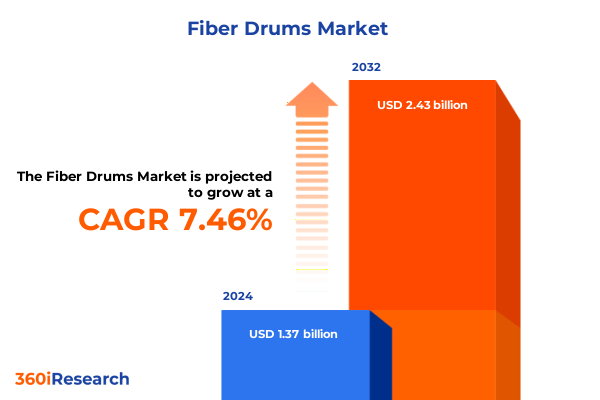

The Fiber Drums Market size was estimated at USD 1.47 billion in 2025 and expected to reach USD 1.58 billion in 2026, at a CAGR of 7.44% to reach USD 2.43 billion by 2032.

Discover how fiber drums are reshaping industrial packaging with sustainable performance advantages and supply chain resilience

The landscape of industrial packaging has witnessed an unprecedented rise in the prominence of fiber drums as a versatile and sustainable solution. Traditionally, steel and plastic alternatives have dominated heavy-duty transport applications, but evolving environmental priorities and cost pressures have driven decision makers to reevaluate their choices. In this context, fiber drums emerge as an attractive bridge between performance requirements and circular economy principles. Their inherent recyclability, lighter weight profile, and relative cost efficiency compared to metal counterparts position them at the forefront of multi-sector packaging transformation.

This executive summary distills the critical insights from an extensive review of supply chain dynamics, regulatory shifts, and end-user demands shaping the fiber drums sector. It aims to equip business leaders and procurement specialists with a clear understanding of the forces influencing market direction, as well as the opportunities that arise from adopting more sustainable packaging platforms. As stakeholder expectations elevate the importance of green credentials, fiber drums have moved from niche applications into mainstream adoption within chemicals, food and beverage, pharmaceuticals, and adhesives industries.

Moreover, global disruptions-from fluctuating raw material availability to geopolitical tensions-underscore the necessity of resilient packaging strategies. This report synthesizes qualitative and quantitative evidence to provide a holistic view of current market conditions. By unpacking these elements at the outset, industry professionals are better positioned to navigate emerging challenges and to capitalize on growth trajectories inherent in the fiber drums ecosystem.

Exploring industry upheavals driven by eco regulations, digital innovation, and supply chain diversification in fiber drums

The packaging industry is at a pivotal juncture, propelled by a confluence of sustainability mandates, regulatory overhauls, and technological breakthroughs. In recent years, corporations and governments have imposed stringent requirements aimed at reducing single-use plastics and lowering carbon footprints. These mandates have sparked a wave of material innovation, leading to fiber-based solutions that meet both environmental targets and logistic demands. As a result, fiber drums have transitioned from a cost-driven alternative to a strategic enabler for sustainable supply chains and brand differentiation.

Furthermore, digitalization has begun to permeate the packaging domain, introducing smart tagging and real-time tracking capabilities that were once exclusive to high-value electronics and pharmaceuticals. Fiber drums are increasingly being outfitted with embedded sensors and QR codes, facilitating end-to-end traceability and compliance reporting. This shift not only streamlines reverse logistics operations but also enhances inventory management for global producers and distributors.

Supply chain volatility has also catalyzed a reevaluation of regional manufacturing footprints. Companies are diversifying sources of raw paperboard and prefabricated drums to mitigate the impact of trade disputes and transport bottlenecks. In parallel, collaborations between packaging firms and material science specialists have resulted in advanced liner technologies that improve chemical compatibility without compromising the eco-friendly profile. Altogether, these transformative shifts underscore a broader realignment toward agility, transparency, and resource efficiency in the fiber drums landscape.

Examining how 2025 United States tariffs have reshaped fiber drums sourcing, cost structures, and resilient manufacturing networks

The advent of new United States tariffs in early 2025 has exerted a profound influence on the global fiber drum supply chain. By imposing additional duties on imported paperboard and preassembled drums, domestic users have faced elevated procurement costs and extended lead times. This policy change has prompted both multinational manufacturers and regional converters to revise their sourcing strategies, with many opting to localize production or to establish joint ventures with North American partners to alleviate tariff burdens.

Moreover, the tariffs have triggered a domino effect on raw material markets. Exporters from Asia and Europe have redirected packaging volumes to alternative regions, tightening availability and driving spot-price volatility. Domestic producers have struggled to match the surge in demand, leading to capacity backlogs and longer delivery windows. In response, stakeholders have accelerated investment in automated drum assembly lines and optimized plant layouts to boost throughput and to safeguard supply continuity.

Transitioning from reactive measures to proactive resilience, several firms have engaged in scenario planning exercises to model the cumulative impact of further trade policy shifts. These initiatives prioritize flexible manufacturing networks capable of rerouting production flows within weeks, rather than months. While cost pressures remain a concern, the tariff landscape has also incentivized technological adoption and strategic partnerships that collectively enhance the long-term stability of fiber drum supply chains.

Unveiling comprehensive segmentation factors revealing how applications, end industries, drum types, capacity tiers, and liner systems shape market direction

A nuanced understanding of market segmentation reveals the diverse forces driving product requirements and adoption patterns across multiple dimensions. Based on application, demand spans adhesives and sealants, where the compatibility of liners with high-viscosity compounds is critical; chemicals and petrochemicals, which encompass agricultural chemicals, petrochemicals, and specialty chemicals necessitating stringent barrier properties; food and beverage, subdivided into dairy products, edible oils, and processed foods that demand hygienic packaging solutions; and pharmaceuticals, covering both bulk drug intermediates and finished dosage forms for regulated supply chains.

In parallel, the market’s end user industry segmentation mirrors these application domains while extending into adjacent categories such as paints and coatings. This structure underscores the cross-pollination of packaging innovations, as insights from petrochemical drum liners inform barrier improvements in food-grade vessels, and vice versa. Companies are leveraging this interplay to streamline R&D investments and to accelerate product launches that cater to multiple industry verticals.

Drum type serves as another key axis of differentiation. Closed head configurations dominate environments requiring sealed transport and long-term storage, whereas open head drums gain traction for refill processes and sectors with frequent on-site decanting needs. Capacity segmentation further stratifies offerings, distinguishing compact units up to 20 liters tailored to specialty chemicals and high-value pharmaceutical intermediates, mid-range drums between 21 and 60 liters that balance handling efficiency and volume throughput, and larger vessels above 60 liters optimized for bulk shipments in agrochemicals and food ingredients.

Finally, lining preferences differentiate drums equipped with plastic liners to protect sensitive contents against moisture and migration from unlined fiber composites. This choice is closely tied to end-user risk profiles, with pharmaceutical and specialty chemical applications prioritizing high-purity liner systems, while less reactive contents can leverage unlined shells for simplified recycling.

This comprehensive research report categorizes the Fiber Drums market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Drum Type

- Capacity

- Lining

- Application

- End User Industry

Revealing regional disparities in adoption, regulations, and supply chain infrastructure across Americas, EMEA, and Asia Pacific markets

Geographic analysis uncovers stark contrasts in adoption rates, regulatory landscapes, and logistical infrastructures that define regional market trajectories. In the Americas, North American markets lead in integrating sustainable packaging solutions, propelled by federal and state-level recycling mandates. The United States and Canada benefit from well-established paperboard supply chains and advanced liner manufacturing facilities, which support rapid iteration on drum designs. Latin American nations, while at an earlier stage of market maturity, are witnessing growth driven by agricultural exports requiring robust and lightweight drums for bulk fertilizers and edible oils.

Across Europe, Middle East, and Africa, regulatory stringency stands as the most significant catalyst. The European Union’s packaging waste directive has catalyzed the substitution of single-use plastics with fiber alternatives, particularly in food and beverage applications. Meanwhile, the Middle East’s construction and petrochemical sectors are gradually adopting fiber drums as part of broader sustainability pledges. Sub-Saharan Africa remains a nascent region, with adoption largely concentrated around mining chemicals and import-driven industrial segments.

The Asia-Pacific region presents a multifaceted picture. Established manufacturing hubs in China and India drive both domestic consumption and outbound exports of fiber drums, leveraging low-cost raw materials and large-scale production capacities. Southeast Asian markets are gaining momentum as local converters collaborate with global packaging suppliers to meet rising demand in processed foods and pharmaceuticals. In Oceania, stringent biosecurity standards and remote supply chain challenges have accelerated the use of fiber drums over heavier steel alternatives, given their lighter weight and ease of disposal.

This comprehensive research report examines key regions that drive the evolution of the Fiber Drums market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting how leading players are innovating, partnering, and expanding footprints to secure competitive advantage in fiber drums

A review of leading market participants illustrates a dynamic competitive landscape defined by strategic partnerships, technology licensing, and targeted capacity expansions. Major sheet fiber and drum manufacturers are investing in advanced liner formulations that reduce permeation risks while maintaining high recycled content. In addition, joint ventures between material suppliers and converters have emerged to streamline raw material flow and to innovate at the board-to-drum interface.

Many incumbents are deploying digital capabilities to differentiate their offerings. Pilot projects integrating RFID tags and blockchain-based traceability systems aim to provide end users with full visibility into drum provenance and handling conditions. These initiatives not only support compliance in regulated sectors such as pharmaceuticals but also facilitate trade financing by ensuring verifiable custody chains.

Investment patterns further underscore a push toward geographic diversification. Companies are establishing new drum assembly lines in regions previously reliant on imports, thereby reducing exposure to tariff fluctuations and transport delays. Concurrently, a wave of mergers and acquisitions has consolidated small and mid-sized converters, enabling broader product portfolios and expanded distribution networks. By leveraging scale and innovation, these players are positioning themselves to capture rising demand in both established and emerging markets.

This comprehensive research report delivers an in-depth overview of the principal market players in the Fiber Drums market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABZAC

- Ami Enterprise

- Bansidhar Pharma

- BWAY Corporation

- C.L. Smith Company

- ENVASES VICMAR, SA

- Enviro-Pak, Inc.

- FDL Packaging Group

- Feldman Industries Inc.

- Fengchen Group Co., Ltd.

- Fibre Drum Company

- Flow Packaging Sdn Bhd

- Fukui Youdaru Co., Ltd.

- Great Western Containers Inc.

- Greif, Inc.

- Jakacki Bag & Barrel, Inc.

- McManus Drum Company, Inc.

- Milford Barrel

- Müller Group

- Novoflex

- Patrick Kelly Drums

- Questar, LLC

- Safepack Solutions

- Schütz GmbH & Co. KGaA

- Sonoco Products Company

- Taiyo Seal Pack Co., Ltd.

Presenting targeted strategic imperatives for business leaders to strengthen sustainability, digitalization, and supply chain flexibility

Industry leaders should prioritize a cohesive strategy that aligns sustainability objectives with operational resilience. First, diversifying raw material sourcing by incorporating certified recycled paperboard and exploring alternative fiber composites will mitigate cost pressures and regulatory risks. By forging partnerships with forestry stewardship councils and secondary fiber collectors, companies can establish a stable pipeline of eco-certified inputs.

Second, investing in digital transformation is essential. Implementing IoT-enabled drum tracking and condition monitoring not only enhances transparency and inventory visibility but also drives efficiencies in reverse logistics. Firms that adopt cloud-based analytics platforms can rapidly detect quality deviations and optimize maintenance schedules for reusable drum programs.

Third, proactive scenario planning for trade policy shifts will strengthen supply chain agility. Establishing flexible manufacturing alliances across multiple regions allows rapid rerouting of production when tariffs or geopolitical events disrupt established routes. Concurrently, automating core assembly processes can increase throughput without significant labor cost escalation.

Finally, customizing solutions for high-growth end markets-such as specialty chemicals or formulated food ingredients-by developing tailored liner chemistries and ergonomic handling features will unlock premium pricing opportunities. Embedding circularity programs, including drum take-back schemes and consumer education campaigns, will further reinforce brand reputation and customer loyalty.

Outlining the comprehensive research approach that integrates expert interviews, secondary data, and rigorous triangulation

This analysis is grounded in a robust methodology combining primary interviews, secondary research, and rigorous data triangulation. Primary research included in-depth discussions with senior executives at packaging manufacturers, liner suppliers, and end-user organizations across chemical, food, and pharmaceutical sectors. These conversations provided firsthand insights into emerging requirements, technology adoption, and sourcing strategies.

Secondary research drew on publicly available sources such as corporate annual reports, industry association publications, and regulatory filings to capture macro-level trends and policy developments. Data points from trade databases and customs records were cross-referenced with stakeholder input to validate material flow patterns and tariff impacts. Quantitative findings were then triangulated with qualitative perspectives to ensure analytical coherence.

To maintain objectivity, multiple analysts reviewed and reconciled conflicting data, while sensitivity analyses tested the robustness of key assumptions. Recognizing the dynamic nature of trade policies and raw material markets, update workshops with subject-matter experts were conducted to verify that the conclusions reflect the latest available information. This multi-stage process ensures that the resulting insights are both credible and actionable.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Fiber Drums market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Fiber Drums Market, by Drum Type

- Fiber Drums Market, by Capacity

- Fiber Drums Market, by Lining

- Fiber Drums Market, by Application

- Fiber Drums Market, by End User Industry

- Fiber Drums Market, by Region

- Fiber Drums Market, by Group

- Fiber Drums Market, by Country

- United States Fiber Drums Market

- China Fiber Drums Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Drawing strategic conclusions on drivers, regional dynamics, segmentation, and competition to guide resilient market participation

The synthesis of market drivers, regulatory forces, and technological trends offers a clear roadmap for stakeholders navigating the fiber drums domain. Sustainability imperatives and digital advancements are converging to redefine packaging standards, compelling firms to innovate in liner chemistry, drum design, and lifecycle management. Tariff developments have underscored the importance of supply chain diversification, prompting strategic investments in regional manufacturing footprints.

Segmentation insights reveal that demand profiles vary significantly by application, industry, drum configuration, capacity, and lining choice, highlighting the necessity of tailored solutions. Regional analysis further differentiates the market context across the Americas, EMEA, and Asia Pacific, each presenting unique regulatory environments and growth catalysts. Finally, the competitive landscape is characterized by collaboration, consolidation, and a pursuit of technological differentiation to capture emerging opportunities.

Collectively, these findings equip decision makers with the foundational knowledge required to chart a resilient and growth-oriented strategy. By aligning product innovation with evolving user requirements and regulatory frameworks, industry participants can secure long-term advantages in an increasingly complex packaging ecosystem.

Connect personally with Ketan Rohom to unlock exclusive insights and accelerate strategic decisions in the fiber drums market

For those seeking to gain a competitive edge and access the comprehensive analysis, engaging directly with Ketan Rohom, Associate Director of Sales & Marketing, presents the ideal next step. Ketan offers personalized guidance on how this research can be tailored to your specific strategic priorities and operational needs. By partnering with Ketan Rohom, you will unlock priority access to in-depth sections, proprietary insights, and expert advisory support designed to accelerate your decision making. Connect today to explore volume licensing options, receive exclusive executive summaries, and confirm your purchase of the full market research report to stay ahead in the evolving fiber drums landscape

- How big is the Fiber Drums Market?

- What is the Fiber Drums Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?