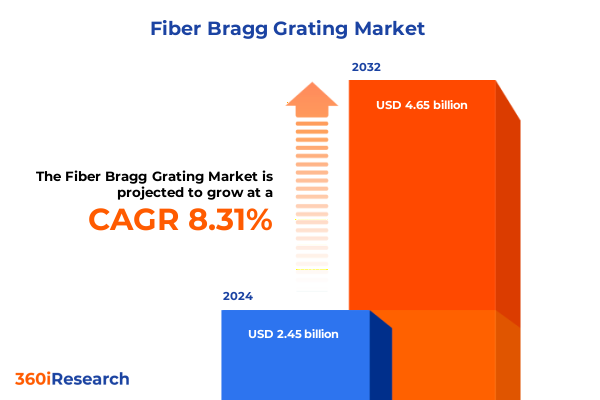

The Fiber Bragg Grating Market size was estimated at USD 2.66 billion in 2025 and expected to reach USD 2.85 billion in 2026, at a CAGR of 8.30% to reach USD 4.65 billion by 2032.

Exploring the Fundamental Principles and Versatile Applications of Fiber Bragg Grating Technology That Are Transforming Fiber Optic Communication and Sensing

Fiber Bragg Grating technology represents a paradigm shift in fiber optic systems, leveraging the unique interaction between light and periodic refractive index variations inscribed within optical fibers. By reflecting specific wavelengths while transmitting others, fiber Bragg gratings enable precise filtering, multiplexing, and sensing capabilities that underpin modern telecommunication and instrumentation frameworks. The introduction of photosensitivity enhancement techniques and advanced inscription methods has elevated the practical performance of these elements, facilitating their integration into increasingly demanding applications.

As industries pursue higher data throughput, greater signal fidelity, and more resilient sensing networks, the role of fiber Bragg gratings has become indispensable. These components deliver a compact and cost-effective method of achieving wavelength selectivity in Dense Wavelength Division Multiplexing systems, while also affording real-time monitoring of temperature, strain, and pressure in critical infrastructure. Moreover, their passive, intrinsic nature-free from electromagnetic interference-makes them ideal for deployment in harsh environments where electronic sensors face limitations, thus broadening the scope of fiber Bragg grating utilization well beyond conventional optical networks.

With a foundation rooted in photonics and materials science, fiber Bragg grating technology continues to evolve, driven by growing demands for higher resolution sensing and more efficient spectral management. Research into femtosecond laser inscription, nano-structuring techniques, and specialty fiber platforms promises further gains in sensitivity, bandwidth, and environmental stability. Consequently, stakeholders from diverse sectors are poised to leverage these advancements to optimize system performance, reduce operational costs, and unlock new application frontiers.

Analyzing the Key Technological Breakthroughs and Industry Drivers That Are Reshaping the Fiber Bragg Grating Landscape Across Multiple Sectors

Over the past decade, fiber Bragg grating technology has undergone transformative shifts propelled by breakthroughs in both material science and manufacturing processes. Innovations such as ultrafast laser inscription have enabled the creation of gratings with sub-micron precision, substantially improving the reflectivity and spectral bandwidth control of these elements. Concurrently, enhancements in fiber dopants and photosensitizing treatments have increased grating stability and sensitivity, unlocking more consistent performance across temperature and mechanical stress variations.

Alongside optical refinements, digital signal processing advancements have synergistically elevated the utility of fiber Bragg gratings in complex sensor networks. High-speed interrogation units now extract spectral information with unprecedented resolution, empowering system architects to deploy distributed sensing arrays that deliver real-time insights into structural health monitoring, pipeline leak detection, and smart grid management. These developments have not only enhanced detection limits but also streamlined integration with cloud-based analytics platforms, thereby forging an interconnected ecosystem of photonic sensors and data intelligence.

Furthermore, the expansion of telecommunications frameworks into 5G and emerging 6G domains has driven demand for agile wavelength selection and tunable filtering solutions. Fiber Bragg gratings offer a compact, low-power alternative to traditional thin-film filters, facilitating flexible network architectures that can dynamically allocate bandwidth based on traffic patterns. As the industry pivots toward software-defined networking and edge computing paradigms, the ability of fiber Bragg grating devices to deliver spectral agility and resilience continues to redefine the landscape of optical communications.

Assessing the Far-Reaching Consequences of Recent United States Tariff Policies on Fiber Bragg Grating Supply Chains and Manufacturing Dynamics

Recent tariff measures enacted by the United States have introduced significant variables into the supply chains of fiber Bragg grating components. With certain imports facing elevated duties, manufacturers and integrators have been compelled to reassess sourcing strategies and adjust procurement protocols. This reconfiguration has had a cascading effect on cost structures, prompting stakeholders to evaluate near-shore production options and pursue deeper relationships with domestic suppliers to mitigate exposure to trade-related disruptions.

In response to tariff-induced pressures, several industry participants have bolstered investments in local fabrication capabilities. These efforts aim to secure critical fiber Bragg grating inventory and reduce lead times that are susceptible to volatility in international shipping lanes. Concurrently, research partnerships with academic institutions and national laboratories have intensified, leveraging government incentives designed to stimulate domestic photonics innovation. Such collaborative initiatives not only address supply chain resilience but also contribute to the development of next-generation grating architectures adapted to the evolving regulatory landscape.

Moreover, the ripple effects of duty escalations extend to ecosystem service providers-ranging from photonic equipment assemblers to sensor network operators-who must navigate higher component expenses without compromising system performance. To preserve project viability, many organizations are optimizing design specifications and exploring hybrid solutions that balance the precision of fiber Bragg gratings with alternative sensing modalities. As trade policies remain dynamic, the ability to adapt swiftly through strategic sourcing and technological agility will continue to define competitive advantage in the fiber Bragg grating domain.

Uncovering Critical Insights from Segmentation Analysis Illuminating Type Variations Wavelength Bands Sensing Ranges and Diverse End User Applications

An in-depth segmentation review reveals differentiated performance and adoption patterns across various fiber Bragg grating classifications. Type I gratings, known for their low cost and ease of fabrication, predominantly serve applications with moderate sensitivity requirements, while enhanced Type IA variants offer improved thermal stability for scenarios demanding extended operational lifespans. In contrast, Type II gratings, inscribed using high-power laser pulses, deliver higher reflectivity and temperature tolerance, making them preferred for high-precision measurement tasks.

Spectral segmentation further delineates device applicability, with C-Band gratings dominating traditional telecom networks due to their alignment with established erbium-doped amplifier windows. L-Band solutions extend capacity in long-haul transmission systems by accommodating additional wavelength channels and reducing channel crosstalk. Meanwhile, O-Band gratings are increasingly utilized in short-reach data center interconnects, benefiting from lower chromatic dispersion and enhanced signal integrity in metro and hyperscale computing environments.

Sensing range classification sheds light on deployment scales, where long-range gratings spanning beyond fifty kilometers are leveraged for extensive oil and gas pipeline monitoring and border security infrastructure. Medium-range sensors covering ten to fifty kilometers enable railway track inspection and dam stress analysis, offering a balance between spatial resolution and distance. Short-range implementations under ten kilometers focus on localized monitoring, such as crane load assessment in manufacturing plants and patient vital tracking in medical facilities.

End-user segmentation underscores the cross-industry relevance of fiber Bragg grating technology. Defense and aerospace sectors rely on ruggedized sensors for structural health systems in aircraft and satellite platforms. The energy and utilities industry integrates gratings for temperature and strain detection in wind turbines and power transmission lines. Healthcare providers deploy biocompatible sensor arrays in minimally invasive diagnostics, while manufacturing environments use gratings to optimize robotic assembly and machine tool calibration. Research and academic institutes leverage these devices for experimental photonics studies, and telecom service providers continue to integrate gratings for agile wavelength management in next-generation network rollouts.

This comprehensive research report categorizes the Fiber Bragg Grating market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Wavelength Range

- Sensing Range

- End User

Mapping the Regional Dynamics Driving Adoption and Development of Fiber Bragg Grating Technology across Americas Europe Middle East Africa and Asia Pacific

Examining regional dynamics highlights distinct growth drivers and adoption pathways for fiber Bragg grating technology across global markets. In the Americas, a robust ecosystem of aerospace and defense contractors, coupled with government funding for infrastructure monitoring, fuels demand for high-performance sensors and filtering solutions. North American research institutions continue to pioneer novel grating inscription techniques, while South American oil and gas corporations explore extended-range gratings for pipeline integrity applications.

Within Europe, Middle East and Africa, stringent regulatory standards for safety and environmental monitoring drive uptake of fiber Bragg grating systems in critical infrastructure projects. Western European telecom operators spearhead the deployment of flexible optical networks, whereas Middle Eastern utilities invest in smart grid frameworks incorporating distributed sensing. In Africa, emerging applications in mining operations and renewable energy installations are fostering early adoption of portable and resilient grating-based measurement tools.

Across the Asia-Pacific region, a surge in data center construction and 5G rollout activities has amplified the need for compact wavelength selective elements. East Asian markets, led by Japan and South Korea, emphasize precision-engineered gratings for research laboratories and semiconductor manufacturing facilities. Meanwhile, China’s push for domestic photonics self-reliance catalyzes large-scale production investments, and Southeast Asian countries focus on affordable sensing solutions to support urban infrastructure expansion and environmental monitoring initiatives.

This comprehensive research report examines key regions that drive the evolution of the Fiber Bragg Grating market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling the Leading Companies Driving Innovation in Fiber Bragg Grating Technologies through Advanced Research Strategic Partnerships and Solutions

Industry leaders are continuously advancing the frontier of fiber Bragg grating technology through strategic innovation and collaboration. Global optics manufacturers are expanding their patent portfolios while refining inscription techniques to achieve sub-angstrom precision and low insertion losses. Collaborations with material science startups and nanofabrication facilities are yielding next-generation fibers with bespoke doping profiles that enhance spectroscopic sensitivity and broaden operational temperature ranges.

Established photonics integrators are forging partnerships with systems-level electronics companies to embed interrogation modules into turnkey solutions for smart infrastructure and aerospace applications. These alliances facilitate the convergence of photonic sensors with real-time data analytics platforms, enabling predictive maintenance frameworks and digital twin models. Furthermore, a number of regional specialists are focusing on scalable manufacturing processes, leveraging automated laser inscription systems to meet surging demand without compromising device uniformity or performance.

To differentiate their offerings, key players are investing in service ecosystems that encompass installation support, calibration services, and continuous software updates for spectrum analysis tools. This holistic approach not only adds value for end users but also cultivates long-term relationships predicated on operational excellence and reliability. As the competitive landscape intensifies, companies demonstrating agility in responding to emerging standards and customer-driven customization will command a distinct strategic advantage.

This comprehensive research report delivers an in-depth overview of the principal market players in the Fiber Bragg Grating market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Advanced Optics Solutions GmbH

- Alnair Labs Corporation

- Ascentta Inc

- AtGrating Technologies Co Ltd

- Bandweaver

- FBGS Technologies GmbH

- FISO Technologies Inc

- fos4x GmbH

- Halliburton Company

- HBK FiberSensing S.A.

- ITF Technologies Inc

- Luna Innovations Incorporated

- Micron Optics

- National Instruments Corporation

- Omnisens SA

- Opsens Inc

- OptaSense

- Optromix Inc

- Proximion AB

- Schlumberger Limited

- Smart Fibres Limited

- Technica Optical Components LLC

- TeraXion Inc

Strategic Roadmap Outlining Actionable Recommendations to Enhance Competitiveness Foster Collaboration and Drive Sustainable Growth Within Fiber Bragg Grating

Industry leaders should prioritize the diversification of their supply chains by establishing strategic partnerships with multiple fabrication hubs. This approach will mitigate risks associated with geopolitical uncertainties and tariff fluctuations, ensuring consistent access to critical fiber Bragg grating components. Simultaneously, investing in modular manufacturing capabilities and flexible production lines can enable rapid scaling to meet project-specific demands while controlling cost structures.

To foster technological leadership, organizations are encouraged to deepen collaborations with academic research centers and participate in consortia focused on next-generation photonics. By co-developing advanced photosensitizing processes and ultrafast inscription platforms, companies can accelerate innovation cycles and secure intellectual property that differentiates their product portfolios. In parallel, embedding sensor networks within digital twin environments will optimize performance monitoring, driving new service revenue streams through predictive maintenance and analytics packages.

Additionally, aligning product roadmaps with emerging regulatory frameworks and industry standards will streamline market entry and reduce compliance overhead. Companies should actively engage with standardization bodies to influence best practices for grating performance metrics and interoperability protocols. Finally, cultivating cross-functional expertise-spanning optical engineering, software development, and application-specific domain knowledge-will empower teams to deliver integrated solutions that resonate with diverse end users.

Detailed Explanation of the Research Approach Data Sources Analytical Techniques and Validation Processes Ensuring Integrity of Fiber Bragg Grating Study

This research incorporates a hybrid methodology combining primary and secondary data collection to ensure rigorous analysis. Primary insights were garnered through structured interviews with industry executives, technical experts, and end users across key application segments. These dialogues provided granular perspectives on performance requirements, deployment challenges, and technology adoption timelines.

Secondary research involved comprehensive reviews of academic publications, patent filings, and publicly available technical papers to map the evolution of fiber Bragg grating technologies. Additionally, analysis of regulatory filings and government reports offered clarity on trade policies and infrastructure investment trends influencing the market. A thorough patent landscape evaluation helped identify innovation hotspots and emerging capabilities.

Quantitative and qualitative findings were triangulated through expert validation workshops, wherein outcomes were cross-checked against industry benchmarks and historical performance data. This iterative vetting process bolstered the reliability of conclusions and reinforced the actionability of recommendations. The resulting framework synthesizes diverse inputs into cohesive insights designed to inform strategic decision making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Fiber Bragg Grating market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Fiber Bragg Grating Market, by Type

- Fiber Bragg Grating Market, by Wavelength Range

- Fiber Bragg Grating Market, by Sensing Range

- Fiber Bragg Grating Market, by End User

- Fiber Bragg Grating Market, by Region

- Fiber Bragg Grating Market, by Group

- Fiber Bragg Grating Market, by Country

- United States Fiber Bragg Grating Market

- China Fiber Bragg Grating Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 795 ]

Synthesizing Key Findings and Strategic Implications Highlighting the Critical Role of Fiber Bragg Grating Technology in Future Optical and Sensing Innovations

The convergence of advanced inscription methods, enhanced interrogation systems, and strategic supply chain realignments underscores the transformative trajectory of fiber Bragg grating technology. As market dynamics continue to evolve-shaped by regulatory developments, tariff regimes, and regional infrastructure priorities-the agility with which organizations adapt will determine their competitive standing.

Throughout this executive summary, we have examined the foundational principles of fiber Bragg grating operation, the pivotal technological breakthroughs driving expanded applications, and the segmentation nuances that frame device performance across type, wavelength, sensing range, and end-user domains. Regional analyses have illuminated unique adoption drivers in the Americas, Europe, Middle East & Africa, and Asia-Pacific, while company profiles have showcased the strategic maneuvers and collaborative ventures propelling industry innovation.

Looking ahead, stakeholders who leverage these insights to optimize sourcing strategies, deepen cross-sector partnerships, and align product development with emerging standards will be best positioned to capitalize on the opportunities that lie within fiber Bragg grating markets. The road to sustained growth hinges on a balanced investment in R&D, operational resilience, and a nuanced understanding of end-user needs.

Connect with Ketan Rohom to Unlock Comprehensive Fiber Bragg Grating Market Intelligence and Elevate Strategic Decision Making with Tailored Insights

To explore the full depth of analysis, actionable insights, and strategic intelligence provided in this comprehensive market research report, reach out to Ketan Rohom, Associate Director, Sales & Marketing. Ketan can offer personalized guidance on how the findings align with your organizational objectives and facilitate tailored solutions to meet your decision-making needs. By engaging directly with Ketan, you will gain clarity on report scope, delivery timelines, and any bespoke analyses that can further enhance your competitive positioning. Secure your access today and empower your team with robust, expert-driven data that will shape your Fiber Bragg Grating strategy for the years ahead.

- How big is the Fiber Bragg Grating Market?

- What is the Fiber Bragg Grating Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?