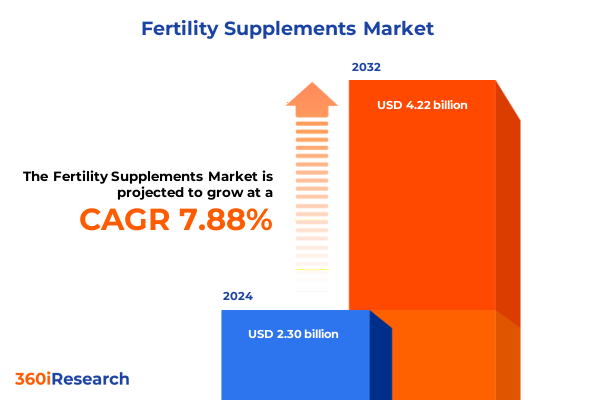

The Fertility Supplements Market size was estimated at USD 2.48 billion in 2025 and expected to reach USD 2.66 billion in 2026, at a CAGR of 7.90% to reach USD 4.22 billion by 2032.

Introducing the Fertility Supplements Ecosystem Through Emerging Consumer Demands and Scientific Advances in Reproductive Wellness

The realm of fertility supplements has become a focal point for both healthcare professionals and consumers seeking non-invasive solutions to support reproductive health. In recent years, the intersection of advanced scientific research and heightened consumer awareness has fostered an environment ripe for innovation. As individuals confront a range of fertility challenges, from hormonal imbalances to nutrient deficiencies, the appetite for evidence-based interventions has grown substantially. Moreover, the emphasis on preventive healthcare has led to a deeper exploration of how tailored nutritional support can optimize reproductive outcomes, making fertility supplements an integral component of holistic wellness regimens.

In this context, it is essential to present a panoramic view of the fertility supplements ecosystem, tracing its evolution from niche offerings to mainstream acceptance. By examining the convergence of cutting-edge ingredient development, rigorous clinical evaluation, and consumer demand for transparency, this analysis lays the foundation for understanding emerging market dynamics. Additionally, recognizing the influence of demographic shifts and lifestyle factors underscores the necessity of a nuanced approach. As we embark on this exploration, the reader gains clarity on why fertility supplementation has transcended its supplementary role to become a cornerstone of reproductive health strategies.

Revealing the Transformative Shifts in Ingredient Science and Personalized Nutrition within Fertility Supplements

The fertility supplements landscape has undergone transformative shifts, driven by breakthroughs in ingredient science and heightened demand for personalized nutrition. Advances in amino acid formulations, such as L-Arginine and L-Carnitine, have underpinned new approaches to improving cellular energy metabolism and reproductive function. Simultaneously, herbal extracts like Ashwagandha and Maca have garnered attention for their adaptogenic and hormone-balancing properties, reflecting a broader shift toward botanically derived interventions. In parallel, the reintegration of traditional compounds, including chasteberry, into evidence-based protocols has illuminated the potential synergies between ancient remedies and modern research.

Furthermore, the rise of targeted probiotic strains, notably Bifidobacterium and Lactobacillus variants designed for urogenital health, has expanded the scope of fertility-focused supplementation. Hormonal agents such as Clomiphene and DHEA, once confined to clinical settings, are now formulated for consumer accessibility under professional guidance. Transitioning beyond ingredients, the proliferation of varied dosage forms-including capsule technologies, powders, and softgels-has empowered consumers to align intake methods with lifestyle preferences. As a result, the industry has witnessed a recalibration toward bespoke formulations, signaling a future in which precision nutrition becomes integral to reproductive well-being.

Analyzing the Cumulative Impact of 2025 United States Tariffs on Fertility Supplement Supply Chains and Sourcing Dynamics

United States tariffs introduced in 2025 have exerted a cumulative impact on the fertility supplements supply chain, prompting manufacturers to reassess sourcing strategies and operational efficiencies. In particular, duty adjustments on key minerals such as iodine, selenium, and zinc have increased input costs, driving a reevaluation of domestic versus international procurement. Simultaneously, heightened tariffs on herbal extracts originating from select regions have compelled brands to diversify supplier networks and invest in quality assurance processes to maintain consistency and compliance.

Moreover, the levies have catalyzed a strategic realignment among market participants, with larger organizations leveraging scale to negotiate preferential agreements while smaller innovators pursue vertical integration models. Consequently, companies have intensified efforts to localize production and streamline logistics, mitigating exposure to tariff volatility. As these shifts unfold, the resilience of distribution channels-ranging from hospital pharmacies to ecommerce platforms-has emerged as a critical determinant of market agility, underscoring the importance of robust partnerships and adaptive supply chain frameworks.

Uncovering Key Segmentation Insights Spanning Product Composition, Delivery Forms, Channels, Applications, and Pricing Tiers

Insight into consumer preferences underscores distinct patterns across product typologies, dosage formats, distribution touchpoints, applications, and price tiers. Fertility supplements based on product composition reveal an appetite for amino acid blends, including L-Arginine and L-Carnitine, alongside botanical solutions like Ashwagandha, Chasteberry, and Maca. Hormone-centric offerings containing Clomiphene and DHEA attract those seeking clinical-grade support, while mineral-enriched formulations with iodine, selenium, and zinc respond to micronutrient gap concerns. Probiotics featuring targeted strains of Bifidobacterium and Lactobacillus illustrate the growing recognition of gut–reproductive axis interactions, and vitamin complexes integrating folic acid, vitamin D, and vitamin E continue to underpin foundational fertility regimens.

Consumer affinity for form variations has also become pronounced. Encapsulated solutions, whether in hard gelatin or plant-based shells, yield convenience and stability, whereas powders offer customizable dosing. Softgels and coated or monolayer tablets appeal to those prioritizing ease of ingestion and shelf life. Distribution channel insights highlight the role of digital platforms-brand websites, major ecommerce marketplaces, and online pharmacies-in fostering direct-to-consumer engagement, while traditional outlets such as hospital and retail pharmacies maintain credibility among healthcare practitioners. Application-driven segmentation distinguishes female-centric products supporting menstrual health and ovulation from male-focused solutions enhancing motility and sperm count, as well as unisex formulations targeting general wellness and hormonal equilibrium. Observing consumer spending across economy, mid tier, and premium price bands reveals a willingness to invest in efficacy-backed products that align with individual budgets and perceived value.

This comprehensive research report categorizes the Fertility Supplements market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Form

- Distribution Channel

- Application

Highlighting Regional Diversity in Fertility Supplement Preferences Across Americas, EMEA, and Asia-Pacific

Geographic analysis highlights divergent growth trajectories and consumer behaviors across major regions of the global fertility supplement sphere. In the Americas, robust demand reflects heightened awareness campaigns and strong healthcare infrastructure, with the United States leading adoption of hormone-based protocols and hybrid wellness products. Latin American markets exhibit an affinity for herbal and traditional remedies, bolstered by cultural acceptance of natural health solutions.

In Europe, Middle East, and Africa, regulatory complexities and regional diversity shape market access, driving localized innovation in botanical blends and micronutrient formulations. Consumer trust in certified quality standards and clean-label ingredients has spurred collaborations between nutraceutical firms and academic institutions. Across the Asia-Pacific, rapid urbanization and rising disposable incomes fuel demand for premium fertility supplements, particularly in East Asian economies where technologically advanced softgel and encapsulated formats are preferred. Southeast Asia’s expanding ecommerce ecosystem has further democratized access to specialized formulations, while Oceania markets display balanced interest across foundational vitamins and emerging probiotic therapies.

This comprehensive research report examines key regions that drive the evolution of the Fertility Supplements market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Strategic Moves by Leading Companies to Differentiate through Innovation, Partnerships, and Digital Engagement

Leading industry participants have intensified strategic initiatives to capture evolving opportunities in the fertility supplements domain. Global nutritional giants have expanded their pipelines through targeted acquisitions, integrating novel botanical research and probiotic technologies to differentiate their portfolios. Simultaneously, agile specialist firms leverage clinical partnerships to validate proprietary formulations, securing physician endorsements that enhance brand credibility. Collaborative ventures between ingredient suppliers and supplement manufacturers accelerate entry to market with high-potency complexes and patented delivery systems.

In addition, digital-first companies utilize direct-to-consumer models, harnessing data analytics to tailor marketing messages and optimize user experience. These innovative players have refined subscription offerings that support long-term supplementation adherence. Meanwhile, contract manufacturing organizations have scaled capacity to accommodate personalized batch production, meeting the bespoke needs of emerging brands. As competitive intensity intensifies, intellectual property protection and regulatory intelligence stand at the forefront of corporate strategies, underpinning sustainable differentiation and market resilience.

This comprehensive research report delivers an in-depth overview of the principal market players in the Fertility Supplements market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AdvaCare Pharma

- Beli

- Bionova Lifesciences

- Carlson Labs

- Coast Science

- Elan Healthcare Inc

- Eu Natural

- Exeltis USA Inc

- Fairhaven Health LLC

- Fertility Nutraceuticals LLC Ovaterra

- FullWell

- Hera (HeraNow)

- LENUS Pharma GesmbH

- Life Extension

- Nestlé

- Nua Fertility Ireland Ltd

- Ocean Healthcare

- Orthomol Pharmazeutische Vertriebs GmbH

- Premama

- Ritual

- Theralogix LLC

- Thorne Research

- Vitabiotics Ltd

Crafting Actionable Strategies for Fertility Supplement Leaders to Elevate Innovation, Supply Chain Agility, and Consumer Trust

To navigate the complexity of the fertility supplements landscape, industry leaders must align their strategies with consumer expectations for efficacy, safety, and transparency. Organizations are advised to prioritize partnerships with clinical researchers and academic centers to substantiate product claims through randomized trials and peer-reviewed publications. By incorporating novel ingredients supported by robust scientific data, brands can differentiate their offerings and inspire confidence among healthcare practitioners and end users.

Moreover, companies should invest in scalable manufacturing platforms that enable rapid customization of formulations, facilitating agile responses to emerging trends in application-specific support. Strengthening supply chain resilience through diversified sourcing and localized production will mitigate exposure to external shocks and regulatory changes. In parallel, enhancing digital ecosystems-from personalized customer portals to interactive educational content-will foster deeper consumer engagement and bolster subscription-driven revenue streams. Cultivating transparent labeling practices, including full disclosure of origin, purity, and manufacturing processes, will further reinforce brand trust and loyalty, positioning industry stakeholders to capitalize on the sustained momentum in reproductive wellness.

Outlining the Rigorous Multi-Source Research Methodology Underpinning Our Reproductive Wellness Supplements Analysis

This analysis synthesizes primary and secondary research methodologies to ensure a rigorously validated perspective on the fertility supplements sector. Secondary sources encompass peer-reviewed journals, industry publications, regulatory databases, and trade association reports, providing comprehensive context on ingredient efficacy, compliance frameworks, and global trade dynamics. Meanwhile, primary research includes structured interviews with key opinion leaders in reproductive medicine, surveys of formulators and supply chain executives, and site visits to manufacturing facilities to observe quality assurance protocols.

Data triangulation techniques reinforce the credibility of insights by cross-verifying information across independent sources. Qualitative inputs are complemented by thematic analysis, uncovering emerging consumer sentiment and shifting professional recommendations. Concurrently, quantitative assessments employ statistical validation of ingredient performance studies, leveraging meta-analytic approaches to highlight consistent efficacy signals. By integrating these rigorous methods, the research offers a balanced, multi-dimensional understanding of fertility supplements, equipping stakeholders with the analytical depth necessary for strategic decision making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Fertility Supplements market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Fertility Supplements Market, by Product Type

- Fertility Supplements Market, by Form

- Fertility Supplements Market, by Distribution Channel

- Fertility Supplements Market, by Application

- Fertility Supplements Market, by Region

- Fertility Supplements Market, by Group

- Fertility Supplements Market, by Country

- United States Fertility Supplements Market

- China Fertility Supplements Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2703 ]

Concluding with Strategic Imperatives That Define the Next Frontier in Evidence-Driven Fertility Supplement Solutions

In summary, the fertility supplements arena stands at the convergence of scientific innovation, evolving consumer expectations, and dynamic regulatory landscapes. The proliferation of targeted amino acids, botanical extracts, probiotic strains, and hormone-based complexes underscores the sector’s progression toward precision nutrition for reproductive health. Regional nuances across the Americas, EMEA, and Asia-Pacific highlight the importance of localized strategies, while shifting tariff environments necessitate resilient supply chain architectures.

Moving forward, success in this domain will hinge on the ability to harness clinical validation, optimize direct-to-consumer engagement, and maintain transparent, quality-driven practices. As industry leaders deploy actionable recommendations-ranging from research collaborations to digital ecosystem enhancements-they will shape the future contours of this vital wellness segment. Ultimately, a commitment to evidence-based innovation and consumer-centric approaches will differentiate those who chart the next wave of growth in fertility supplementation.

Engaging Industry Stakeholders to Secure Comprehensive Fertility Supplements Insights and Propel Strategic Decision Making

We invite stakeholders and decision makers to acquire the comprehensive research report on the fertility supplements domain by reaching out to Ketan Rohom, Associate Director, Sales & Marketing. Leverage our in-depth analysis to inform strategic planning, optimize product positioning, and capitalize on evolving consumer preferences. Our report provides actionable insights tailored to support informed decision making, guiding your organization toward sustained growth and competitive differentiation. Engage with Ketan today to access the full suite of proprietary data and expert recommendations and secure your advantage in this rapidly transforming landscape.

- How big is the Fertility Supplements Market?

- What is the Fertility Supplements Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?