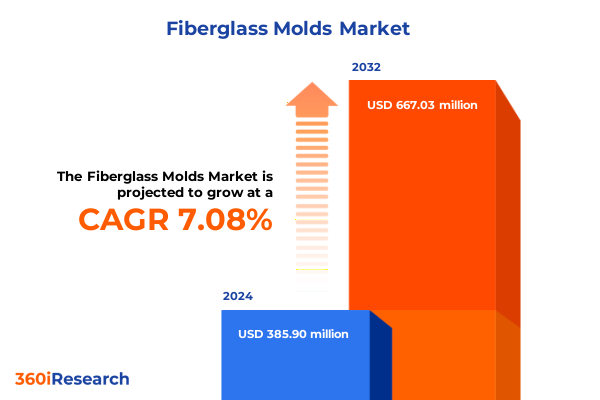

The Fiberglass Molds Market size was estimated at USD 412.22 million in 2025 and expected to reach USD 445.33 million in 2026, at a CAGR of 7.11% to reach USD 667.02 million by 2032.

Pioneering Pathways in Fiberglass Mold Manufacturing Unveils Strategic Foundations Driving Market Evolution Across Multiple High-Performance Industries

The fiberglass mold industry has emerged as a pivotal element in modern composite manufacturing, serving as the backbone for producing lightweight, high-strength components deployed across a variety of demanding applications. From aerospace to renewable energy, the reliance on precise, durable molds has intensified as organizations strive to enhance performance, reduce weight, and drive fuel efficiency. Amid escalating demands for advanced materials, the strategic importance of fiberglass molds lies not only in their capacity to deliver consistent dimensional accuracy but also in their adaptability to complex geometries and specialized surface finishes.

Against this backdrop, manufacturers are continuously refining fabrication techniques to meet stringent quality standards while optimizing cost and throughput. Technological enhancements in mold material formulations and tooling methods are advancing capabilities in rapid prototyping and short-run production, empowering original equipment manufacturers to accelerate product development cycles. As the composite materials ecosystem becomes more sophisticated, stakeholders are placing increased emphasis on predictive maintenance, real-time process monitoring, and integrated automation to minimize downtime and ensure process reliability.

Moreover, regulatory pressures around environmental performance and worker safety are motivating industry participants to adopt eco-friendly mold release agents and closed-loop resin systems. This evolving landscape underscores a clear need for comprehensive insights into technological trajectories, supply chain partnerships, and emerging end-use requirements, establishing the foundation for informed decision-making at every level of the value chain.

Unraveling Disruptive Shifts in Fiberglass Mold Innovations Fueled by Sustainability Demands and Digital Transformation Across Global Production

At the forefront of industry transformation is the convergence of sustainability imperatives with digital innovation, reshaping how fiberglass molds are designed, fabricated, and deployed. Environmental stewardship is driving the adoption of renewable resins and recyclable tooling materials, enabling manufacturers to curtail waste streams and align with circular economy principles. These efforts are complemented by the advent of digital twin technology, which facilitates virtual mold trials, predictive wear analysis, and rapid iteration without the need for physical prototypes.

Simultaneously, automation has transcended basic mechanization to integrate advanced robotics, sensor networks, and machine learning algorithms into mold production facilities. Automated layup cells and robotic filament winding systems now deliver improved repeatability and throughput, reducing variability inherent to manual processes. This shift not only accelerates time-to-market but also enhances consistency in dimensional tolerances, meeting the rigorous demands of aerospace and automotive OEMs.

The escalating emphasis on performance optimization has further stimulated research into high-pressure resin transfer molding and innovative curing technologies that shorten cycle times while preserving structural integrity. Additionally, cross-industry collaborations are fostering the development of surface treatments and coatings that extend mold life and streamline release, propelling the landscape toward a more agile, efficient, and environmentally responsible future.

Assessing the Comprehensive Consequences of 2025 United States Tariffs on Fiberglass Mold Ecosystem and Strategic Adaptations in Supply Chains

The imposition of new U.S. tariffs on fiberglass raw materials and mold components in early 2025 has triggered a profound recalibration across sourcing strategies, production footprints, and cost structures. By elevating import duties on glass reinforcements and specialized tooling materials, domestic fabricators have gained renewed competitive leverage, prompting several manufacturers to repatriate production lines and diversify supplier networks. This reshoring trend has alleviated some exposure to volatile freight rates and supply chain disruptions, while also compelling investments in advanced processing equipment to offset higher input costs.

Consequently, strategic alliances between mold makers and resin formulators have intensified, as both parties seek to secure preferential access to high-grade materials and optimize total system performance. These partnerships are complemented by joint R&D initiatives aimed at developing low-tariff resin substitutes and hybrid glass-carbon composites that preserve mechanical properties while navigating tariff constraints. Moreover, forward-looking organizations are adopting hedging strategies and long-term off-take agreements to mitigate price volatility, ensuring stability in production planning and cash flow management.

While the immediate impact of the tariffs has been an uptick in per-unit tooling expenses, the resulting drive toward supply chain resilience has yielded long-term benefits, including enhanced quality control, reduced lead times, and improved intellectual property protection. The cumulative effect underscores the critical importance of proactive tariff scenario planning and strategic supplier engagement for sustaining competitiveness in the evolving fiberglass mold ecosystem.

Unearthing In-Depth Segmentation Insights Revealing Diverse Opportunities Across Manufacturing Techniques Resin Types Fiber Variants and End Use Verticals

A multidimensional lens on the fiberglass mold market reveals that manufacturing processes form the primary axis of differentiation, encompassing compression molding, filament winding, hand layup, resin transfer molding, and spray up. Within resin transfer molding, the delineation between high-pressure and low-pressure variants underscores divergent applications: the high-pressure approach excels in producing intricate, high-strength components with rapid cycle times, whereas its low-pressure counterpart offers cost advantages and suitability for larger, less demanding geometries.

Turning to resin chemistries, the choice among epoxy, phenolic, polyester, and vinyl ester systems is dictated by performance requirements and environmental considerations. Epoxy resins command premium applications that demand superior mechanical properties and chemical resistance, while phenolic formulations provide fire retardancy for sectors such as rail and mass transit. Polyester remains a workhorse in general industrial fabrication, bolstered by its cost-effectiveness, and vinyl ester is increasingly prized for its corrosion resilience in marine and chemical processing contexts.

Fiber type further stratifies the market, with alkali-resistant glass variants gaining traction in infrastructure projects exposed to harsh chemical environments. Conventional C glass and E glass fibers maintain broad utility due to balanced cost and performance, and specialty S glass fibers are deployed where peak tensile strength and impact resistance are nonnegotiable.

End-use segmentation underscores the expansive reach of fiberglass molds across aerospace, automotive, construction, marine, and wind energy industries. In aerospace, molds support civil aircraft, military platforms, and spacecraft with stringent certification standards. The automotive arena leverages both commercial vehicle and passenger vehicle applications to drive lightweighting initiatives, while construction relies on architectural elements and infrastructure components for aesthetic and structural enhancements. Marine uses span commercial vessels as well as recreational boats, and wind energy demands both offshore and onshore turbine components capable of withstanding extreme environmental loads.

This comprehensive research report categorizes the Fiberglass Molds market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Manufacturing Process

- Resin Type

- Fiber Type

- End Use Industry

Global Regional Dynamics Shaping the Fiberglass Mold Market Landscape with Distinct Growth Drivers in Americas EMEA and Asia-Pacific Regions

Regional nuances play an instrumental role in shaping the trajectory of fiberglass mold adoption and innovation. In the Americas, burgeoning investments in renewable energy infrastructure and a reinvigorated domestic automotive sector are driving demand for specialized molds capable of producing large-scale wind turbine blades and lightweight vehicle components. Concurrently, regional policymakers are incentivizing nearshore manufacturing clusters, enhancing logistics efficiency and reducing lead times for critical tooling.

Across Europe, the Middle East, and Africa, stringent environmental regulations and ambitious sustainability targets are catalyzing the transition toward bio-based resins and energy-efficient mold production processes. Mature aerospace hubs in Western Europe continue to pioneer certification procedures for high-performance composite parts, while emerging markets in the Gulf and North Africa are prioritizing infrastructural development projects that utilize weather-resistant C glass and alkali-resistant fiber systems.

In the Asia-Pacific region, rapid urbanization and industrial expansion are bolstering demand for construction-related molding solutions as well as growth in marine vessel production. Local manufacturers are investing heavily in automation and digital process controls to meet the dual imperatives of cost competitiveness and quality assurance. Moreover, public-private partnerships in Southeast Asia are fostering knowledge transfer and capacity building, expanding the region’s footprint in global composite value chains.

This comprehensive research report examines key regions that drive the evolution of the Fiberglass Molds market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Fiberglass Mold Manufacturers Illuminates Competitive Strategies Innovations and Collaborative Ventures Defining Market Leadership Standards

Analysis of prominent fiberglass mold fabricators reveals a pronounced focus on innovation ecosystems, where collaboration with materials scientists, OEMs, and research institutions underpins the development of next-generation tooling solutions. Leading providers are integrating additive manufacturing techniques to produce mold inserts and conformal cooling channels, reducing cycle times and enhancing dimensional accuracy. Strategic alliances with software vendors are enabling the deployment of predictive maintenance platforms, leveraging real-time sensor data to forecast mold degradation and schedule proactive servicing.

In parallel, several tier-one mold makers have established dedicated sustainability centers of excellence, focusing on the qualification of recyclable thermoset resins and closed-loop manufacturing streams. These initiatives are frequently conducted in partnership with governmental bodies and industry consortia, accelerating the adoption of low-emission curing ovens and solvent recovery systems. Additionally, mergers and acquisitions activity is consolidating expertise, with specialized tooling companies joining forces with global composite fabricators to expand geographic reach and service portfolios.

Competitive benchmarking further highlights the growing importance of after-market services, as fabricators provide comprehensive lifecycle support ranging from mold refurbishment to end-of-life recycling solutions. This shift toward service-oriented business models is enhancing customer retention and unlocking recurring revenue streams, while reinforcing the strategic value proposition of advanced mold capabilities.

This comprehensive research report delivers an in-depth overview of the principal market players in the Fiberglass Molds market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- All Plastics and Fiberglass Inc

- APH 3G Limited

- Bayview Composites LCC

- China Jushi Co. Ltd.

- CMDT Manufacturing

- Compagnie de Saint-Gobain S.A.

- Custom Fibreglassing

- Dencam Composite A/S

- Gurit Holding AG

- Holland Fiberglass & Restoration LLC

- Indutch Composites Technology Pvt. Ltd.

- Janicki Industries Inc.

- Johns Manville by Berkshire Hathaway Company

- Molded Fiber Glass Co.

- mouldCAM Pty Ltd.

- Nippon Electric Glass Co. Ltd.

- NORCO Composites & GRP

- Owens Corning

- Performance Composites Inc.

- PFG Fiber Glass Corporation

- REV Group, Inc.

- Schutz GmbH & Co. KGaA

- Shandong Shaungyi Technology

- Taishan Fiberglass Inc.

- TPI Composites Inc.

Strategic Roadmap for Industry Leaders Embracing Technological Advancements and Supply Chain Resilience to Capitalize on Emerging Fiberglass Mold Opportunities

To thrive in an environment characterized by rapid technological change and tariff-induced cost pressures, industry leaders should prioritize the integration of advanced automation and digital process controls within their mold production lines. Embracing robotic layup cells and automated trimming systems can yield immediate gains in throughput, while the adoption of machine learning models for process optimization will drive incremental improvements in quality and cost efficiency.

At the same time, companies are advised to diversify their supplier networks by establishing regional partnerships that mitigate exposure to trade barriers and logistical bottlenecks. Engaging in joint R&D ventures with resin and fiber manufacturers will facilitate the development of low-tariff material substitutes and hybrid composite solutions tailored to evolving end-use demands. Concurrently, investing in workforce upskilling programs will ensure that technicians and engineers possess the digital literacy required to operate sophisticated equipment and interpret predictive analytics.

Finally, embedding sustainability into the core strategy through the qualification of bio-based resins, recyclable tooling materials, and energy-efficient curing processes will not only address regulatory requirements but also resonate with end users who prioritize environmental stewardship. By aligning innovation roadmaps with clear sustainability milestones and customer-centric service offerings, organizations can unlock new revenue streams and fortify their competitive position for the next phase of market expansion.

Robust Research Methodology Underpinning Comprehensive Analysis Through Expert Consultations Primary Interviews and Rigorous Data Triangulation Practices

The insights presented in this report are underpinned by a rigorous, multi-stage research methodology designed to ensure accuracy, relevance, and actionable intelligence. Primary research involved a series of in-depth interviews with C-level executives, process engineers, and procurement specialists across major manufacturing hubs, providing firsthand perspectives on critical challenges and strategic priorities.

Secondary research encompassed a thorough review of technical papers, industry whitepapers, patents, and public disclosures to map technological trajectories and validate emerging trends. A specialized database of tooling process parameters was analyzed to compare the performance characteristics of various manufacturing techniques under diverse operating conditions.

Expert roundtables and workshops with academic researchers and materials suppliers further enriched the analysis, facilitating dynamic exchanges on innovation roadmaps and sustainability initiatives. All qualitative insights were corroborated through data triangulation, cross-referencing interview findings with secondary sources and quantitative performance benchmarks.

This blended methodology ensures that the report delivers holistic coverage of the fiberglass mold landscape, empowering decision-makers to formulate strategies grounded in empirical evidence and industry best practices.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Fiberglass Molds market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Fiberglass Molds Market, by Manufacturing Process

- Fiberglass Molds Market, by Resin Type

- Fiberglass Molds Market, by Fiber Type

- Fiberglass Molds Market, by End Use Industry

- Fiberglass Molds Market, by Region

- Fiberglass Molds Market, by Group

- Fiberglass Molds Market, by Country

- United States Fiberglass Molds Market

- China Fiberglass Molds Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1749 ]

Concluding Insights Synthesizing Key Findings and Strategic Imperatives to Propel Future Developments in the Fiberglass Mold Ecosystem with Precision

In summary, the fiberglass mold sector stands at a pivotal juncture, shaped by the interplay of tariff policy shifts, sustainability mandates, and rapid technological advancements. The confluence of reshoring trends, strategic supplier partnerships, and digital transformation is redefining competitive benchmarks, elevating the importance of agility and innovation excellence. Simultaneously, diverse end-use segments spanning aerospace, automotive, construction, marine, and wind energy continue to generate demand for specialized molds that deliver complex geometries and stringent performance criteria.

Segmentation insights illuminate a landscape where process differentiation, resin chemistry selection, fiber variant deployment, and end-use customization serve as critical levers for market participants. Regional dynamics in the Americas, EMEA, and Asia-Pacific further underscore the importance of localized strategies and strategic alignment with regulatory frameworks. Leading manufacturers are responding by integrating digitization, sustainability, and lifecycle services into their core offerings, thereby unlocking new revenue streams and reinforcing customer loyalty.

Looking ahead, organizations that invest in advanced automation, diversify material sourcing, and embed sustainability across the value chain will be best positioned to capitalize on emerging opportunities. By leveraging robust research methodologies and strategic agility, industry leaders can navigate the evolving landscape with confidence, ensuring long-term resilience and market leadership.

Take Decisive Action and Unlock Strategic Intelligence by Engaging with Ketan Rohom to Access the Definitive Fiberglass Mold Market Research Report

Ready to amplify your strategic decision-making and gain unparalleled clarity on global fiberglass mold dynamics? Contact Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch, to secure your copy of the comprehensive market research report and position your organization ahead of evolving industry trends

- How big is the Fiberglass Molds Market?

- What is the Fiberglass Molds Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?