herein underscores a dynamic landscape for fenoverine, shaped by transformative shifts in digital health integration, evolving regulatory and trade environments, and strategic imperatives for segmentation and regional diversification. While escalating tariffs and complex reimbursement structures present tangible challenges to cost management and market access, they also catalyze innovation in supply chain optimization, formulation development, and patient engagement solutions.

Segmentation insights reveal multifaceted opportunities across formulation types, administration routes, clinical indications, and distribution channels, enabling tailored value propositions that resonate with specific stakeholder groups. Regional nuances demand adaptive launch strategies and localized collaboration to align with divergent healthcare policies and market maturity levels. Moreover, the strategic moves of leading companies reflect an industry-wide commitment to enhancing resilience, securing competitive advantage, and driving sustainable growth.

By embracing the recommended strategic actions-ranging from diversified sourcing models and digital therapeutics integration to robust health economics research and proactive policy engagement-market participants can navigate uncertainties and capitalize on emerging demand trends. This cohesive strategic outlook empowers decision-makers to harness fenoverine’s therapeutic potential while mitigating external risks.

Take the Next Step Toward Competitive Insights and Revenue Growth by Engaging with Our Expert Associate Director for Comprehensive Market Intelligence

Elevate your strategic positioning in the evolving fenoverine landscape by engaging directly with our Associate Director of Sales & Marketing, Ketan Rohom. His expertise in gastrointestinal therapeutic commercialization and regulatory navigation equips you with tailored guidance to align your product portfolio with emerging patient care paradigms and supply chain resilience strategies. By partnering with his team, you gain expedited access to comprehensive market intelligence and actionable insights designed to inform your next growth initiative. Seize this opportunity to leverage high-impact data and bespoke consultation to accelerate your competitive advantage. Reach out now to secure your copy of the definitive fenoverine market research report and transform insights into measurable business outcomes.

- How big is the Fenoverine Market?

- What is the Fenoverine Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?