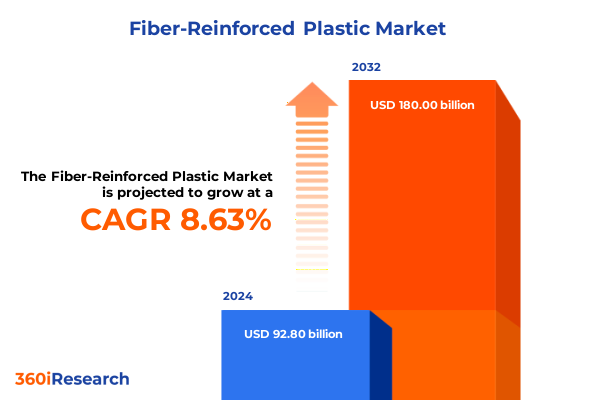

The Fiber-Reinforced Plastic Market size was estimated at USD 100.67 billion in 2025 and expected to reach USD 108.92 billion in 2026, at a CAGR of 8.65% to reach USD 180.00 billion by 2032.

Transforming Global Industries with High-Performance Fiber Reinforced Plastics Offering Exceptional Durability Lightweight Efficiency and Eco-Friendly Innovation

Fiber reinforced plastics are engineered composite materials that combine polymer matrices with reinforcing fibers such as glass, carbon, or aramid to deliver an exceptional strength-to-weight ratio, corrosion resistance, and design flexibility beyond conventional metals. Over the past decades, such composites have transitioned from niche applications to mainstream adoption in critical sectors, driven by their capacity to reduce structural mass without sacrificing performance. This evolution is perhaps most notable in aerospace, where composites now account for more than half of the structural weight in leading commercial aircraft programs, a paradigm shift that revolutionized airframe design and validated the material’s transformative potential

Expanding beyond aviation, fiber reinforced plastics have become essential to automotive manufacturers seeking improved fuel efficiency and extended electric-vehicle range, while construction and infrastructure projects leverage their corrosion resistance and longevity for bridges and building facades. At the same time, renewable energy developers harness composite materials to produce longer, lighter wind turbine blades that enhance energy capture and operational life. These cross-industry drivers underscore a convergence of performance objectives and sustainability goals, positioning fiber reinforced plastics as cornerstone materials for modern engineering challenges

Navigating the Next Wave of Technological and Sustainability-Driven Disruptions Redefining the Competitive Fiber Reinforced Plastics Landscape

The fiber reinforced plastics landscape is undergoing a profound transformation fueled by converging technological, regulatory, and sustainability imperatives. Across manufacturing hubs worldwide, advancements in automated fiber placement and robotic lay-up processes are streamlining production, reducing material waste, and delivering greater consistency in complex composite structures. These intelligent manufacturing solutions integrate machine learning and deep-data analytics to optimize fiber orientation and resin distribution, signaling a shift from artisanal fabrication toward fully digitized, Industry 4.0-enabled operations

Parallel to these process innovations, the growing burden of environmental regulations and corporate net-zero commitments has accelerated the adoption of bio-based resins, recycled fiber reinforcements, and natural fibers such as flax and jute. As end users demand greener materials, suppliers are expanding their portfolios to include closed-loop recycling systems and certified sustainable inputs, blending performance with minimal ecological footprint. Moreover, the emergence of AI-driven design and simulation tools is compressing development cycles, enabling rapid virtual prototyping of composite components for industries as diverse as motorsport, consumer electronics, and marine vessels

Looking ahead, the march of electrification across automotive and aerospace platforms will further elevate composites’ role in next-generation, lightweight architectures. Hybrid and electric powertrains incentivize weight reduction to maximize efficiency, creating new growth avenues for advanced fiber reinforced plastics. This synergy between material innovation and clean technology ambitions cements composites’ position as transformative enablers in a rapidly evolving industrial ecosystem.

Assessing the Far-Reaching Implications of New United States Trade Duties on Composite Feedstocks and Advanced Polymer Reinforcements in 2025

In 2025, a sweeping array of U.S. trade measures targeting imported resin chemistries and composite fibers introduced new overheads for manufacturers dependent on offshore supply chains. Early in the year, the federal government invoked emergency powers to impose 25% duties on resin and fiber imports from Canada and Mexico, alongside 10% levies on analogous Chinese shipments. These actions were justified on grounds ranging from national security to supply-chain integrity, but they notably reshaped cost structures for products reliant on aramid, carbon, and glass fiber feedstocks

Shortly thereafter, under expanded Section 301 provisions, tariffs on raw carbon fiber tow surged to 25%, while prepreg materials faced duties of 17.5%. Concurrent proposals for a carbon border adjustment mechanism foreshadowed additional fees linked to upstream emissions, potentially adding 8–12% to costs for carbon-intensive imports. In parallel, higher duties on specialty thermoplastics and thermoset resins have prompted procurement teams to accelerate nearshoring initiatives, negotiate long-term supplier agreements, and invest in domestic joint ventures to secure critical inventories. Collectively, these policies have sparked supply-chain realignments, cost-containment strategies, and capital allocations toward regional production enhancements, underscoring the importance of proactive tariff mitigation measures in sustaining competitive advantage

Unveiling Critical Insights from Multifaceted Market Segmentation Spanning End Use Industries Fiber Types and Resin Technologies

The market’s multifaceted segmentation reveals nuanced dynamics that underscore divergent growth vectors across end-use industries, fiber categories, and resin systems. Within aerospace and defense, high-performance carbon and aramid fiber composites continue to dominate structural applications, while the automotive sector aggressively pursues lightweight glass fiber laminates to boost fuel economy and electric-vehicle range. Construction and marine industries leverage corrosion-resistant composites for enduring infrastructure, even as sports and leisure products exploit natural fiber reinforcements for eco-conscious design. Meanwhile, wind energy remains a pivotal driver of demand, propelling longer, more durable rotor blades crafted from advanced fiber blends.

Equally critical is the evolution of fiber offerings, spanning aramid fibers prized for impact resistance, carbon fibers categorized into PAN and pitch precursors tailored for ultimate stiffness, and glass fibers differentiated across C-, E-, and S-grades to balance cost and performance. Natural fibers such as jute, kenaf, and sisal are carving out sustainable niches, delivering lower embodied energy and end-of-life biodegradability. On the matrix side, thermoplastics like polyamide, polycarbonate, and polypropylene unlock rapid processing and recyclability, while thermosets including epoxy, unsaturated polyester, and vinyl ester maintain strongholds in high-temperature and chemical-resistant applications. Together, these layered segmentation dimensions define strategic pathways for tailored material selection and product innovation in a highly competitive composite ecosystem

This comprehensive research report categorizes the Fiber-Reinforced Plastic market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Fiber Type

- Resin Type

- End User Industry

Decoding Regional Dynamics Influencing Fiber Reinforced Plastic Adoption Across the Americas Europe Middle East Africa and Asia-Pacific

Regional dynamics play a pivotal role in shaping fiber reinforced plastic adoption and innovation across global markets. In the Americas, robust demand from aerospace, automotive, and infrastructure sectors has spurred capacity expansions and localized production clusters, further catalyzed by tariff-driven supply-chain nearshoring. The United States remains a leading source of R&D investments, while Canada and Mexico bolster North American integration under renewed trade realignments.

Across Europe, the Middle East, and Africa, stringent environmental regulations and aggressive decarbonization mandates are directing investments toward sustainable composites and recycling technologies. The European Commission’s threat to target U.S. resin and polymer exports as countermeasures illustrates the interplay of policy and market access, prompting stakeholders to prioritize low-carbon feedstocks and circular model innovations.

In Asia-Pacific, rapid industrialization and government incentives have established the region as the world’s largest composites manufacturing hub. China and India lead with massive output for automotive and electrical sectors, while Japan and South Korea advance high-performance carbon fiber technologies. Ongoing infrastructure development, wind energy expansion, and relocation of manufacturing bases to Southeast Asian economies underscore the region’s strategic importance in the global fiber reinforced plastics landscape

This comprehensive research report examines key regions that drive the evolution of the Fiber-Reinforced Plastic market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Evaluating Market Leaders and Emerging Innovators Shaping the Fiber Reinforced Plastics Sector with Strategic Partnerships and Cutting-Edge Technologies

Key industry leaders are leveraging differentiated strategies to maintain market primacy and foster innovation in fiber reinforced plastics. Hexcel Corporation, recognized for its integrated supply chain encompassing carbon fiber production, prepreg systems, and adhesive technologies, has secured high-value contracts in the aerospace sector, driving composite content in leading airframe programs and advancing next-generation thermoset solutions. Toray Industries sustains its dominant position in aerospace-grade carbon fibers through large-scale manufacturing and technology licensing, supplying critical materials for flagship platforms while pioneering bio-based fiber initiatives to align with emerging sustainability requirements.

Meanwhile, Owens Corning continues to optimize its composite portfolio through strategic capital allocation and margin expansion, harnessing its vertically integrated glass fiber and continuous reinforcement capabilities to serve diversified end markets. The company’s commitment to The OC Advantage™ underscores an emphasis on brand strength, scale efficiencies, and technology leadership as it drives growth in insulation, roofing, and composite applications across global industries. In parallel, emerging players and regional innovators are forging partnerships and deploying digitalized platforms to enhance performance analytics, supply-chain visibility, and rapid customization, collectively reshaping competitive dynamics in the composite materials sphere.

This comprehensive research report delivers an in-depth overview of the principal market players in the Fiber-Reinforced Plastic market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- American International Industries

- AWMCO, Incorporated

- Bedford Reinforced Plastics

- Fiber-Tech Industries

- Golden Valley Supply Co.

- InPlant Offices, Inc.

- Interstate Plastics

- Kal-Lite

- Kamco Supply Corp.

- LF Manufacturing

- Nudo Products, Inc.

- Resolite

- Retterbush Fiberglass Corp.

- Risk Logic Inc.

- Signature Enclosures Inc.

- Stabilit America Inc.

- Tucker Acoustical Products

Strategic Imperatives and Actionable Measures Industry Stakeholders Must Embrace to Capitalize on Emerging Opportunities in Advanced Composite Manufacturing

To navigate this evolving market landscape, industry stakeholders should prioritize diversification of feedstock sources, blending domestic resin and fiber capacities with strategic global suppliers to minimize exposure to tariff volatility. Investment in modular, automated manufacturing cells will not only boost throughput and quality control but also facilitate swift reconfiguration for new fiber-matrix combinations. Additionally, collaboration with research institutions and cross-industry consortia can accelerate development of recyclable thermoplastic composites and bio-based resin chemistries, aligning product roadmaps with tightening regulatory requirements.

Moreover, integrating advanced analytics into procurement and production workflows will enable predictive demand forecasting and cost scenario planning in the face of shifting trade policies. Companies should also explore value-added services such as design-for-manufacturing consultation and lifecycle assessments to differentiate offerings and deepen customer engagement. By embracing circular economy principles-recovering and reprocessing composite scrap-and forging joint ventures for near-market recycling, organizations can both mitigate waste challenges and unlock new revenue streams. Ultimately, proactive alignment of supply chains, technology investments, and sustainability initiatives will position leaders to capitalize on high-growth segments and build long-term resilience.

Robust Research Framework Combining Primary Interviews Secondary Analysis and Triangulated Data to Illuminate Fiber Reinforced Plastics Market Complexities

This report synthesizes insights derived from a robust research framework encompassing primary interviews with OEM engineers, composite fabricators, and raw material suppliers, alongside secondary analysis of industry publications, patent filings, and trade data. Quantitative inputs were triangulated through both bottom-up assessments of plant capacities and top-down validation against historical trade flows, ensuring comprehensive coverage of market dynamics. Expert discussions guided scenario modeling for tariff impacts and technology adoption rates, while continuous cross-verification with publicly disclosed company financials enhanced accuracy.

The methodology also integrates qualitative evaluation of regulatory developments and environmental policy trajectories to gauge future demand for sustainable composite solutions. Regional intelligence was deep-dive analyzed through local industry association reports and government announcements on infrastructure and renewable energy projects. This multi-layered approach delivers a nuanced understanding of segment-specific drivers, competitive positioning, and technology trends shaping the global fiber reinforced plastics landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Fiber-Reinforced Plastic market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Fiber-Reinforced Plastic Market, by Fiber Type

- Fiber-Reinforced Plastic Market, by Resin Type

- Fiber-Reinforced Plastic Market, by End User Industry

- Fiber-Reinforced Plastic Market, by Region

- Fiber-Reinforced Plastic Market, by Group

- Fiber-Reinforced Plastic Market, by Country

- United States Fiber-Reinforced Plastic Market

- China Fiber-Reinforced Plastic Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 1431 ]

Converging Key Takeaways on Innovation Sustainability and Trade Factors to Chart a Resilient Path Forward for Fiber Reinforced Plastics Stakeholders

In summary, fiber reinforced plastics have cemented their role as transformative materials across aerospace, automotive, construction, and renewable energy sectors by delivering unmatched performance-to-weight benefits and enabling eco-driven innovations. Technological advancements in automated manufacturing, AI-enabled design, and circular recycling pathways are redefining production paradigms, while evolving trade policies are prompting strategic realignments in supply chains and nearshoring efforts. A deep segmentation analysis highlights the interplay of end-use demands, fiber characteristics, and resin matrix choices in shaping product roadmaps, and regional contrasts underscore the importance of localized strategies in North America, EMEA, and Asia-Pacific.

Looking ahead, the confluence of electrification requirements, sustainability mandates, and performance objectives will continue to fuel composite adoption, presenting both challenges and growth opportunities. Organizations that invest in advanced manufacturing agility, supply-chain diversification, and sustainable material innovations will be best placed to thrive in this dynamic environment and drive the next wave of composite-enabled progress.

Reach Out to Ketan Rohom Associate Director Sales Marketing to Secure Comprehensive Fiber Reinforced Plastics Market Analysis and Unlock Strategic Advantages

To learn more about this in-depth market research and secure a transformative analysis of fiber reinforced plastics that can empower strategic decision-making, reach out directly to Ketan Rohom Associate Director, Sales & Marketing at 360iResearch You can connect with him to discuss customized insights, explore licensing options, and arrange a confidential briefing tailored to your organization’s needs Initiate your inquiry today and take the next step toward unlocking the full potential of this critical materials market

- How big is the Fiber-Reinforced Plastic Market?

- What is the Fiber-Reinforced Plastic Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?