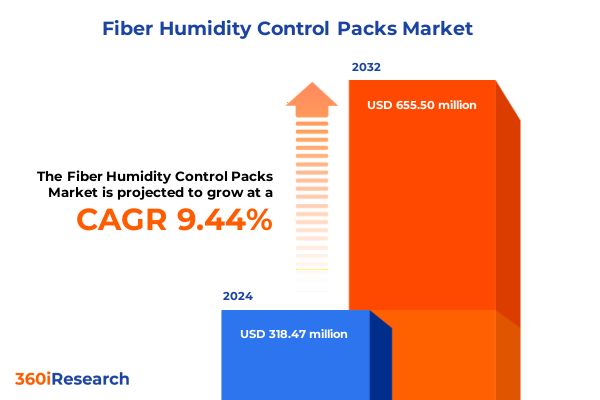

The Fiber Humidity Control Packs Market size was estimated at USD 345.87 million in 2025 and expected to reach USD 379.56 million in 2026, at a CAGR of 9.56% to reach USD 655.50 million by 2032.

Revealing the Critical Role of Fiber Humidity Control Packs in Safeguarding Moisture-Sensitive Industries Across Global Supply Chains

Fiber humidity control packs have emerged as a critical component in protecting moisture-sensitive products across a wide array of industries, underpinning reliability and quality from manufacturing through distribution. Originally designed to safeguard high-value electronics against corrosion and short circuits, these fiber-based desiccant solutions now play a pivotal role in preserving pharmaceuticals, food packaging, leather goods, and textiles. Their ability to maintain stringent relative humidity thresholds helps prevent microbial growth, chemical degradation, and material warping, ensuring product integrity during storage and transit. This growing relevance is underscored by the global electronics manufacturing services market, valued at half a trillion dollars in 2022, which has increasingly adopted fiber humidity control packs to reduce moisture-related defects in semiconductors and circuit boards.

How Technological Breakthroughs and Sustainability Imperatives Are Driving a New Era in Fiber Humidity Control Solutions

Recent technological innovations and environmental imperatives have converged to redefine the landscape of fiber humidity control solutions, catalyzing a period of unprecedented transformation. Digital monitoring platforms now integrate smart sensors and IoT connectivity, enabling real-time moisture tracking and predictive alerts that preempt product damage and optimize stock replenishment cycles. Meanwhile, sustainability mandates-driven by regulations such as the EU’s Single-Use Plastics Directive and California’s SB 54-have accelerated the shift toward biodegradable fibers and non-toxic indicator chemistries, compelling manufacturers to reformulate traditional desiccants and embrace circular-economy principles.

Simultaneously, supply chain resilience strategies have gained prominence in response to raw material shortages and geopolitical disruptions. Companies are diversifying their sourcing footprints by forging partnerships with specialty fiber and salt suppliers across Southeast Asia and South America, reducing lead-time volatility and tariff exposure. Furthermore, rising demand for tailored solutions in aerospace, pharmaceuticals, and premium consumer electronics has driven a modular approach to product design, with tiered service offerings that align desiccant performance with specific end-use requirements. These dynamics have fostered a competitive environment where agility, collaboration, and sustainable innovation determine market leadership.

Assessing the Aggregate Impact of 2025 U.S. Tariff Measures on Fiber Humidity Control Pack Supply Chains and Material Costs

In 2025, the U.S. government implemented reciprocal tariff measures that impose baseline duties of 10 percent on chemical imports-including key desiccant materials such as silica gel, activated alumina, and molecular sieves-while allowing individual country rates to climb as high as 50 percent under specific industrial policy exemptions. Although tariffs on China remain suspended at an elevated rate of 245 percent, broader trade tensions have triggered supply-chain recalibrations as domestic producers and importers seek to mitigate cost pressures. This evolving framework, justified on national security grounds and articulated through Section 232 investigations into critical minerals, has elevated the urgency for manufacturers to reassess sourcing strategies and explore local or alternative raw material options.

The cumulative impact of these measures has manifested in higher landed costs for raw materials and increased inventory carrying expenses. Companies reliant on silica-based desiccants have reported a 7 to 12 percent rise in per-unit input costs, compelling many to either absorb margin erosion or implement complex price adjustment clauses with distributors. In response, some industry players are accelerating R&D investments into bio-based substitutes such as rice-husk and coconut-fiber blends, which bypass traditional tariff classifications while aligning with sustainability targets. Additionally, strategic near-shoring of production facilities has emerged as a key mitigation tactic to curb tariff exposure and streamline logistics under the heightened trade-policy environment.

Unveiling the Multidimensional Market Structure of Fiber Humidity Control Packs Across Applications, Materials, and Distribution Strategies

The fiber humidity control pack market is structured around five distinct dimensions that collectively define performance profiles, cost parameters, and channel strategies. Across the application landscape, solutions span from consumer electronics-where compact moisture absorbers protect smartphones and cameras-to industrial electronics requiring robust barrier properties for control panels and heavy machinery. In food packaging, non-perishable items leverage standard desiccant blends for extended shelf life, whereas perishable goods depend on calibrated humidity thresholds to maintain freshness and prevent microbial growth. Leather goods face dual requirements: apparel demands aesthetic preservation, while footwear prioritizes dimensional stability. In pharmaceuticals, injectable formulations necessitate ultra-low moisture levels, whereas oral medications benefit from broader humidity margins. Additionally, textiles encompass both apparel fibers and home furnishings, each with unique absorption kinetics to prevent mold and maintain fabric integrity.

Material selection further refines these offerings, with activated alumina prized for its high adsorption capacity under variable humidity, molecular sieves delivering targeted moisture regulation in low-humidity environments, and silica gel providing cost-effective and widely certified solutions. Product architectures diverge between active packs-featuring electronic-controlled or temperature-regulated functionalities for continuous performance monitoring-and passive variants available in indicating form for visual humidity status or non-indicating form for basic moisture absorption. Packet sizes range from micro-quantities under 1 g for sensitive devices to bulk configurations exceeding 5 g for industrial and maritime applications. Distribution pathways include direct sales via field representatives and e-commerce platforms, distributor networks encompassing both retail and wholesale channels, and OEM partnerships across electronics and pharmaceutical sectors-each driving differentiated service models and inventory strategies.

This comprehensive research report categorizes the Fiber Humidity Control Packs market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material Type

- Product Type

- Packet Size

- Application

Exploring Regional Dynamics and Distinctive Market Drivers Shaping Fiber Humidity Control Pack Adoption Worldwide

Regionally, the Americas lead in adoption through a mature manufacturing landscape and stringent regulatory frameworks. In the United States, FDA guidelines under 21 CFR 175.300 and EPA restrictions on indicator chemistries necessitate rigorous material compliance, fostering innovation in certified fiber blends. Meanwhile, Canada’s logistics sectors leverage desiccant packs extensively to safeguard agricultural exports and high-value machinery, with CMTA agreements smoothing cross-border trade routes and reinforcing quality standards.

In Europe, Middle East & Africa, regulatory convergence under REACH and the EU’s F-Gas Regulation has galvanized manufacturers to adopt non-toxic and bio-based alternatives. Companies operating in the European Union must achieve ASTM D6400 compostability certification by 2030 for a portion of pack materials, while Middle Eastern markets benefit from free-zone incentives that encourage local assembly of smart humidity solutions. In Africa, expanding e-commerce channels and infrastructure upgrades are introducing fiber-based desiccants into pharmaceutical and food distribution networks, albeit with cost-sensitivity driven by economic variability.

Asia-Pacific represents the fastest growing region, fueled by electronics hubs in China, consumer markets in India, and agricultural exporters across Southeast Asia. Local startups are developing clay-infused fiber packs optimized for tropical climates, offering cost advantages and competitive performance. Government initiatives in Japan and South Korea to reduce microplastic usage have further propelled demand for biodegradable and refillable cartridges, establishing the region as a hub for sustainable desiccant innovation.

This comprehensive research report examines key regions that drive the evolution of the Fiber Humidity Control Packs market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Emerging Contenders Transforming Fiber Humidity Control with Cutting-Edge Solutions

The competitive landscape is anchored by both established multinationals and agile regional innovators. Clariant has introduced advanced polymer blends that enhance adsorption efficiency and reduce particle shedding, securing partnerships with leading electronics OEMs in Asia and North America. Silverson’s SmartSorb line integrates phase-change materials and sensor modules to maintain consistent humidity levels in semiconductor and aerospace storage, achieving a 27 percent reduction in moisture-related defects. Desiccare Inc. champions compostable fiber packs derived from bamboo and hemp, validated by USDA BioPreferred and Cradle to Cradle certifications, which resonate strongly in North American organic food and pharmaceutical segments.

Emerging players like India’s Sorbead India leverage clay-infused substrates to create cost-optimized solutions for high-humidity environments, capturing significant share in agricultural export markets across Southeast Asia. Sorbent Systems, responding to the EU’s Single-Use Plastics Directive, has pioneered algae-based films for fiber desiccant packaging, reducing microplastic release by nearly 90 percent in laboratory trials. Strategic collaborations-such as joint R&D ventures between material science institutes and market leaders-are fostering breakthroughs in moisture-kinetics modeling and customized service offerings, positioning these companies to address niche applications from electric vehicle battery storage to precision agriculture.

This comprehensive research report delivers an in-depth overview of the principal market players in the Fiber Humidity Control Packs market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Benz Packaging Solutions Pvt. Ltd.

- Boveda

- Bry-Air

- Clariant

- Condair Group

- Fujian Huaying Chemical Co., Ltd.

- Furukawa Electric Co., Ltd.

- IMPAK Corporation

- NTT Advanced Technology Corporation

- Shenzhen Chunwang New Meterials Co.,Ltd.

Strategic Imperatives for Industry Stakeholders to Navigate Disruption and Capitalize on Growth Opportunities in Fiber Humidity Control

Industry stakeholders must embrace a proactive strategy to navigate evolving market dynamics and regulatory complexities. First, investing in next-generation materials that marry high adsorption performance with stringent sustainability credentials will be critical for differentiation and regulatory compliance; this includes exploring bio-based fiber substrates and non-toxic indicator chemistries. Second, integrating digital monitoring and IoT capabilities into pack designs can unlock value-added services-such as real-time humidity tracking and automated replenishment alerts-that enhance customer retention and operational efficiency.

Third, supply chain diversification should be prioritized to mitigate tariff exposure and raw material volatility. Establishing regional manufacturing hubs and qualifying multiple suppliers across key geographies will buffer against trade-policy shifts and logistical disruptions. Fourth, forging strategic alliances with end-use industry leaders-particularly in aerospace, pharmaceuticals, and premium electronics-can facilitate co-development of specialized solutions and secure long-term contracts. Finally, enhancing market intelligence capabilities to monitor regulatory changes, competitor moves, and emerging technology trends will empower rapid, data-driven decision-making, ensuring resilience and sustained growth in a rapidly evolving environment.

Outlining the Rigorous Research Framework and Methodological Approach Underpinning the Fiber Humidity Control Packs Analysis

Our analysis draws upon a robust, mixed-method research methodology that combines comprehensive secondary research with targeted primary engagements. Secondary sources included Federal Register notices, trade policy documents, industry whitepapers, and regulatory standards issued by bodies such as the FDA, EPA, and REACH agencies. These materials were systematically reviewed to map tariff changes, compliance requirements, and certification frameworks impacting desiccant materials.

Primary research efforts encompassed in-depth interviews with key stakeholders across manufacturing, distribution, and end-use industries, supplemented by supplier surveys to quantify operational impacts and identify best practices. Data triangulation techniques were employed to validate findings, with cross-referencing across official trade data sets, company disclosures, and expert insights. Segmentation analyses were constructed by layering application, material type, product architecture, packet sizing, and distribution channel criteria, ensuring a granular understanding of market dynamics. This rigorous framework underpins our actionable insights and strategic recommendations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Fiber Humidity Control Packs market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Fiber Humidity Control Packs Market, by Material Type

- Fiber Humidity Control Packs Market, by Product Type

- Fiber Humidity Control Packs Market, by Packet Size

- Fiber Humidity Control Packs Market, by Application

- Fiber Humidity Control Packs Market, by Region

- Fiber Humidity Control Packs Market, by Group

- Fiber Humidity Control Packs Market, by Country

- United States Fiber Humidity Control Packs Market

- China Fiber Humidity Control Packs Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1908 ]

Synthesizing Key Insights to Illuminate the Future Trajectory of Fiber Humidity Control Packs in a Complex Global Landscape

The fiber humidity control packs market stands at a critical juncture, shaped by converging forces of technological innovation, sustainability mandates, and trade-policy realignments. Our analysis highlights the imperative for stakeholders to adopt integrated strategies that address material sourcing risks, regulatory compliance, and evolving consumer expectations. The delineation of key segments-ranging from consumer electronics to injectable pharmaceuticals-reveals divergent performance and cost requirements that can be leveraged for targeted solution development.

Moreover, regional insights underscore differentiated growth trajectories in the Americas, EMEA, and Asia-Pacific, each influenced by unique regulatory frameworks and market maturities. Leading companies exemplify the competitive edge gained through material science breakthroughs, digital integration, and sustainability certification. As 2025’s tariff measures reshape global supply chains, manufacturers who proactively diversify sourcing, invest in green materials, and harness digital capabilities will solidify their market positions and capture emerging value pools. This synthesis of critical insights lays the groundwork for informed strategic decision-making in a dynamic, high-stakes environment.

Engage with Expert Guidance from Ketan Rohom to Leverage Comprehensive Insights and Secure Your Fiber Humidity Control Market Intelligence

We appreciate your interest in deepening your understanding of the fiber humidity control packs market. To access the full, detailed analysis, industry-leading insights, and comprehensive data sets developed through our rigorous research process, please reach out to Ketan Rohom, Associate Director, Sales & Marketing. Ketan will guide you through our report’s benefits, answer any questions you have about market segmentation, regulatory impacts, and competitive dynamics, and facilitate your purchase process. Empower your strategic planning and decision-making by securing your copy of the report today-connect with Ketan to unlock the actionable intelligence you need to succeed in the evolving fiber humidity control packs landscape!

- How big is the Fiber Humidity Control Packs Market?

- What is the Fiber Humidity Control Packs Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?