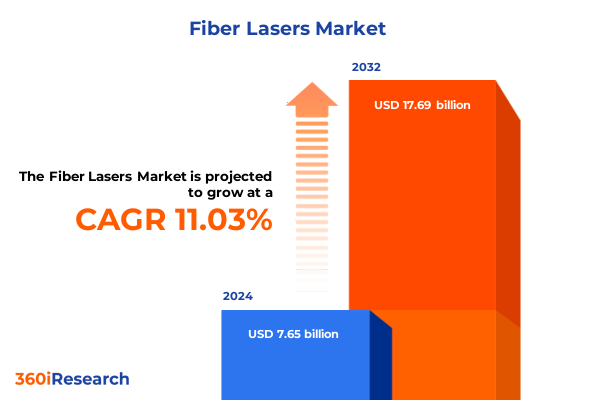

The Fiber Lasers Market size was estimated at USD 8.46 billion in 2025 and expected to reach USD 9.36 billion in 2026, at a CAGR of 11.10% to reach USD 17.69 billion by 2032.

Exploring the foundational role and distinct advantages of fiber lasers shaping precision manufacturing and high-end research applications

Fiber laser technology has emerged as a pivotal innovation in both industrial manufacturing and high-precision research environments, driven by its unmatched performance characteristics and operational flexibility. Rooted in the amplification of light through doped optical fibers, these systems deliver high beam quality, exceptional reliability, and compact form factors that traditional solid-state lasers struggle to match. As production tolerances tighten and demand for speed intensifies, fiber lasers offer a compelling blend of efficiency and precision, making them a cornerstone for modern machining, materials processing, and scientific applications.

In recent years, continuous improvements in doping materials and advances in diode-pumping techniques have elevated the performance thresholds of fiber lasers, enabling higher output powers and refined wavelength control. These technological advances have lowered total cost of ownership by extending component lifetimes and reducing maintenance intervals, thereby driving broader adoption across a spectrum of industries. Notably, the integration of fiber lasers into automated production lines has accelerated throughput while maintaining micron-level accuracy, further solidifying their role as key enablers of Industry 4.0 transformations.

Moreover, the scalability of fiber laser platforms-from low-power, ultrafast systems to high-power, continuous-wave configurations-ensures adaptability across varied operational contexts. As enterprises strive to enhance productivity and maintain competitiveness, understanding the foundational principles and inherent advantages of fiber laser technology is essential. This introduction sets the stage for exploring the dynamic shifts, regulatory influences, segmentation intricacies, and strategic imperatives that define the fiber laser landscape today.

Analyzing paradigm-changing innovations and emerging market drivers reshaping the global fiber laser technology ecosystem

The fiber laser landscape is undergoing transformative shifts driven by rapid advancements in photonic materials, system integration, and digital connectivity. Over the past decade, breakthroughs in rare-earth doping-particularly within erbium, ytterbium, and thulium fibers-have unlocked new wavelength regimes and pulsed operation modes, enabling applications previously beyond the reach of conventional lasers. In parallel, the emergence of ultrafast fiber lasers, capable of generating femtosecond pulses, has revolutionized microprocessing tasks, from precision drilling in semiconductor wafers to delicate medical device fabrication.

Simultaneously, Industry 4.0 initiatives have accelerated the integration of fiber lasers with smart factory ecosystems. Real-time monitoring, predictive maintenance algorithms, and cloud-based performance analytics are enhancing uptime and yield. This digital overlay has also fueled the development of compact, turnkey laser modules that seamlessly integrate with robotic arms and automated material handling systems. As a result, manufacturers are experiencing unprecedented levels of throughput and consistency, while research institutions leverage modular fiber laser arrays for advanced spectroscopy and nonlinear imaging studies.

Furthermore, the push towards sustainable manufacturing has catalyzed the adoption of high-efficiency fiber lasers with optimized electrical-to-optical conversion rates. By reducing energy consumption and minimizing heat-affected zones, these systems not only lower operational costs but also contribute to corporate sustainability goals. Collectively, these innovations and market drivers are reshaping the competitive landscape, prompting stakeholders to reevaluate traditional laser solutions in favor of agile, high-performance fiber technologies.

Evaluating how 2025 United States tariff measures have transformed fiber laser supply chains cost structures and competitive alliances

The imposition of new U.S. tariffs on imported fiber laser components and finished systems in early 2025 has introduced significant cost pressures and supply chain complexities. These measures target key materials such as specialty optical fibers, high-power pump diodes, and precision optical assemblies, resulting in elevated import duties that cascade through the value chain. As a consequence, manufacturers have been compelled to reassess sourcing strategies and examine the viability of regional supply partnerships to mitigate tariff-induced margin erosion.

In response, many OEMs and component suppliers have accelerated efforts to localize production facilities in North America. Establishing domestically based manufacturing lines for critical fiber preforms and diode bars not only circumvents tariff hurdles but also enhances supply resilience. However, the initial capital outlay for setting up these operations, coupled with the need to cultivate specialized fiber-drawing expertise, has created short-term financial strain. Despite these challenges, forward-looking firms view tariff-driven adjustments as an impetus to foster innovation, invest in automation, and strengthen intellectual property holdings within U.S. borders.

Moreover, the evolving tariff landscape has prompted a shift in pricing models and contract structures. Suppliers are increasingly offering comprehensive service packages and performance-based agreements to differentiate their offerings and justify premium price points. Simultaneously, end users are exploring alternative delivery mechanisms, including local assembly of imported subcomponents and long-term strategic alliances with domestic partners. As a result, the cumulative impact of the 2025 U.S. tariffs is redefining competitive dynamics, supply chain architectures, and collaborative frameworks across the fiber laser industry.

Uncovering deep insights across fiber laser segmentation by type operation mode doping material power level application and end-user dynamics

A nuanced examination of fiber laser market segmentation reveals distinct performance profiles and application rationales across multiple dimensions. When considering the type of laser, infrared fiber lasers dominate in high-power materials processing due to their deep penetration and efficient energy transfer, whereas ultrafast variants excel in microfabrication tasks demanding sub-micron precision. Ultraviolet fiber lasers, with their shorter wavelengths, enable high-resolution surface structuring, while visible fiber lasers cater to specialized applications in biomedical imaging and advanced spectroscopy.

Shifting focus to operational distinctions, continuous-wave lasers maintain a stable output ideal for welding and cutting, offering consistent thermal effects and streamlined process control. In contrast, pulsed lasers deliver high-peak-power bursts that minimize thermal damage and facilitate precision ablation. This operational dichotomy allows manufacturers to tailor solutions based on process requirements, whether prioritizing speed or surface integrity.

Mode structure further influences performance, with multimode fibers providing broader beam profiles suited to bulk material removal, and single-mode fibers delivering superior beam quality for intricate cutting and engraving. Similarly, the choice of doping material-whether erbium for eye-safe telecommunications, thulium for medical applications, or ytterbium for high-power industrial tasks-determines both emission wavelength and conversion efficiency. Power rating adds another layer of granularity, as systems below 1 kW serve laboratory and prototyping needs, midrange offerings between 1 kW and 5 kW address general industrial processing, and units exceeding 5 kW drive heavy-duty manufacturing at scale.

Application-based segmentation underscores the versatility of fiber lasers: in laser processing, macro operations like cutting, marking, and welding dominate large-scale fabrication, while microprocessing addresses delicate tasks such as hole drilling and surface texturing. Beyond processing, fiber lasers play integral roles in optical communication networks and optoelectronic devices. Finally, end-user categories ranging from aerospace and defense to automotive, electronics, energy, IT and telecommunications, and manufacturing reflect the broad industrial footprint, with distribution channels spanning traditional offline sales channels and emerging online platforms. This comprehensive segmentation framework illuminates where opportunities and competitive pressures converge within the fiber laser domain.

This comprehensive research report categorizes the Fiber Lasers market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Operation

- Mode

- Dopping Material

- Power Rating

- Application

- End-User

- Distribution Channel

Highlighting regional fiber laser dynamics and distinct growth trajectories across Americas Europe Middle East Africa and Asia Pacific

Regional dynamics in the fiber laser sector reveal contrasting growth trajectories driven by distinct industrial priorities and policy environments. In the Americas, established manufacturing hubs and advanced research institutions fuel demand for both high-power and ultrafast fiber laser systems. The presence of leading aerospace and defense contractors alongside a robust automotive industry underpins ongoing investments in materials processing and additive manufacturing initiatives, reinforcing North America’s position as a critical innovation ecosystem.

Meanwhile, Europe, the Middle East and Africa exhibit a diverse array of market forces. Western European nations, characterized by stringent regulatory standards and sustainability mandates, favor energy-efficient laser solutions that align with green manufacturing objectives. Central and Eastern European economies leverage cost-competitive production capabilities to expand into mass fabrication, with a growing emphasis on high-throughput cutting and welding applications. In the Middle East, strategic infrastructure projects and defense modernization programs are catalyzing demand for fiber lasers in both industrial and security contexts, while select African markets are beginning to adopt laser-based processes in mining and energy sectors.

Asia-Pacific stands out as the fastest-evolving region, propelled by government-sponsored innovation programs and sizable electronics and semiconductor manufacturing clusters. China’s ongoing push for self-sufficiency in photonics, combined with South Korea’s leadership in display technology and Japan’s expertise in precision engineering, creates a fertile environment for diverse fiber laser applications. Furthermore, India’s burgeoning manufacturing reforms and Southeast Asia’s expanding automotive and renewable energy sectors promise to unlock new areas of growth. Collectively, these regional distinctions underscore the importance of tailored market approaches and strategic investments aligned with local demand drivers and policy landscapes.

This comprehensive research report examines key regions that drive the evolution of the Fiber Lasers market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling leading fiber laser manufacturers advancing R&D collaborations portfolio expansions and service-led differentiation

Leading fiber laser manufacturers are actively redefining the competitive landscape through targeted investments in research, strategic partnerships, and portfolio diversification. One prominent player has solidified its global presence by pioneering high-power ytterbium-doped systems and establishing advanced manufacturing facilities across North America, Europe, and Asia to meet localized demand efficiently. Another company has distinguished itself in ultrafast laser development, securing collaborations with research institutions to advance femtosecond fiber laser technology and expand into biomedical and scientific imaging markets.

Several firms have adopted an acquisition-led growth strategy, integrating complementary capabilities such as diode laser production and precision optics assembly to streamline supply chains and enhance vertical integration. Meanwhile, specialists in thulium-doped fiber lasers have forged alliances with medical device manufacturers, tailoring solutions for minimally invasive surgical applications and ophthalmic procedures. Others have focused on expanding service networks, offering predictive maintenance analytics, remote diagnostics, and extended warranty packages to differentiate their offerings and strengthen customer loyalty.

Furthermore, joint ventures between optical component suppliers and system integrators are driving innovation in visible and ultraviolet fiber laser modules, enabling new applications in microelectronics and nano-fabrication. These collaborations often involve co-development agreements that accelerate time to market and share intellectual property, positioning participants to capture emerging opportunities. Overall, the competitive arena is characterized by proactive R&D, dynamic partnerships, and a relentless pursuit of next-generation fiber laser capabilities.

This comprehensive research report delivers an in-depth overview of the principal market players in the Fiber Lasers market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Advalue Photonics Inc.

- ALPHALAS GmbH

- Amonics Ltd.

- ams-OSRAM AG

- Apollo Instruments Inc.

- Applied Manufacturing Technologies

- Arima Optoelectronics Corporation

- Arima Optoelectronics Corporation

- ASML Holding N.V.

- Beneq Oy

- BODORLASER INC.

- Coherent Corp.

- CY Laser SRL

- FANUC Corporation

- Fujikura Ltd.

- Furukawa Electric Co., Ltd.

- Hamamatsu Photonics K.K.

- Han's Laser Technology Industry Group Co., Ltd

- Innolume GmbH

- IPG PHOTONICS CORPORATION

- IPG Photonics Corporation

- JENOPTIK AG

- Jinan Xintian Technology Co. Ltd.

- Keopsys by Lumibird S.A.

- Laser Marking Technologies, LLC

- Laserline GmbH

- Lumentum Holdings Inc.

- Maxphotonics Co,.Ltd

- Menlo Systems GmbH

- Mitsubishi Electric Corporation

- MKS Instruments, Inc.

- Newport Corporation by MKS Instruments, Inc.

- nLIGHT, Inc.

- Prima Industrie S.p.A.

- RMI Laser

- Rohm Co., Ltd.

- Sacher Lasertechnik, Inc.

- Sharp Corporation

- Shenzhen JPT Opto-electronics Co., Ltd.

- Sony Corporation

- The TOPTICA Group

- Thorlabs, Inc.

- Toptica Photonics AG

- TRUMPF SE + Co. KG

- TRUMPF SE + Co. KG

- Wuhan Raycus Fiber Laser Technologies Co., Ltd.

Providing strategic recommendations for industry leaders to optimize technology investments supply chains and sustainable growth

To thrive amid rapid technological evolution and shifting trade landscapes, industry leaders must pursue a multi-pronged strategic approach. First, prioritizing investment in research and development focused on next-generation materials and emission wavelengths will position organizations to capture emerging applications in microfabrication, telecommunications, and medical therapies. Establishing collaborative partnerships with academic institutions and specialized photonics research centers can expedite innovation cycles and provide early access to breakthrough technologies.

In parallel, companies should reexamine supply chain configurations to enhance resilience and cost efficiency. By diversifying sourcing across geographies and incorporating regional production capabilities for critical components, firms can mitigate the impact of trade policy fluctuations. Implementing advanced analytics and digital twins in supply chain management will further improve visibility and agility, enabling proactive risk mitigation and dynamic reconfiguration in response to market changes.

Moreover, embracing service-based revenue models-such as performance guarantees, predictive maintenance subscriptions, and training curricula-can foster deeper customer engagement and create recurring income streams. Cultivating a workforce equipped with laser safety and process optimization expertise will also bolster adoption rates and reduce operational downtime. Finally, aligning product roadmaps with sustainability targets, including energy-efficient designs and recyclable components, will meet escalating regulatory demands and resonate with environmentally conscious end users. By executing these recommendations in concert, industry leaders can unlock new value levers and sustain long-term competitive advantage.

Detailing the comprehensive methodology that integrated secondary research primary consultations and rigorous data validation processes

The research underpinning this analysis employed a rigorous, multi-stage methodology integrating both quantitative and qualitative data collection techniques. Initially, a comprehensive secondary research phase involved reviewing technical white papers, patent filings, and supplier catalogs to map technological advancements and product offerings. This desk research was complemented by an exhaustive examination of regulatory publications and trade data to understand the evolving tariff environment and regional policy impacts.

Subsequently, primary research was conducted through structured interviews with senior executives, applications engineers, and procurement specialists across key fiber laser user industries. These discussions yielded first-hand insights into emerging pain points, adoption drivers, and strategic priorities. Additionally, expert roundtables and workshops were convened with academic researchers and industry consultants to validate hypotheses and explore frontier applications such as quantum photonics and biomedical imaging.

Data triangulation was achieved by cross-referencing findings from company financial reports, technical performance benchmarks, and end-user surveys, ensuring consistency and reliability. All quantitative inputs underwent statistical validation and sensitivity analysis to account for market volatility and policy changes. Finally, an internal peer review process involving subject matter experts ensured methodological transparency and analytical robustness. This multi-faceted approach provides a solid foundation for the conclusions and recommendations presented herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Fiber Lasers market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Fiber Lasers Market, by Type

- Fiber Lasers Market, by Operation

- Fiber Lasers Market, by Mode

- Fiber Lasers Market, by Dopping Material

- Fiber Lasers Market, by Power Rating

- Fiber Lasers Market, by Application

- Fiber Lasers Market, by End-User

- Fiber Lasers Market, by Distribution Channel

- Fiber Lasers Market, by Region

- Fiber Lasers Market, by Group

- Fiber Lasers Market, by Country

- United States Fiber Lasers Market

- China Fiber Lasers Market

- Competitive Landscape

- List of Figures [Total: 20]

- List of Tables [Total: 1749 ]

Drawing conclusive perspectives on strategic imperatives and future directions shaping the fiber laser industry’s competitive landscape

The fiber laser industry stands at a pivotal juncture characterized by rapid technological innovation, shifting trade policies, and evolving end-user requirements. As suppliers refine doping materials and integrate digital capabilities, manufacturers and research institutions must adapt to maintain a competitive edge. The cumulative effects of emerging ultrafast modalities, expanding wavelength ranges, and enhanced energy efficiencies will redefine process capabilities and open new application frontiers.

Simultaneously, the reconfiguration of supply chains in response to U.S. tariffs highlights the importance of geographic diversification and localized component production. Organizations that proactively invest in regional manufacturing and forge resilient supplier networks will be better positioned to navigate policy disruptions and cost fluctuations. Moreover, the growing emphasis on sustainable manufacturing practices underscores a broader industry commitment to reducing environmental footprints and aligning with global decarbonization goals.

Looking ahead, strategic agility will be paramount. Stakeholders who leverage robust segmentation insights to tailor their offerings, harness advanced predictive analytics for operational excellence, and cultivate collaborative ecosystems across the value chain will capture disproportionate value. By balancing innovation with disciplined execution, companies can unlock transformative growth opportunities and shape the future trajectory of the fiber laser landscape.

Connect directly with Ketan Rohom Associate Director of Sales & Marketing to unlock bespoke fiber laser market intelligence and strategic insights

Engage directly with Ketan Rohom, Associate Director of Sales & Marketing, to discover how comprehensive fiber laser market intelligence can be tailored precisely to your organizational priorities. By collaborating with Ketan, you will gain privileged access to expert analyses, detailed competitive assessments, and actionable strategic frameworks designed to accelerate decision-making and enhance market positioning. Whether you seek a bespoke research briefing, deeper dives into specific technology segments, or customized scenarios addressing unique supply chain challenges, Ketan will ensure the insights align seamlessly with your growth objectives. Reach out to harness the full potential of our advanced research methodologies and translate data-driven perspectives into tangible business outcomes. Secure your copy of the definitive fiber laser market research report today and equip your leadership team with the foresight required to navigate evolving industry dynamics with confidence.

- How big is the Fiber Lasers Market?

- What is the Fiber Lasers Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?