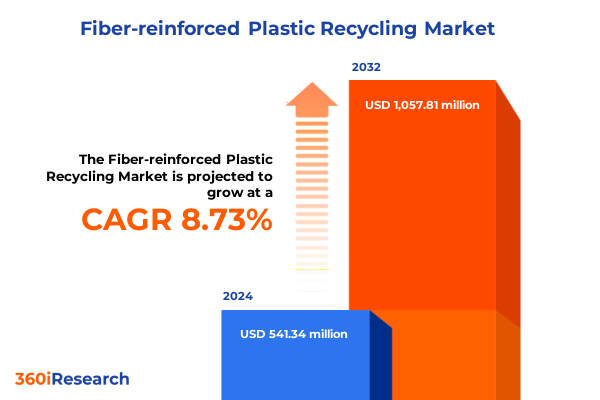

The Fiber-reinforced Plastic Recycling Market size was estimated at USD 588.28 million in 2025 and expected to reach USD 640.85 million in 2026, at a CAGR of 8.74% to reach USD 1,057.81 million by 2032.

Exploring the critical role and growing importance of sustainable fiber-reinforced plastic recycling across multiple high-demand global industries

Fiber-reinforced plastic recycling occupies a critical niche at the intersection of environmental responsibility and industrial innovation. As the global economy intensifies its focus on circularity and resource efficiency stakeholders across automotive aerospace construction and renewable energy are under pressure to address end-of-life composite waste streams. Recycling these materials not only diverts significant volumes from landfills but also reduces reliance on virgin feedstocks thereby cutting embedded carbon emissions. With sustainability agendas shaping procurement and investment decisions companies are increasingly held accountable for the life cycle impacts of fiber-reinforced plastics.

This executive summary outlines the transformative trends regulatory influences and strategic considerations defining the fiber-reinforced plastic recycling landscape. It presents an integrated view of technology advancements supply chain adjustments tariff-driven market shifts segmentation insights regional developments and leading industry initiatives. By synthesizing primary and secondary research the summary provides a clear lens through which decision-makers can align their operations with dynamic market forces and emerging opportunities.

Unveiling the pivotal technological breakthroughs and market dynamics reshaping fiber-reinforced plastic recycling toward a more circular and innovative future

The recycling landscape for fiber-reinforced plastics has undergone profound shifts in recent years driven by breakthroughs in materials science and process engineering. Chemical depolymerization methods now enable selective recovery of resin constituents while advanced thermal processes such as precise catalytic pyrolysis yield higher quality fibers. Simultaneously digital tracking solutions and blockchain-enabled provenance tools have emerged to ensure material traceability from end-of-life structures back to reprocessing facilities. These developments foster a more cohesive circular ecosystem by enhancing the economic viability of post-consumer composite streams and catalyzing new value chains.

Moreover regulatory and policy frameworks have evolved to reinforce these technological gains. Extended producer responsibility mandates now encompass composite materials in key regions encouraging manufacturers to integrate recyclability considerations at the design stage. Incentives such as tax credits for recycled-content incorporation and public–private partnerships for scaling pilot facilities have accelerated commercial adoption of innovative recycling techniques. As a result industry players are reconfiguring supply networks along principles of closed-loop management and continuously refining processes to maximize recovered material quality.

Assessing the cumulative effects of the 2025 United States tariff implementations on global supply chains and recycling economics for fiber-reinforced plastics

The introduction of a new tariff regime by the United States in early 2025 has significantly altered the economics of composite feedstock flows. By imposing duties on imported scrap from key producing regions and on certain raw fiber imports the policy has driven incremental costs for processors relying on external supply. In response many recyclers have expedited investments in domestic collection infrastructure and local partnerships to mitigate exposure to cross-border levies. These adjustments have also accelerated interest in process intensification to lower per-unit processing costs and improve competitiveness against tariff-adjusted imports.

At the same time the tariff-driven repricing has prompted a reexamination of global supply chains among downstream users. Automotive and aerospace OEMs formerly procuring recycled inputs from low-cost export sources are now evaluating nearshoring opportunities. This shift has encouraged joint development agreements with domestic recycling technology providers and promoted innovation in hybrid supply strategies that combine imported virgin materials with onshore recycled fibers. In this way the cumulative impact of the 2025 tariff changes extends beyond immediate cost increases to influence broader strategic alignments across the recycling ecosystem.

Deriving strategic insights by examining end use product type variations fiber materials and recycling process methodologies in the industry landscape

Segmentation analysis reveals distinct value drivers across four dimensions that guide stakeholder decision-making. Based on end use industry the recycling market sees robust demand from automotive and transportation manufacturers seeking lightweight construction materials alongside burgeoning requirements from construction and infrastructure developers committed to sustainable building practices. Marine and aerospace sectors prioritize high-performance fiber reclamation to meet stringent safety standards while wind energy operators focus on large-scale recycling of turbine blade composites to reduce decommissioning costs.

Evaluating product type segmentation highlights that composite materials dominate reuse streams with thermoplastic composites offering higher recyclability due to melt reprocessing capabilities while thermoset composites call for more intensive chemical or thermal treatments. Fiber type differentiation underscores unique considerations for aramid fiber which demands careful chemical recycling to preserve polymer chains compared to carbon fiber where pyrolysis technologies have matured. Glass fiber continues to represent a significant volume but often yields lower value recovered products. Lastly recycling process segmentation shows mechanical shredding remains prevalent for volume reduction whereas advanced chemical processes such as depolymerization and solvolysis deliver higher purity outputs and targeted thermal pathways like pyrolysis enable energy recovery and fiber reclamation.

This comprehensive research report categorizes the Fiber-reinforced Plastic Recycling market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- End Use Industry

- Product Type

- Fiber Type

- Recycling Process

Analyzing regional developments and competitive advantages across Americas Europe Middle East and Africa and Asia Pacific in fiber reinforced plastic recycling

Regional analysis uncovers varied pace and scale of adoption across major global markets. In the Americas strong legislative frameworks at both federal and state levels have accelerated investment in recycling infrastructure and pilot programs. Public sector grants and private sector alliances have fueled rollouts of mechanical and chemical recycling facilities, while corporate sustainability commitments have further stimulated demand for locally sourced recycled composites.

Europe Middle East and Africa display a regulatory environment heavily influenced by European Union circular economy directives that enforce recycled content targets and extended producer responsibility for composite wastes. This has led to collaborative research consortia and shared use of regional processing hubs. Meanwhile Asia-Pacific reflects a dual profile: established economies in the region pursue advanced thermal recycling techniques to complement wind energy growth, whereas emerging markets focus on basic mechanical recycling solutions tied to construction and automotive remanufacturing.

This comprehensive research report examines key regions that drive the evolution of the Fiber-reinforced Plastic Recycling market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling leading innovators and strategic partnerships driving advancements and sustainable practices within the fiber reinforced plastic recycling ecosystem worldwide

Leading corporations and pioneering ventures are shaping the trajectory of the recycling sector through strategic alliances and technology deployments. Major chemical producers have partnered with specialty recycling companies to co-develop depolymerization reactors that reclaim high-purity resin fractions. Dedicated composite recyclers have struck joint ventures with turbine manufacturers to establish blade-to-blade recycling loops and integrate recovered fibers into new wind blade production.

At the same time innovative startups are commercializing rapid pyrolysis systems capable of reclaiming carbon fiber with minimal mechanical damage while others concentrate on solvolysis units designed for aramid and glass fiber separation. These diverse approaches illustrate how cross-industry collaboration and targeted R&D investments are critical to overcoming material heterogeneity challenges, scaling throughput and reducing overall recycling costs.

This comprehensive research report delivers an in-depth overview of the principal market players in the Fiber-reinforced Plastic Recycling market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aeron Composite Pvt Ltd

- Carbon Conversions

- Carbon Fiber Recycle Industry Co Ltd

- Conenor Ltd

- Eco-Wolf Inc

- ELG Carbon Fibre Ltd

- Gen 2 Carbon Limited

- Global Fiberglass Solutions

- Karborek Recycling Carbon Fibers

- MBA Polymers Inc

- MCR Mixt Composites Recyclables

- Mitsubishi Chemical Advanced Materials GmbH

- neocomp GmbH

- PLASTIC ENERGY Limited

- Procotex

- Republic Services Inc

- SGL Carbon SE

- SUEZ Recycling and Recovery

- Toray Industries Inc

- Ucomposites A/S

- Vartega Inc

- Veolia Environnement S.A.

- Waste Management Inc

Guiding industry leaders with pragmatic strategies for operational excellence regulatory compliance and collaboration to advance fiber reinforced plastic recycling initiatives

Industry leaders must accelerate investments in next-generation recycling technologies that optimize both fiber and resin recovery while minimizing energy consumption. Establishing cross-sector consortia linking OEMs recyclers material suppliers and research institutions will foster shared risk and enable rapid scaling of breakthrough processes. Harmonizing material specifications and adopting digital tracking systems can streamline feedstock quality management and ensure consistent end-product performance.

Furthermore organizations should engage proactively with regulatory bodies to influence standards that support sustainable material loops and advocate for incentives tied to recycled-content procurement. Developing training programs will build a skilled workforce capable of operating sophisticated recycling equipment and analytical tools. By prioritizing these actions companies can strengthen supply chain resilience reduce carbon footprints and unlock new revenue opportunities within the circular economy.

Outlining the comprehensive research framework integrating primary interviews secondary data triangulation and mixed methodology analyses for robust market insights

This research synthesizes insights from qualitative interviews with senior executives across composite manufacturing and recycling organizations supplemented by site visits to leading pilot and commercial facilities. Secondary data sources including regulatory filings industry consortium white papers and trade association reports were systematically triangulated to validate process performance benchmarks and policy impacts.

Quantitative analyses incorporated yield metrics energy intensity figures and cost component breakdowns derived from proprietary and publicly available databases. Scenario modeling was used to assess supply chain responses to tariff adjustments and policy shifts. The combined methodology ensures a robust foundation for strategic recommendations and delivers a comprehensive view of the evolving recycling ecosystem for fiber-reinforced plastics.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Fiber-reinforced Plastic Recycling market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Fiber-reinforced Plastic Recycling Market, by End Use Industry

- Fiber-reinforced Plastic Recycling Market, by Product Type

- Fiber-reinforced Plastic Recycling Market, by Fiber Type

- Fiber-reinforced Plastic Recycling Market, by Recycling Process

- Fiber-reinforced Plastic Recycling Market, by Region

- Fiber-reinforced Plastic Recycling Market, by Group

- Fiber-reinforced Plastic Recycling Market, by Country

- United States Fiber-reinforced Plastic Recycling Market

- China Fiber-reinforced Plastic Recycling Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

Summarizing the strategic significance challenges and future trajectories of sustainable fiber reinforced plastic recycling within evolving industrial and regulatory environments

Sustainable recycling of fiber-reinforced plastics presents both complex challenges and compelling opportunities. Technological maturation in chemical and thermal recovery pathways promises higher-value reclaimed outputs, while evolving regulatory landscapes create impetus for circular design and end-of-life stewardship. At the same time tariff-driven supply chain realignments and segmentation-specific demands underscore the need for nuanced strategies tailored to diverse material streams and regional dynamics.

Moving forward industry stakeholders must embrace collaboration across the value chain, leverage digital innovations for traceability and quality assurance, and maintain agility to navigate policy shifts. By aligning technological capabilities with strategic partnerships and actionable policy engagement, companies can transform the recycling of fiber-reinforced plastics into a scalable, sustainable, and profitable endeavor.

Connect with Ketan Rohom Associate Director Sales and Marketing to secure this in-depth market research report on fiber-reinforced plastic recycling and gain competitive leadership

To obtain the full-depth analysis of recycling pathways cost structures and competitive positioning within the fiber-reinforced plastic recycling ecosystem please reach out to Ketan Rohom Associate Director Sales and Marketing at 360iResearch. Ketan is available to guide you through the report’s value proposition and to discuss tailored access options that align with your strategic and operational priorities.

Securing this research package will equip your organization with actionable intelligence to anticipate regulatory shifts optimize supply chains and unlock new revenue streams. Engage with Ketan Rohom to gain immediate access to comprehensive insights and to partner with a team committed to empowering decision-makers in the sustainable materials sector.

- How big is the Fiber-reinforced Plastic Recycling Market?

- What is the Fiber-reinforced Plastic Recycling Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?