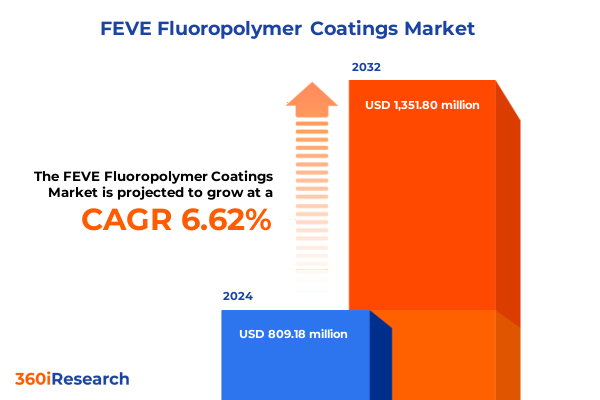

The FEVE Fluoropolymer Coatings Market size was estimated at USD 863.45 million in 2025 and expected to reach USD 910.28 million in 2026, at a CAGR of 6.61% to reach USD 1,351.80 million by 2032.

Discovering How Next-Generation FEVE Fluoropolymer Coatings Are Redefining Surface Longevity, Aesthetic Appeal, and Environmental Performance Across Industries Today

The evolution of high-performance coatings has reached a pivotal milestone with the emergence of FEVE fluoropolymer technology, a class of advanced materials that delivers unmatched weatherability, color retention, and chemical resistance. This introduction frames the transformative potential that FEVE coatings bring to surface protection challenges across demanding environments, from corrosive coastal regions to urban industrial zones. As industries confront increasingly stringent regulatory requirements and heighten demands for long-term asset durability, the role of fluoropolymer-based solutions has become central to preventing revenue loss, reducing maintenance downtime, and enhancing sustainable asset lifecycles.

Moving beyond conventional coating chemistries, formulations based on fluorinated ethylene vinyl ether offer a unique combination of low surface energy and high bond strength, resulting in coatings that resist chalking, fading, and chemical degradation over extended service intervals. The ability to maintain aesthetic integrity while delivering robust protective performance positions FEVE coatings as a premium alternative for clients seeking to optimize their total cost of ownership, whether in infrastructure projects, specialty vehicles, or industrial equipment.

In this executive summary, we establish the foundational context for a comprehensive exploration of the FEVE fluoropolymer coatings market. We highlight key forces reshaping the industry, the implications of new trade policies, vital segmentation perspectives, regional nuances, and competitive landscapes. Through this introduction, decision-makers will appreciate the strategic importance of integrating FEVE fluoropolymer solutions into product roadmaps and maintenance strategies to achieve operational excellence and environmental compliance.

Examining the Revolutionary Shifts in Coating Technologies and Market Dynamics That Are Propelling FEVE Fluoropolymer Applications to New Heights Globally

The coatings landscape is undergoing profound transformations driven by technological breakthroughs, heightened environmental imperatives, and evolving customer expectations. Recent advances in reactor design and polymerization techniques have expanded the performance envelope of FEVE fluoropolymer formulations, enabling ultra-thin film applications that deliver equivalent protection compared to traditional thicker coatings. As a result, companies can achieve significant material savings and reduce cure times, driving operational efficiencies across multiple production lines.

Simultaneously, accelerating regulations targeting volatile organic compounds and persistent organic pollutants have compelled manufacturers and end users to seek greener coating solutions. FEVE fluoropolymer systems, which can be formulated in powder-based, waterborne, or low-solvent variants, provide a compelling pathway to meet strict environmental standards without compromising on longevity or mechanical resilience. This regulatory shift, coupled with growing end-user demand for coatings that lower lifecycle carbon footprints, underscores a broader market realignment towards sustainable surface treatments.

In response to these market drivers, industry participants are forging deep collaborations with raw material suppliers, research institutes, and end-use partners. These alliances are facilitating co-development initiatives aimed at custom FEVE resin architectures, novel additive packages, and innovative application methodologies. Through such collaborative ecosystems, transformative shifts are occurring in how coatings are formulated, applied, and recycled, setting the stage for the next wave of performance benchmarks in the FEVE fluoropolymer coatings sector.

Assessing the Comprehensive Cumulative Impact of 2025 United States Tariff Measures on FEVE Fluoropolymer Coatings and Associated Supply Chains

The implementation of new United States tariff schedules in 2025 has introduced a complex matrix of duties impacting key raw materials and imported coating products, fundamentally reshaping supply chain economics for FEVE fluoropolymer coatings. Cumulative duties on fluoropolymer resin imports, combined with levies on specialty solvents and curing agents, have driven procurement teams to re-evaluate sourcing geographies and negotiate longer-term supply contracts to mitigate cost volatility. This tariff environment has, in turn, accelerated domestic resin production investments while also incentivizing manufacturers to localize value-added activities closer to end markets.

In practice, coating formulators have adjusted system designs to reduce reliance on high-duty inputs, often substituting certain solvent carriers with waterborne alternatives or selectively integrating renewable co-polymers. As a consequence, the overall project cost structure has shifted, compelling engineering firms and asset owners to re-examine their total cost of ownership analyses. Despite initial margin pressures, the strategic response to these tariffs has catalyzed greater vertical integration among major players, fostering resilience and reinforcing supply chain agility in anticipation of future trade policy fluctuations.

Looking ahead, sustained tariff scrutiny will likely remain a focal point for stakeholders across the FEVE coatings ecosystem. Companies with proactive cost containment programs, diversified manufacturing footprints, and agile R&D pipelines will be well positioned to navigate tariff-induced headwinds, secure stable resin throughput, and maintain competitive product pricing in the face of ongoing global trade uncertainties.

Unraveling Critical Segmentation Insights Across End Use, Technology, Coating System, Application, Substrate, Distribution Channel, and Form for FEVE Coatings

Parsing through market segmentation reveals critical insights into how FEVE fluoropolymer coatings are being adopted across a spectrum of industry applications and distribution pathways. When dissecting the end-use dimension, demand drivers in the automotive sector intertwine with stringent appearance and corrosion resistance standards, while the building and construction arena places a premium on long-lived protective facades and architectural aesthetics, and general industrial uses prioritize chemical resistance and ease of maintenance.

In terms of technology platform choices, powder-based formulations are rapidly gaining traction for their near-zero emissions profiles and efficient overspray reclamation, whereas solvent-based systems continue to retain niche advantages in rapid dry times and thinner film capabilities, and water-based alternatives are increasingly selected for their superior environmental footprint and regulatory compliance characteristics.

Examining coating system layers underscores the versatility of FEVE solutions: architectural coatings leverage exceptional color retention under UV exposure; automotive coatings, whether in original equipment manufacturing or refinishing contexts, benefit from glossy finishes and excellent adhesion; industrial coating platforms are optimized for durability under mechanical stress; and marine coating deployments, whether in offshore platforms or shipyard maintenance, capitalize on FEVE’s unparalleled resistance to salt spray and biofouling.

The application viewpoint unearths distinctions among decorative, functional, and protective uses. Decorative applications highlight color vibrancy and texture consistency, functional uses concentrate on tailored friction or self-cleaning surfaces, and protective layers, whether anti-corrosive, chemically resistant, or fire-resistant, underscore a commitment to safeguarding critical assets. Furthermore, substrate considerations-from concrete to metal to plastic to wood-drive formulation tweaks that optimize bonding mechanisms and long-term performance.

Finally, distribution channels and material form represent pivotal go-to-market axes. Producers are balancing direct sales engagements for large-scale industrial projects with channel partnerships through distributors to broaden market reach, while online platforms are emerging as complementary avenues for specialty and small-batch orders. Form innovation between liquid resins and powder products enables coatings companies to meet diverse application requirements and evolving customer preferences in both field and factory environments.

This comprehensive research report categorizes the FEVE Fluoropolymer Coatings market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Coating System

- Substrate

- Form

- Application

- Distribution Channel

- End Use

Illuminating Key Regional Dynamics Influencing FEVE Fluoropolymer Market Evolution Across the Americas, Europe Middle East and Africa, and Asia Pacific Regions

A closer look at regional market dynamics reveals differentiated opportunities and challenges across the Americas, Europe Middle East and Africa, and Asia Pacific. In the Americas, growing infrastructure refurbishment initiatives and federal incentives for energy-efficient building retrofits are fueling demand for FEVE coatings that combine thermal insulation properties with long service intervals. This region’s robust automotive manufacturing hubs are also progressing toward premium paint systems, capitalizing on FEVE’s high gloss retention under demanding environmental cycles.

Within Europe Middle East and Africa, the confluence of rigorous environmental regulations and expanding renewable energy installations is driving coastal and desert-based solar asset protection programs. FEVE-based coatings are increasingly specified for photovoltaic module frames and mounting structures, owing to their resistance to UV-induced degradation and sand erosion. Strategic investments by regional OEMs and government-backed modernization grants are further accelerating FEVE adoption across maritime and industrial infrastructure projects.

Asia Pacific represents perhaps the most dynamic growth corridor, where rapid urbanization in Southeast Asia, accelerated manufacturing capacity expansions in East Asia, and extensive port infrastructure developments in South Asia coalesce to create significant surface treatment requirements. Here, local producers are scaling capacity for waterborne FEVE coatings to satisfy large-scale construction and transportation sector undertakings, while multinational suppliers are forging joint ventures to localize high-performance resin production and align with national manufacturing roadmaps.

This comprehensive research report examines key regions that drive the evolution of the FEVE Fluoropolymer Coatings market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Innovators Driving Advancements in FEVE Fluoropolymer Coating Solutions through Strategic Partnerships and Technological Developments

Leading chemical manufacturers, coating formulators, and equipment providers are strategically positioning themselves to capitalize on the growing preference for FEVE fluoropolymer solutions. These companies are investing in specialized resin synthesis facilities, collaborating with applicators to refine spray and roller application systems, and integrating digital monitoring technologies to validate coating thickness and adhesion in real time. Such initiatives reduce rework rates, accelerate project timelines, and enhance end-user confidence in FEVE-based systems.

Moreover, the competitive environment is characterized by strategic mergers, targeted acquisitions, and cross-industry partnerships that consolidate intellectual property and broaden product portfolios. Some enterprises are developing proprietary nanoparticle additives to further elevate FEVE’s barrier properties, while others are exploring hybrid formulations that blend fluoropolymers with other performance polymers to address niche end-use challenges. In parallel, several solution providers are launching training academies to build applicator proficiency and ensure proper specification compliance, thereby reinforcing brand reputation and market credibility.

As these key players continue to refine their go-to-market strategies, they also emphasize sustainability metrics and transparent supply chains. By adopting renewable feedstocks for fluoropolymer monomers and implementing life cycle assessment frameworks, these frontrunners are not only improving their environmental profiles but also appealing to multinational customers with robust corporate sustainability mandates.

This comprehensive research report delivers an in-depth overview of the principal market players in the FEVE Fluoropolymer Coatings market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AGC Inc.

- Chemours Company FC, LLC

- Daikin Industries, Ltd.

- Fujifilm Holdings Corporation

- H.B. Fuller Company

- Kansai Paint Co., Ltd.

- Nippon Paint Holdings Co., Ltd.

- PPG Industries, Inc.

- Sherwin-Williams Company

- Toagosei Co., Ltd.

- Whitford Worldwide Company

Outlining High-Impact Actionable Recommendations for Industry Leaders to Capitalize on Emerging Opportunities and Strengthen Market Position in FEVE Coatings

Industry leaders can seize emerging opportunities and fortify their competitive positions by enacting several high-impact strategies. First, prioritizing investment in local resin manufacturing and additives compounding facilities will mitigate exposure to international tariff fluctuations and logistics bottlenecks. By ensuring proximity to key end-use clusters, firms can reduce lead times, enhance service levels, and offer more flexible contract terms to large project accounts.

Second, amplifying collaboration with applicator networks and architects through certification programs will elevate professional competence and drive specification momentum. These programs can establish standardized quality benchmarks, facilitate knowledge transfer, and position FEVE fluoropolymer technologies as the benchmark for premium coatings performance. Furthermore, such collaboration fosters a community of practice that accelerates market acceptance and innovation diffusion.

Third, embedding digital solutions such as IoT-enabled cure monitoring, remote color verification, and predictive maintenance dashboards will translate system data into actionable insights for clients. This value-added service model not only differentiates suppliers in a commoditized environment but also unlocks recurring revenue streams through data subscription services and performance guarantees. Collectively, these recommendations will empower industry participants to navigate market complexities, deliver differentiated value propositions, and sustain profitable growth trajectories in the FEVE fluoropolymer coatings domain.

Detailing a Rigorous Multistep Research Methodology Integrating Qualitative and Quantitative Analyses to Deliver Robust FEVE Fluoropolymer Coatings Market Intelligence

The research underpinning this report combines an array of qualitative and quantitative techniques to ensure comprehensive and reliable market intelligence. Primary research involved in-depth discussions with senior executives from resin producers, formulators, raw material suppliers, and end-user organizations, supplemented by structured surveys targeting applicators and specification consultants. These engagements provided first-hand perspectives on technology adoption drivers, cost implications, and sustainability trends in FEVE fluoropolymer coatings.

Secondary research encompassed a thorough review of industry journals, regulatory filings, patent databases, and corporate disclosures, enabling cross-verification of market developments, funding patterns, and strategic alliances. By triangulating data from these diverse sources, the methodology ensures a balanced understanding of market dynamics and mitigates potential biases that may arise from single-source reliance.

Finally, a rigorous data analytics framework was applied, employing scenario modeling to assess tariff impact sensitivities, segmentation performance evaluation to highlight key growth pockets, and regional mapping to capture geographic variations in demand. This multistep approach provides stakeholders with actionable intelligence that combines strategic foresight with empirical validation, delivering a research backbone that supports informed decision-making across the FEVE fluoropolymer coatings landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our FEVE Fluoropolymer Coatings market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- FEVE Fluoropolymer Coatings Market, by Technology

- FEVE Fluoropolymer Coatings Market, by Coating System

- FEVE Fluoropolymer Coatings Market, by Substrate

- FEVE Fluoropolymer Coatings Market, by Form

- FEVE Fluoropolymer Coatings Market, by Application

- FEVE Fluoropolymer Coatings Market, by Distribution Channel

- FEVE Fluoropolymer Coatings Market, by End Use

- FEVE Fluoropolymer Coatings Market, by Region

- FEVE Fluoropolymer Coatings Market, by Group

- FEVE Fluoropolymer Coatings Market, by Country

- United States FEVE Fluoropolymer Coatings Market

- China FEVE Fluoropolymer Coatings Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1749 ]

Concluding Strategic Reflections on the Transformative Potential and Future Outlook of FEVE Fluoropolymer Coatings in Modern Industrial Applications

The collective insights presented herein underscore the pivotal role of FEVE fluoropolymer coatings in meeting the evolving demands of sustainability, performance, and cost efficiency in industrial and architectural applications. As regulatory frameworks tighten and global infrastructure investments accelerate, the advanced chemistries and process innovations that define FEVE solutions will continue to differentiate high-value coatings providers from commoditized alternatives.

Key challenges revolve around navigating evolving tariff environments, optimizing supply chain resilience, and fostering cross-sector collaborations that accelerate technology diffusion. Nevertheless, the accelerating shift toward low-emission, long-life coating systems presents a powerful growth vector for organizations that can align their R&D pipelines, operational footprints, and partner ecosystems with the strategic imperatives outlined in this summary.

In closing, the FEVE fluoropolymer coatings market stands at an inflection point, where sustained investment in material science, applied research, and digital integration will unlock new performance benchmarks and deliver enduring competitive advantages. Companies that act decisively to implement the methodological guidance and actionable recommendations provided here will be best positioned to lead in this dynamic, high-potential space.

Connecting with Associate Director Ketan Rohom to Secure Your Comprehensive FEVE Fluoropolymer Coatings Market Research Report and Gain Competitive Insights

To explore this market intelligence in depth and secure a competitive advantage, contact Ketan Rohom, Associate Director for Sales and Marketing. Engage with a tailored consultation to uncover actionable insights, discuss bespoke research deliverables, and align the comprehensive FEVE fluoropolymer coatings report with your strategic priorities. Initiating this dialogue will connect you to expert analysts who can guide you through the report’s detailed findings, facilitate targeted data extraction, and support your decision-making with personalized recommendations. Partnering directly with Associate Director Ketan Rohom ensures you obtain immediate access to the full suite of qualitative and quantitative analyses, empowering your team to navigate market complexities and seize emerging opportunities with confidence.

- How big is the FEVE Fluoropolymer Coatings Market?

- What is the FEVE Fluoropolymer Coatings Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?