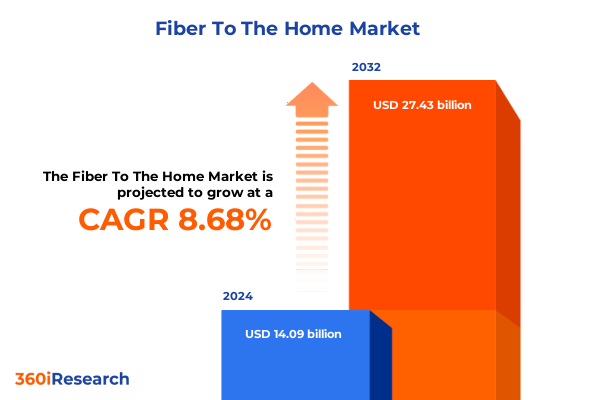

The Fiber To The Home Market size was estimated at USD 15.24 billion in 2025 and expected to reach USD 16.48 billion in 2026, at a CAGR of 8.76% to reach USD 27.43 billion by 2032.

Setting the Stage for Fiber’s Evolution as Digital Connectivity Demands Surge Across Residential and Commercial Sectors

The Fiber To The Home landscape is undergoing a pivotal transformation as digital connectivity becomes foundational to both business operations and daily life. Industry stakeholders are witnessing a surge in demand for high-bandwidth, low-latency networks capable of supporting applications ranging from high-definition video streaming to advanced telehealth and remote work infrastructures. According to the latest Fiber Broadband Association survey, U.S. fiber passings reached an annual record of 10.3 million homes in 2024, bringing total fiber availability to 88.1 million homes and underscoring the rapid pace of domestic deployment and adoption. Worldwide, the FTTH Council reports that 21 countries now exceed 50% household penetration, led by the United Arab Emirates at 99.3% and Singapore at 97.1%, signaling a maturity in markets that sets a benchmark for global rollout strategies.

Amid this acceleration, public policy and funding initiatives are playing a critical role in shaping deployment priorities and timelines. U.S. federal programs such as BEAD have prompted equipment manufacturers and service providers to realign supply chains under Build America, Buy America requirements, driving significant onshore investment and capacity expansion. In Europe, the Digital Decade strategy’s gigabit connectivity targets are stimulating multi-billion euro fiber infrastructure projects, while Asia-Pacific governments are investing heavily in national broadband plans to bridge digital divides. These macro trends establish the imperative for market participants to understand the evolving policy framework, technological advancements, and consumer expectations that together are setting the stage for the next wave of FTTH innovation and adoption.

How Rapid Technological Advances and Policy Initiatives Are Reshaping the Fiber-To-The-Home Landscape Worldwide

The competitive dynamics of the FTTH market are being redefined by rapid advances in passive optical network (PON) technologies and automation platforms. Operators are migrating from legacy GPON deployments to next-generation XGS-PON and 25G PON solutions that deliver symmetric multi-gigabit speeds while leveraging existing fiber infrastructure. For instance, Nokia’s newly launched Broadband Easy platform uses AI-driven automation to streamline design and installation workflows, accelerating deployment timelines by up to 20% and reducing total cost of ownership for service providers deploying fiber to underserved communities. This evolution is not limited to hardware; cloud-native orchestration and open-access architectures are emerging as differentiators in scale and operational efficiency.

Concurrently, shifts in consumer behavior and enterprise requirements are redefining service priorities. The EY Global Digital Home Study found that 46% of U.S. respondents prioritize guaranteed broadband speeds when selecting an internet service, a clear endorsement of fiber’s performance advantages over cable and DSL. Moreover, Lightwave reports indicate that FTTH penetration is enabling new remote work models and home-based businesses, as employees opt for fiber’s lower latency and symmetric bandwidth, often surpassing corporate office connections in reliability and speed. These transformative shifts underscore the necessity for service providers to adopt agile deployment strategies and customer-centric service offerings that harness the full potential of next-generation fiber optics.

Assessing the Far-Reaching Consequences of 2025 U.S. Reciprocal Tariffs on Fiber Optic Technology and Infrastructure Deployment

The imposition of reciprocal tariffs by the U.S. government in 2025 has introduced a new layer of complexity to fiber optic supply chains and deployment economics. While key PON components such as optical line terminals and passive fiber cables have largely been certified under domestic manufacturing mandates, analysts caution that tariff rates-ranging from 10% across most trading partners to as high as 54% for China-could elevate equipment costs and compress provider margins over the medium term. The situation is further compounded by the expansion of tariff scope beyond traditional steel and aluminum to include essential optical subcomponents, potentially leading to price adjustments for lasers, photodetectors, and integrated circuit modules critical to FTTH networks.

Nevertheless, industry experts at Dell’Oro Group report that the fiber broadband sector is relatively insulated from the worst effects, thanks to significant onshoring of assembly operations and pre-emptive supply agreements by major operators such as AT&T and Lumen. Nonetheless, One Touch Intelligence warns that sustained equipment cost increases of even 2% per location can materially slow the pace of rural fiber builds, making strategic inventory management and long-term supplier diversification paramount for carriers seeking to meet aggressive roll-out targets. In this environment, providers are urged to reassess procurement strategies, leverage government incentives for domestic production, and maintain robust stakeholder engagement to mitigate deployment delays and support sustained infrastructure expansion.

Unveiling Deep Segmentation Insights to Understand How Technology, Components, Services, Deployment, and End Users Drive FTTH Dynamics

A nuanced understanding of market segmentation is critical to targeting investments and product development for the diverse FTTH ecosystem. From a technology standpoint, active Ethernet solutions offer unparalleled service-level management, while EPON delivers cost-competitive gigabit connectivity and GPON remains the dominant standard in urban deployments, accounting for over 30 million North American homes connected by early 2024 and over 90% of new urban installations in key Asian markets. Component insights reveal that optical line terminals and network units are complemented by a growing emphasis on passive elements-connectors, fiber cables, and splitters-which together underpin network reliability and installation agility across both metropolitan and rural rollouts.

Service type trends highlight the prevalence of bundled offerings, where double-play and triple-play packages combine internet, video, and voice services to maximize average revenue per user, while single-service options cater to specialized applications and enterprise segments. Deployment models bifurcate into brownfield upgrades of existing broadband infrastructure and greenfield projects capitalizing on new construction opportunities, each with distinct cost structures and regulatory considerations. Finally, end-user segmentation reveals that residential demand continues to drive volume deployments, whereas commercial subscribers-data centers, educational campuses, and healthcare facilities-are increasingly opting for fiber’s low-latency performance to support mission-critical workloads. These layered segmentation perspectives enable market participants to refine go-to-market strategies, optimize product portfolios, and accelerate technology roadmaps.

This comprehensive research report categorizes the Fiber To The Home market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Component

- Service Type

- Deployment

- End User

Comparative Regional Dynamics Highlighting Growth, Challenges, and Strategic Opportunities Across the Americas, EMEA, and Asia-Pacific FTTH Markets

Regional FTTH markets each exhibit unique drivers, challenges, and growth trajectories that influence strategic approaches. In the Americas, the United States leads with 56.5% of households passed by fiber and a take rate surpassing 45% in 2024, reflecting strong consumer uptake and supplier commitments to domestic manufacturing in line with BEAD program requirements. Canada’s fiber expansion, now exceeding 12.1 million homes passed with a 44.6% take rate, underscores the cross-border momentum and shared emphasis on reducing digital divides through government-backed broadband funding.

In Europe, FTTH/B coverage reached 74.6% of homes in the EU39 cluster by September 2024, with Spain overtaking Iceland as the penetration leader at 78.9%, driven by aggressive public-private partnerships and regulatory frameworks that incentivize fiber deployment in both urban and rural zones. Meanwhile, Asia-Pacific commands global attention as the revenue share leader-accounting for nearly 28.8% of industry earnings in 2024-propelled by mass deployments in China, India, and Southeast Asia. Governments across the region are channeling significant investment into national broadband plans to connect underserved areas, cementing FTTH as the foundation for digital economic growth and smart city initiatives. Understanding these regional distinctions is essential for tailoring solutions, forging strategic partnerships, and realizing cross-market synergies.

This comprehensive research report examines key regions that drive the evolution of the Fiber To The Home market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players to Reveal Strategic Investments, Innovations, and Partnerships Shaping the Future of Fiber-To-The-Home Connectivity

Corning Incorporated has strategically expanded its U.S. manufacturing footprint to support rising demand for fiber-optic components and advanced connectivity solutions. In April 2025, Corning announced a $1.5 billion investment to accelerate production capacity at its Michigan facility, focusing on domestic supply for both FTTH and emerging solar sectors and creating hundreds of skilled manufacturing roles to fortify the supply chain against global disruptions. CommScope is similarly enhancing its stateside capabilities, committing over $60 million to North Carolina expansions that will bolster BEAD-compliant fiber cable output and support rural broadband initiatives, thereby aligning operational scale with national ‘Internet For All’ objectives and fortifying its HeliARC™ product line for drop cable deployments.

Nokia’s pivotal partnerships with major U.S. carriers illustrate its leadership in next-generation PON adoption. Service Electric Cablevision’s deployment of Nokia’s 25G PON solution to pass 200,000 homes with XGS-PON capabilities exemplifies the operational advantages of scalable 10Gb/s symmetrical services and a clear path to 50G and 100G PON transitions. Calix is driving software-defined fiber innovation through large-scale platform deployments: Fatbeam’s adoption of the Calix Broadband Platform and SmartLife™ managed services is targeting a twofold residential subscriber increase in Idaho’s Treasure Valley, showcasing how integrated cloud, access, and subscriber management solutions accelerate market expansion and improve customer experiences. Together, these companies illustrate the synergistic investments in manufacturing capacity, technology partnerships, and service orchestration that are redefining the FTTH competitive landscape.

This comprehensive research report delivers an in-depth overview of the principal market players in the Fiber To The Home market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Belden Inc.

- China Telecom Corporation Limited

- Chunghwa Telecom Co., Ltd.

- Corning Incorporated

- FiberHome Telecommunication Technologies Co., Ltd.

- Fujikura Ltd.

- Furukawa Electric Co., Ltd.

- Hengtong Group Co., Ltd.

- HFCL Limited

- KDDI Corporation

- KT Corporation

- LS Cable & System Ltd.

- Nexans S.A.

- Optical Cable Corporation

- Orange S.A.

- Panduit Corp.

- Prysmian S.p.A.

- Sterlite Technologies Limited

- Sumitomo Electric Industries, Ltd.

- Verizon Communications Inc.

- ZTT International Limited

Actionable Strategies and Practical Recommendations to Help Industry Leaders Navigate Market Disruptions and Capitalize on Fiber Broadband Opportunities

To capitalize on emerging opportunities and navigate an increasingly complex competitive environment, industry leaders should prioritize the adoption of next-generation PON technologies and AI-driven network automation. Investing in platforms that support multi-vendor interoperability and software-defined orchestration can reduce operational expenditures and accelerate time-to-market for new services, as evidenced by Nokia’s Broadband Easy deployment and comparable frameworks from other leading vendors. Proactively aligning product roadmaps with government incentive programs-whether federal broadband grants in the Americas or digital infrastructure funds in Europe and APAC-ensures access to critical funding and reinforces compliance with domestic manufacturing stipulations.

Supply chain resilience must remain at the forefront of strategic planning. Operators and equipment manufacturers should diversify sourcing across multiple geographies to mitigate the impact of tariff fluctuations, while leveraging pre-negotiated supply agreements and inventory hedging strategies adopted by major carriers during recent tariff escalations. Cultivating long-term partnerships with a mix of established Tier 1 suppliers and emerging regional producers can stabilize component lead times and buffer against future trade uncertainties, laying the groundwork for uninterrupted network expansions that meet evolving bandwidth demands.

Rigorous Research Methodology Explained Including Data Sources, Expert Interviews, and Triangulation Techniques Underpinning the FTTH Market Analysis

This analysis integrates a multi-faceted research methodology to ensure robust and credible insights. Secondary research involved systematic reviews of industry publications, regulatory filings, and corporate press releases to compile quantitative data on passings, take rates, and regional deployment metrics. Primary research included structured interviews with subject-matter experts across service providers, equipment vendors, and regulatory bodies, enabling qualitative triangulation of trends and validating market observations. Methodological triangulation-employing multiple data sources, diverse analytical frameworks, and cross-validation across expert perspectives-was applied to enhance the depth and reliability of conclusions drawn.

To further reinforce analytic rigor, market data were subjected to peer review and consistency checks against publicly available government broadband reports and independent industry surveys. Sampling strategies for qualitative interviews were designed to represent both global and regional stakeholders, ensuring a balanced outlook across mature and emerging markets. Financial performance metrics were normalized to common currency baselines, and thematic coding of interview transcripts enabled systematic identification of key drivers, barriers, and innovation trajectories within the FTTH domain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Fiber To The Home market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Fiber To The Home Market, by Technology

- Fiber To The Home Market, by Component

- Fiber To The Home Market, by Service Type

- Fiber To The Home Market, by Deployment

- Fiber To The Home Market, by End User

- Fiber To The Home Market, by Region

- Fiber To The Home Market, by Group

- Fiber To The Home Market, by Country

- United States Fiber To The Home Market

- China Fiber To The Home Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Synthesis of Key Findings on Technological, Regulatory, and Market Trends Driving Fiber-To-The-Home Adoption and Long-Term Infrastructure Development

The convergence of technological innovation, supportive policy frameworks, and strategic industry investments is propelling the FTTH market into a new era of growth and diversification. High-performance PON architectures and digital orchestration platforms are now critical enablers for delivering symmetrical multi-gigabit services that align with evolving consumer and enterprise demands. Regional funding mechanisms-from U.S. BEAD grants to Europe’s Digital Decade programs and Asia-Pacific national broadband plans-are providing vital fuel for network expansion, while tariff-induced supply chain reconfiguration is accelerating domestic manufacturing and sourcing diversification.

Segmentation analyses reveal that service differentiation through bundled offerings, tailored solutions for commercial applications, and flexible deployment models are essential for maximizing return on investment. Leading companies such as Corning, CommScope, Nokia, and Calix are exemplifying best practices through targeted capacity expansions, strategic partnerships, and platform-centric approaches that integrate hardware, software, and managed services. Looking ahead, operators that effectively synthesize these insights-balancing technology adoption with supply chain resilience and regulatory compliance-will be best positioned to capture the next wave of FTTH opportunities and drive sustainable broadband leadership.

Take the Next Step in Fiber-To-The-Home Market Intelligence by Contacting Ketan Rohom to Secure Your Comprehensive Market Research Report Today

To explore these in-depth insights and unlock the full potential of fiber broadband market intelligence, reach out directly to Ketan Rohom, Associate Director, Sales & Marketing, to secure your comprehensive market research report that equips your team with the strategic foresight and data-driven guidance necessary to lead in the Fiber To The Home sector

- How big is the Fiber To The Home Market?

- What is the Fiber To The Home Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?