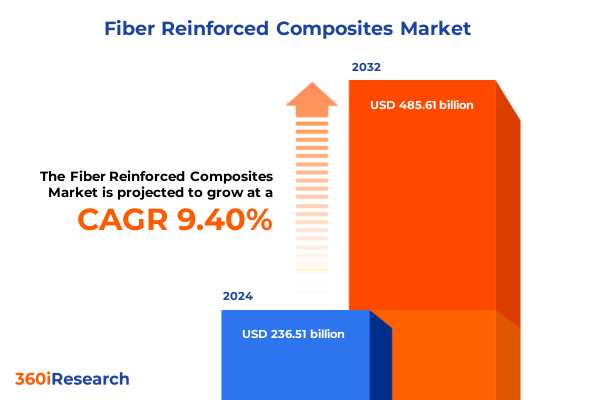

The Fiber Reinforced Composites Market size was estimated at USD 257.86 billion in 2025 and expected to reach USD 281.15 billion in 2026, at a CAGR of 9.46% to reach USD 485.61 billion by 2032.

Unveiling the Increasing Significance of Fiber Reinforced Composites in Modern Manufacturing and Pioneering Applications in Aerospace and Energy

Fiber reinforced composites have emerged as a cornerstone material class in advanced engineering applications, offering a blend of high strength, lightweight properties, and versatile formability that traditional metals struggle to match. Over the past decade, continuous advancements in fiber technologies and resin chemistries have expanded their use across critical sectors such as aerospace, automotive, renewable energy, and infrastructure. These materials combine the mechanical robustness of fibers like carbon, glass, and aramid with the adaptability of thermoplastic and thermoset matrices, creating structural components that deliver superior performance without compromising on weight or durability.

Driven by global imperatives to reduce carbon emissions, improve fuel efficiency, and enhance structural longevity, manufacturers are increasingly turning to fiber reinforced composites to meet stringent regulatory and sustainability targets. In aerospace, the demand for lightweight yet resilient components is reshaping aircraft design and enabling more fuel-efficient fleets. Meanwhile, automotive OEMs are integrating composites into exterior panels, crash structures, and battery enclosures to lower vehicle weight and extend electric vehicle range. As infrastructure projects pursue longer-lasting bridges and corrosion-resistant elements, composites are being chosen to replace or reinforce steel components, offering reduced maintenance costs and extended service life.

As the industry continues to innovate, stakeholders must remain cognizant of evolving material formulations, manufacturing processes, and regulatory dynamics that collectively influence the direction of fiber reinforced composites. This introduction provides a comprehensive lens through which to appreciate the material’s transformative capabilities and its growing footprint across strategic markets.

Examining the Paradigm Shifts Shaping the Fiber Reinforced Composites Landscape Through Sustainability Innovation and Advanced Manufacturing

The landscape of fiber reinforced composites is undergoing fundamental shifts as sustainability imperatives, digital transformation, and evolving end-use requirements converge. Manufacturers are now prioritizing recyclable and bio-based resin systems, signaling a departure from traditional thermoset formulations in favor of recyclable thermoplastics that enable circular material flows. Concurrently, the rise of additive manufacturing and automation in composite fabrication is reducing cycle times, lowering labor costs, and driving consistency in high-mix production environments. These technological inflections are redefining how composite parts are designed, manufactured, and integrated into broader systems.

Another pivotal change is the integration of data-driven design and predictive analytics, which is enabling engineers to optimize fiber orientations, resin distribution, and laminate stacking sequences for precise load-bearing performance. Through digital twins and simulation platforms, composite structures can be virtually tested under a range of real-world conditions, accelerating product development cycles and reducing the need for costly physical prototypes. In addition, material suppliers and OEMs are forging deeper collaborations to co-develop customized fiber architectures and specialized sizing treatments that enhance interfacial bonding and overall material toughness.

Supply chain resilience has also become a strategic priority following global disruptions. Companies are diversifying their fiber and resin sourcing across multiple geographies to mitigate risks associated with tariff volatility, shipping delays, and raw material shortages. As a result, regional production hubs are gaining prominence, supported by investments in localized pultrusion, filament winding, and prepreg capacity. This holistic transformation underscores the importance of agility, sustainability, and digitalization in maintaining competitive advantage within the fiber reinforced composites sector.

Analyzing the Comprehensive Impact of Evolving United States Tariff Regulations on Fiber Reinforced Composite Materials in 2025 and Supply Chain Dynamics

The United States tariff regime introduced in early 2025 has had a profound and multifaceted impact on the fiber reinforced composites industry. Under Section 301 of the Trade Act of 1974, tariffs on raw carbon fiber tow increased from 7.5% to 25%, while prepreg materials faced a hike from 4.2% to 17.5%, reflecting heightened import duties on advanced manufacturing inputs aimed at bolstering domestic production capacity. These adjustments have driven many manufacturers to intensify domestic sourcing initiatives or adjust their product portfolios to incorporate alternative fiber types with more favorable duty structures.

Simultaneously, new “reciprocal” tariffs under the International Emergency Economic Powers Act imposed a baseline 10% duty on virtually all imports outside of Canada and Mexico, thereby affecting composite panel imports and resin systems alike. Although subsequent legal challenges temporarily paused the collection of certain IEEPA-based duties, ongoing appeals have maintained a degree of uncertainty, leading companies to hedge their supply chains by stockpiling critical materials and negotiating extended lead times with suppliers. Meanwhile, Section 232 investigations into national security considerations for steel, aluminum, and related composite inputs have introduced additional layers of complexity to procurement strategies.</n Despite these headwinds, the tariff environment has also catalyzed a wave of investment in domestic fiber manufacturing, including capacity expansions for carbon and aramid fibers, as well as increased R&D spending on lower-cost glass fiber alternatives. While short-term cost pressures have necessitated price adjustments and margin recalibrations, industry players are leveraging strategic sourcing, nearshoring, and vertical integration to navigate this evolving policy landscape and safeguard their long-term competitiveness.

Revealing Critical Segmentation-driven Insights That Define Market Opportunities Across Fiber Types Resin Systems and Application Areas

Deep examination of fiber supply chains and resin systems reveals nuanced growth drivers and potential constraints across the composite value chain. The market’s segmentation by fiber type highlights carbon fiber’s dominance in high-performance sectors alongside aramid fiber’s critical role in applications demanding superior impact resistance. Glass fiber retains broad adoption in cost-sensitive segments, with specific attention on meta and para aramid variants for ballistic protection and high-temperature environments. Resin segmentation, distinguishing thermoplastic families like polyamide, PEEK, PPS, and polypropylene from thermoset chemistries such as epoxy, phenolic, polyester, and vinyl ester, underscores the tradeoffs between recyclability, thermal stability, and processing parameters.

Manufacturing technologies offer further insight, as autoclave molding, resin transfer molding, and filament winding continue to serve aerospace and wind energy applications, whereas compression molding, hand layup, pultrusion, and injection molding provide scalable solutions for automotive, construction, and electrical markets. Application-driven segmentation reveals the composite industry’s diversified demand base, ranging from lightweight structural components in aerospace and defense to corrosion-resistant elements in marine and infrastructure, as well as energy-efficient wind turbine blades and performance-enhancing equipment in sports and leisure.

Reinforcement form also shapes value creation, with continuous fibers in multiaxial, unidirectional, and woven formats enabling tailored mechanical properties, while discontinuous fibers from chopped strand mats, needled mats, and nonwoven mats offer design flexibility and cost efficiency. By integrating these segmentation frameworks, stakeholders can pinpoint high-growth niches, optimize product design, and align manufacturing investments with end-market requirements.

This comprehensive research report categorizes the Fiber Reinforced Composites market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Fiber Type

- Resin Type

- Manufacturing Process

- Reinforcement Form

- Application

Emerging Regional Dynamics Shaping Growth Trajectories for Fiber Reinforced Composites Across the Americas EMEA and Asia-Pacific

Regional dynamics are playing an increasingly crucial role in shaping the strategic direction of the fiber reinforced composites market. In the Americas, robust aerospace and defense procurement programs are complemented by rapid adoption of composite materials in electric vehicles, driven by stringent emissions regulations and incentives for lightweight transportation. The establishment of new carbon fiber production facilities and resin development centers across the United States is strengthening the domestic value chain, reducing reliance on imports, and fostering innovation clusters that interconnect material suppliers with end-users and research institutions.

In Europe, Middle East, and Africa, policy support for renewable energy infrastructure and building sustainability has fueled demand for composites in wind turbine blades, bridge reinforcements, and façade panels. European manufacturers are leading in the commercialization of advanced thermoset recycling processes and bio-based resin formulations, aligning with the European Green Deal’s circular economy objectives. Additionally, regional consortiums are facilitating technology sharing for automated composite manufacturing, accelerating deployment of robotic layup and out-of-autoclave curing solutions to meet growing order backlogs without compromising quality.

Asia-Pacific remains a powerhouse for low-cost production and high-volume applications, with leading chemical and fiber players expanding capacity in China, India, Japan, and Southeast Asia. Investment in domestic autoclave, pultrusion, and injection molding infrastructure is enabling local OEMs to capture rapidly expanding markets in infrastructure, electronics, marine, and consumer goods. Government initiatives that subsidize renewable energy projects and green building programs are further reinforcing Asia-Pacific’s pivotal role in the global composites economy, while cross-border cooperation is improving raw material reliability and fostering shared research agendas across the region.

This comprehensive research report examines key regions that drive the evolution of the Fiber Reinforced Composites market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Identifying Strategic Moves and Competitor Innovations by Leading Companies Driving the Fiber Reinforced Composites Industry

Leading composites suppliers and OEMs have been actively refining their strategies to capture market share and address evolving customer demands. Major carbon fiber producers have invested heavily in next-generation fiber manufacturing technologies, scaling continuous tow production lines and developing higher-modulus grades tailored for aerospace and defense applications. At the same time, aramid fiber suppliers are enhancing end-of-life recycling programs to reclaim and repurpose high-quality fiber for second-life composites, demonstrating a holistic approach to sustainability and cost reduction.

Resin manufacturers are similarly advancing specialty chemistries, accelerating commercial launches of high-performance thermoplastics like PEEK and PPS with improved processability and longer shelf life. They are forging partnerships with automation integrators to deliver turnkey resin transfer molding and injection molding solutions that streamline composite part production. In parallel, glass fiber producers are expanding capacity for specialty glass formulations with enhanced mechanical properties, positioning themselves to serve wind energy and automotive markets with stringent cost and performance requirements.

Concurrently, system integrators and tier-one converters are diversifying their service offerings to include design engineering, prototyping, and full-scale production capabilities. These companies are establishing regional centers of excellence equipped with digital engineering platforms and rapid curing ovens to shorten development timelines. Through strategic acquisitions, joint ventures, and co-development projects with end-users, leading players are embedding themselves within key industrial ecosystems, ensuring they remain at the forefront of product innovation and customer support.

This comprehensive research report delivers an in-depth overview of the principal market players in the Fiber Reinforced Composites market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Asahi Kasei Corporation

- Celanese Corporation

- DuPont de Nemours, Inc.

- Exel Composites Oyj

- Gurit Holding AG

- Gurit Services AG

- Hexcel Corporation

- Hyosung Corporation

- Johns Manville Corporation

- Jushi Group Co., Ltd.

- Kineco Kaman Composites‑India Private Limited

- LANXESS AG

- LyondellBasell Industries N.V.

- Mitsubishi Chemical Holdings Corporation

- Mitsubishi Rayon Co., Ltd.

- Mitsui Chemicals, Inc.

- Nippon Electric Glass Co., Ltd.

- Owens Corning

- Plasan Carbon Composites Ltd.

- RTP Company

- Röchling SE & Co. KG

- SGL Carbon SE

- Solvay SA

- Teijin Limited

- Ten Cate N.V.

- Toray Industries, Inc.

Empowering Industry Stakeholders with Targeted Actionable Strategies to Navigate Challenges and Accelerate Growth in Fiber Reinforced Composites Market

To navigate the complex and rapidly evolving composite materials landscape, industry leaders must adopt a proactive and multifaceted approach. First, investing in advanced manufacturing technologies such as automated layup systems, out-of-autoclave curing, and additive manufacturing will enable organizations to reduce cycle times, improve quality, and increase production flexibility. By integrating digital design tools and predictive maintenance platforms, companies can further optimize asset utilization and anticipate process bottlenecks before they impact delivery schedules.

Second, forging strategic partnerships across the value chain is essential for co-developing next-generation materials and securing raw material supply. Collaborative R&D initiatives with universities, government laboratories, and technology startups can expedite the commercialization of recyclable resin systems and bio-based fibers, aligning product portfolios with emerging regulatory frameworks and sustainability goals. Additionally, diversifying sourcing strategies by cultivating regional partnerships will mitigate tariff-related risks and shipping delays while strengthening local manufacturing ecosystems.

Third, implementing a data-driven market intelligence capability will empower decision-makers to anticipate end-user trends, monitor competitor activity, and tailor offerings for high-growth segments such as electric vehicles, renewable energy, and defense. By establishing cross-functional teams that blend market analysts, materials scientists, and supply chain experts, organizations can translate insights into decisive actions-whether that involves expanding capacity, entering new geographies, or optimizing pricing structures. Collectively, these recommendations will reinforce market leadership and foster long-term resilience in an increasingly competitive environment.

Elucidating a Rigorous and Transparent Research Methodology Integrating Diverse Data Sources and Expert Insights for Market Intelligence

The research underpinning this analysis was conducted through a robust and systematic methodology combining primary and secondary investigations. Extensive desk research was performed, encompassing industry publications, technical whitepapers, and regulatory filings to establish a foundational understanding of fiber reinforced composites technologies, raw material markets, and policy landscapes. Specialized databases and patent repositories were also mined to trace recent innovations in fiber architectures, resin chemistries, and manufacturing equipment.

Complementing secondary sources, structured interviews and surveys were carried out with a diverse panel of stakeholders, including fiber and resin producers, OEM engineers, Tier 1 converters, and end-user procurement managers. These engagements provided direct insights into market drivers, supply chain challenges, and emerging application requirements. Findings from these primary interactions were triangulated with quantitative shipment data and trade statistics to validate trends and vendor strategies.

Finally, the research incorporated rigorous data analysis techniques and cross-validation processes, ensuring consistency and accuracy in segmentation, regional dynamics, and competitive mapping. All insights were peer-reviewed by industry experts to confirm alignment with real-world market behavior. This comprehensive methodology delivers a transparent and credible perspective on the fiber reinforced composites market, empowering stakeholders to make informed strategic decisions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Fiber Reinforced Composites market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Fiber Reinforced Composites Market, by Fiber Type

- Fiber Reinforced Composites Market, by Resin Type

- Fiber Reinforced Composites Market, by Manufacturing Process

- Fiber Reinforced Composites Market, by Reinforcement Form

- Fiber Reinforced Composites Market, by Application

- Fiber Reinforced Composites Market, by Region

- Fiber Reinforced Composites Market, by Group

- Fiber Reinforced Composites Market, by Country

- United States Fiber Reinforced Composites Market

- China Fiber Reinforced Composites Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1908 ]

Summarizing Key Findings and Strategic Imperatives to Propel the Fiber Reinforced Composites Industry into a Sustainable and Innovative Future

This report consolidates critical insights into the evolving dynamics of the fiber reinforced composites industry, emphasizing transformative material innovations, regional growth patterns, and the impact of policy influences such as United States tariffs. Key findings underscore the accelerating adoption of recyclable thermoplastics, digital manufacturing technologies, and sustainable fiber architectures that are reshaping product development lifecycles. Moreover, the strategic segmentation analysis reveals lucrative opportunities across high-strength carbon fiber, versatile glass fiber, and impact-resistant aramid fiber applications.

Regional assessments highlight differentiated growth drivers, from aerospace modernization in the Americas to circular economy initiatives in Europe, Middle East, and Africa, and high-volume manufacturing expansions in Asia-Pacific. Competitive intelligence demonstrates that leading companies are leveraging vertical integration, automation partnerships, and targeted R&D investments to maintain market leadership. Meanwhile, the 2025 tariff landscape has prompted supply chain realignments and accelerated domestic fiber capacity expansions, influencing cost structures and procurement decisions.

On the heels of these insights, stakeholders are equipped with strategic imperatives to invest in advanced manufacturing, diversify supply chain networks, and harness data-driven market intelligence. By aligning organizational capabilities with emerging trends and policy contexts, industry participants can drive innovation, capture new application segments, and secure sustainable growth trajectories. Ultimately, this report offers a comprehensive roadmap for decision-makers seeking to navigate the complex opportunities and challenges defining the future of fiber reinforced composites.

Connect with Ketan Rohom to Discover How Comprehensive Market Intelligence Can Power Your Strategic Decisions in Fiber Reinforced Composites

Elevate your strategic planning by engaging directly with Ketan Rohom, Associate Director of Sales & Marketing, whose deep expertise in the fiber reinforced composites market can offer tailored insights that meet your organization’s unique challenges. Ketan Rohom is available to guide you through the comprehensive market research report, highlighting the most relevant data and strategic implications for your business objectives. By partnering with him, you’ll gain access to proprietary analysis, advanced segmentation details, and actionable recommendations that empower you to stay ahead of competitors and seize emerging opportunities. Don’t leave your market strategy to guesswork; reach out today and discover how in-depth market intelligence can drive sustainable growth and innovation across your product portfolio.

- How big is the Fiber Reinforced Composites Market?

- What is the Fiber Reinforced Composites Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?